Delaware Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Division Of Assets Between Partners?

US Legal Forms - one of the largest repositories of legal templates in the USA - provides a vast selection of legal document templates available for download or printing.

By utilizing the site, you can access thousands of forms for business and personal use, categorized by type, state, or keywords.

You can find the latest versions of forms such as the Delaware Agreement to Dissolve and Wind Up Partnership with Distribution of Assets between Partners in just seconds.

If the form does not meet your needs, use the Search field at the top of the page to find the one that does.

If satisfied with the form, confirm your choice by clicking the Get now button. Then, choose your preferred payment plan and enter your details to set up an account.

- If you already hold a subscription, Log In to download the Delaware Agreement to Dissolve and Wind Up Partnership with Distribution of Assets between Partners from your US Legal Forms library.

- The Download option will appear on each form you view.

- You can access all previously saved forms within the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Select the appropriate form for your city/county.

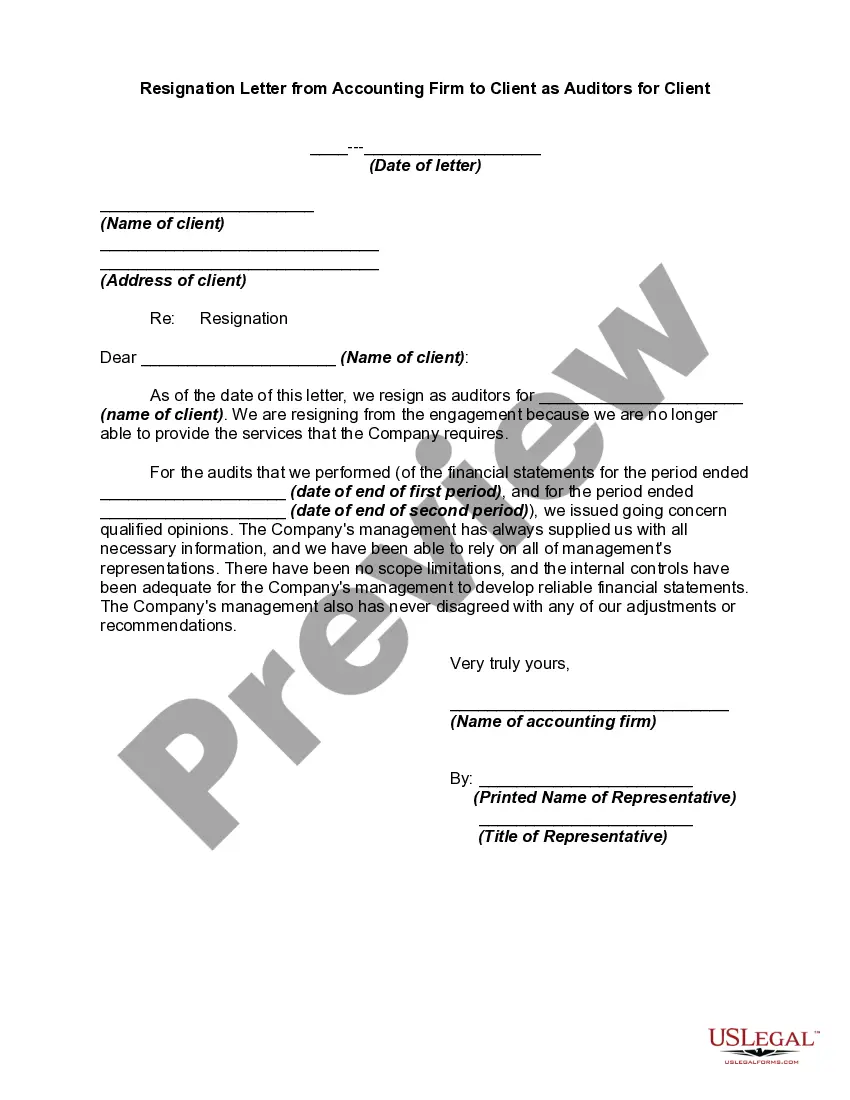

- Preview the form content by clicking the relevant option.

Form popularity

FAQ

Domestic (California) limited partnerships: To cancel the Certificate of Limited Partnership of a California limited partnership (LP), the LP must file a Certificate of Dissolution (Form LP-3) and Certificate of Cancellation (Form LP-4/7).

Can one partner force the dissolution of an LLC partnership? The short answer is yes. If there are two partners, each holding a 50% stake in the business, one partner can force the LLC to dissolve.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

Steps to Cancel a Delaware LLCConsult the LLC Operating Agreement.Take a Member Vote.Appoint a Manager to Wind up the LLC's Affairs.Payoff Creditors, Current and Forseeable, before paying Members.Pay The Delaware Franchise Tax.Pay the LLC's members.File a Certificate of Cancellation.More items...

Under Section 17-801 of the DRULPA, a Delaware limited partnership will voluntarily dissolve upon the occurrence of certain events, including: (i) at a time specified in the limited partnership agreement; (ii) upon the happening of events specified in the limited partnership agreement; or (iii) the vote of at least two

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves. Your partners may not want to dissolve the partnership due to your departure.

How long does it take the state to process the filing? It will take approximately two to three weeks to dissolve your LLC or corporation.

Take a Vote or Action to Dissolve In most cases, dissolution provisions in a partnership agreement will state that all or a majority of partners must consent before the partnership can dissolve. In such cases, you should have all partners vote on a resolution to dissolve the partnership.

There is a $200 fee to file the certificate. Your filing usually will be processed in 2-3 weeks. Various forms of expedited service are available for additional fees. A basic certificate of cancellation form is available for download from the SOS website.

In the dissolution process, any partner may dissolve the partnership at any time by providing a notice of dissolution. The partnership is then required to wind up its business activities and distribute its assets.