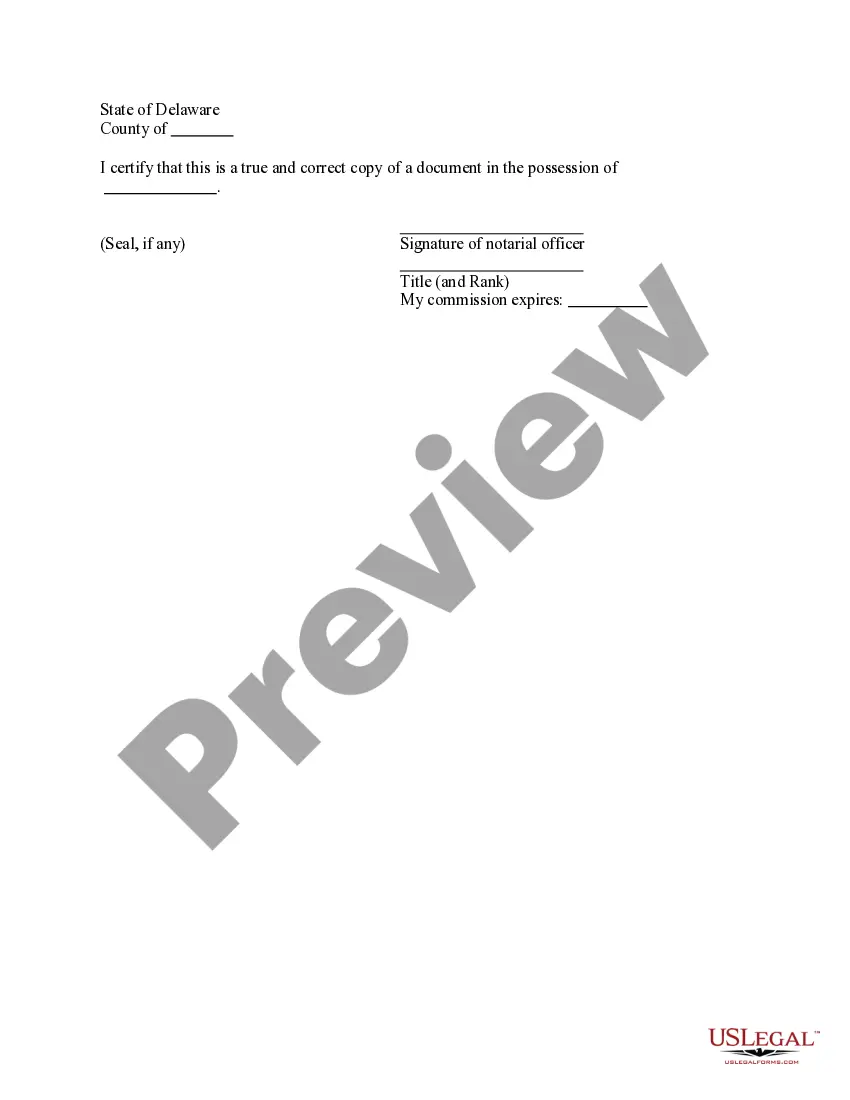

Delaware Return Authorization Form

Description

How to fill out Return Authorization Form?

If you need to compile, download, or create official document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website's straightforward and user-friendly search feature to locate the documents you require.

Various templates for commercial and personal purposes are categorized by groups and states, or keywords.

- Use US Legal Forms to find the Delaware Return Authorization Form with just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click on the Download button to retrieve the Delaware Return Authorization Form.

- You may also access forms you previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form's details. Don't forget to read the information.

Form popularity

FAQ

Delaware Form 700 is specifically designed for individual taxpayers to report their income, deductions, and tax credits to the state. This form plays a crucial role in calculating your tax obligations accurately. By completing the Delaware Return Authorization Form in conjunction with Form 700, you can create a seamless and compliant tax submission process.

Yes, Delaware provides e-filing options for various tax forms, streamlining the filing process for taxpayers. Using the e-file system can save time and reduce errors when submitting your tax declaration. Be sure to include the Delaware Return Authorization Form as you proceed with your e-filing to maintain accuracy and compliance.

The Delaware pension exemption allows residents to exclude a portion of their pension income from state taxation. This exemption is beneficial for retirees, as it promotes financial well-being in their retirement years. To take advantage of this, ensure you file the appropriate Delaware Return Authorization Form when reporting your income.

Form 700 is a tax document that Delaware residents use to report their tax obligations to the state. This form is particularly important for those who need to manage their tax liabilities accurately. By filing the Delaware Return Authorization Form, you ensure compliance with Delaware's tax laws and facilitate a smoother filing process.

You should send your Delaware state tax return to the address specified on the tax form you are using. Typically, the Delaware Division of Revenue handles these submissions. If you're using a Delaware Return Authorization Form, make sure to adhere to the instructions provided, as they will guide you to the appropriate mailing address. For any specific queries, consider visiting the Us Legal Forms platform for direct support.

Individuals required to file a tax return in Delaware include anyone earning income from Delaware sources, regardless of residency. This applies to residents and non-residents alike, making compliance key. To ease this process, use the Delaware Return Authorization Form as part of your documentation. Being informed and proactive about your tax obligations can significantly benefit your financial planning.

To amend a Delaware tax return, you must file a new Form 200-01 along with the corrections noted. Submit this amended form to the Delaware Division of Revenue for processing. Additionally, you may want to include the Delaware Return Authorization Form to clarify your situation and ensure a smooth review. Amending your return properly is key to maintaining accurate tax records.

You are required to file a Delaware tax return if you earn income from Delaware sources, regardless of your residency status. This includes employed individuals or those earning income from business activities in the state. To facilitate your tax filing, the Delaware Return Authorization Form helps streamline the necessary documentation. Understanding your requirements can save you from potential penalties.

All individuals who earn income in Delaware must file a tax return, whether they reside in the state or not. This includes both residents and non-residents who derive income from Delaware sources. If you fall into this category, the Delaware Return Authorization Form becomes essential for proper documentation and compliance with state regulations. Don’t overlook your filing responsibilities.

Non-residents in Delaware typically use Form 200-01 to file their tax returns. This specific form allows non-residents to report Delaware income accurately. When completing this form, consider also submitting the Delaware Return Authorization Form for clarity and organization of your tax records. Ensuring you use the right forms can significantly ease your tax filing experience.