Delaware Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose

Description

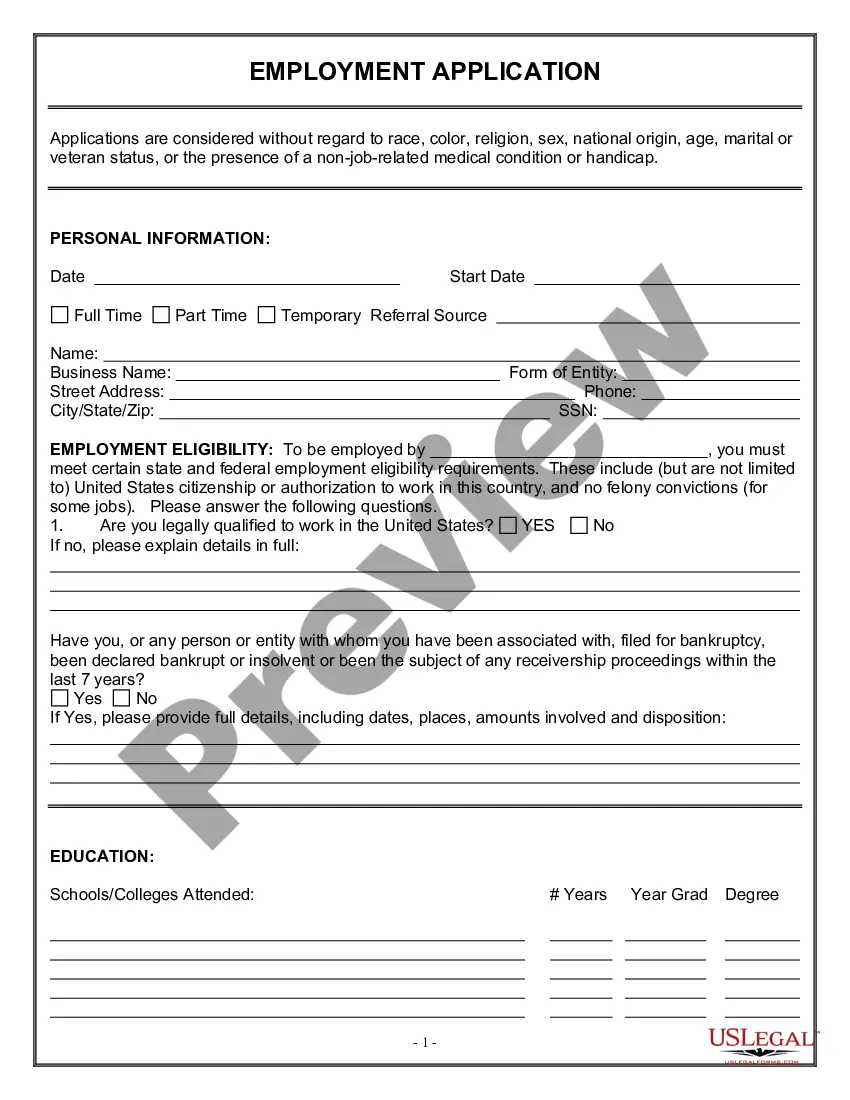

How to fill out Provision In Testamentary Trust With Bequest To Charity For A Stated Charitable Purpose?

It is feasible to spend hours online searching for the legal document template that complies with the federal and state regulations you require.

US Legal Forms provides thousands of legal forms that can be evaluated by professionals.

You can easily download or print the Delaware Provision in Testamentary Trust with Bequest to Charity for a Designated Charitable Purpose from my service.

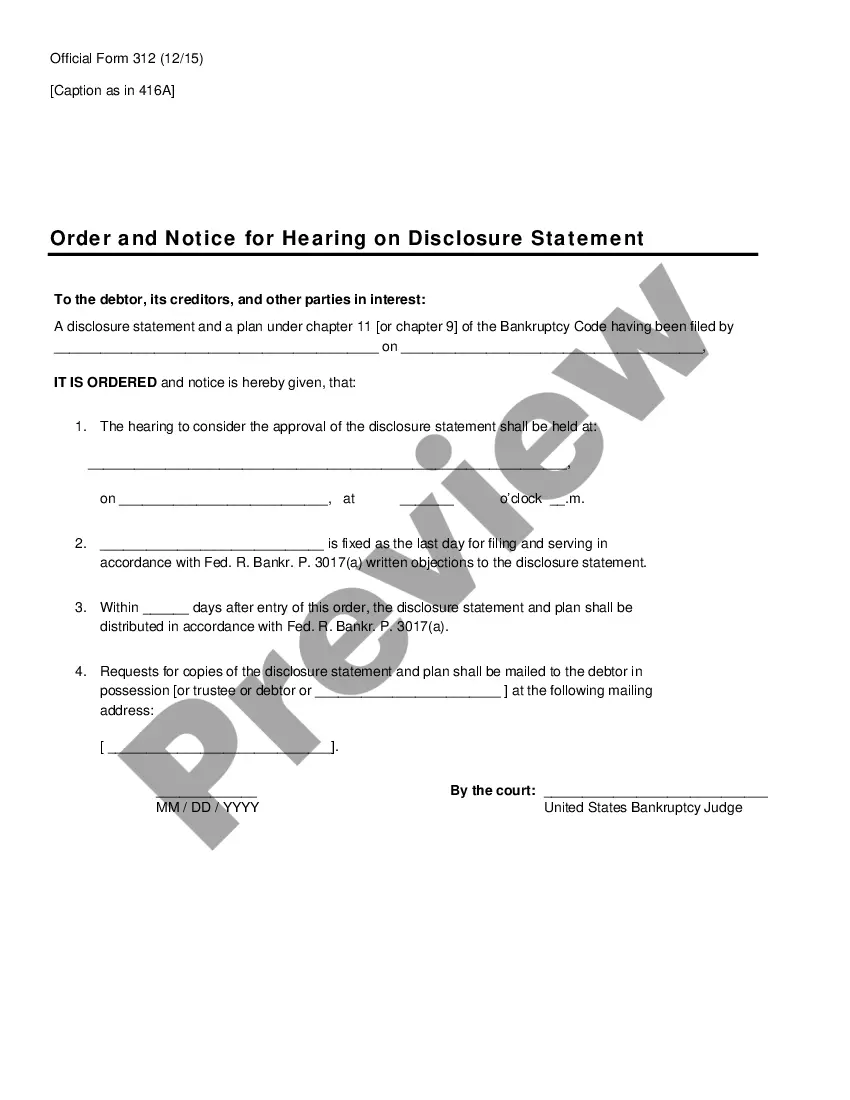

- If you already have a US Legal Forms account, you can sign in and select the Download option.

- Then, you can complete, modify, print, or sign the Delaware Provision in Testamentary Trust with Bequest to Charity for a Designated Charitable Purpose.

- Every legal document template you obtain is yours permanently.

- To obtain another copy of a purchased form, visit the My documents tab and click on the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for your region/city of choice.

- Read the form description to ensure you have selected the correct form. If available, use the Review option to browse the document template as well.

- If you wish to find another version of your form, utilize the Lookup field to find the template that suits your needs and requirements.

- Once you have identified the template you want, click Purchase now to proceed.

- Select the pricing plan you would like, fill in your details, and register for your account on US Legal Forms.

- Complete the transaction. You can use your Visa or Mastercard or PayPal account to purchase the legal form.

- Select the format of your document and download it to your device.

- Make modifications to the document if necessary. You can complete, amend, sign, and print the Delaware Provision in Testamentary Trust with Bequest to Charity for a Designated Charitable Purpose.

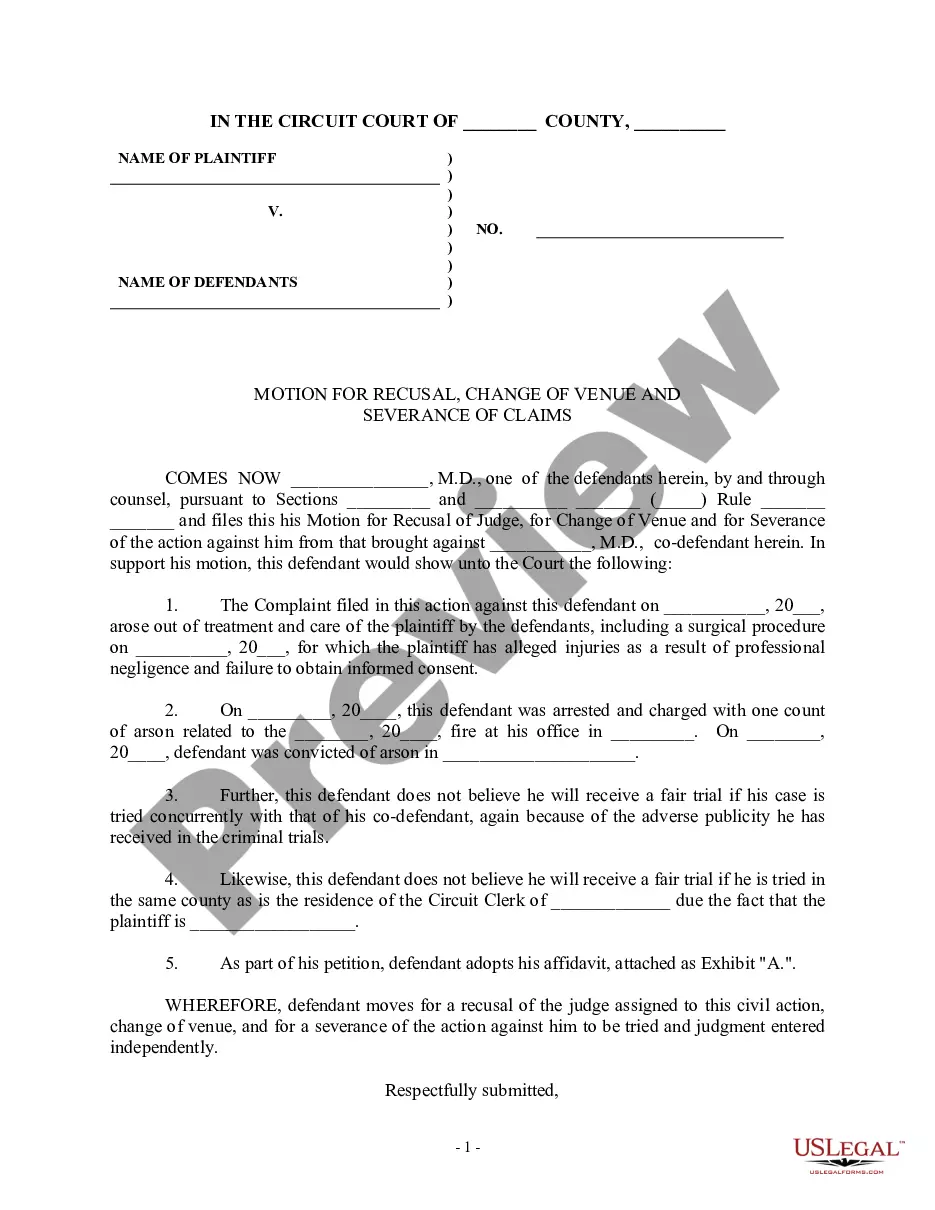

- Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms.

- Utilize professional and state-specific templates to meet your business or personal needs.

Form popularity

FAQ

A critical mistake parents often make in setting up a trust fund in the UK is failing to clearly outline the terms and purpose of the trust. Without a well-defined Delaware Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose, beneficiaries may not understand their rights or duties. Ensuring clarity can prevent future disputes and ensure the trust serves its intended purpose.

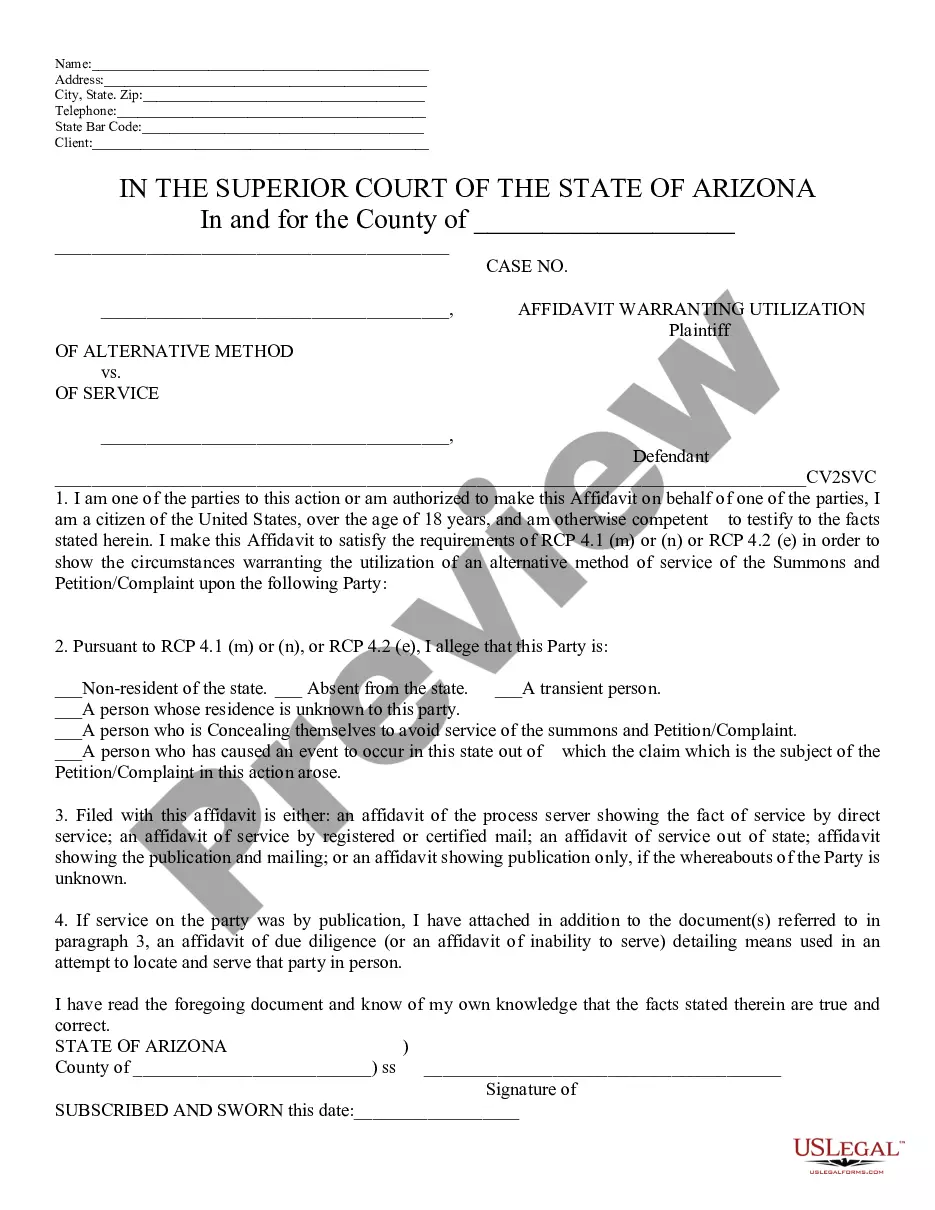

A testamentary trust (a trust established by will after death) is subject to tax at graduated income tax rates. Conversely, an inter vivos trust (a trust created during a settlor's lifetime) is taxed at the highest marginal tax rate applicable to individuals (currently 43.7% in BC).

To help you get started on understanding the options available, here's an overview the three primary classes of trusts.Revocable Trusts.Irrevocable Trusts.Testamentary Trusts.More items...?

How does it save tax? A testamentary trust allows the person who controls it to split the income generated by the trust between family members. Importantly, children who receive income from a testamentary trust are taxed at adult tax rates, instead of penalty rates (up to 66%) which apply to other types of trusts.

You can make a gift bequest to benefit MCCF by designating a dollar amount, securities, specific property or a percentage of the remainder of your estate. According to current laws, your estate will receive a charitable deduction for the donation, so your heirs will not be required to pay estate tax on these assets.

A testamentary charitable remainder trust is created with assets upon your death. The trust then makes regular income payments to your named heirs for life or a term of up to 20 years.

1) Vested interest is not affected by the rule because once the interest are vested it cannot be bad for remoteness. 2) The rule is not applicable to land purchased or held by Corporation. 3) Gift to charities, the rule does not apply to transfer for the benefit of public for religious, pious, or charitable purposes.

Unlike with private trusts, the common law Rule Against Perpetuities (Rule) does not apply to the duration of charitable trusts.

RULE AGAINST PERPETUITIES. The rule against perpetuities applies to trusts other than charitable trusts. Accordingly, an interest is not good unless it must vest, if at all, not later than 21 years after some life in being at the time of the creation of the interest, plus a period of gestation.

The trust can also be used to reduce estate tax liabilities and ensure professional management of the assets. A disadvantage of a testamentary trust is that it does not avoid probatethe legal process of distributing assets through the court.