If you have to comprehensive, acquire, or print out authorized document web templates, use US Legal Forms, the greatest collection of authorized kinds, that can be found on the web. Make use of the site`s easy and hassle-free research to find the papers you need. A variety of web templates for company and specific purposes are sorted by types and claims, or keywords. Use US Legal Forms to find the Delaware Guide to Complying with the Red Flags Rule under FCRA and FACTA in just a few click throughs.

If you are already a US Legal Forms customer, log in in your bank account and click on the Acquire key to get the Delaware Guide to Complying with the Red Flags Rule under FCRA and FACTA. You may also access kinds you formerly acquired within the My Forms tab of your own bank account.

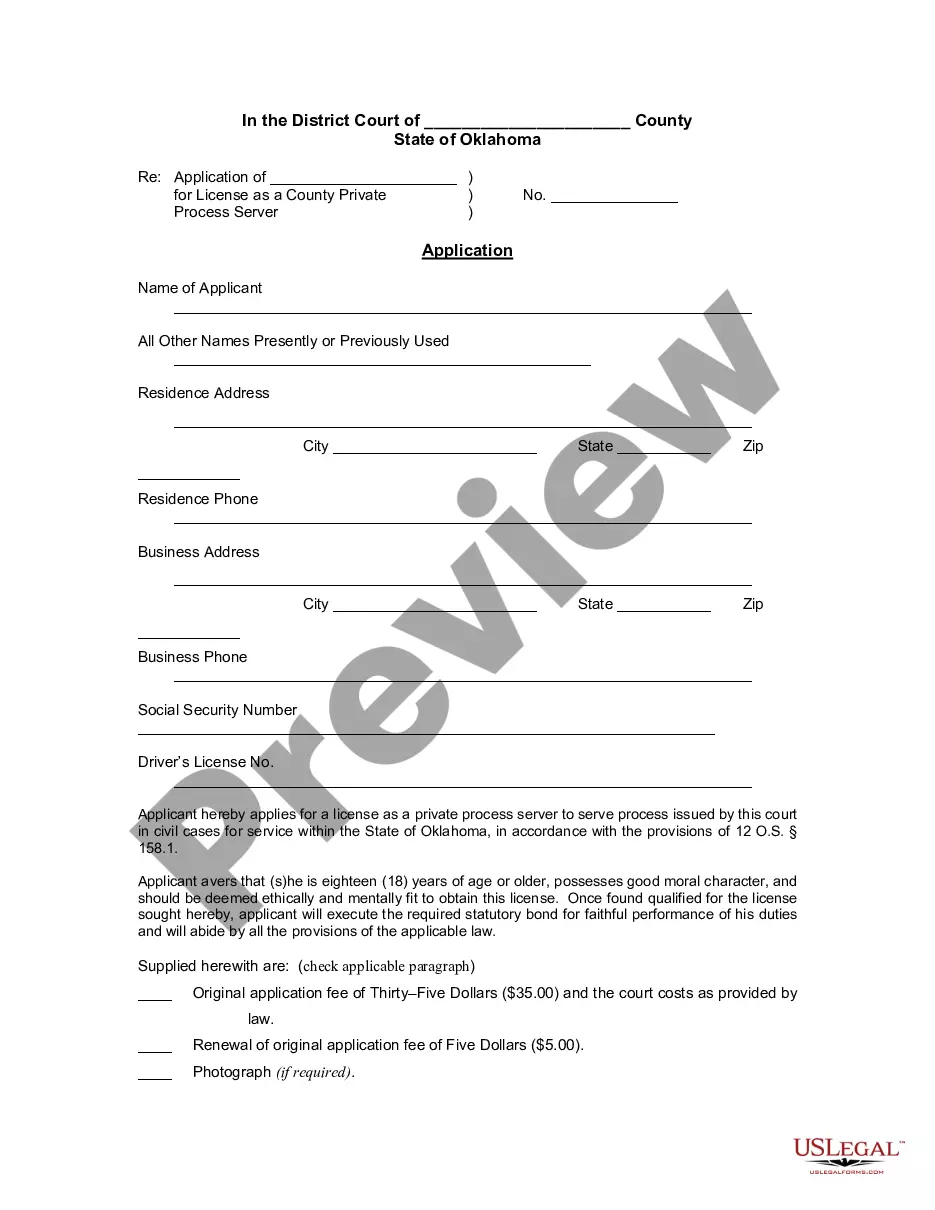

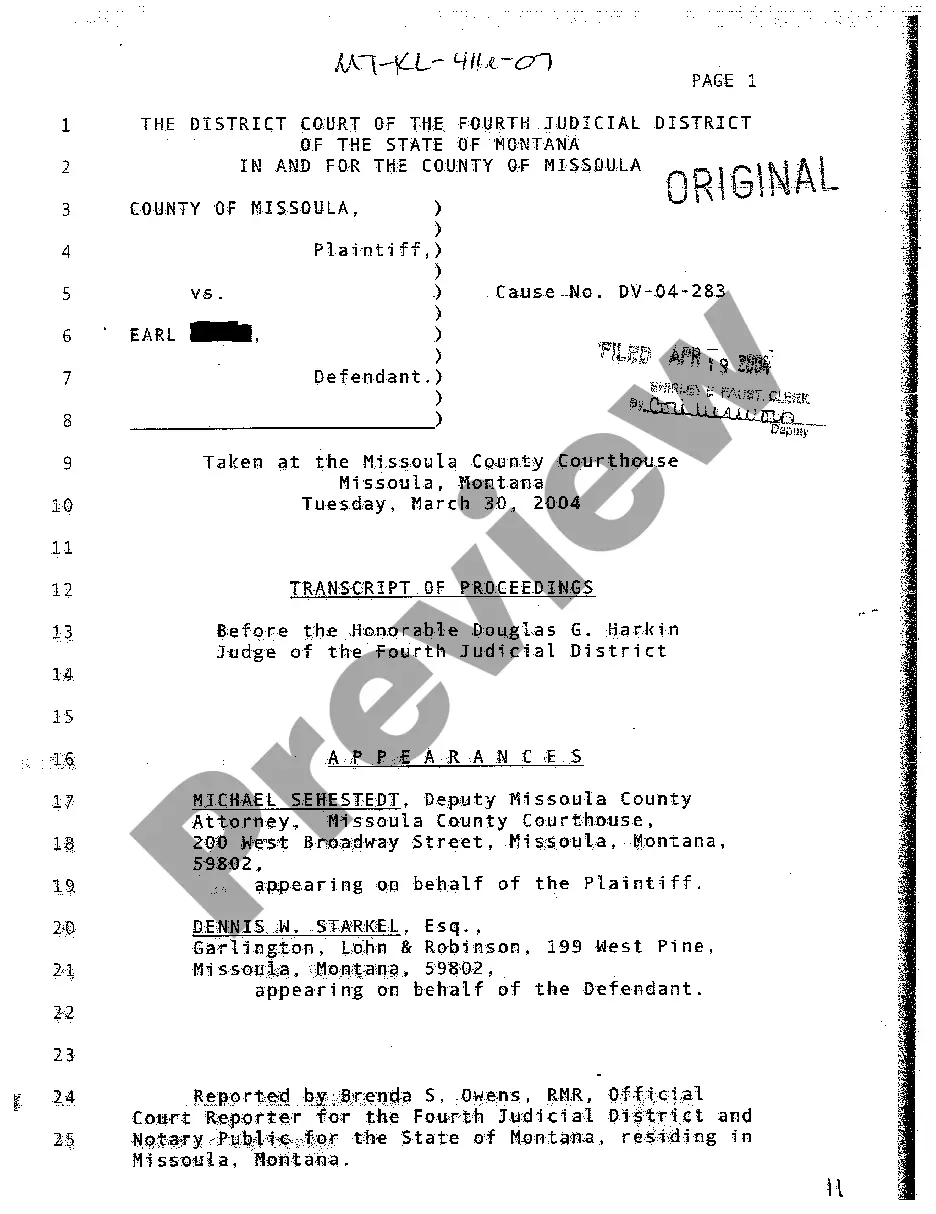

If you work with US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the form for that correct metropolis/land.

- Step 2. Take advantage of the Review method to look through the form`s articles. Do not neglect to learn the outline.

- Step 3. If you are not satisfied using the develop, utilize the Look for area on top of the monitor to find other variations of your authorized develop web template.

- Step 4. When you have located the form you need, click the Acquire now key. Choose the costs program you prefer and add your accreditations to register for an bank account.

- Step 5. Procedure the purchase. You may use your credit card or PayPal bank account to finish the purchase.

- Step 6. Pick the structure of your authorized develop and acquire it in your device.

- Step 7. Comprehensive, revise and print out or indicator the Delaware Guide to Complying with the Red Flags Rule under FCRA and FACTA.

Every authorized document web template you acquire is your own property eternally. You might have acces to every develop you acquired inside your acccount. Select the My Forms area and decide on a develop to print out or acquire once more.

Remain competitive and acquire, and print out the Delaware Guide to Complying with the Red Flags Rule under FCRA and FACTA with US Legal Forms. There are many specialist and state-distinct kinds you can utilize for your personal company or specific needs.