Delaware Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co.

Description

How to fill out Plan And Agreement Of Merger By Wheeling Pittsburgh Corp, WHX Corp, And WP Merger Co.?

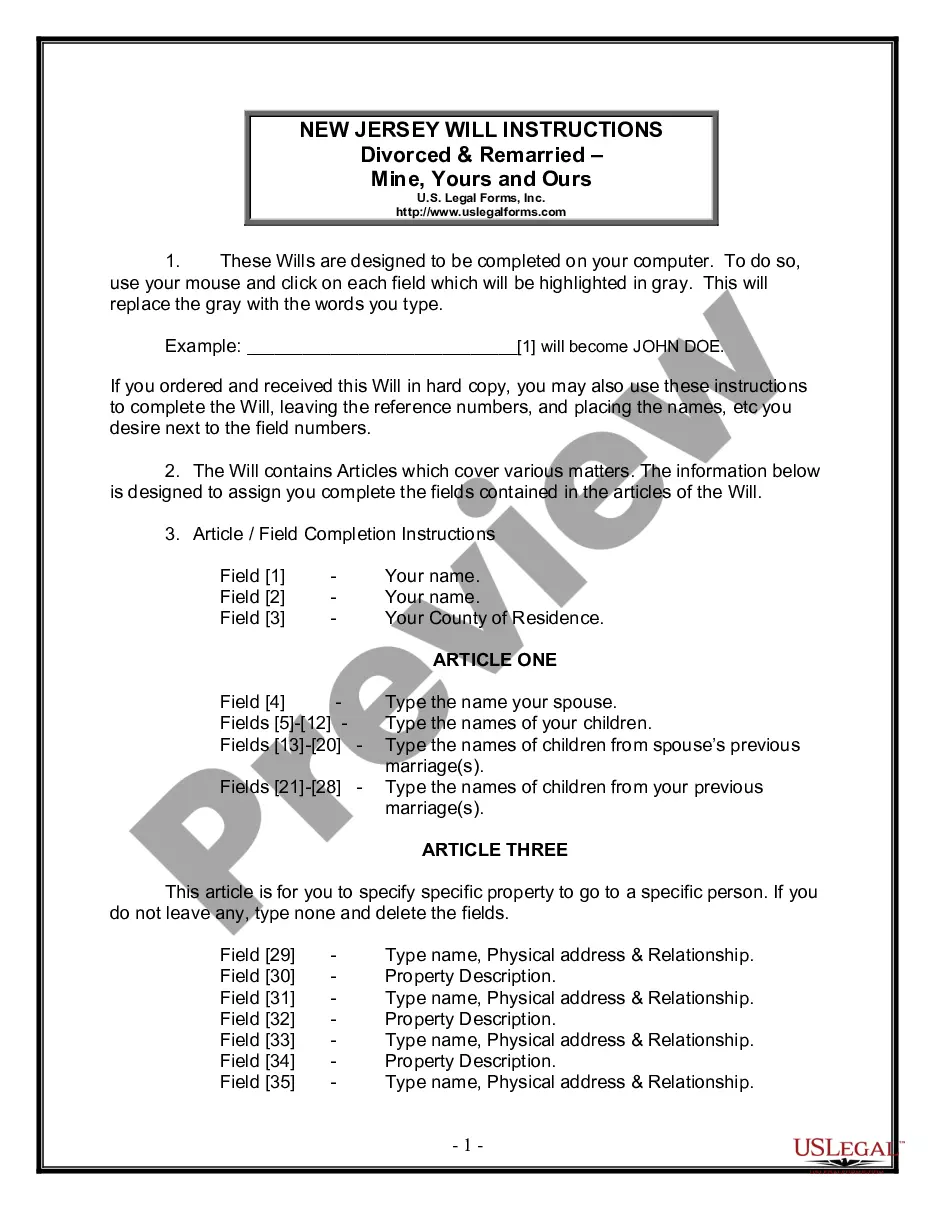

It is possible to devote several hours on the Internet trying to find the lawful papers format which fits the federal and state needs you require. US Legal Forms supplies a large number of lawful varieties which can be examined by specialists. You can easily down load or produce the Delaware Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co. from my support.

If you already have a US Legal Forms accounts, it is possible to log in and click on the Obtain button. Following that, it is possible to full, modify, produce, or signal the Delaware Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co.. Each and every lawful papers format you purchase is yours forever. To have yet another duplicate of any purchased kind, go to the My Forms tab and click on the corresponding button.

If you use the US Legal Forms site for the first time, follow the basic recommendations beneath:

- Initial, be sure that you have chosen the best papers format for your state/town that you pick. See the kind outline to make sure you have picked out the appropriate kind. If readily available, take advantage of the Review button to appear through the papers format as well.

- If you want to find yet another version from the kind, take advantage of the Lookup field to get the format that meets your needs and needs.

- After you have discovered the format you want, click on Acquire now to continue.

- Find the pricing strategy you want, enter your references, and sign up for an account on US Legal Forms.

- Full the transaction. You should use your Visa or Mastercard or PayPal accounts to cover the lawful kind.

- Find the formatting from the papers and down load it to the system.

- Make adjustments to the papers if required. It is possible to full, modify and signal and produce Delaware Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co..

Obtain and produce a large number of papers layouts using the US Legal Forms Internet site, which provides the largest collection of lawful varieties. Use expert and express-particular layouts to deal with your company or person requirements.

Form popularity

FAQ

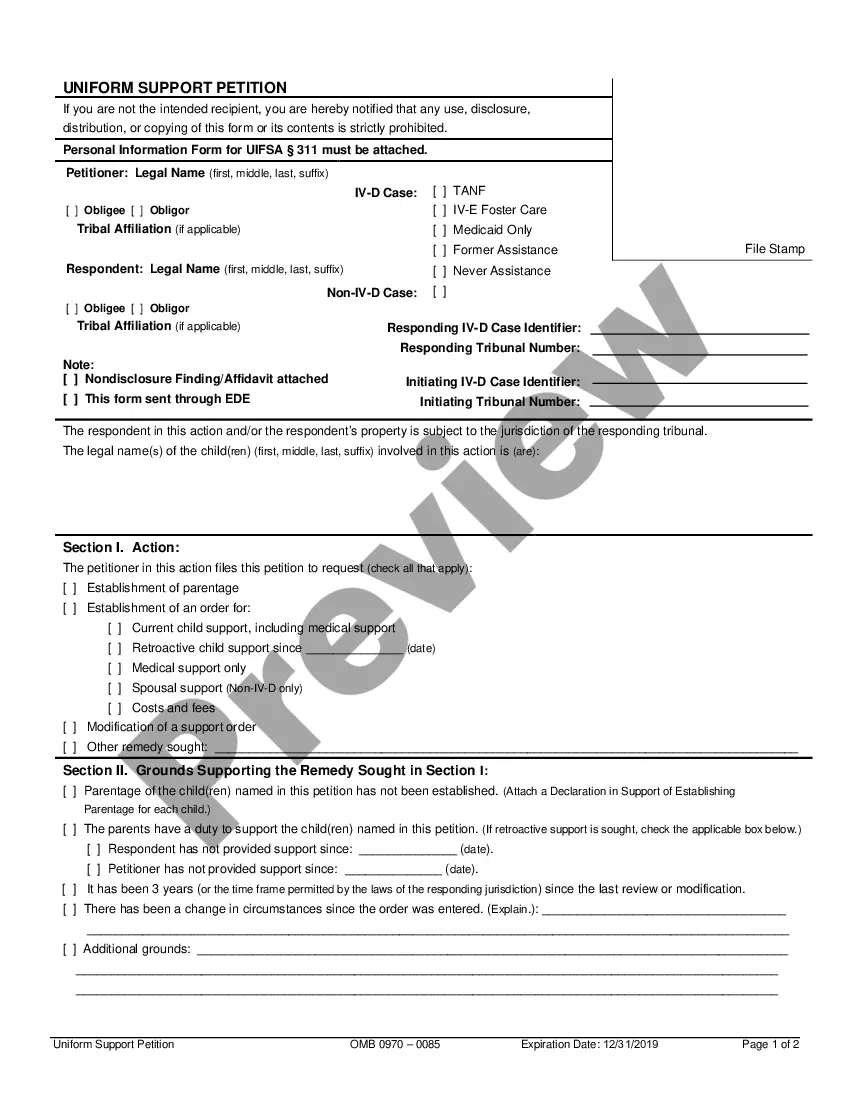

Short-form merger The short form is a type of ?friendly? merger that can be used to combine two LLCs in Delaware. The state of Delaware also approved the consolidation of a Delaware non-corporate entity as the parent and a subsidiary in which the parent accounts for a minimum of 90% outstanding shares per stock class.

What is an Agreement Of Merger? An agreement of merger is a legal document that establishes the terms and conditions to combine two or more businesses into one new entity. The business owners of the merging companies agree to sell all their stock and assets to the newly formed company for an agreed upon price.

Your Operating Agreement gives confidence and impacts the price to those who would offer you riches to merge, acquire, or buy your business. The Operating Agreement protects the owner's personal assets.

In contract law, a merger clause, or integration clause, absorbs an inferior form of contract into a superior form of contract on the same subject matter, making the final written contract complete and binding.

?parties? means Parent, Merger Sub and the Company.

If the merger or acquisition requires a vote by shareholders, the agreement will be available in the proxy document, Schedule 14A (or sometimes an information statement, Schedule 14C). The proxy will include the terms of the merger and what shareholders can expect to receive as proceeds.

An integration clause?sometimes called a merger clause or an entire agreement clause?is a legal provision in Contract Law that states that the terms of a contract are the complete and final agreement between the parties.