Delaware Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner

Description

How to fill out Agreement To Dissolve And Wind Up Partnership Between Surviving Partners And Estate Of Deceased Partner?

Should you require to complete, acquire, or print authentic document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Leverage the site’s user-friendly and efficient search feature to locate the documents you desire.

A plethora of templates for both business and personal applications are categorized by type, jurisdiction, or keywords.

Step 4. Once you have located the desired form, click the Download now button. Choose the payment option you prefer and provide your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to process the payment.

- Employ US Legal Forms to discover the Delaware Agreement for Dissolving and Finalizing Partnership between Surviving Partners and the Estate of the Deceased Partner with just a few clicks.

- If you are a registered customer of US Legal Forms, sign in to your account and select the Download button to obtain the Delaware Agreement for Dissolving and Finalizing Partnership between Surviving Partners and the Estate of the Deceased Partner.

- You can also access documents you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Confirm that you have selected the form for the correct state/country.

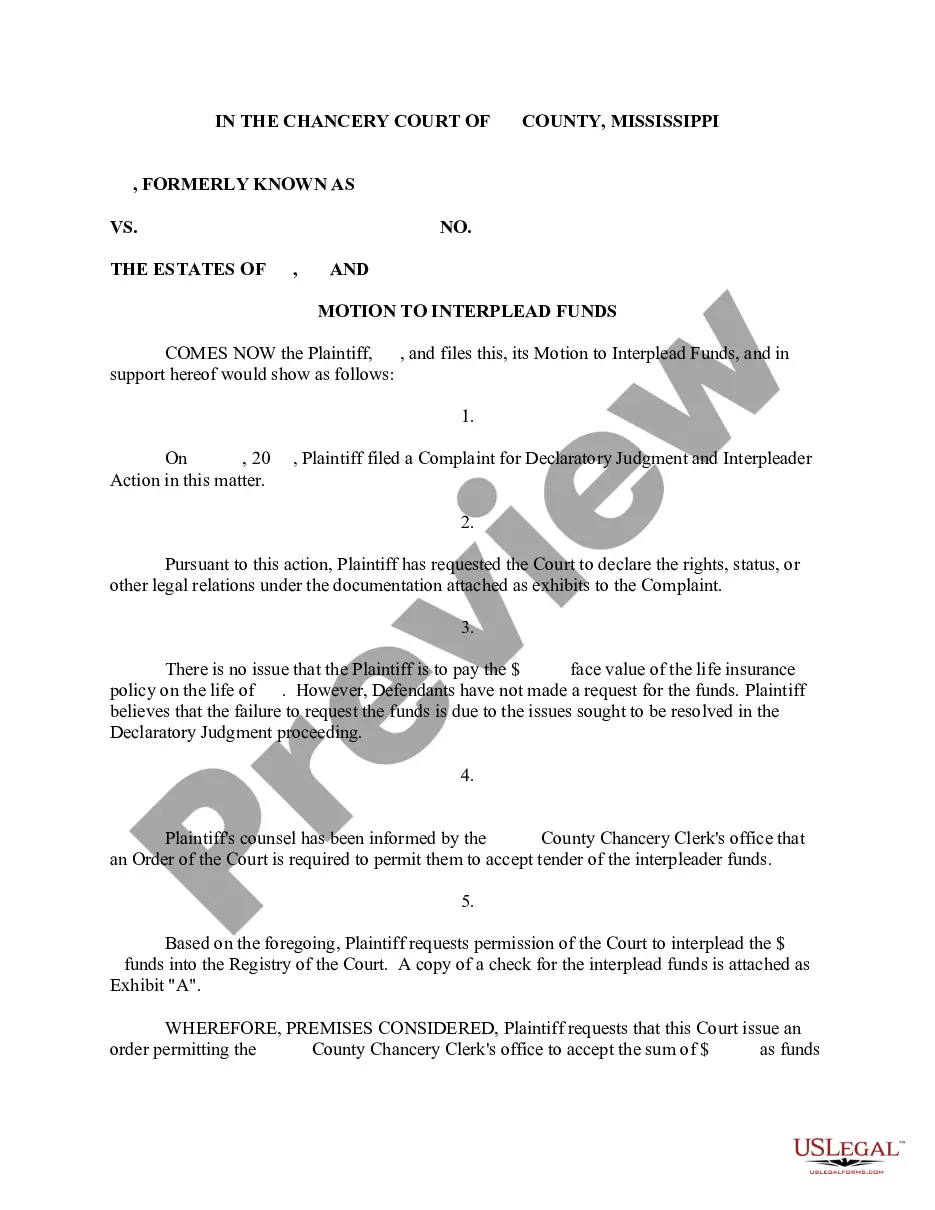

- Step 2. Use the Preview option to review the content of the form. Be sure to read the overview.

- Step 3. If you are unsatisfied with the document, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

As provided under Section 40 of the Act, winding up of a partnership firm may be processed only with the consent of all the partners or in accordance with a contract between them. The partners may, by consent or by entering into an agreement, dissolve the firm and proceed for winding up of a partnership firm.

Winding up a partnership business is a procedure that distributes, or liquidates, any remaining property of the partnership and any assets that remain after the dissolution of the partnership business. Only those partners that remain with the partnership have the right to partnership assets in the wind up process.

Section 37 of the UPA provides that unless otherwise agreed, the partners who have not wrongfully dissolved the partnership or the legal representative of the last surviving solvent partner have the right to wind up the partnership affairs, provided, however, that any partner, his legal representative, or his assignee

Even if the partnership failed to register with the SEC, it still has a separate juridical personality. Thus, the partnership, as a separate person can acquire its own property, bring actions in court in its own name and incur its own liabilities and obligations.

The first step in termination is known as dissolution. Dissolution occurs when any partner discontinues his or her involvement in the partnership business or when there is any change in the partnership relationship. The second step is known as winding up.

In an at-will partnership, the death (including termination of an entity partner), bankruptcy, incapacity, or expulsion of a partner will not cause dissolution.

There are only two ways in which a partner can be removed from a partnership or an LLP. The first is through resignation and the second is through an involuntary departure, forced by the other partners in accordance with the terms of a partnership agreement.

The partners who have not wrongfully dissociated may participate in winding up the partnership business. On application of any partner, a court may for good cause judicially supervise the winding up. UPA, Section 37; RUPA, Section 803(a).

Section 37 of the UPA provides that unless otherwise agreed, the partners who have not wrongfully dissolved the partnership or the legal representative of the last surviving solvent partner have the right to wind up the partnership affairs, provided, however, that any partner, his legal representative, or his assignee

Only partners who have not wrongfully caused dissolution or have not wrongfully dissociated may participate in winding up the partnership's affairs. State partnership statutes set the procedure to be used to wind up partnership business.