Delaware Equipment Financing Agreement

Description

There is a large variety of financing techniques that businesses and consumers can use to receive financing; these techniques range from IPOs to bank loans. The use of financing is vital in any economic system as it allows consumers to purchase products out of their immediate reach, like houses, and businesses to finance large investment projects.

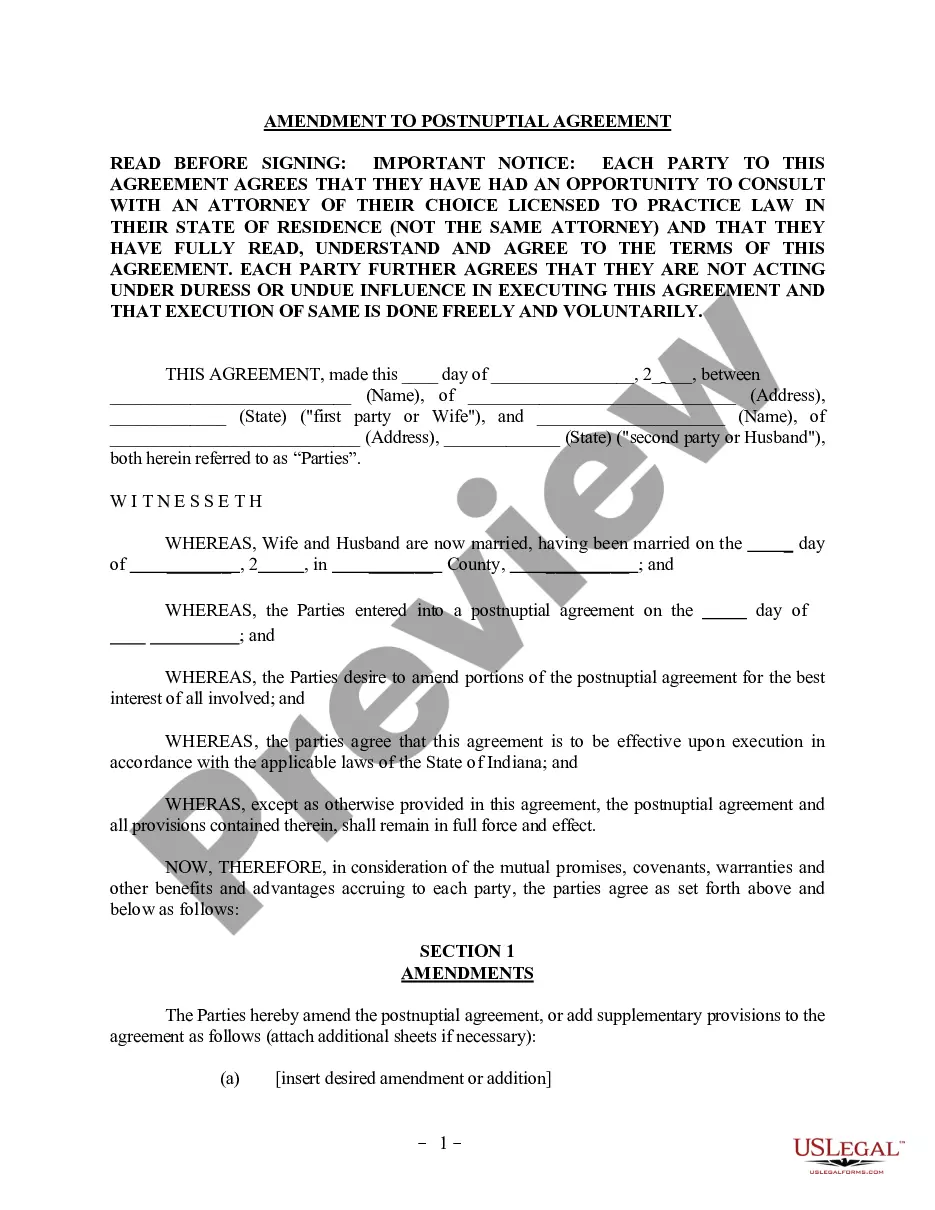

How to fill out Equipment Financing Agreement?

US Legal Forms - among the most significant libraries of legitimate types in America - provides an array of legitimate file themes you are able to obtain or print out. Using the internet site, you may get 1000s of types for organization and personal purposes, categorized by categories, claims, or keywords.You can get the newest types of types such as the Delaware Equipment Financing Agreement in seconds.

If you already have a registration, log in and obtain Delaware Equipment Financing Agreement in the US Legal Forms catalogue. The Down load option can look on each type you perspective. You gain access to all in the past delivered electronically types within the My Forms tab of your respective accounts.

If you wish to use US Legal Forms for the first time, listed below are basic instructions to help you get began:

- Make sure you have picked the proper type for your town/region. Go through the Preview option to check the form`s articles. Browse the type outline to ensure that you have selected the correct type.

- In case the type does not suit your specifications, make use of the Look for field on top of the display to discover the one that does.

- If you are happy with the form, affirm your decision by simply clicking the Purchase now option. Then, choose the rates prepare you favor and give your accreditations to sign up for an accounts.

- Procedure the deal. Use your credit card or PayPal accounts to accomplish the deal.

- Choose the formatting and obtain the form on your own gadget.

- Make changes. Load, modify and print out and sign the delivered electronically Delaware Equipment Financing Agreement.

Each and every web template you included with your money does not have an expiration particular date and is your own for a long time. So, in order to obtain or print out one more backup, just go to the My Forms segment and click on around the type you will need.

Get access to the Delaware Equipment Financing Agreement with US Legal Forms, one of the most comprehensive catalogue of legitimate file themes. Use 1000s of expert and status-distinct themes that meet your business or personal requirements and specifications.

Form popularity

FAQ

A lease works as a rental agreement and generally has a lower month-to-month cost. Financing is a type of business loan that typically costs more each month but may result in paying less overall. This is because you own the equipment outright once the loan is paid off.

Under a security deed, the lender is automatically able to foreclose or sell the property when the borrower defaults. Foreclosing on a mortgage, on the other hand, involves additional paperwork and legal requirements, thus extending the process.

Security interest and lien are two legal interests creditors can have over a borrower's property or assets to secure debt payment. Here are some key differences between them: Scope: It can be taken over real and personal property, while liens typically take over real property.

A security agreement creates the security interest, making it enforceable between the secured party and the debtor. A UCC-1 financing statement neither creates a security interest nor does it alter its scope; it only gives notice of the security interest to third parties.

Key Takeaways. A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Loans from banks or other institutional lenders are always made using a number of documents, two of which are a promissory and security agreement. In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

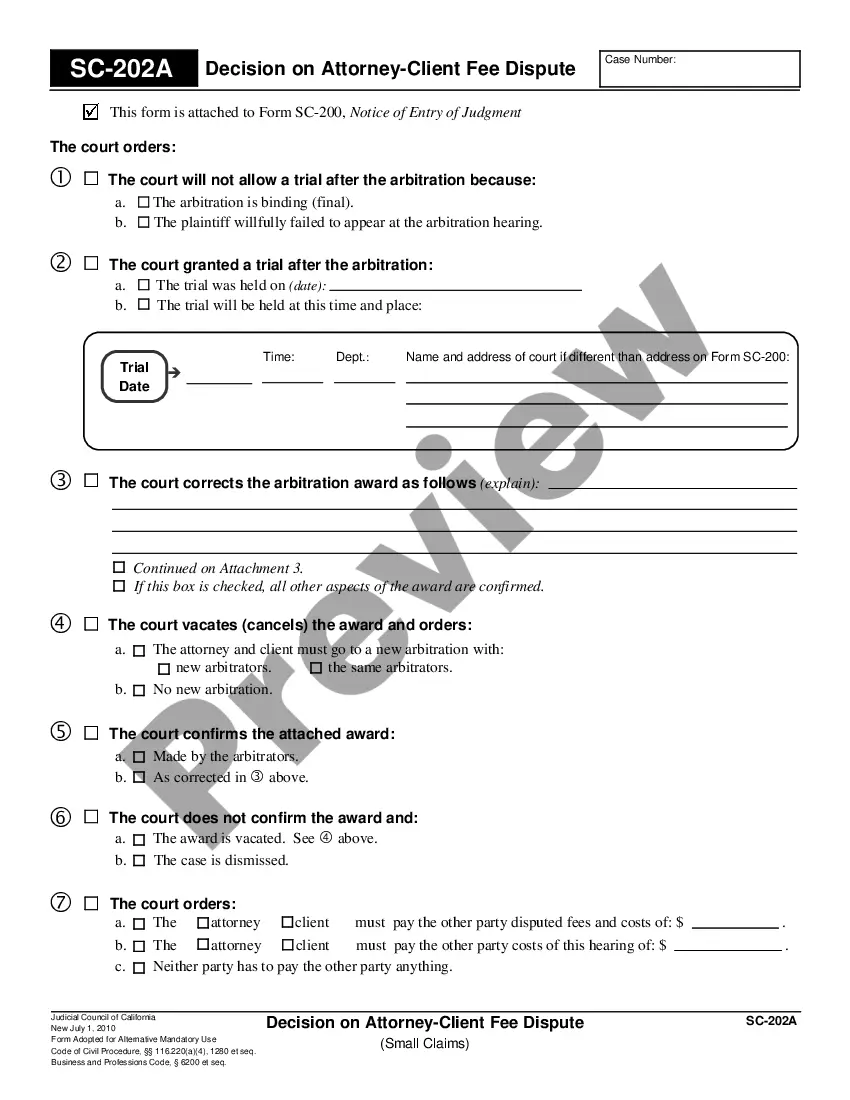

An equipment finance agreement (EFA) is like a loan, security agreement, and promissory note all packaged together into a single document. EFAs also contain some unique features that make them one of the most popular and versatile equipment financing options.