Delaware Sample Self-Employed Independent Contractor Contract - for specific job

Description

How to fill out Sample Self-Employed Independent Contractor Contract - For Specific Job?

You can dedicate several hours online looking for the legal document format that meets the federal and state criteria you need.

US Legal Forms offers thousands of legal templates that are examined by professionals.

You can easily download or print the Delaware Sample Self-Employed Independent Contractor Agreement - for specific task from our service.

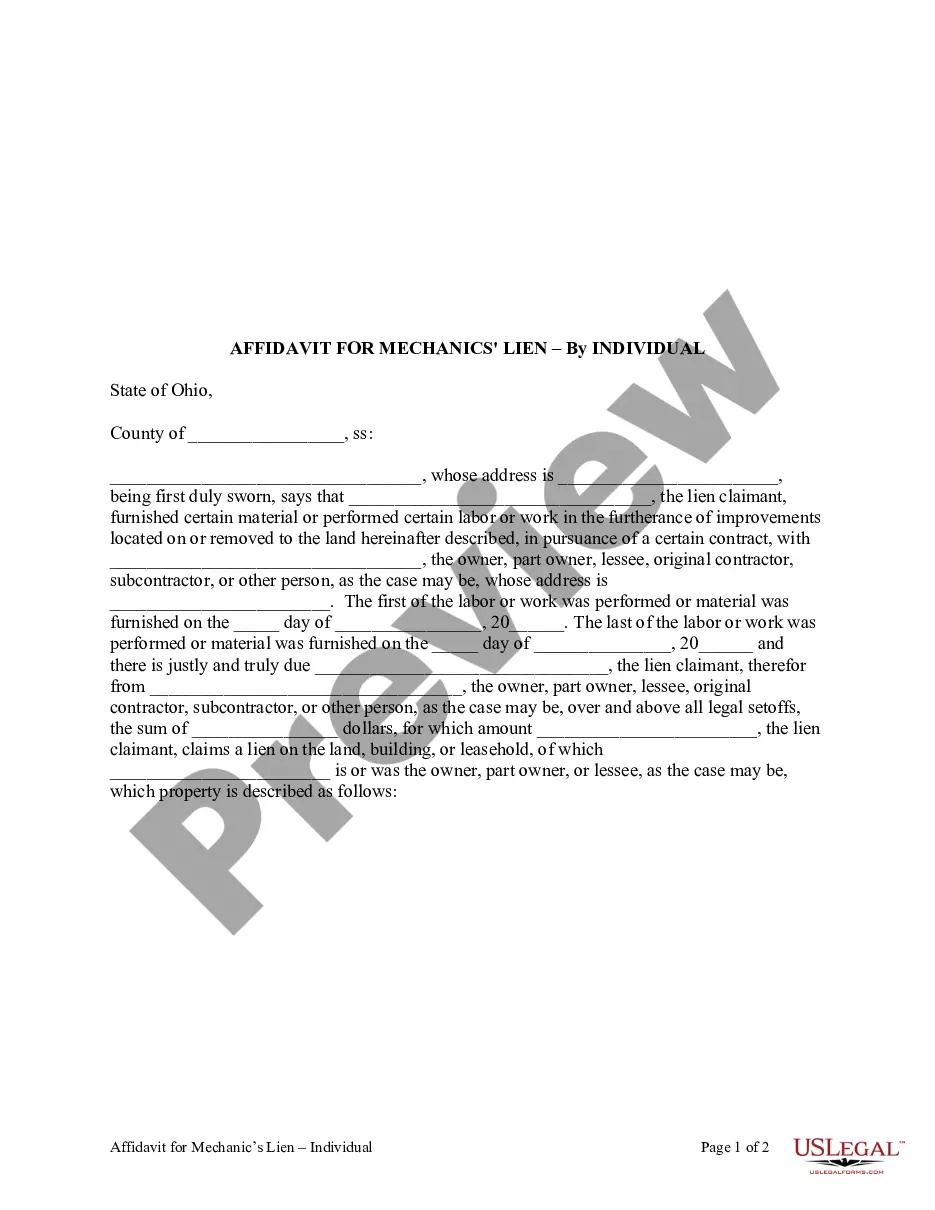

If available, use the Preview button to review the document format as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Delaware Sample Self-Employed Independent Contractor Agreement - for specific task.

- Every legal document template you acquire is yours permanently.

- To obtain an additional copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the region/city that you select.

- Read the form description to ensure you have selected the correct form.

Form popularity

FAQ

The employee's or worker's name, job title or a description of work and start date. How much and how often an employee or worker will get paid. Hours and days of work and if and how they may vary (also if employees or workers will have to work Sundays, nights or overtime)

The IRS says that someone is self-employed if they meet one of these conditions:Someone who carries on a trade or business as a sole proprietor or independent contractor,A member of a partnership that carries on a trade or business, or.Someone who is otherwise in business for themselves, including part-time business.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

An independent contractor agreement is a contract between a freelancer and a company or client outlining the specifics of their work together. This legal contract usually includes information regarding the scope of the work, payment, and deadlines.

How to write an employment contractTitle the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.

Write the contract in six stepsStart with a contract template.Open with the basic information.Describe in detail what you have agreed to.Include a description of how the contract will be ended.Write into the contract which laws apply and how disputes will be resolved.Include space for signatures.