In a charitable lead trust, the lifetime payments go to the charity and the remainder returns to the donor or to the donor's estate or other beneficiaries. A donor transfers property to the lead trust, which pays a percentage of the value of the trust assets, usually for a term of years, to the charity. Unlike a charitable remainder trust, a charitable lead annuity trust creates no income tax deduction to the donor, but the income earned in the trust is not attributed to donor. The trust itself is taxed according to trust rates. The trust receives an income tax deduction for the income paid to charity.

Delaware Charitable Inter Vivos Lead Annuity Trust

Description

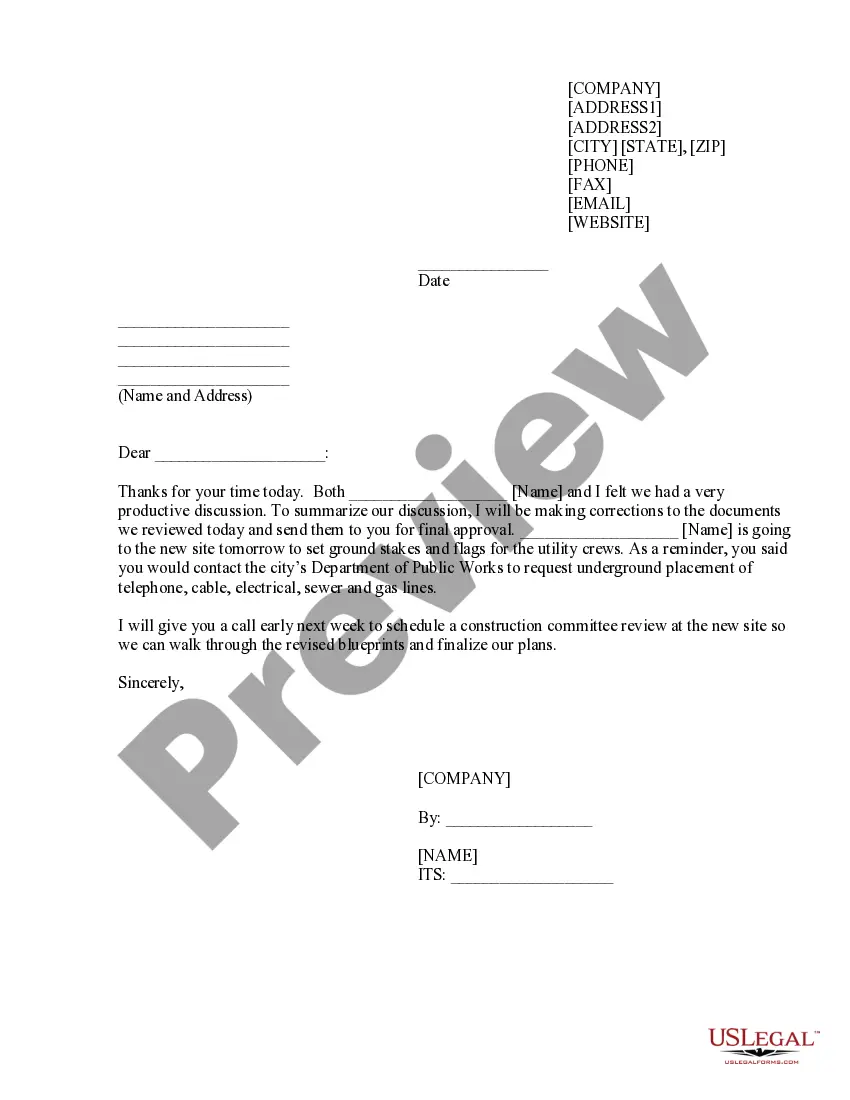

How to fill out Charitable Inter Vivos Lead Annuity Trust?

If you want to be thorough, acquire, or print sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Leverage the site's simple and convenient search to find the documents you need.

A collection of templates for business and individual purposes is sorted by categories and states, or keywords.

Every legal document template you purchase is yours forever. You have access to every form you saved in your account. Go to the My documents section and choose a form to print or download again.

Act quickly and download, and print the Delaware Charitable Inter Vivos Lead Annuity Trust with US Legal Forms. There are numerous professional and jurisdiction-specific forms available for your business or individual requirements.

- Employ US Legal Forms to obtain the Delaware Charitable Inter Vivos Lead Annuity Trust in just a few clicks.

- If you're already a US Legal Forms customer, Log In to your account and press the Acquire button to get the Delaware Charitable Inter Vivos Lead Annuity Trust.

- You can also access forms you've saved before in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the correct form for your city/state.

- Step 2. Utilize the Review option to examine the content of the form. Don’t forget to read the description.

- Step 3. If you are unhappy with the form, use the Search bar at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the payment plan you prefer and enter your details to register for the account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal document and download it to your system.

- Step 7. Fill out, modify, and print or sign the Delaware Charitable Inter Vivos Lead Annuity Trust.

Form popularity

FAQ

At the end of a Delaware Charitable Inter Vivos Lead Annuity Trust's term, the remaining assets are transferred to your designated beneficiaries. This transfer can potentially create a significant financial benefit for them, as they receive the assets without any immediate tax implications. Meanwhile, the charity continues to receive financial support during the trust's term. It's important to understand the specific terms of your trust to ensure all parties benefit as intended.

One potential downside of a Delaware Charitable Inter Vivos Lead Annuity Trust involves the commitment to charity; once set up, you cannot withdraw the donated assets. Additionally, the fixed payment structure may limit your investment flexibility if the trust income fluctuates. Lastly, establishing and managing a trust can incur legal fees and administrative costs, which should be weighed against the benefits.

A charitable lead annuity trust (CLAT) pays the charity first, providing them with annuity payments for a specified term. In contrast, a charitable remainder annuity trust provides income to you or your beneficiaries, and the remaining assets go to the charity at the end of the term. Each trust serves different financial and philanthropic purposes, so understanding your goals is essential when choosing between them. Delaware Charitable Inter Vivos Lead Annuity Trusts are particularly beneficial for immediate charitable giving.

A Delaware Charitable Inter Vivos Lead Annuity Trust, or CLAT, allows you to make regular charitable donations while receiving annuity payments. You donate assets to the trust, which then pays a fixed annual amount to your chosen charity for a set number of years. After this period, the remaining assets pass to your beneficiaries. This arrangement can provide tax benefits while supporting a cause you care about.

Charitable remainder trusts have several potential downsides, including the complexity of their setup and ongoing administration costs. Additionally, the income they generate may be subject to tax, depending on how and when distributions are made. It's important to weigh these factors against the benefits of a Delaware Charitable Inter Vivos Lead Annuity Trust to determine the best fit for your charitable goals.

Yes, an inter vivos trust is required to file a tax return if it has any taxable income, which is reported on IRS Form 1041. The tax treatment can vary based on how the trust's income is distributed. Consulting with a tax professional can provide additional clarity on the implications for a Delaware Charitable Inter Vivos Lead Annuity Trust.

While charitable trusts can provide tax benefits, they also have some disadvantages. These can include limited control over the assets once the trust is established and potential costs associated with setting up and maintaining the trust. Being aware of these factors can help you make an informed decision when considering a Delaware Charitable Inter Vivos Lead Annuity Trust.

Charitable lead annuity trusts are generally subject to federal income tax on their earnings. However, the donor can often claim a charitable deduction when the trust is established, potentially lowering their taxable income. Understanding the tax implications can guide you in maximizing the benefits of a Delaware Charitable Inter Vivos Lead Annuity Trust.

Yes, a charitable lead trust must file IRS Form 1041, which is the income tax return for estates and trusts. This form reports both income generated by the trust and distributions made to charities. Properly handling these filings is crucial for maintaining the tax benefits associated with a Delaware Charitable Inter Vivos Lead Annuity Trust.

Filing a trust in Delaware requires drafting a trust agreement and naming a trustee. You'll need to follow Delaware's legal requirements, including any necessary filings with the state. Using the resources available on the US Legal Forms platform can help simplify this process, ensuring your Delaware Charitable Inter Vivos Lead Annuity Trust meets all legal standards.