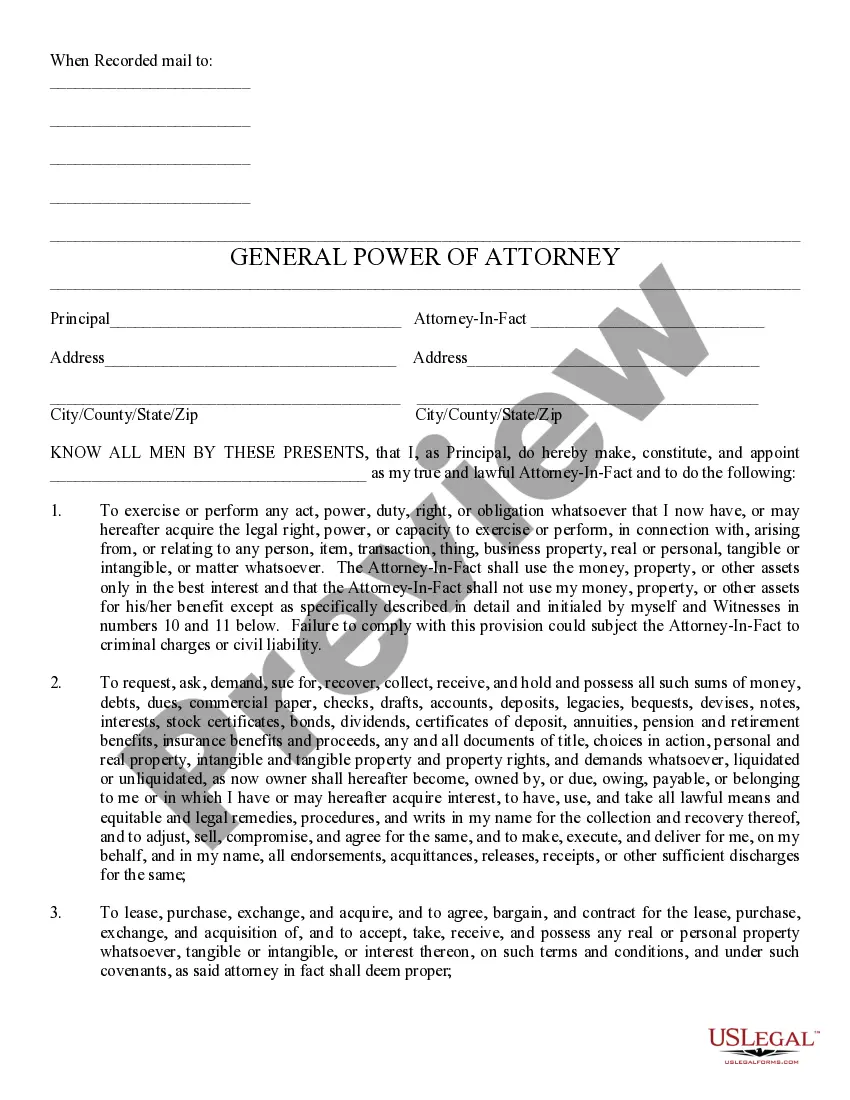

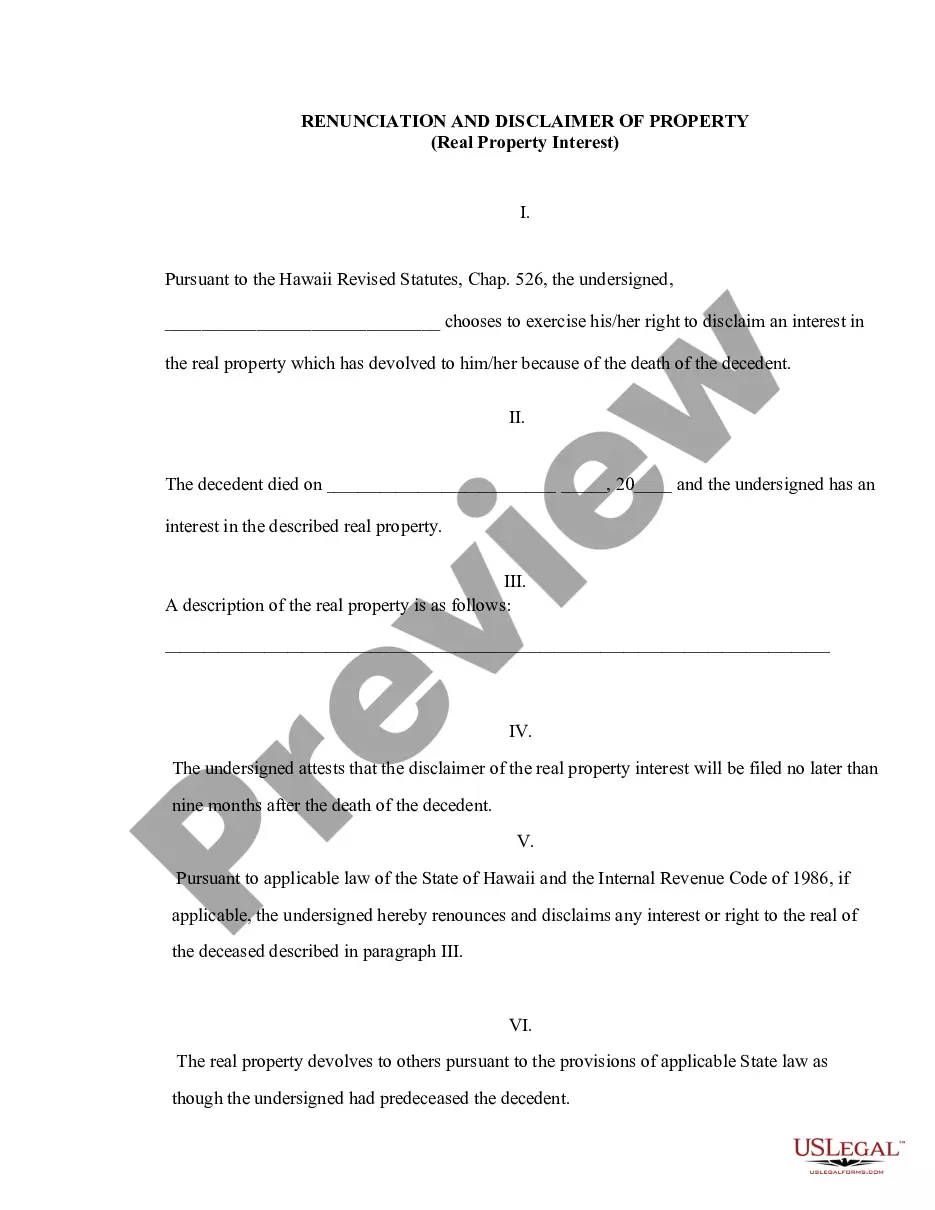

This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

Delaware Notice of Default in Payment Due on Promissory Note

Description

How to fill out Notice Of Default In Payment Due On Promissory Note?

You can invest time online trying to locate the lawful document template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that have been reviewed by experts.

It is easy to obtain or print the Delaware Notice of Default in Payment Due on Promissory Note from the service.

If available, use the Preview button to view the document template as well. If you wish to find another version of the form, use the Search field to find the template that meets your needs and requirements. Once you have located the template you desire, click Buy now to proceed. Select your preferred pricing plan, enter your information, and create an account on US Legal Forms. Complete the transaction. You may utilize your credit card or PayPal account to purchase the legal document. Choose the format of the document and download it to your device. Make adjustments to the document if necessary. You can complete, edit, sign, and print the Delaware Notice of Default in Payment Due on Promissory Note. Download and print a multitude of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and click the Get button.

- Then, you can complete, modify, print, or sign the Delaware Notice of Default in Payment Due on Promissory Note.

- Each legal document template you download is yours forever.

- To obtain an additional copy of a purchased form, navigate to the My documents section and click the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your chosen area/region.

- Review the form summary to confirm you have selected the right document.

Form popularity

FAQ

Defaulting on a promissory note indicates that the borrower has failed to meet the payment terms specified in the agreement. This situation typically triggers a Delaware Notice of Default in Payment Due on Promissory Note from the lender. Such a notice signifies serious consequences, including potential legal action or damage to credit ratings. Addressing the issue promptly can provide opportunities for negotiation or repayment plans.

Section 8106 of the Delaware Code outlines the procedures regarding the enforcement of payment obligations under promissory notes. It provides the legal framework for lenders to issue a Delaware Notice of Default in Payment Due on Promissory Note when payments are missed. Understanding this section can be vital for both lenders and borrowers, as it clarifies rights and obligations. Knowledge of this law could help you navigate your financial commitments more effectively.

When you default on a promissory note, the lender has the right to initiate collections efforts and may contact you regarding the overdue balance. They might issue a Delaware Notice of Default in Payment Due on Promissory Note to officially communicate the situation. If the issue remains unresolved, the lender could pursue legal actions to reclaim the funds. Staying proactive can help you manage this circumstance more effectively.

If you default on a promissory note, the lender may take legal action to recover the owed amount. This often involves filing a Delaware Notice of Default in Payment Due on Promissory Note, which formally notifies you of your missed payments. It's crucial to address this situation quickly to avoid additional penalties or potential court proceedings. Remember, your credit score may also suffer, impacting future borrowing opportunities.

A promissory note can indeed be enforced as long as it complies with legal standards and is properly documented. Lenders can pursue legal action to recover debts owed under the note if the borrower defaults. Utilizing resources like US Legal Forms can help you prepare and enforce a Delaware Notice of Default in Payment Due on Promissory Note efficiently.

Yes, promissory notes are generally enforceable in court if they meet specific legal criteria. The clarity of terms, signatures of both parties, and proper documentation significantly strengthen their legal standing. Thus, ensuring that your promissory note adheres to the Delaware Notice of Default in Payment Due on Promissory Note format increases its effectiveness in legal disputes.

When someone defaults on a promissory note, the first step is to send a notice of default to inform the borrower of their missed payments. This opens a dialogue, allowing the borrower a chance to rectify the issue or negotiate a new payment plan. Using the Delaware Notice of Default in Payment Due on Promissory Note template can help streamline this process and provide you with the necessary legal framework.

Writing a notice of default involves clearly stating the terms of the promissory note and identifying the specific default. Include the borrower's information, the amount owed, and details about the missed payment. By issuing a Delaware Notice of Default in Payment Due on Promissory Note, you ensure that the borrower understands their obligations and the consequences of continued non-payment.

A notice of default on a promissory note is a formal declaration that the borrower has failed to meet their payment obligations. This document notifies the borrower of their default status and gives them a chance to remedy the situation, often before any legal action is taken. In the context of Delaware, this process is essential to protect the lender's rights and facilitate potential recovery under the Delaware Notice of Default in Payment Due on Promissory Note.

In Delaware, the statute of limitations for indemnification claims is typically three years. This timeframe starts when you become aware of the default, such as the Delaware Notice of Default in Payment Due on Promissory Note. It is essential to act promptly to protect your rights. For those seeking guidance on filing such claims, US Legal Forms provides comprehensive resources and forms to help you navigate the legal process effectively.