Delaware Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner By Retiring Partner?

Selecting the most suitable authentic document template can be a challenge.

It goes without saying that there are numerous designs accessible online, but how will you identify the authentic type you need.

Utilize the US Legal Forms platform. The service offers thousands of templates, such as the Delaware Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, that can be utilized for business and personal purposes.

If the document does not meet your standards, use the Search box to find the appropriate template. Once you are sure the document is suitable, click the Get now button to retrieve the template. Select the pricing option you prefer and enter the necessary information. Create your account and pay for an order using your PayPal account or credit card. Choose the file format and download the authentic document template for your requirements. Complete, modify, and print and sign the acquired Delaware Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner. US Legal Forms is the premier repository of legal documents where you can find various file formats. Take advantage of the service to acquire properly-crafted documents that adhere to state regulations.

- All of the documents are reviewed by experts and comply with state and federal regulations.

- If you are currently registered, Log In to your account and click the Download button to access the Delaware Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner.

- Use your account to search through the legal templates you have secured in the past.

- Proceed to the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward instructions to follow.

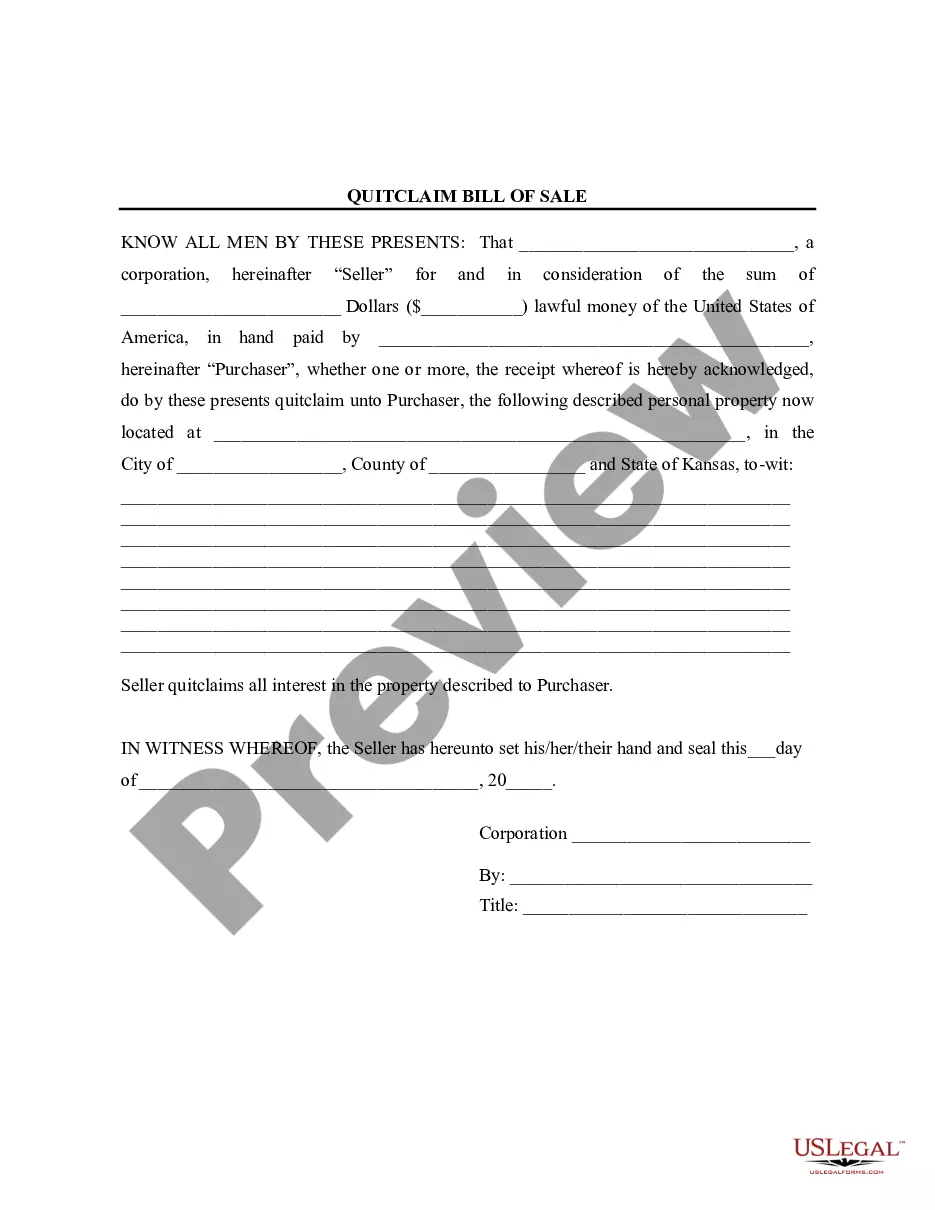

- First, ensure you have chosen the correct template for your locality/state. You can review the document using the Preview button and read the form details to confirm it is the suitable one for you.

Form popularity

FAQ

Section 17 302 outlines the procedures for filing documents related to a Delaware limited partnership, including annual reports and other essential filings. Understanding these requirements is crucial for maintaining good standing. This knowledge is particularly useful when executing a Delaware Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, ensuring you comply with all state regulations.

Section 17 801 specifies regulations regarding the amendment and repeal of limited partnership agreements in Delaware. Knowing this section can be beneficial if partners wish to make changes during or after the dissolution process. It is especially relevant when working on a Delaware Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, as updates might be necessary.

Section 18 217 deals with the cancellation of a Delaware limited liability company’s certificate and outlines the necessary procedures for doing so. This section is important for understanding the formal dissolution process. If this pertains to your situation in conjunction with a Delaware Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, being informed ensures compliance with state laws.

Yes, Delaware law does require a limited partnership agreement for the formation of a limited partnership. This agreement outlines the operational structure and responsibilities of partners. When drafting a Delaware Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, having a clear partnership agreement in place can facilitate smoother processes and ensure adherence to legal requirements.

Section 17 218 of the Delaware Act focuses on partner responsibilities and management powers within a limited partnership. This section is integral for understanding how partners can navigate operational decisions during dissolution. It plays a significant role in any Delaware Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, ensuring that all actions taken are legal and effective.

To dissolve a Delaware limited partnership, you typically need a formal agreement among partners, in line with partnership terms outlined in your contract. Filing necessary documents with the Delaware Secretary of State is also required. If you are contemplating a Delaware Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, ensure you follow these critical steps to facilitate a smooth transition.

Section 17 607 addresses the rights of partners when it comes to withdrawing from a Delaware limited partnership. This section is vital for partners planning their exit strategy. When executing a Delaware Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, familiarity with this section can ensure that all legal protocols are properly followed.

Section 17 218 pertains to the powers and duties of partners in a Delaware limited partnership. It outlines essential aspects of a partner's ability to manage and control the partnership. Understanding this section is crucial for partners considering a Delaware Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, as it provides clarity on authority during dissolution.

Winding up a partnership involves several stages, starting with settling any outstanding debts, followed by liquidating assets. The remaining profits are then distributed among partners according to the partnership agreement. Utilizing a Delaware Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner can simplify this procedure significantly.

Removing someone from a limited company typically requires following procedures outlined in the company’s articles of association and obtaining necessary approvals. This can include shareholder meetings and potential amendments to company records. Keeping detailed documentation during this process is essential for legal compliance.