Delaware Involuntary Petition Against a Non-Individual

Description

How to fill out Involuntary Petition Against A Non-Individual?

Are you currently within a situation the place you require paperwork for either organization or person functions nearly every working day? There are tons of lawful papers templates accessible on the Internet, but discovering versions you can rely on is not easy. US Legal Forms delivers thousands of form templates, like the Delaware Notice to Creditors and Other Parties in Interest - B 205, which are published to satisfy state and federal demands.

If you are already knowledgeable about US Legal Forms site and also have an account, basically log in. Following that, you can download the Delaware Notice to Creditors and Other Parties in Interest - B 205 design.

Should you not come with an accounts and need to start using US Legal Forms, abide by these steps:

- Discover the form you will need and make sure it is for the right city/state.

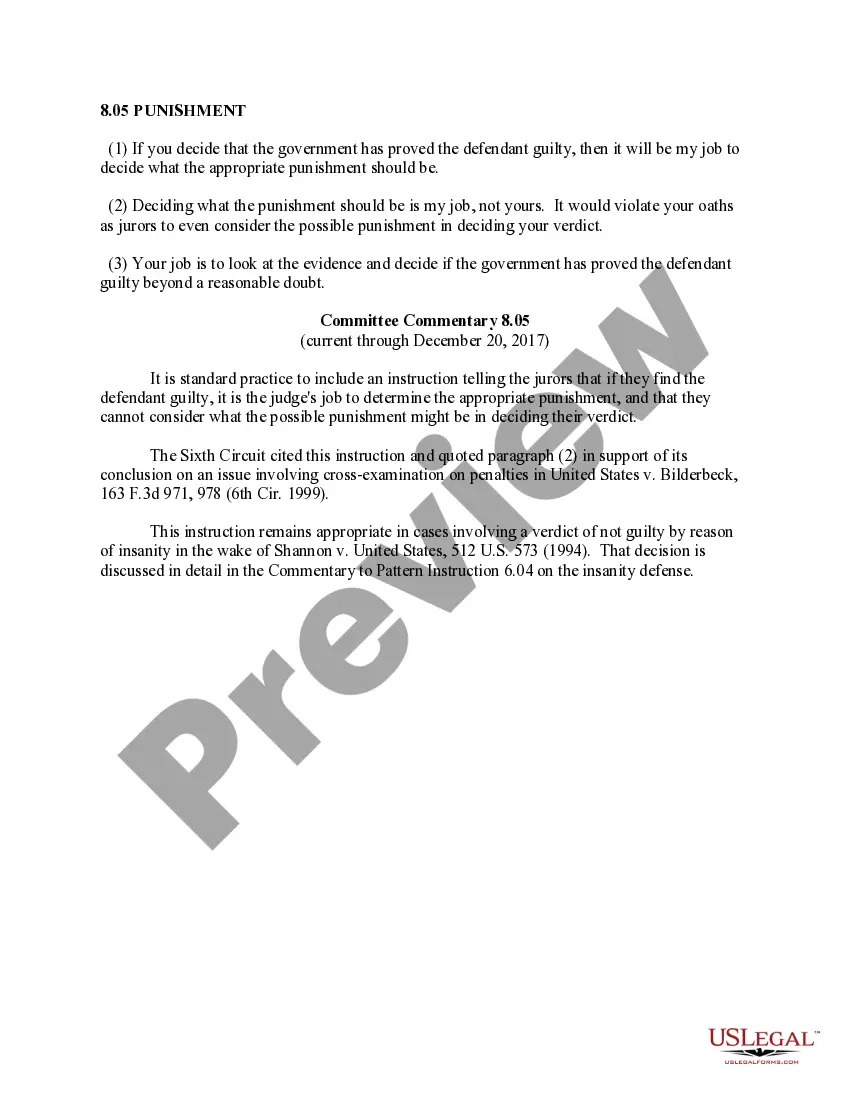

- Take advantage of the Review button to check the form.

- See the outline to actually have chosen the appropriate form.

- In case the form is not what you are looking for, make use of the Look for area to obtain the form that meets your requirements and demands.

- Whenever you obtain the right form, click Get now.

- Pick the rates program you would like, submit the specified info to make your bank account, and buy the transaction using your PayPal or Visa or Mastercard.

- Choose a handy paper format and download your copy.

Find all of the papers templates you might have purchased in the My Forms menus. You can get a extra copy of Delaware Notice to Creditors and Other Parties in Interest - B 205 at any time, if possible. Just click the necessary form to download or print out the papers design.

Use US Legal Forms, the most comprehensive selection of lawful forms, to save lots of time and stay away from errors. The assistance delivers skillfully produced lawful papers templates that you can use for an array of functions. Generate an account on US Legal Forms and initiate producing your daily life a little easier.

Form popularity

FAQ

Pursuing a Derivative Action Shareholders must have been owners at the time of alleged improper conduct; Shareholders must prove they will fairly represent the interests of the company; and. Shareholders must formally demand, in writing, the company's board take action on the basis of suspected misconduct.

Creditors have a certain time frame, typically eight months from the date of appointment of the executor or administrator, to file their claims for payment. If the estate has enough assets, the debts are paid.

(1) In a derivative action, the Court may award reasonable attorney's fees and expenses to derivative counsel. (2) Any person from whom payment is sought may oppose the award, and any person with standing to object to a proposed dismissal or settlement may object to the award.

An authorized person would be the person hired to set up the LLC. This is often an attorney or could also be the registered agent listed on the Certificate of Formation. Although an annual LLC tax, which is in the amount of $300, must be paid each year by the first day of June, the tax can be filed and paid online.

-- Rule 26 protects communications between the party's attorney and any witness required to provide an opinion under Rule 26(b)(4) regardless of the form of the communications, except to the extent that communications: (i) relate to compensation for the expert study or testimony; (ii) identify facts or data that the ...

A motion to dismiss may be based on the following grounds: Lack of subject matter jurisdiction. Lack of personal jurisdiction. Improper venue.

Your Delaware LLC Certificate of Formation must be signed by an Authorized Person. An Authorized Person is any person or company who you authorize to file your Delaware Certificate of Formation. There is no authorization form required.

If you need to amend your Certificate of Formation for a Delaware LLC, you'll need to file a Certificate of Amendment with the Delaware Secretary of State, Division of Corporations. Along with your amendment, you'll need to include a cover letter and the $200 filing fee.

Rule 11 - Signing of Pleadings, Motions, and Other Papers; Representations to Court; Sanctions (a) Signature. Every pleading, motion, and other paper shall be signed by at least 1 attorney of record in the attorney's individual name, or, if the party is not represented by an attorney, shall be signed by the party.

File a Certificate of Incorporation and Maintain Your Entity The certificate must include the name of the entity, the name and address of the registered agent, and the name, address and signature of the person authorized to file the certificate (the ?incorporator?). Again, this is public information.