Delaware Clerical Staff Agreement - Self-Employed Independent Contractor

Description

How to fill out Clerical Staff Agreement - Self-Employed Independent Contractor?

Are you currently in a predicament where you need documents for either business or personal purposes almost every day.

There are many legal document templates accessible online, but finding versions you can trust is not easy.

US Legal Forms provides a vast array of form templates, such as the Delaware Clerical Staff Agreement - Self-Employed Independent Contractor, that are drafted to comply with federal and state regulations.

You can obtain an additional copy of the Delaware Clerical Staff Agreement - Self-Employed Independent Contractor at any time if needed. Just click on the required form to download or print the document template.

Make use of US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid errors. The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the Delaware Clerical Staff Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Find the form you need and confirm it is for the correct city/region.

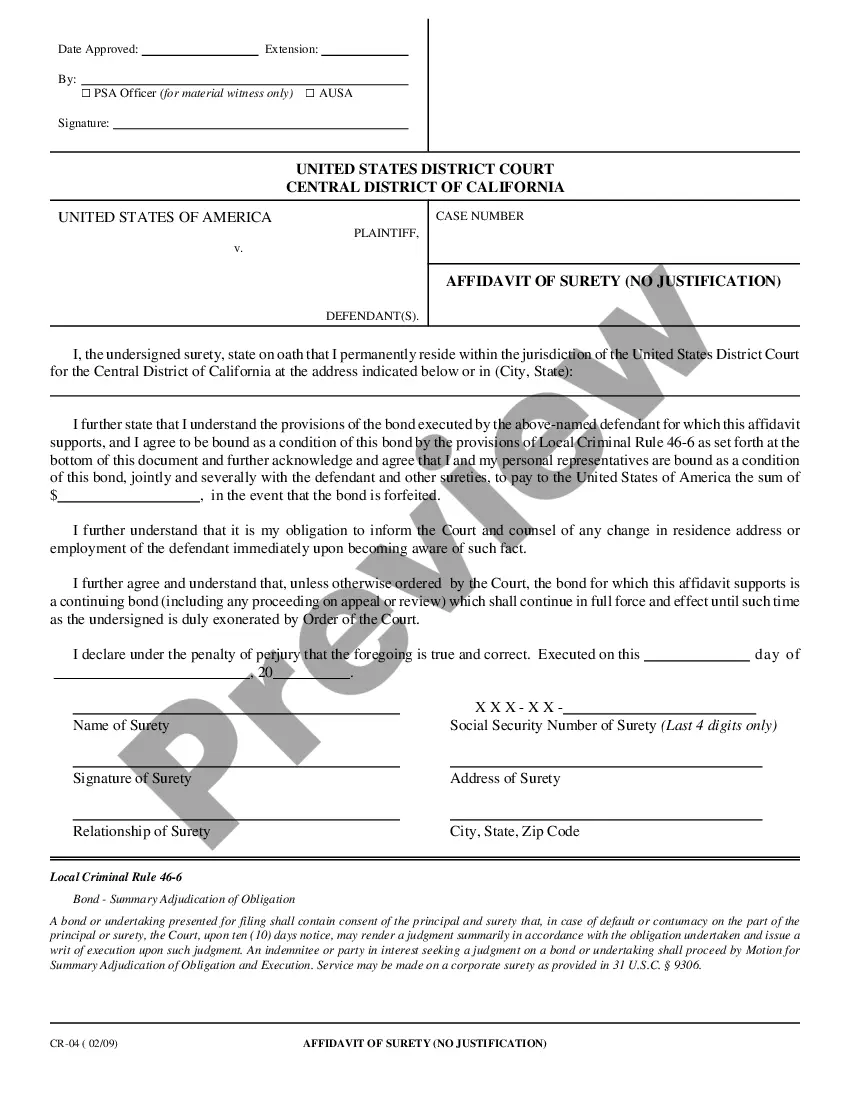

- Utilize the Review button to check the form.

- Read the description to ensure that you have selected the correct form.

- If the form is not what you’re looking for, use the Search box to find the form that meets your needs and requirements.

- Once you find the right form, click on Purchase now.

- Select the pricing plan you want, fill in the necessary details to create your account, and pay for the order using your PayPal or credit card.

- Choose a convenient document format and download your copy.

- Access all the document templates you have purchased in the My documents menu.

Form popularity

FAQ

Yes, you can call yourself an independent contractor as long as you meet the criteria set by state and federal laws. This title conveys your role in providing services independently. It’s important to utilize a proper structure, such as a Delaware Clerical Staff Agreement - Self-Employed Independent Contractor, to formalize your status and outline your responsibilities.

No, a 1099 contractor does not count as an employee. This classification refers to independent contractors who receive a 1099 form for tax purposes, whereas employees receive a W-2 form. Understanding this distinction is crucial for compliance and tax obligations. A Delaware Clerical Staff Agreement - Self-Employed Independent Contractor can help clarify these definitions.

Independent contractors are not considered employees primarily due to the control they have over their work. They operate independently, deciding how and when to complete tasks. In contrast, employees typically follow the directives of their employer. Using a Delaware Clerical Staff Agreement - Self-Employed Independent Contractor clearly outlines this relationship for both parties.

In Delaware, independent contractors often do not need a business license, but there are exceptions. Depending on the nature of your work and where you operate, certain licenses may be necessary. It is essential to understand the requirements for your specific situation. A Delaware Clerical Staff Agreement - Self-Employed Independent Contractor can guide you through the process and ensure compliance with state laws.

Yes, a 1099 employee can and should have a contract, especially a Delaware Clerical Staff Agreement - Self-Employed Independent Contractor. This contract clarifies the relationship between the independent contractor and the hiring entity, ensuring that both parties understand their rights and responsibilities. Contracts help prevent misunderstandings while protecting your interests. By using resources from US Legal Forms, you can easily access a variety of contract templates designed for independent contractors.

Creating a Delaware Clerical Staff Agreement - Self-Employed Independent Contractor starts with outlining the roles and responsibilities of both parties. You should include payment terms, project deadlines, and any confidentiality clauses necessary for your specific situation. It’s essential to ensure that the agreement complies with local laws and regulations. Utilizing platforms like US Legal Forms can simplify this process, providing templates that are already tailored for such agreements.

To fill out a declaration of independent contractor status form, first, ensure you gather all necessary personal and business information, such as your name, address, and the nature of your business activities. Clearly describe your relationship with the client, highlighting your independent status as outlined in the Delaware Clerical Staff Agreement - Self-Employed Independent Contractor. Provide accurate details about your services and any payment terms agreed upon. For a seamless experience, you might want to explore guidance available on the US Legal Forms platform.

When working as a Self-Employed Independent Contractor under a Delaware Clerical Staff Agreement, you typically need to complete a W-9 form to provide your Taxpayer Identification Number. Additionally, you may sign a contract that outlines the terms of your work arrangement, including payment details and project expectations. It’s also important to keep records of invoices and receipts, as these will help you manage your finances and taxes effectively. For assistance with these documents, consider using the resources available on the US Legal Forms platform.

To provide proof of employment as an independent contractor, maintain detailed records of your agreements and invoices. You can also present documentation such as tax forms or bank statements that reflect payments received. This evidence demonstrates your professional status, supporting your role under the Delaware Clerical Staff Agreement - Self-Employed Independent Contractor.

Filling out an independent contractor form involves similar steps to completing an agreement. Start by providing your personal information and the nature of the work you'll perform. Include your payment details and relevant identifiers, such as a tax ID number, to establish your status as a self-employed individual, aligned with the Delaware Clerical Staff Agreement - Self-Employed Independent Contractor.