Delaware Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation

Description

How to fill out Shareholders' Agreement With Special Allocation Of Dividends Among Shareholders In A Close Corporation?

If you require to aggregate, obtain, or print authentic document templates, utilize US Legal Forms, the leading assortment of legal forms, available online.

Take advantage of the website's user-friendly and efficient search function to locate the documents you need.

A selection of templates for business and personal purposes is organized by categories and states, or keywords.

Step 4. Once you have found the form you desire, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for the account.

Step 5. Complete the transaction. You can utilize your credit card or PayPal account to process the payment.

- Utilize US Legal Forms to find the Delaware Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Delaware Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation.

- You may also access forms you've previously downloaded in the My documents tab of your account.

- If you're using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct region/state.

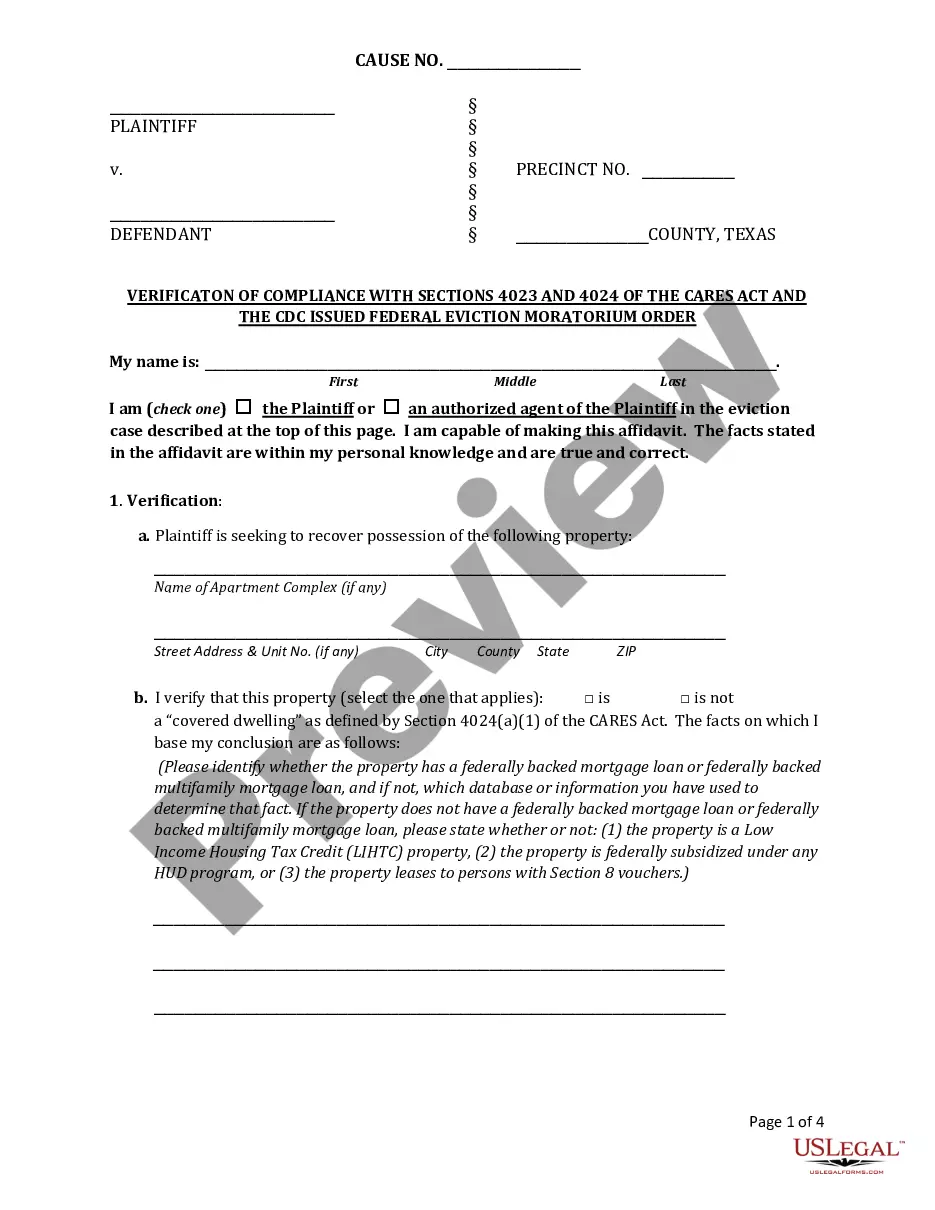

- Step 2. Utilize the Preview mode to review the content of the form. Remember to check the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions in the legal form template.

Form popularity

FAQ

A shareholder agreement, on the other hand, is optional. This document is often by and for shareholders, outlining certain rights and obligations. It can be most helpful when a corporation has a small number of active shareholders.

Unlike in many other states, Delaware corporate law cases are tried exclusively by professional judges, and not by juries. Delaware has been the premier state of formation for business entities since the early 1900s. Today, more than one million business entities have made Delaware their legal home.

Important provisions within a Shareholders' Agreement include the decision-making powers of directors and shareholders, restrictions on the sale and transfer of shares, and the process for resolving disputes. If you're the only owner of your business, then you won't need to worry about a Shareholders' Agreement.

A Shareholders Agreement is a contract concluded between shareholders to a company that formalizes the relationship and governs the duties and responsibilities between all stakeholders to the company.

Fortunately, Delaware is not one of those states. The Delaware Division of Corporations allows Delaware general corporations to hold up to to 1,500 shares of no-par stock fee-free. Learn more about Delaware no-par stock and par value.

Bearer shares are not permitted. Shares without par value can be issued. Minimum number of shareholders is one (natural person/legal entity). Minimum number of directors is one (natural person/legal entity).

Delaware Generally Uses Stockholder Interestingly, while the 1883 law does use the term stockholder, there is one occurrence of shareholder (actually, the plural shareholders)!

Stockholder Approval Required to: Amend the Certificate of Incorporation. Enter into fundamental corporate transactions (sale of company, merger, sale of substantially all assets of corporation, etc.) Elect Directors (though vacant seats from departed directors can often be filled by Board)

The terms stockholder and shareholder both refer to the owner of shares in a company, which means that they are part-owners of a business. Thus, both terms mean the same thing, and you can use either one when referring to company ownership.

What to Think about When You Begin Writing a Shareholder Agreement.Name Your Shareholders.Specify the Responsibilities of Shareholders.The Voting Rights of Your Shareholders.Decisions Your Corporation Might Face.Changing the Original Shareholder Agreement.Determine How Stock can be Sold or Transferred.More items...