Delaware Sample Letter for Initiate Probate Proceedings regarding Estate - Renunciation of Executorship

Description

How to fill out Sample Letter For Initiate Probate Proceedings Regarding Estate - Renunciation Of Executorship?

US Legal Forms - one of many greatest libraries of legitimate kinds in the USA - provides an array of legitimate document layouts you can down load or print out. Using the website, you can get a huge number of kinds for organization and personal functions, categorized by categories, says, or search phrases.You can get the most up-to-date models of kinds like the Delaware Sample Letter for Initiate Probate Proceedings regarding Estate - Renunciation of Executorship in seconds.

If you currently have a subscription, log in and down load Delaware Sample Letter for Initiate Probate Proceedings regarding Estate - Renunciation of Executorship through the US Legal Forms catalogue. The Acquire key can look on each and every type you look at. You gain access to all previously delivered electronically kinds from the My Forms tab of your respective accounts.

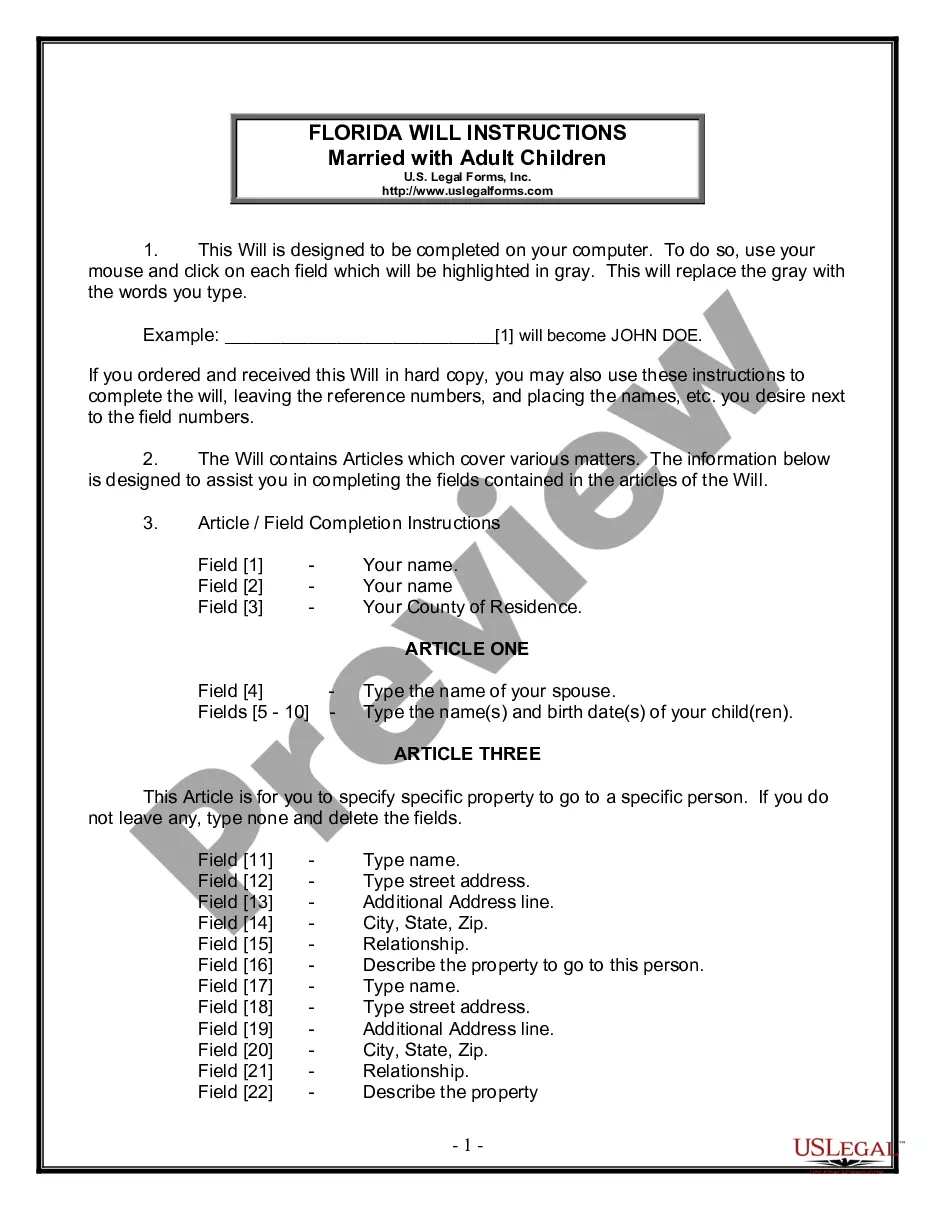

If you want to use US Legal Forms the very first time, listed below are simple directions to obtain began:

- Be sure to have selected the right type for your area/region. Go through the Review key to analyze the form`s content. Read the type outline to ensure that you have chosen the correct type.

- When the type doesn`t fit your specifications, take advantage of the Research industry towards the top of the monitor to obtain the the one that does.

- Should you be content with the form, confirm your option by visiting the Acquire now key. Then, pick the prices program you like and provide your references to register for an accounts.

- Process the financial transaction. Make use of bank card or PayPal accounts to perform the financial transaction.

- Find the structure and down load the form in your gadget.

- Make alterations. Fill up, edit and print out and indicator the delivered electronically Delaware Sample Letter for Initiate Probate Proceedings regarding Estate - Renunciation of Executorship.

Every single format you put into your bank account lacks an expiration date and is also your own forever. So, if you would like down load or print out another version, just check out the My Forms segment and then click about the type you want.

Gain access to the Delaware Sample Letter for Initiate Probate Proceedings regarding Estate - Renunciation of Executorship with US Legal Forms, probably the most considerable catalogue of legitimate document layouts. Use a huge number of specialist and express-distinct layouts that fulfill your company or personal needs and specifications.

Form popularity

FAQ

These documents, called either LETTERS TESTAMENTARY (for an executor) or LETTERS OF ADMINISTRATION (for an administrator), are obtained through the Register of Wills in the county in which the DECEDENT (the deceased person) lived at the time of death.

PA15 is a legal document commonly referred to as the Renunciation of Executor form. It is used when someone wishes to give up the responsibility of being an executor stated on a testator's will or codicil, whether as a sole executor and/or residuary legatee and devisee in trust.

Except where circumstances justify a longer period, an executor or administrator shall have 1 year from the date of letters for settling the estate of the decedent; and until the expiration of that time, the executor or administrator shall not be required to make distribution, nor be chargeable with interest upon the ...

Every estate is different and can take a different length of time to administer depending on its complexity. There is a general expectation that an executor or administrator should try to complete the estate administration within a year of the death, and this is referred to as the executor's year.

In Delaware, the probate process generally follows these steps: Filing a petition: A petition must be filed with the local probate court, also known as the Register of Wills, to either admit the will to probate and appoint the executor. Or, if there's no will, to appoint an administrator of the estate.

If you die with a surviving spouse and with children with someone other than that spouse, the spouse gets ½ of your intestate assets, plus the right to use any intestate real estate for life. Your children get everything else. If you die with children but no surviving spouse, your children inherit everything.

In Delaware, creditors have a window of eight months from the date of death to make claims against the estate for any debts owed. Paying Debts and Taxes: The executor must then pay off any valid claims from the estate's assets and settle any final income taxes or estate taxes owed.

Despite the lack of statutory guidance on executor fees in Delaware, the general consensus among legal professionals is that an executor can expect to receive about 2-5% of the estate's value. However, this percentage can fluctuate based on the specifics of the estate and the executor's responsibilities.