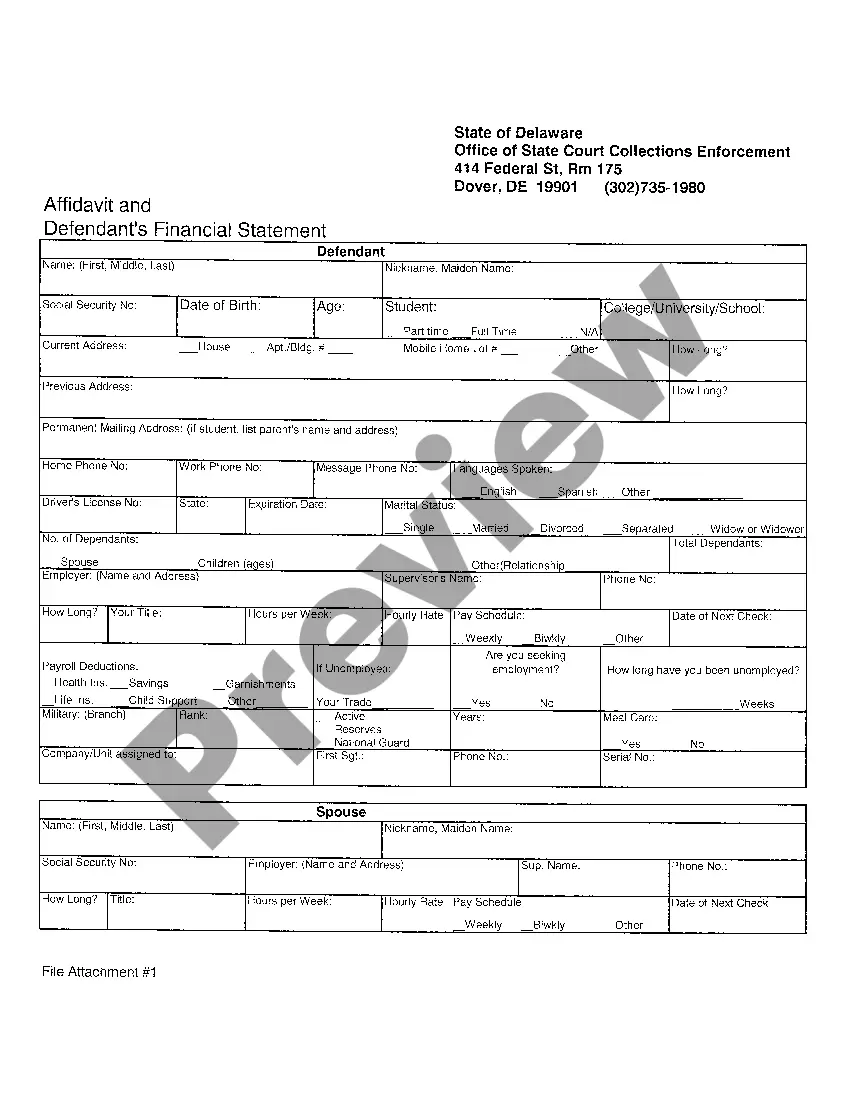

This due diligence form is a checklist of company records provided for review at meetings regarding business transactions.

Delaware Company Records Checklist

Description

How to fill out Company Records Checklist?

Have you ever been in a situation where you need documents for both business or specific purposes almost every day.

There are many legal document templates accessible online, but finding forms you can rely on is not straightforward.

US Legal Forms provides a vast array of form templates, including the Delaware Company Records Checklist, which can be tailored to fulfill federal and state requirements.

Once you locate the right form, click on Get now.

Choose the payment plan you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Delaware Company Records Checklist template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it is for the correct city/state.

- Use the Review button to evaluate the form.

- Read the description to confirm you have selected the correct form.

- If the form isn’t what you are looking for, utilize the Search field to find the form that suits your needs.

Form popularity

FAQ

Yes, information from Delaware entity searches is available to the public. This allows users to find vital details about registered businesses, including their status and filing history. Utilizing a Delaware Company Records Checklist can help you navigate this information effectively. By having this checklist, you enhance your ability to make informed decisions regarding business engagements.

Yes, Delaware UCC filings are public records. This means anyone can access these filings to view the details of secured transactions involving Delaware entities. This transparency is beneficial for businesses and individuals who want to verify the financial standing and obligations of a company. You can easily include this information in your Delaware Company Records Checklist to ensure thorough research.

A request for production of documents in Delaware is a legal procedure used during litigation where one party asks the other to provide specific documents relevant to the case. This process ensures that necessary information is shared for fair proceedings. Familiarizing yourself with these requests can help you prepare effectively.

You can prove ownership of a Delaware LLC by presenting the Operating Agreement, membership certificates, and any documentation that supports your ownership stake. It's also wise to maintain a Delaware Company Records Checklist to ensure all ownership documents are current and accessible.

Yes, Delaware Corporations are generally required to issue stock certificates to their shareholders. However, electronic records may suffice as well, depending on the corporation’s bylaws. Keeping track of issued stock certificates is vital for maintaining ownership transparency.

To get corporate documents from Delaware, you can request copies through the Delaware Division of Corporations. They offer online services and forms for document requests. Using a Delaware Company Records Checklist can streamline this process and help you gather all necessary information.

The Delaware business tax loophole refers to specific legal advantages offered to companies incorporated in Delaware, such as low taxes and no sales tax. These incentives make Delaware an attractive option for businesses looking to minimize their tax burden. Understanding this loophole can help you optimize your financial strategy.

To obtain a copy of your Delaware annual report, you can visit the Delaware Secretary of State's website. They provide resources for accessing business documents quickly. A Delaware Company Records Checklist can help ensure you have all necessary paperwork readily available.

To form a Delaware LLC, you typically need the Certificate of Formation, a Delaware Company Records Checklist, and an Operating Agreement. The Certificate of Formation is filed with the state, while the Operating Agreement outlines the management structure. It's essential to keep these documents organized as they are foundational for your business.

You can verify a company in Delaware through the state's Division of Corporations website, where you can access relevant business information. By searching for a company's name, you can find out its status, registration date, and more. Including verification processes in your Delaware Company Records Checklist helps ensure that you are dealing with legitimate entities in your business dealings.