This due diligence checklist identifies the guidelines and general overview of a corporation by providing information and supportive materials regarding business transactions.

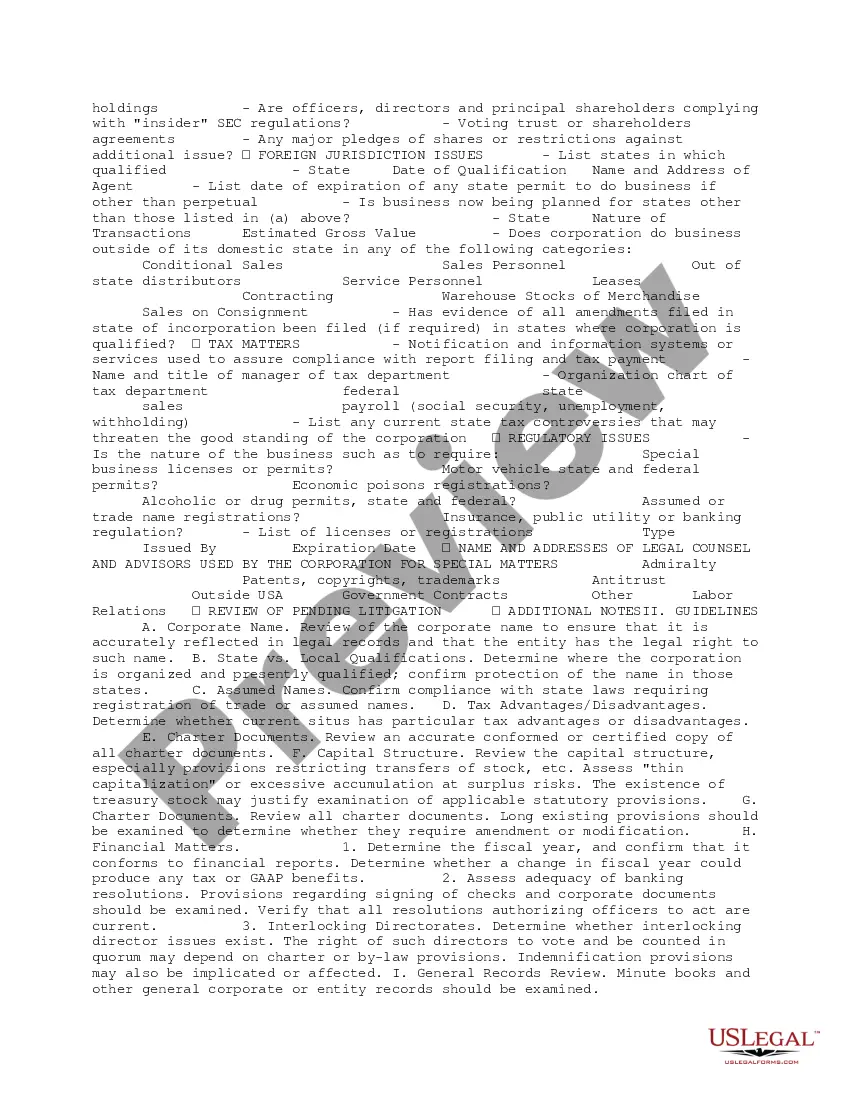

Delaware Short Form Checklist and Guidelines for Basic Corporate Entity Overview

Description

How to fill out Short Form Checklist And Guidelines For Basic Corporate Entity Overview?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal template documents that you can download or print.

By using the website, you can access thousands of forms for personal and business purposes, categorized by types, states, or keywords. You can find the latest versions of forms such as the Delaware Short Form Checklist and Guidelines for Basic Corporate Entity Overview in a matter of seconds.

If you already have a membership, Log In to download the Delaware Short Form Checklist and Guidelines for Basic Corporate Entity Overview from the US Legal Forms collection. The Download button will appear on every form you view. You can access all previously saved forms from the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit. Complete, modify, and print or sign the downloaded Delaware Short Form Checklist and Guidelines for Basic Corporate Entity Overview. Each template saved to your account has no expiration date and belongs to you permanently. So, if you wish to download or print another copy, just go to the My documents section and click on the form you need. Access the Delaware Short Form Checklist and Guidelines for Basic Corporate Entity Overview with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- To use US Legal Forms for the first time, follow these simple steps to get started.

- Make sure you have selected the correct form for your area/state.

- Click the Review button to preview the content of the form.

- Check the description of the form to ensure you have chosen the right one.

- If the form does not fit your requirements, use the Search field at the top of the page to find one that does.

- Once satisfied with the form, confirm your selection by clicking the Buy Now button.

- Then, select your preferred pricing plan and provide your information to sign up for an account.

Form popularity

FAQ

To establish a Delaware LLC, you will need a few critical documents, including the Certificate of Formation and an operating agreement. These documents define your LLC's structure and operational guidelines. It's advisable to consult the Delaware Short Form Checklist and Guidelines for Basic Corporate Entity Overview to ensure you have all necessary documentation on hand. By preparing correctly, you set a strong foundation for your new business venture.

Yes, every LLC in Delaware is required to file an annual report alongside a franchise tax. This obligation ensures that companies remain compliant with state regulations and continue to enjoy their legal benefits. Adhering to these requirements is crucial, so it's wise to check the Delaware Short Form Checklist and Guidelines for Basic Corporate Entity Overview for essential steps and details. This way, you can avoid any potential penalties.

Many corporations are reconsidering their choice of Delaware as their business home due to rising costs and evolving regulations. Businesses are now exploring states that offer more tax incentives and a simpler regulatory environment. This shift reflects a broader trend as companies seek more flexible options while still maintaining compliance. To navigate these changes, reviewing the Delaware Short Form Checklist and Guidelines for Basic Corporate Entity Overview can provide valuable insights.

The requirements for a short-form merger in Delaware include ownership of at least 90% of the subsidiary's shares by the parent company. This stipulation ensures that the parent company has significant control over the subsidiary during the merger process. To ensure compliance, review the Delaware Short Form Checklist and Guidelines for Basic Corporate Entity Overview, which outlines the necessary steps and documentation.

The practical law surrounding a short-form merger emphasizes efficiency and compliance with specific requirements. This type of merger allows expedited processes compared to traditional mergers, making it favorable for many businesses. Familiarizing yourself with our Delaware Short Form Checklist and Guidelines for Basic Corporate Entity Overview can offer practical insights into executing a successful merger.

The Delaware business tax loophole refers to the advantages some companies gain by incorporating in Delaware. The state offers various incentives, like low corporate taxes, which can significantly reduce overall tax burdens. Utilizing our Delaware Short Form Checklist and Guidelines for Basic Corporate Entity Overview can help you understand and navigate these beneficial aspects effectively.

form merger allows a parent company to merge with a subsidiary without the need for formal shareholder approval. This process simplifies and accelerates the merger timeline, reducing administrative burdens. For a thorough understanding, refer to the Delaware Short Form Checklist and Guidelines for Basic Corporate Entity Overview, which outlines the steps you need to take.

Section 262 of Delaware law governs appraisal rights for shareholders during mergers and consolidations. This section allows shareholders to demand a fair value for their shares if they disagree with the merger proposed by the company. Understanding this is essential for anyone navigating the Delaware corporate landscape, and our Delaware Short Form Checklist and Guidelines for Basic Corporate Entity Overview can help clarify these provisions.

Yes, filing an annual report for your LLC in Delaware is mandatory. This report ensures that your company remains compliant with state regulations. By adhering to the Delaware Short Form Checklist and Guidelines for Basic Corporate Entity Overview, you can simplify the reporting process and maintain your LLC’s standing.

Failing to file an annual report can lead to penalties and potential dissolution of your LLC. The state of Delaware may impose fines, and your company could lose its good standing. To avoid these unwanted consequences, follow the Delaware Short Form Checklist and Guidelines for Basic Corporate Entity Overview diligently.