Iowa Articles of Incorporation, Not for Profit Organization, with Tax Provisions

Description

The proper form and necessary content of articles or certificates of incorporation for a nonprofit corporation depend largely on the requirements of the state nonprofit corporation act in the state of incorporation. Typically nonprofit corporations have no capital stock and therefore have members, not stockholders. Because federal tax-exempt status will be sought for most nonprofit corporations, the articles or certificate of incorporation must be carefully drafted to include specific language designed to ensure qualification for tax-exempt status.

How to fill out Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

If you need to complete, acquire, or printing legitimate record layouts, use US Legal Forms, the biggest collection of legitimate forms, which can be found on the Internet. Use the site`s easy and hassle-free lookup to obtain the papers you want. Numerous layouts for enterprise and personal purposes are categorized by classes and suggests, or keywords and phrases. Use US Legal Forms to obtain the Iowa Articles of Incorporation, Not for Profit Organization, with Tax Provisions with a handful of clicks.

If you are previously a US Legal Forms consumer, log in to the profile and click on the Obtain button to have the Iowa Articles of Incorporation, Not for Profit Organization, with Tax Provisions. You can even gain access to forms you formerly saved inside the My Forms tab of the profile.

If you are using US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for that right area/nation.

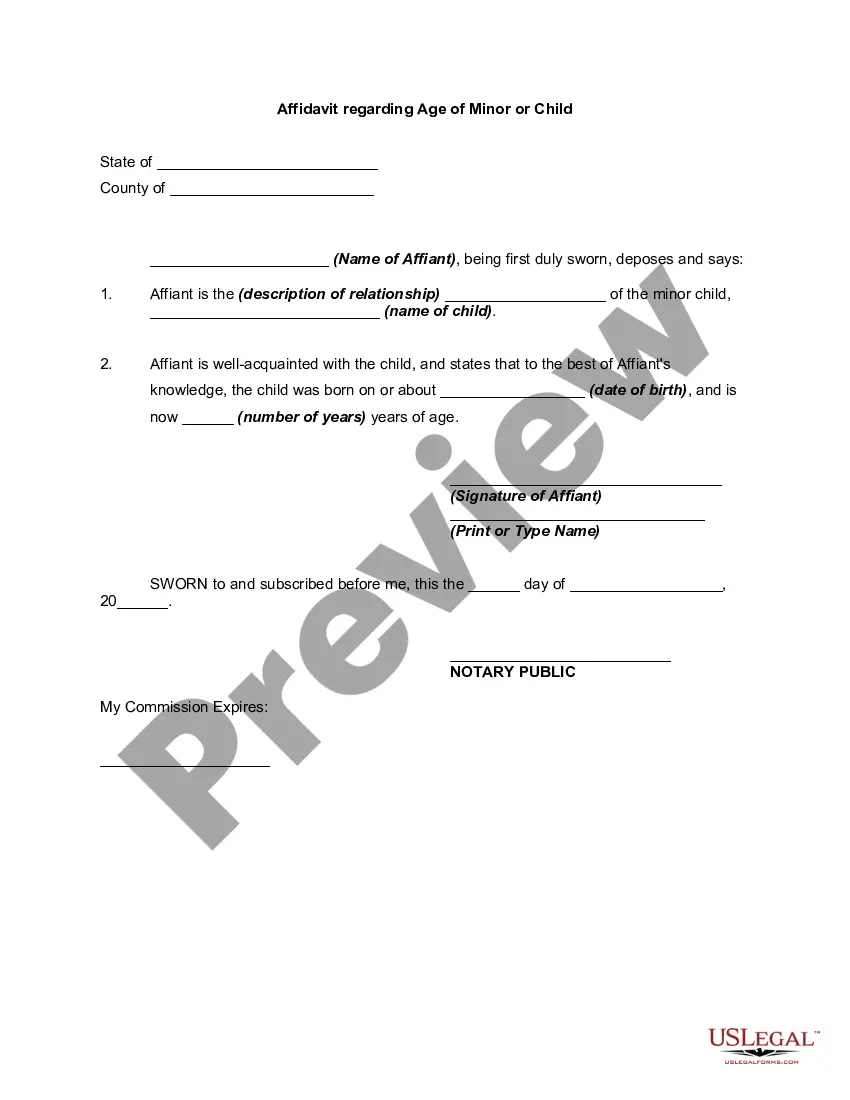

- Step 2. Make use of the Preview method to check out the form`s content material. Never neglect to see the description.

- Step 3. If you are unsatisfied using the form, use the Search field near the top of the display to get other models of your legitimate form template.

- Step 4. Once you have located the shape you want, click on the Acquire now button. Choose the costs strategy you prefer and put your qualifications to register on an profile.

- Step 5. Procedure the purchase. You can utilize your charge card or PayPal profile to finish the purchase.

- Step 6. Select the file format of your legitimate form and acquire it on your device.

- Step 7. Full, change and printing or sign the Iowa Articles of Incorporation, Not for Profit Organization, with Tax Provisions.

Every legitimate record template you purchase is your own forever. You have acces to every single form you saved inside your acccount. Click on the My Forms area and decide on a form to printing or acquire once more.

Contend and acquire, and printing the Iowa Articles of Incorporation, Not for Profit Organization, with Tax Provisions with US Legal Forms. There are millions of specialist and state-distinct forms you can utilize to your enterprise or personal demands.

Form popularity

FAQ

Non-Profit Organization Definition. Non Profit making organizations are formed for social welfare or charity. They usually promote science, art, charity, commerce or religion for social development and not for personal profit. Such establishments can be registered under Section 8 of the Indian Companies Act, 2003.

A charitable nonprofit organization can be organized in Iowa as a corporation, a trust, a limited liability company or an unincorporated association.

Non-profit status may make an organization eligible for certain benefits, such as state sales, property, and income tax exemptions; however, this corporate status does not automatically grant exemption from federal income tax.

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.

exempt organization must file an annual information return or notice with the IRS, unless an exception applies. Annual information returns for most types of organizations include Form 990, Form 990EZ or Form 990PF. Small organizations may be eligible to file Form 990N (ePostcard), an annual notice.

Organizations that meet the requirements of Internal Revenue Code section 501(a) are exempt from federal income taxation. In addition, charitable contributions made to some section 501(a) organizations by individuals and corporations are deductible under Code section 170.

In Iowa, nonprofit entities, even if they have qualified for federal tax exempt status, are treated the same as individuals for sales and use tax purposes. However, purchases made for resell are exempt from all sales taxes, even if a nonprofit corporation does not have a sales tax permit.

The federal government doesn't require nonprofits to pay taxes, so the money they save can be used for charitable purposes. Nonprofits that qualify for 501(c)(3) don't have to pay federal or state income taxes. Most nonprofits fall into the 501(c)(3) category, and this is the category that offers the most tax benefits.