Delaware Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

Description

How to fill out Charitable Trust With Creation Contingent Upon Qualification For Tax Exempt Status?

Finding the correct authorized document template can be challenging. Naturally, there are numerous templates accessible online, but how do you find the legitimate one you require? Use the US Legal Forms website.

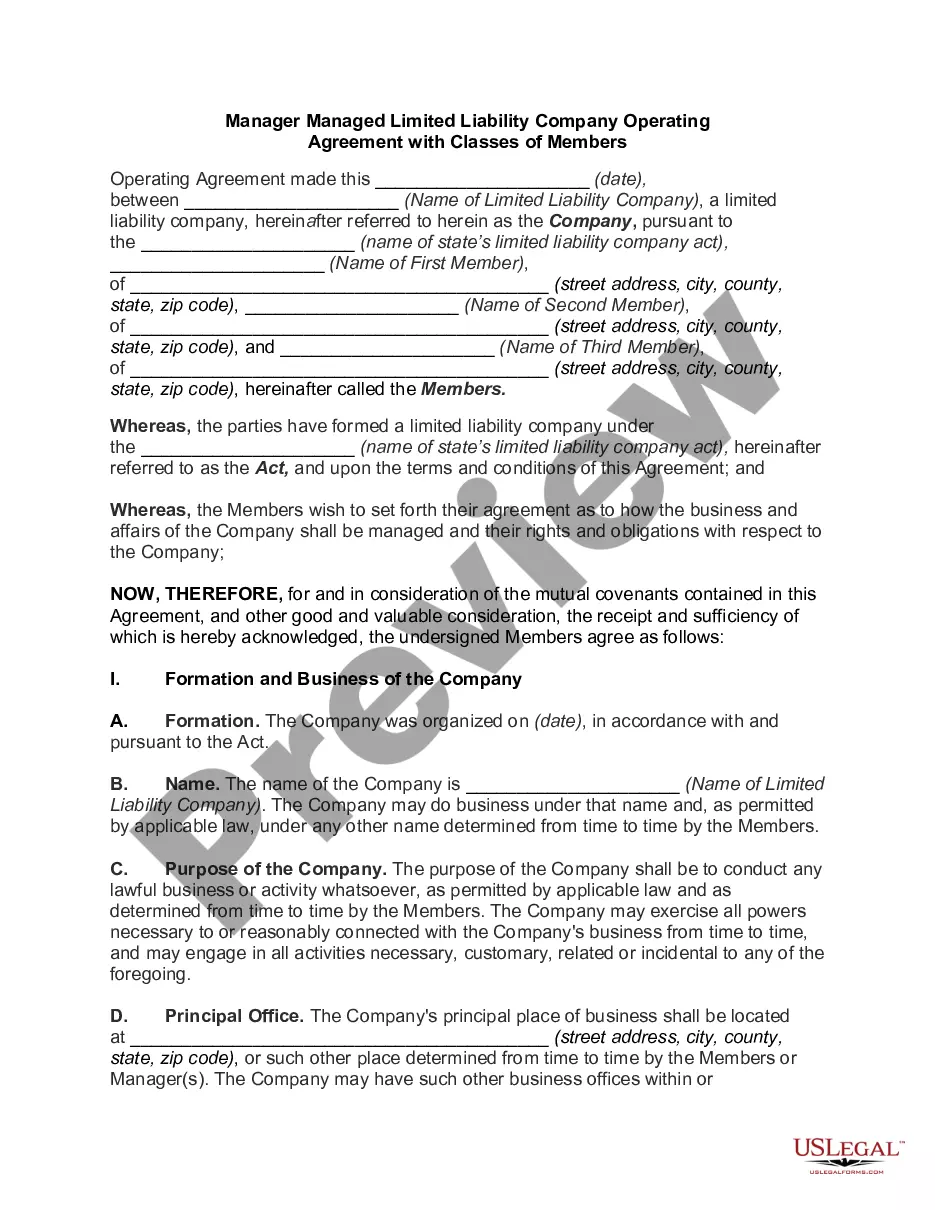

The service offers thousands of templates, including the Delaware Charitable Trust with Creation Contingent upon Eligibility for Tax Exempt Status, which you can utilize for both business and personal needs. All forms are reviewed by professionals and meet state and federal regulations.

If you are already registered, sign in to your account and click the Download button to retrieve the Delaware Charitable Trust with Creation Contingent upon Eligibility for Tax Exempt Status. Utilize your account to search for the legal forms you have previously acquired. Navigate to the My documents tab of your account and obtain another copy of the document you require.

Complete, modify, print, and sign the received Delaware Charitable Trust with Creation Contingent upon Eligibility for Tax Exempt Status. US Legal Forms is the largest collection of legal forms where you can find countless document templates. Use the service to download properly crafted documents that adhere to state requirements.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

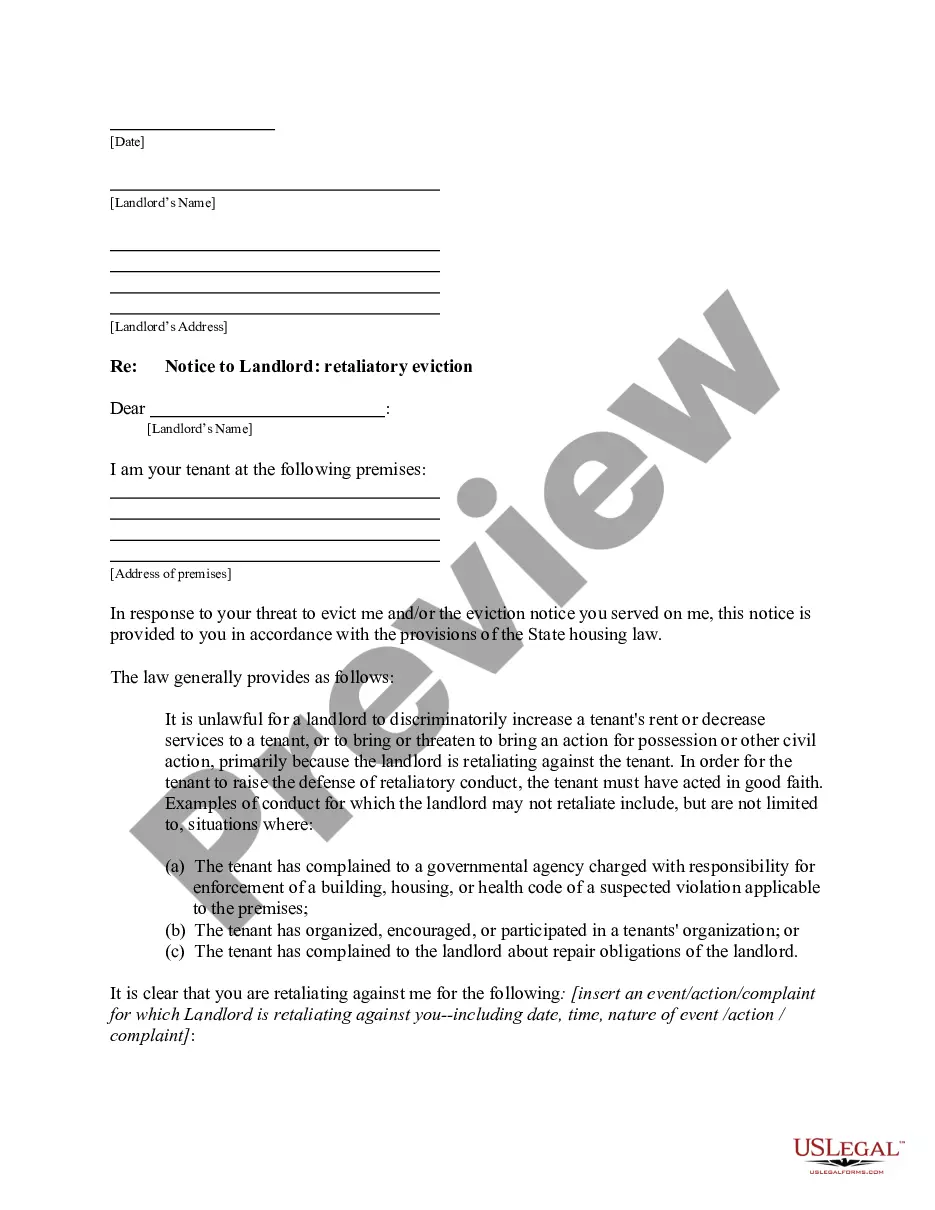

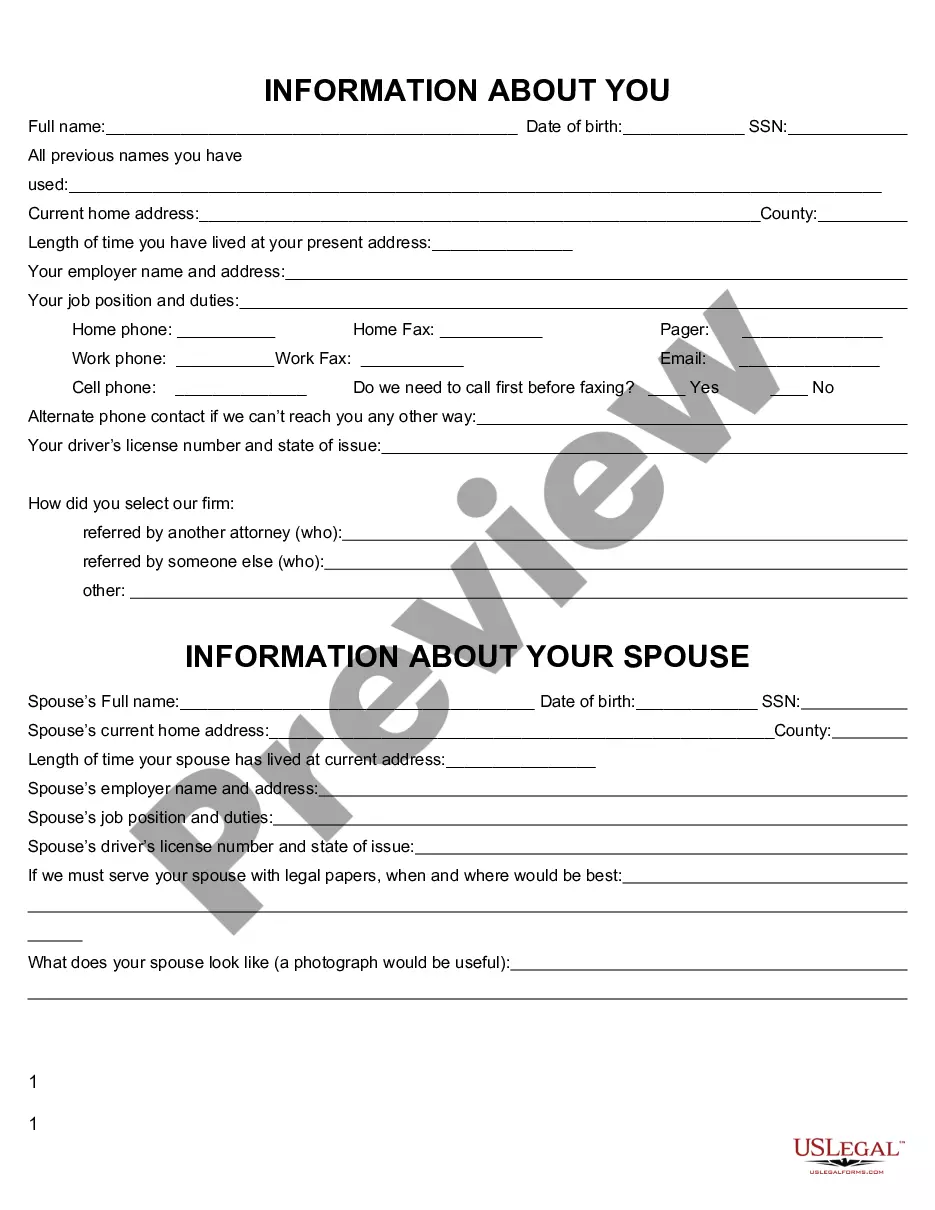

- First, ensure that you have selected the correct form for your city/region. You can preview the form using the Preview button and review the form details to confirm this is the right one for you.

- If the form does not meet your needs, utilize the Search area to find the suitable form.

- When you are confident the form is appropriate, click the Get now button to obtain the form.

- Choose the pricing plan you desire and enter the required information. Create your account and pay for the order using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

Within the United States, you should find the 501(c)(3) tax code. When determining the nonprofit status of an organization, begin by using the IRS Select Check database. The IRS provides an Exempt Organization List on its website. You can also ask the nonprofit for proof of their status.

Exempt Organization TypesCharitable Organizations.Churches and Religious Organizations.Private Foundations.Political Organizations.Other Nonprofits.

How to Start a Nonprofit in DelawareName Your Organization.Choose a Delaware nonprofit corporation structure.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.More items...

Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, educational, or other specified purposes and that meet certain other requirements are tax exempt under Internal Revenue Code Section 501(c)(3).

The IRS groups the 501(c)(9), 501(c)(4), and 501(c)(17) together when the latter two are employees' associations.

However, a charitable trust is not treated as a charitable organization for purposes of exemption from tax. Accordingly, the trust is subject to the excise tax on its investment income under the rules that apply to taxable foundations rather than those that apply to tax-exempt foundations.

Tax information for charitable, religious, scientific, literary, and other organizations exempt under Internal Revenue Code ("IRC") section 501(c)(3). Information, explanations, guides, forms, and publications available on irs.gov for tax-exempt social welfare organizations.

File Form 1023 with the IRS. Most nonprofit corporations apply for tax-exempt status under Sec. 501(c)(3).

Exemption Requirements - 501(c)(3) Organizations To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual.

For the purposes of PSLF, eligible not-for-profit organizations include a organizations that are tax exempt under section 501(c)(3) of the Internal Revenue Code (IRC), or other not-for-profit organizations that provide a qualifying service.