Delaware Approval for Relocation Expenses and Allowances

Description

How to fill out Approval For Relocation Expenses And Allowances?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast selection of legal form templates that you can download or create.

While using the website, you can access thousands of templates for personal and business purposes, organized by categories, states, or keywords.

You can find the latest forms such as the Delaware Approval for Relocation Expenses and Allowances in just moments.

Review the summary of the form to confirm you have chosen the right one.

If the form does not meet your requirements, use the Search bar at the top of the screen to find the one that does.

- If you already possess a membership, Log In and download the Delaware Approval for Relocation Expenses and Allowances from the US Legal Forms library.

- The Download button will be visible on every form you view.

- You can access all previously saved forms in the My documents tab of your account.

- If you want to explore US Legal Forms for the first time, here are straightforward instructions to get started.

- Ensure you have selected the correct form for your city/state.

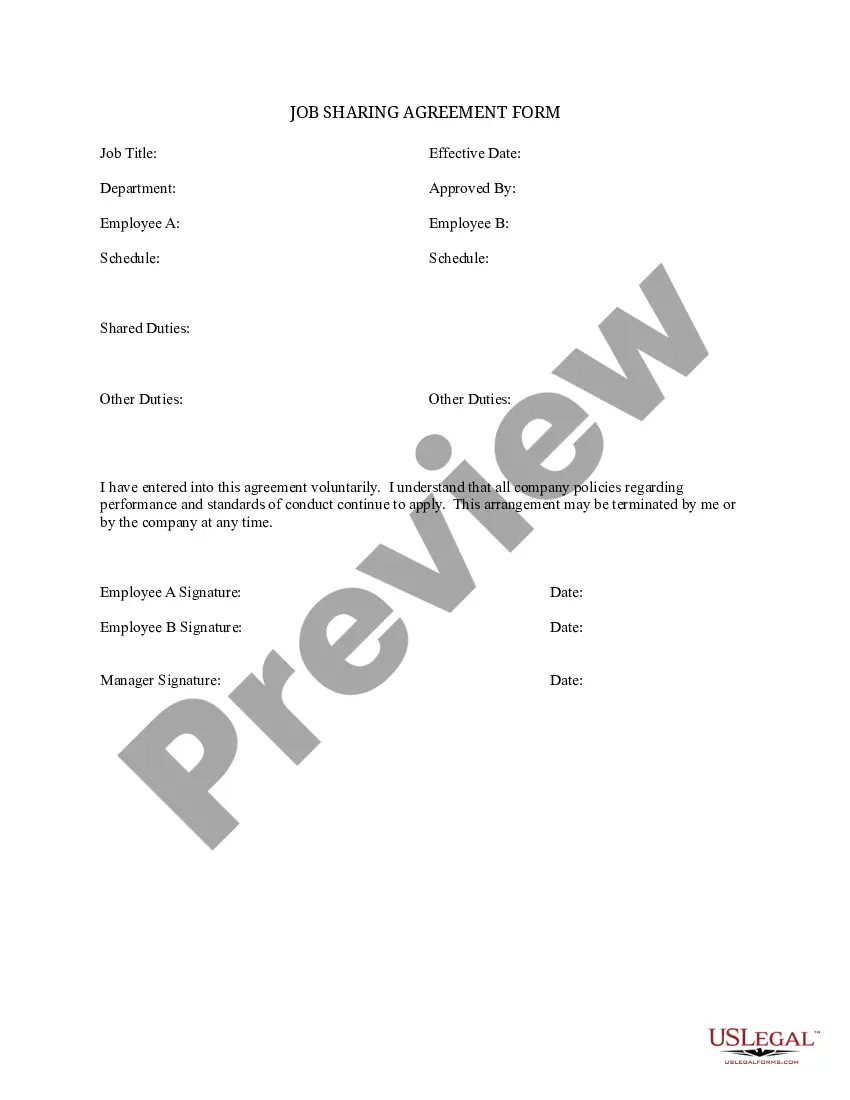

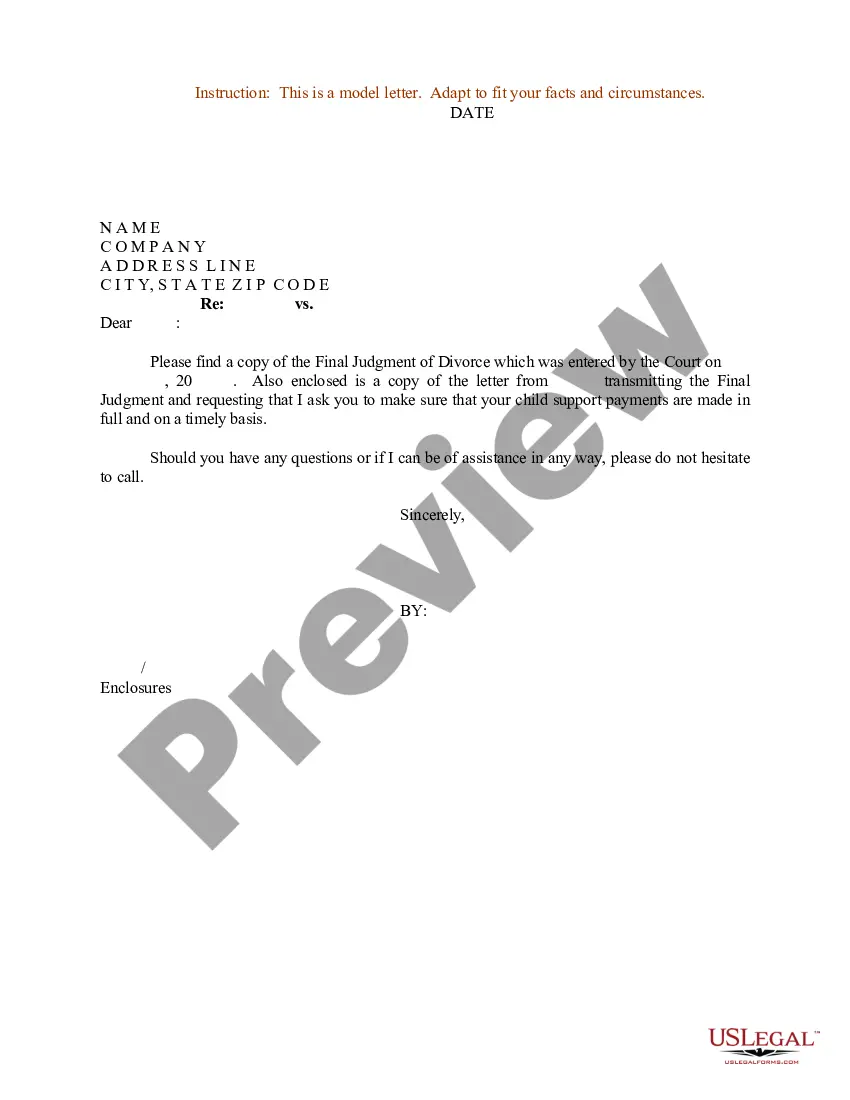

- Click the Preview button to examine the content of the form.

Form popularity

FAQ

In a relocation package, it is reasonable to ask for expenses directly tied to your move, such as transportation costs, hiring professional movers, and temporary housing. You should also consider including allowances for meals and incidentals during the transition. Highlight the Delaware Approval for Relocation Expenses and Allowances to underscore your request to ensure you receive a comprehensive support package.

A typical relocation package usually covers the costs of moving and storing furnishings, household goods, assistance with selling an existing home, costs incurred with house-hunting, temporary housing, and all travel costs by the employee and family to the new location.

The short answer is yes. Relocation expenses for employees paid by an employer (aside from BVO/GBO homesale programs) are all considered taxable income to the employee by the IRS and state authorities (and by local governments that levy an income tax).

Answer. In short, no. But that's provided your employer completes the pay stub accurately as part of their expense reimbursement process. If they incorrectly lump the reimbursed amount with your wages, it's taxed.

Relocation Income Tax Allowance The RITA is designed to reimburse most of the federal and state income tax paid as a result of a PCS transfer. The RITA is taxable.

Essentially, when employees are given relocation benefits, the benefit amount becomes taxable income, which normally means they would have to pay income and FICA taxes on the amount received. Tax gross-ups can help make sure employees have no additional out-of-pocket tax expenses.

Debit "Relocation Benefits" or "Moving Expenses" for the same amount. For example, if you issue a $25,000 relocation benefit, credit the accrual account $25,000 and debit the expense account $25,000.

Taxability for Moving Expenses Any expense or amount paid for moving expenses, whether or not they are paid directly to an employee, on or after January 1, 2018 are includible in an employee's gross income subject to applicable federal income tax withholding, social security and Medicare taxes.

Business expense reimbursements are not considered wages, and therefore are not taxable income (if your employer uses an accountable plan). An accountable plan is a plan that follows the Internal Revenue Service regulations for reimbursing workers for business expenses in which reimbursement is not counted as income.

Due to the Tax Cuts and Jobs Act (TCJA) passed in 2017, most people can no longer deduct moving expenses on their federal taxes. This aspect of the tax code is pretty straightforward: If you moved in 2020 and you are not an active-duty military member, your moving expenses aren't deductible.