Delaware Notice of Default on Promissory Note Installment

Description

How to fill out Notice Of Default On Promissory Note Installment?

Are you presently in a situation where you frequently need documents for either business or personal purposes.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

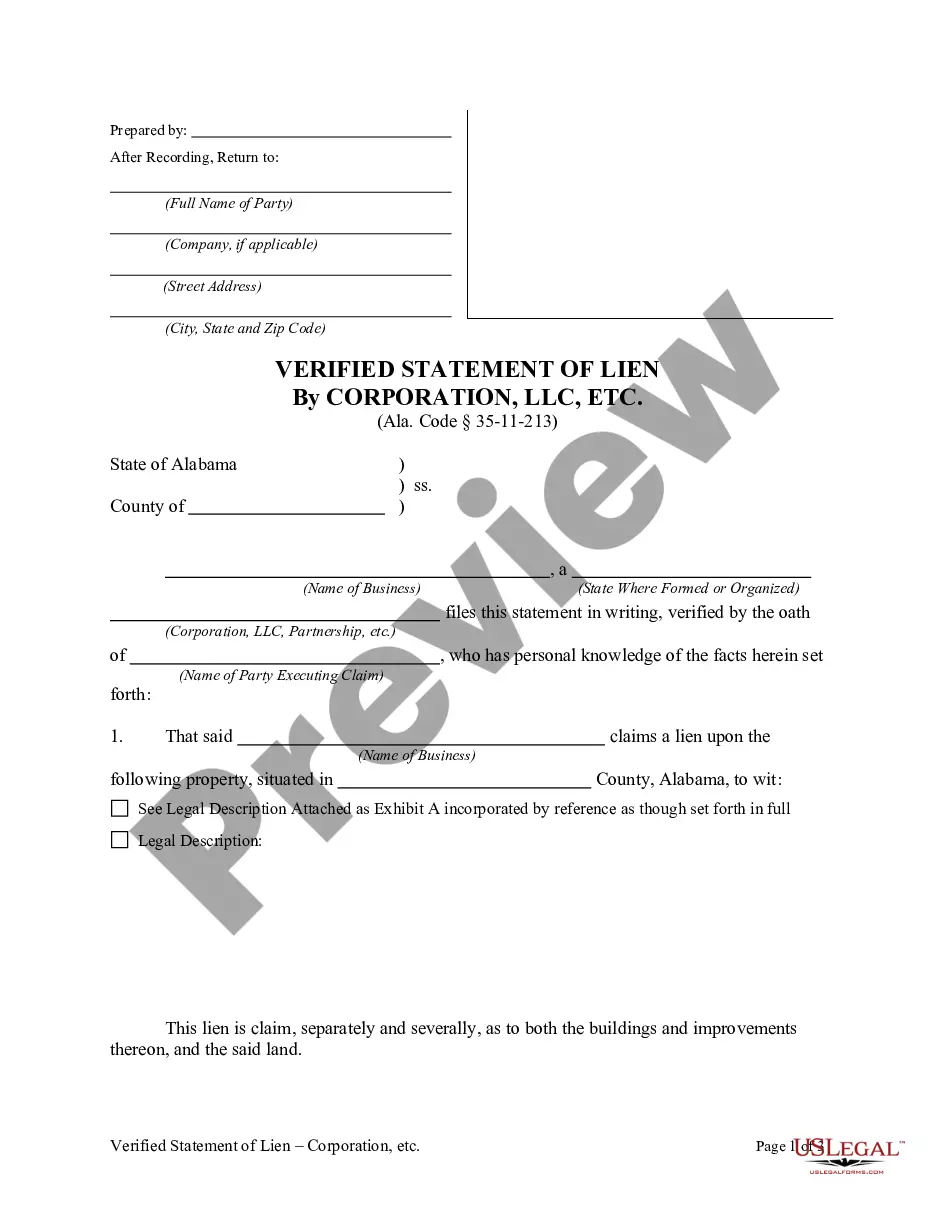

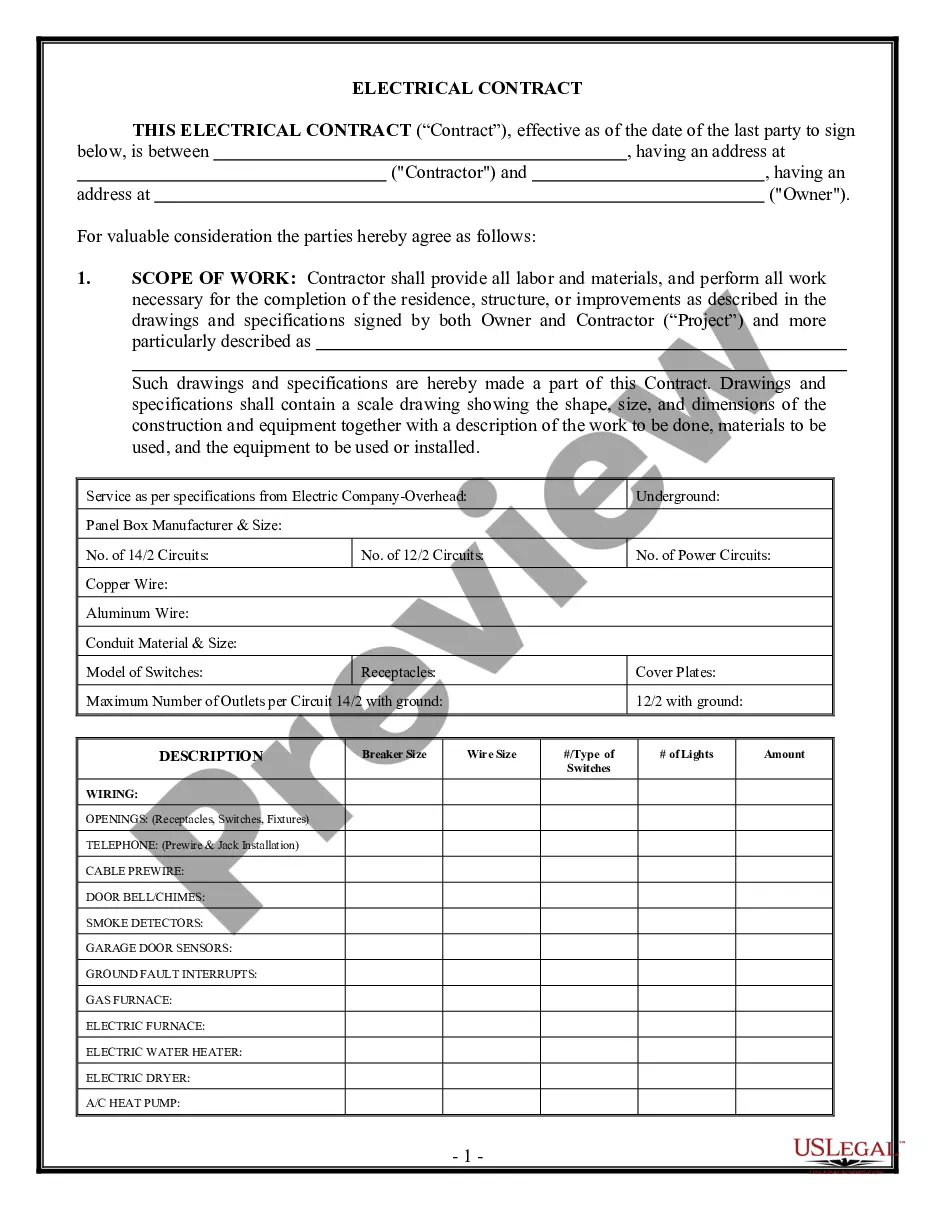

US Legal Forms offers a wide variety of form templates, such as the Delaware Notice of Default on Promissory Note Installment, which are designed to meet federal and state requirements.

Choose the pricing plan you want, fill in the required information to set up your account, and pay for the transaction using your PayPal or credit card.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Delaware Notice of Default on Promissory Note Installment template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct area/region.

- Utilize the Preview option to review the form.

- Check the details to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search bar to find a form that suits your needs and requirements.

- When you find the appropriate form, click Acquire now.

Form popularity

FAQ

To write a Delaware Notice of Default on Promissory Note Installment, begin with a clear statement indicating the borrower has failed to make a payment. Include the due date of the missed payment, the amount owed, and any relevant account information. Ensure to mention the consequences of continued default, as this can help communicate the seriousness of the situation. For convenient template options, consider using the US Legal Forms platform, which provides reliable resources tailored for your needs.

When someone defaults on a promissory note, the lender usually initiates the Delaware Notice of Default on Promissory Note Installment. This notice formally informs the borrower of their default and allows them to rectify the situation within a specific timeframe. If the borrower fails to respond or make the payments, the lender may proceed with legal actions to recover the owed amount. Understanding this process can help both parties navigate the complexities of default and encourage resolution.

A notice of default on a promissory note is a formal document that informs the borrower they have failed to meet the agreed-upon payment terms. This notice outlines the details of the missed payment and serves as an official warning. It typically includes specific steps the borrower must take to avoid further action. Understanding this process is crucial, and our platform offers comprehensive resources related to a Delaware Notice of Default on Promissory Note Installment.

When someone defaults on a promissory note, the first step is to send a notice of default to the borrower. This notice should outline the default and provide a timeframe for resolving the issue. If the problem is not resolved, consider negotiating a payment plan or seeking legal advice. Utilizing our platform can provide you with tailored forms and guidance for handling a Delaware Notice of Default on Promissory Note Installment.

To write a default notice, start by clearly stating the borrower’s name and contact information. Next, include details about the promissory note, such as the amount owed and the payment schedule. Be sure to explain how the default occurred, typically by missing a payment. Finally, specify the actions the borrower needs to take to rectify the situation, reinforcing the context of Delaware Notice of Default on Promissory Note Installment.

In Delaware, the statute of limitations for collecting on a promissory note is typically three years. This timeframe begins from the date of default or non-payment. Understanding this limit is crucial for enforcing your rights in case of a default. If you find yourself needing assistance, USLegalForms can provide valuable resources and templates to help navigate these situations.

Defaulting on a promissory note typically triggers legal consequences, including potential lawsuits or foreclosures, depending on the agreement's terms. A Delaware Notice of Default on Promissory Note Installment initiates this process and signals serious implications if not addressed. In many cases, it can lead to damage to your credit score and additional financial liabilities. Act quickly to explore resolution options before matters escalate.

To collect on a default promissory note, you should first reach out to the borrower and discuss the outstanding amount. Sending a Delaware Notice of Default on Promissory Note Installment can serve as a formal reminder of their obligation. If informal efforts fail, you might need to consult an attorney or utilize collection agencies specialized in such matters. Ensuring you have proper documentation is crucial throughout this process.

If someone defaults on a promissory note, the first step is to assess the situation and communicate with the borrower. You may want to issue a Delaware Notice of Default on Promissory Note Installment to formally document the default. Remember, seeking a resolution through negotiation can often be more effective than pursuing legal action right away. If necessary, consider consulting legal resources to understand your options.

You cannot go to jail simply for not paying a promissory note. A Delaware Notice of Default on Promissory Note Installment indicates a financial issue rather than a criminal one. However, if the situation escalates to fraud or willful misconduct, legal actions could lead to serious consequences involving law enforcement. Addressing the default promptly can help prevent complications.