Maryland Checking Log

Description

How to fill out Checking Log?

If you wish to complete, acquire, or create legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the site's straightforward and user-friendly search feature to find the documents you need.

A variety of templates for business and personal purposes are categorized by type and state, or keywords.

Every legal document template you purchase is yours permanently. You have access to each form you saved in your account. Click the My documents section and select a form to print or download again.

Stay competitive and obtain, and print the Maryland Checking Log with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to locate the Maryland Checking Log In just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to access the Maryland Checking Log.

- You can also retrieve forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

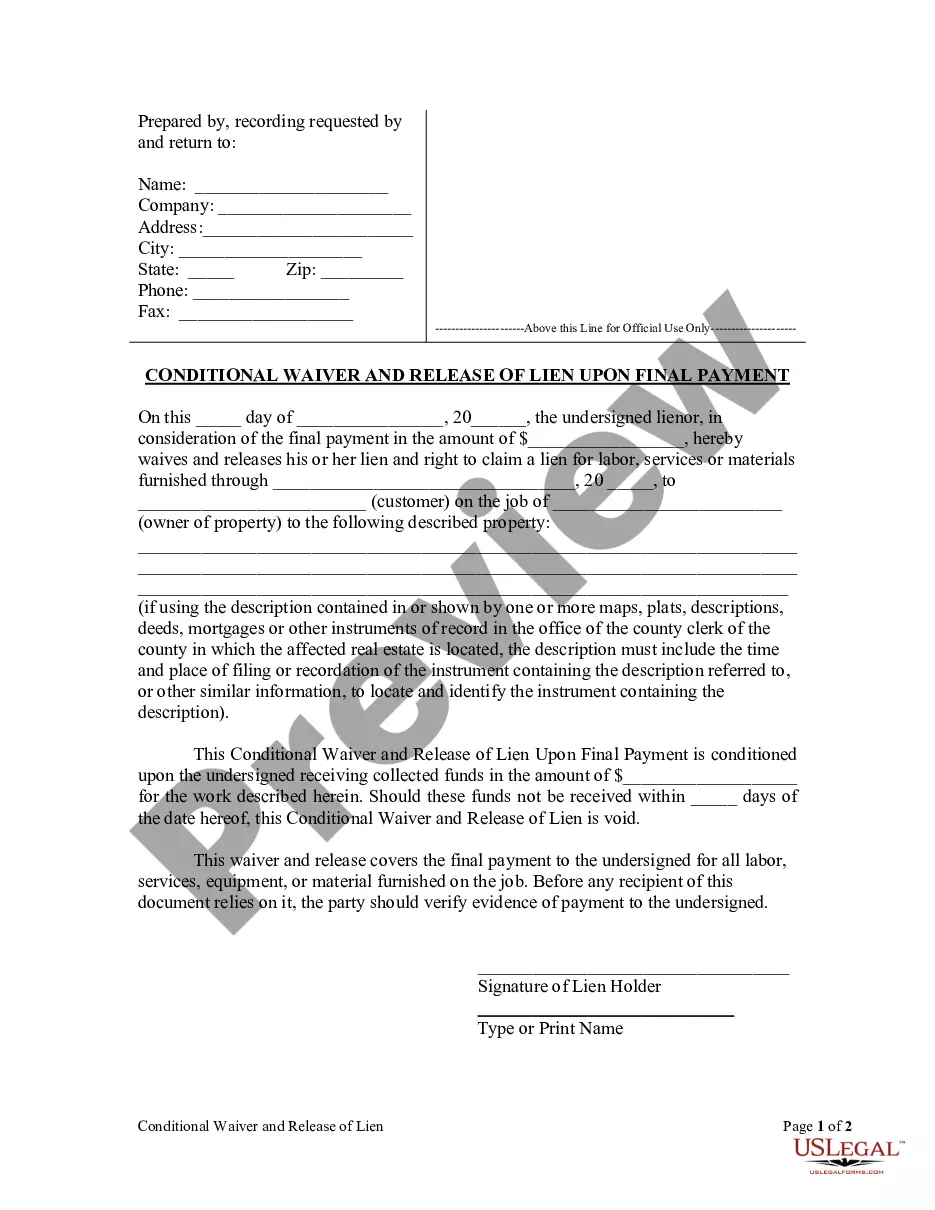

- Step 1. Ensure you have chosen the form for your specific city/state.

- Step 2. Use the Review option to examine the form's details. Do not forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Buy Now button. Select your preferred pricing plan and enter your information to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Maryland Checking Log.

Form popularity

FAQ

To quickly obtain an FBI background check, you can submit your request through the FBI’s Identity History Summary Checks service. Utilizing online options helps expedite the process, but ensure you provide complete and accurate information. This method allows you to access detailed information that might relate back to your Maryland Checking Log, enhancing your overall understanding of your background.

Yes. Criminal records in Maryland are classified as public records per the Maryland Public Information Act (MPIA). Generally, interested members of the public have a broad right to inspect or access records unless restricted by law.

How Can I Get Court Records?Maryland Judiciary Case Search (Case Search) is the primary way that the public may search for records of court cases.Maryland Electronic Courts (MDEC) allows users to electronically view and file documents in a court case to which they are a party.More items...

It is our goal to communicate to students a decision on their completed application file within two-three weeks.

The records maintained by the Office of the Clerk of Court are available to the public for review. However, access to some records may be restricted. For more information, see Access to Court Records. Court records can be searched on the Maryland Judiciary Web site.

The records maintained by the Office of the Clerk of Court are available to the public for review. However, access to some records may be restricted. For more information, see Access to Court Records. Court records can be searched on the Maryland Judiciary Web site.

To initiate a background check on employees, complete the Private Party Petition Packet or General Registration Form, then fax to (410) 653-5690 or 6320, or mail to: CJIS Authorization Administrator, Post Office Box 32708, Pikesville, Maryland 21282-2708.

Under a State statute and related court rule, a criminal trial in a circuit court must commence within 180 days of the defendant's first appearance in that court or entry of appearance of defense counsel a requirement often referred to as the Hicks rule. Under the Hicks rule, a trial may be continued from the

You'll receive a decision by April 1 if you complete the application by this date. Due to space limitations, early application is strongly encouraged. More information is available on our Application Deadlines page.

Most colleges have status checks through their undergraduate admissions offices website. The confirmation that tells you they have received your application usually will have a website login and password so only you can see at what stage of the process your application is.