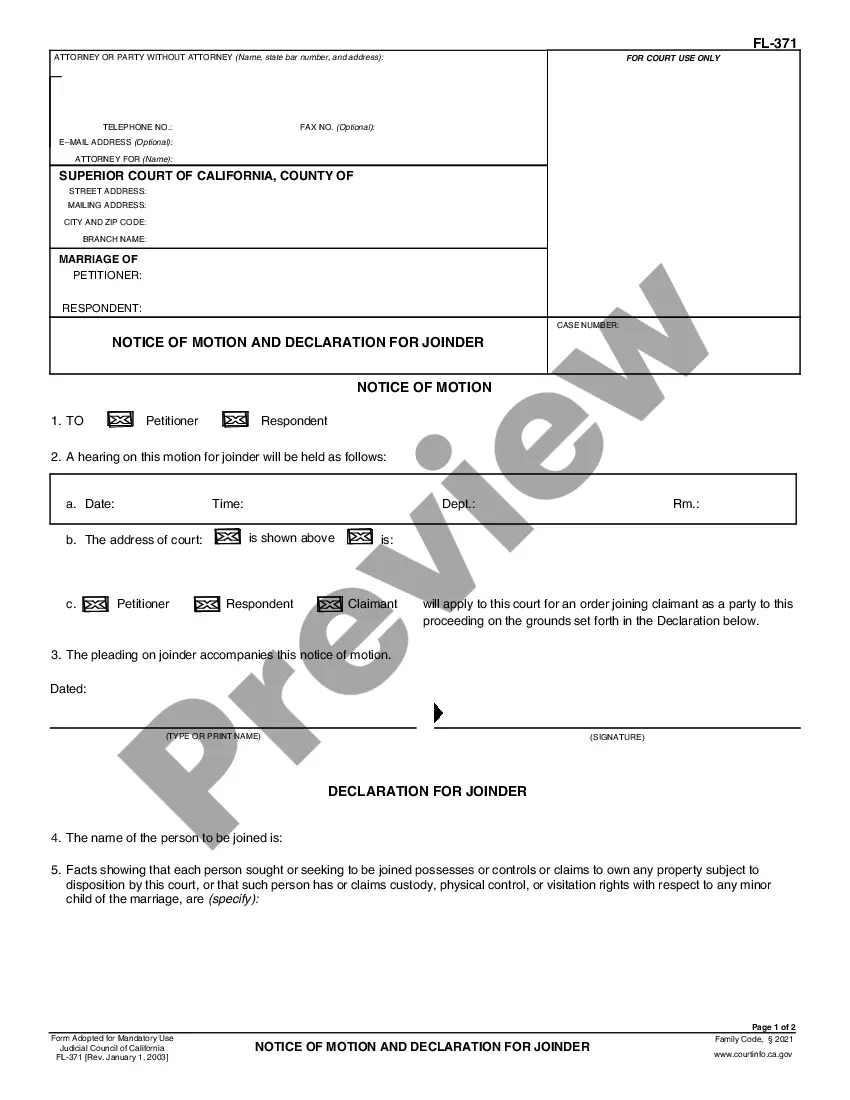

Delaware Sample Letter for Initiate Probate Proceedings for Estate - Request to Execute Waiver and Consent

Description

How to fill out Sample Letter For Initiate Probate Proceedings For Estate - Request To Execute Waiver And Consent?

Choosing the best legal papers web template can be a battle. Needless to say, there are plenty of web templates available on the Internet, but how would you get the legal develop you want? Use the US Legal Forms web site. The services gives thousands of web templates, such as the Delaware Sample Letter for Initiate Probate Proceedings for Estate - Request to Execute Waiver and Consent, that you can use for organization and personal requirements. All of the types are checked by specialists and fulfill state and federal requirements.

When you are presently authorized, log in to the bank account and click on the Acquire switch to obtain the Delaware Sample Letter for Initiate Probate Proceedings for Estate - Request to Execute Waiver and Consent. Utilize your bank account to search with the legal types you possess bought in the past. Check out the My Forms tab of the bank account and get an additional backup in the papers you want.

When you are a new end user of US Legal Forms, listed here are basic recommendations that you should stick to:

- Very first, be sure you have selected the proper develop for your city/region. You are able to check out the form using the Review switch and read the form explanation to make certain it will be the best for you.

- In the event the develop will not fulfill your expectations, make use of the Seach discipline to find the appropriate develop.

- Once you are certain the form is suitable, select the Buy now switch to obtain the develop.

- Choose the rates strategy you want and enter in the required details. Make your bank account and pay money for your order with your PayPal bank account or Visa or Mastercard.

- Opt for the document structure and obtain the legal papers web template to the gadget.

- Full, modify and produce and signal the received Delaware Sample Letter for Initiate Probate Proceedings for Estate - Request to Execute Waiver and Consent.

US Legal Forms is the largest library of legal types for which you can discover a variety of papers web templates. Use the company to obtain skillfully-manufactured paperwork that stick to condition requirements.

Form popularity

FAQ

Except where circumstances justify a longer period, an executor or administrator shall have 1 year from the date of letters for settling the estate of the decedent; and until the expiration of that time, the executor or administrator shall not be required to make distribution, nor be chargeable with interest upon the ...

The Personal Representative of your estate (also commonly referred to as an administrator or executor) is responsible to gather and inventory all of your property at the time of your death, determine all your outstanding debts, pay all of your legitimate debts and then distribute the remaining property in ance ...

Delaware probate follows this general flow: contact the court, get appointed as personal representative, submit will if it exists, inventory and submit valuations of all relevant assets, have the court and beneficiaries approve it, and then distribute the assets to beneficiaries.

If you are in the trade or business of being an executor, report fees received from the estate as self-employment income on Schedule C (Form 1040), Profit or Loss From Business.

Despite the lack of statutory guidance on executor fees in Delaware, the general consensus among legal professionals is that an executor can expect to receive about 2-5% of the estate's value. However, this percentage can fluctuate based on the specifics of the estate and the executor's responsibilities.

These documents, called either LETTERS TESTAMENTARY (for an executor) or LETTERS OF ADMINISTRATION (for an administrator), are obtained through the Register of Wills in the county in which the DECEDENT (the deceased person) lived at the time of death.

In Delaware, an estate skips probate if it's less than $30,000. That means your heirs might skip the lengthy probate process and claim their inheritance that much more quickly. However, the probate process can be a bit more involved than with other states.

How much are executor fees? Executors can be paid a flat fee, an hourly rate, or a percentage based on the gross value of the estate. When the fees are based on the estate value, they are usually tiered ? like 4% of the first $100,000 of the estate, 3% of the next $100,000, and so on.