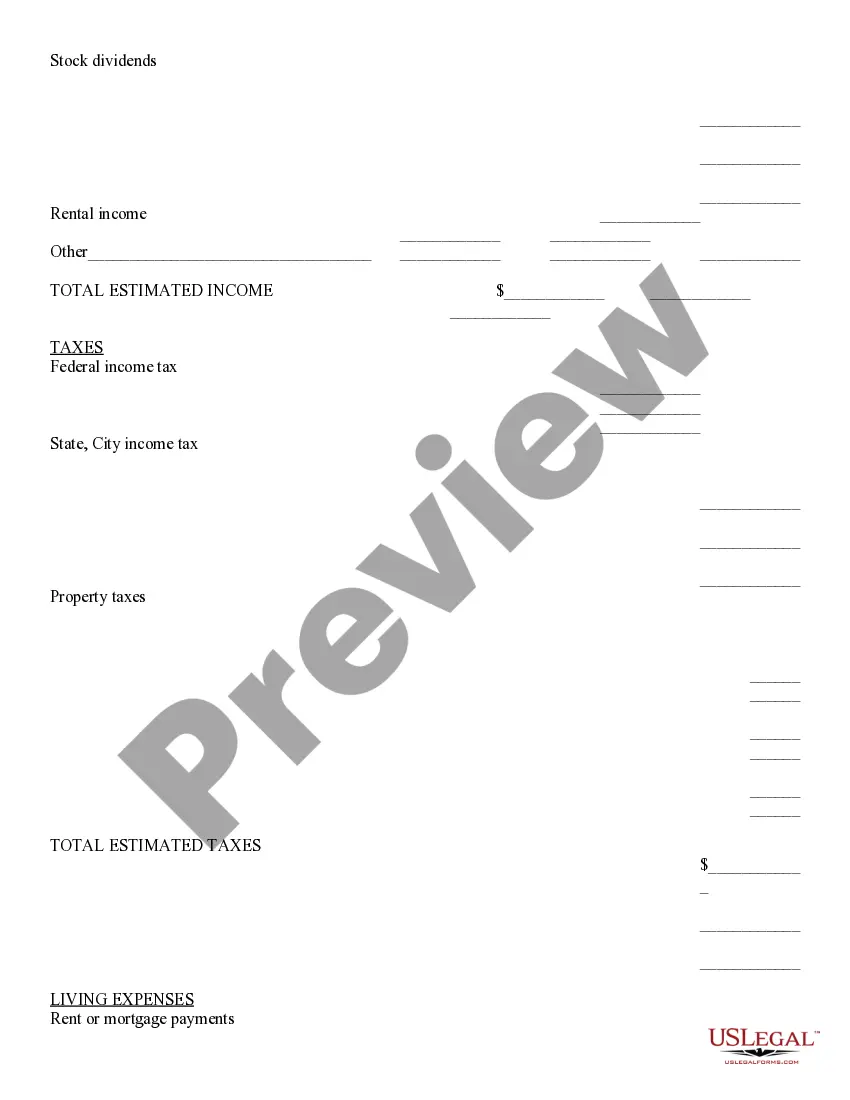

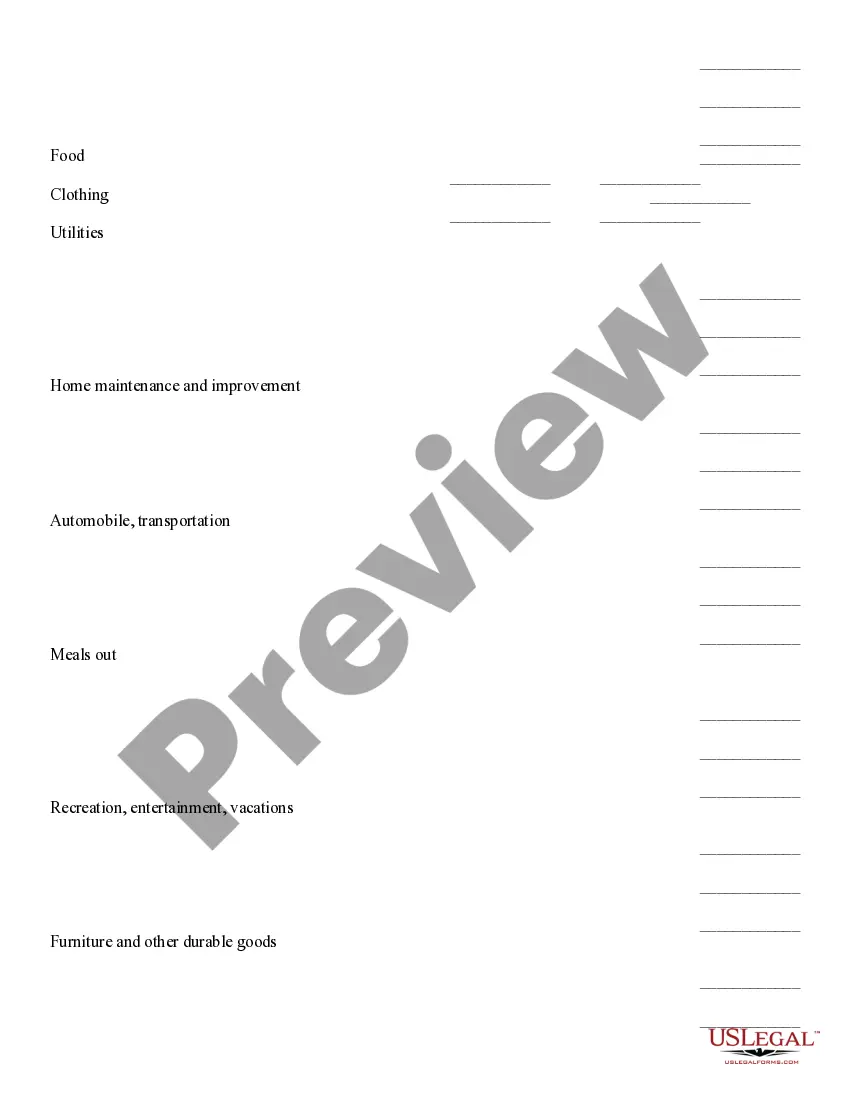

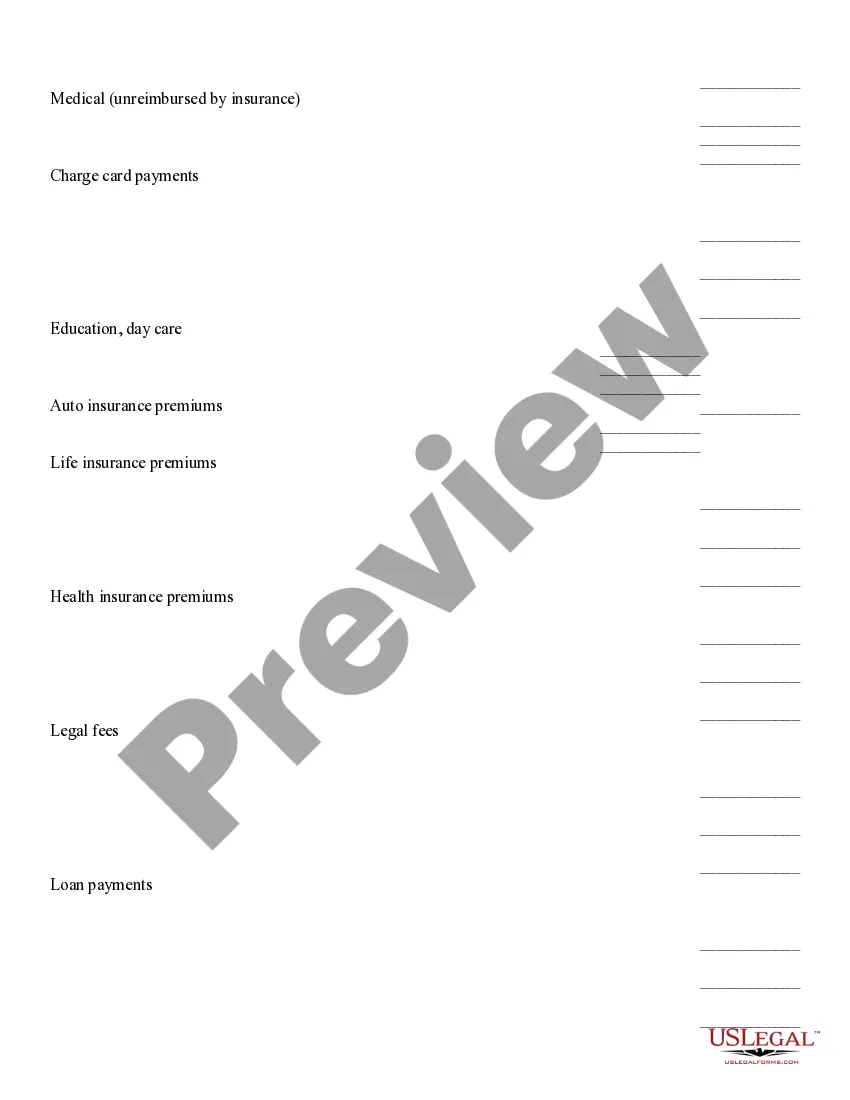

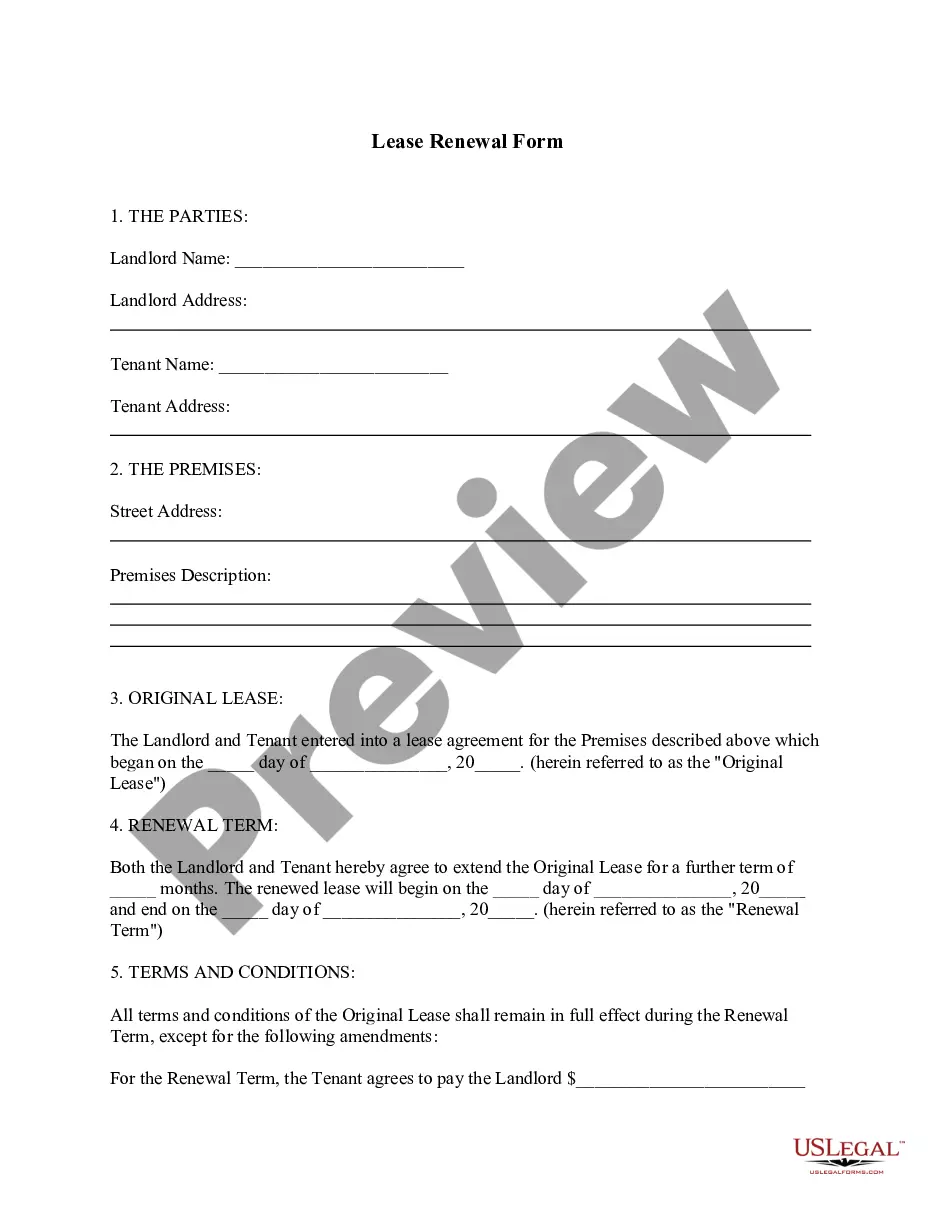

Delaware Retirement Cash Flow

Description

How to fill out Retirement Cash Flow?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a diverse selection of legal document templates that you can download or print.

By using the platform, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Delaware Retirement Cash Flow in moments.

If you already have a monthly subscription, Log In and download the Delaware Retirement Cash Flow from the US Legal Forms collection. The Acquire button will be displayed on every template you open.

Complete the transaction using your Visa or Mastercard or PayPal account.

Select the format and download the form onto your device. Make modifications. Fill out, adjust, print, and sign the downloaded Delaware Retirement Cash Flow. Every template you add to your account has no expiration date and belongs to you permanently. So, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the Delaware Retirement Cash Flow with US Legal Forms, the most comprehensive library of legal document templates. Utilize thousands of expert and state-specific templates that fulfill your business or personal requirements and standards.

- Make sure you have selected the correct form for your jurisdiction/state.

- Click the Preview button to review the form's content.

- Examine the form summary to ensure that you have chosen the right template.

- If the form does not meet your requirements, use the Search section at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, choose your pricing plan and provide your details to create an account.

Form popularity

FAQ

Advantages of retiring in Delaware include the relatively low state income tax, property tax benefits, wealth of things to do and ease of travel to exciting nearby destinations.

My top 10 pros and cons of living in Delaware include:Great place for jobs OR retirement.Excellent tax benefits.Diverse educational opportunities.Plenty of fun things to do.High-quality health care system.Negative effects of overcrowding.Difficult to get places.High crime rates.More items...

Is Delaware a retirement friendly state? Delaware has a favorable tax code for retirees. Delaware has no state sales tax, no taxes on social security income, and allows a $12,500 deduction for income from pensions.

In short, the answer is yes, Delaware is tax-friendly towards retirees. Like most states, Delaware offers a few different benefits for retirees who choose to spend their golden years there, but one benefit can be found in only four other states.

In short, the answer is yes, Delaware is tax-friendly towards retirees. Like most states, Delaware offers a few different benefits for retirees who choose to spend their golden years there, but one benefit can be found in only four other states.

1) Delaware consistently ranks as one of the Best Places to Retire. The criteria used by this January 2020 Wallethub study is some of the best I've seen. They covered affordability, health-related factors, and overall quality of life. Delaware ranks #6!

Delaware is a Tax-Friendly State for Retirees If you retire to Delaware, state income taxes allow for an exclusion of $12,500 from retirement income such as IRA's, pensions, and 401(k) plans. There's no sales tax (tax-free shopping!) An additional $2,500 standard deduction is available for those over 65.

Social Security and Railroad Retirement benefits are not taxable in Delaware and should not be included in taxable income. Also, Delaware has a graduated tax rate ranging from 2.2% to 5.55% for income under $60,000, and 6.60% for income of $60,000 or over.

Is Delaware a retirement friendly state? Delaware has a favorable tax code for retirees. Delaware has no state sales tax, no taxes on social security income, and allows a $12,500 deduction for income from pensions.