Delaware Monthly Retirement Planning

Description

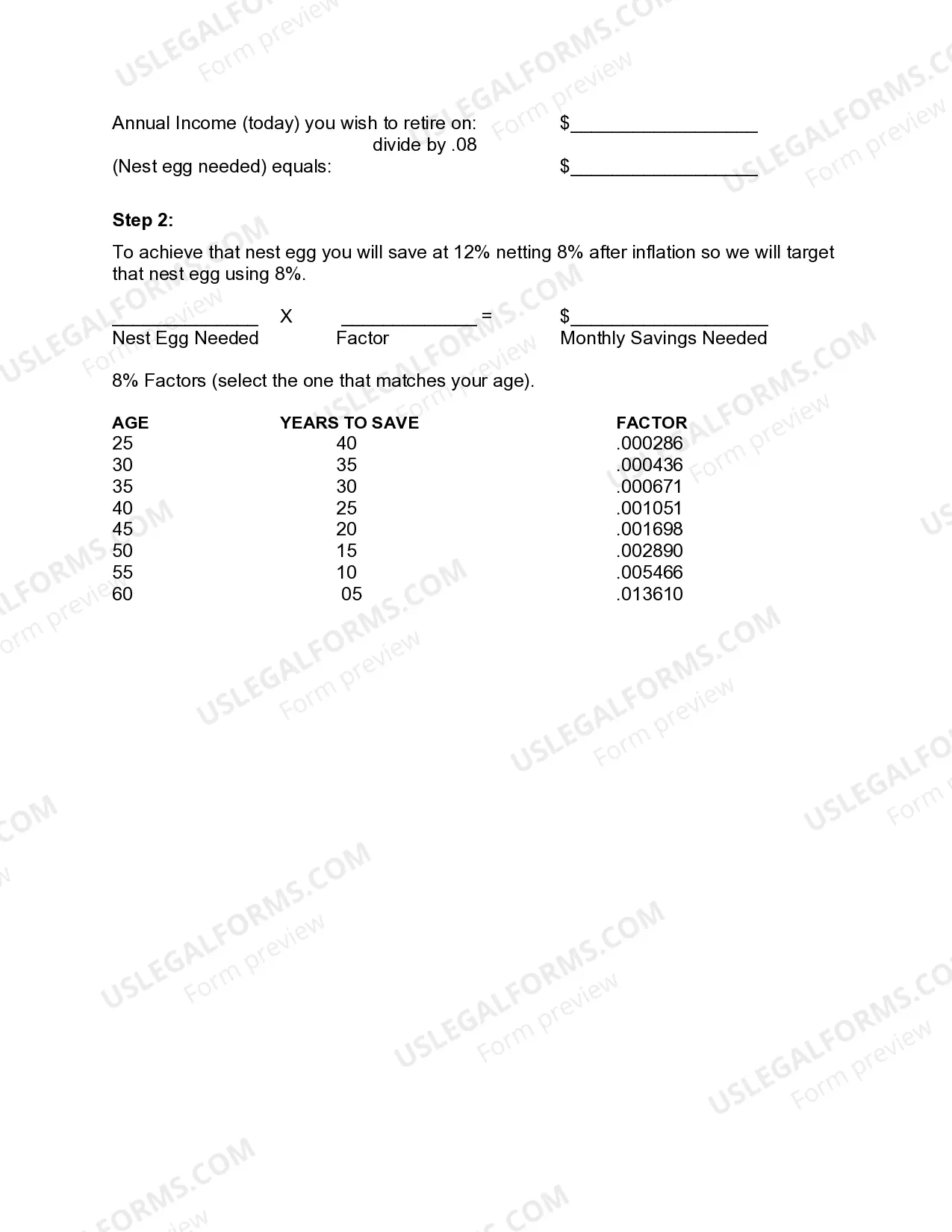

How to fill out Monthly Retirement Planning?

Are you situated in a location where you require documents for potential commercial or specific needs almost every day.

There is a range of legal document templates available online, but finding reliable types can be challenging.

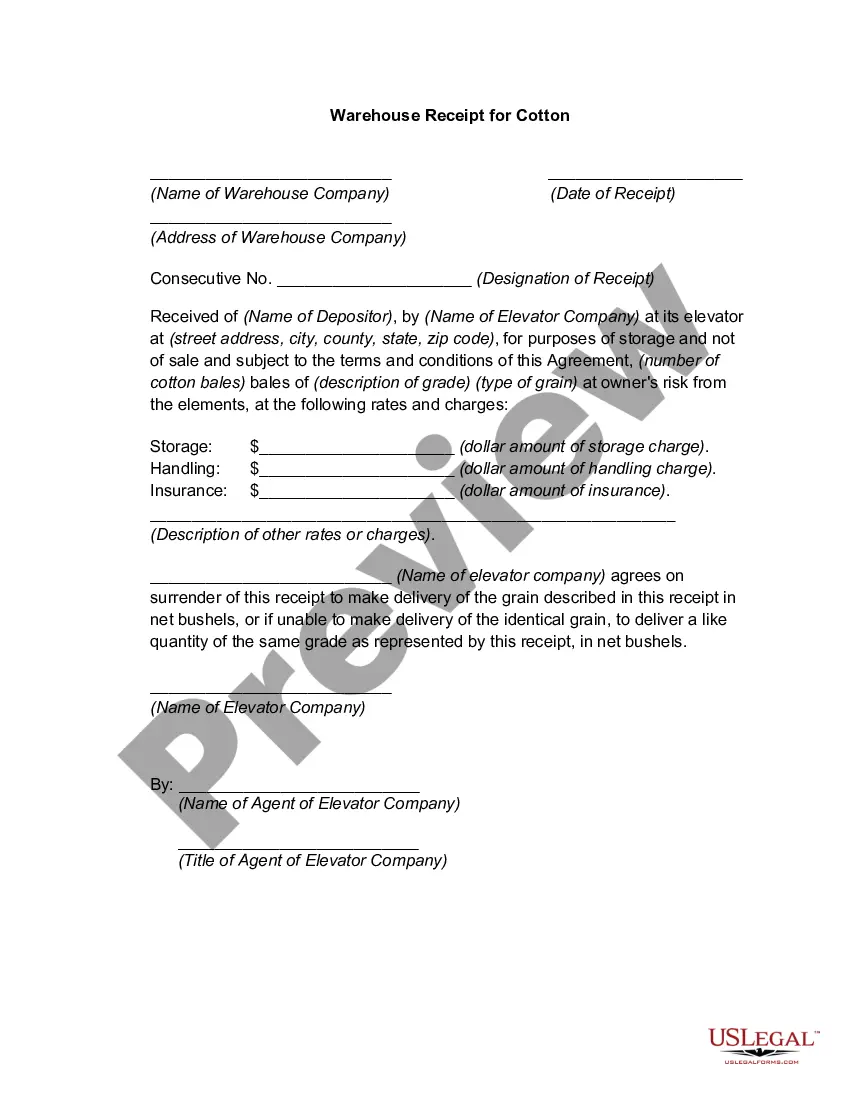

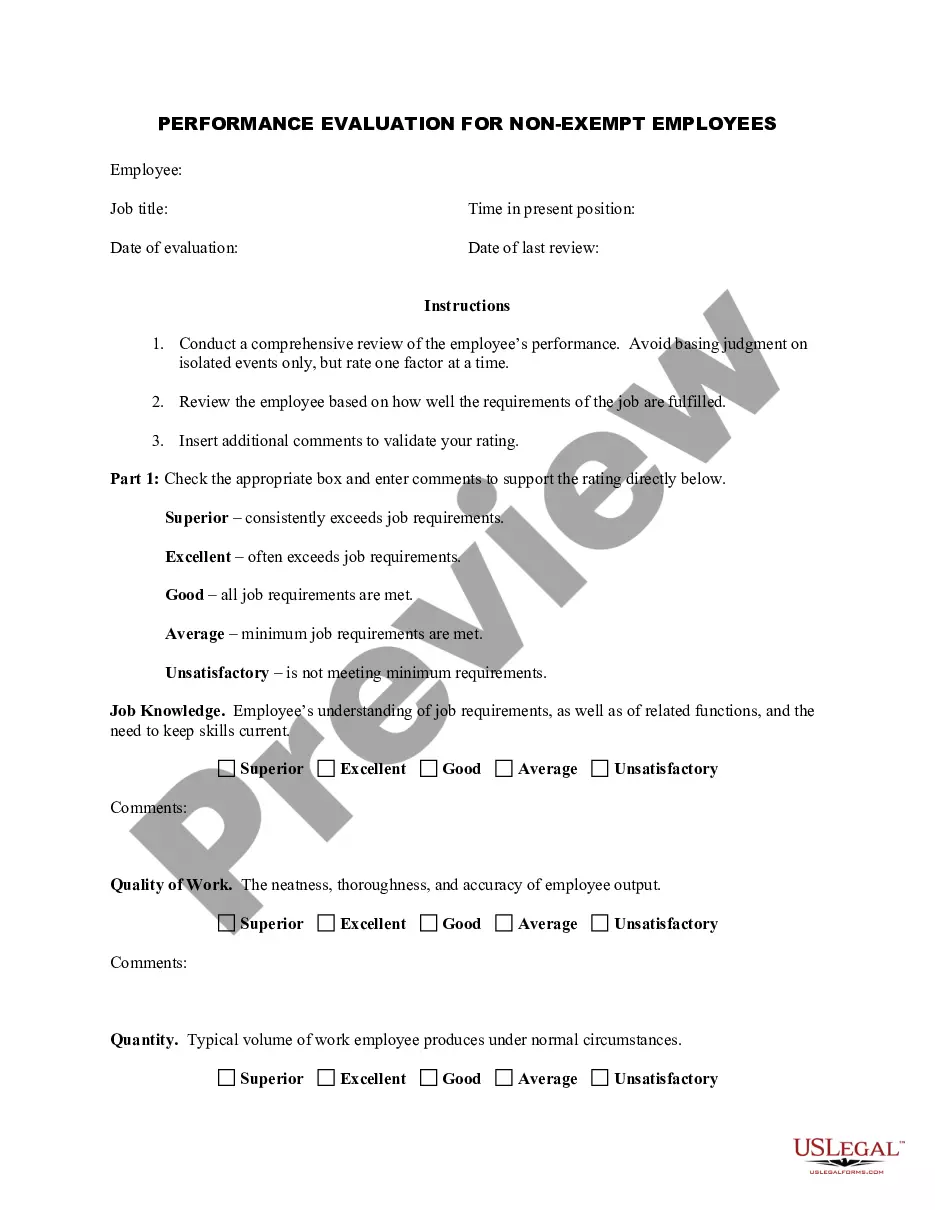

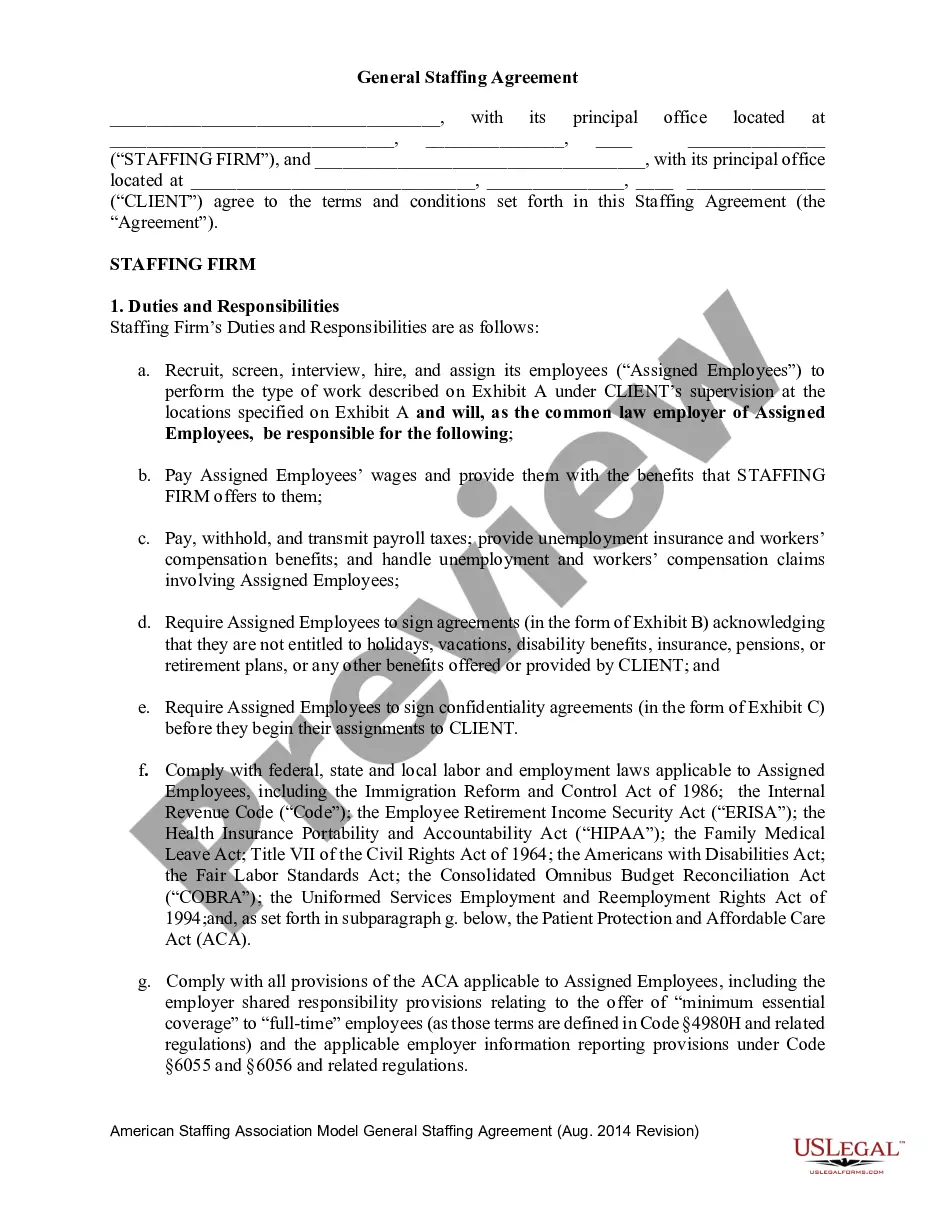

US Legal Forms offers an extensive selection of form templates, similar to the Delaware Monthly Retirement Planning, which are designed to comply with federal and state regulations.

Once you find the right document, click Acquire now.

Select the payment option you prefer, fill in the necessary information to create your account, and process the payment using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Delaware Monthly Retirement Planning template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Acquire the document you need and ensure it is for the correct city/state.

- Utilize the Preview button to review the document.

- Check the description to confirm you have selected the appropriate document.

- If the document does not meet your requirements, use the Search field to find the form that fits your needs.

Form popularity

FAQ

The Plan is a voluntary plan available to all pension-eligible employees (Casual-Seasonal employees are not eligible). There are no age or length of service requirements.

A 457(b) plan is an employer-sponsored, tax-favored retirement savings account. With this type of plan, you contribute pre-tax dollars from your paycheck, and that money won't be taxed until you withdraw the money, usually for retirement.

As an employee of the State of Delaware, you contribute a certain percentage of each paycheck to the State's pension fund. Employees hired prior to January 1, 2012 contribute 3% of that portion of their monthly compensation which exceeds $6,000 per year.

You will usually need at least 10 qualifying years on your National Insurance record to get any State Pension.

Is Delaware a retirement friendly state? Delaware has a favorable tax code for retirees. Delaware has no state sales tax, no taxes on social security income, and allows a $12,500 deduction for income from pensions.

Changes the normal retirement age to: age 65 with 10 consecutive years of pension creditable service; age 60 with 20 years of pension creditable service; 30 years of pension creditable service at any age; increases vesting from 5 years to 10 years.

Your traditional pension plan is designed to provide you with a steady stream of income once you retire. That's why your pension benefits are normally paid in the form of lifetime monthly payments. Increasingly, employers are making available to their employees a one-time payment for all or a portion of their pension.

The annual contribution limits for 401(k) plans are identical to those allowed for 457(b) plans. However, it's more common for employers to make matching contributions to these accounts. With a 401(k) match, the employer can determine what percentage of employees' income to match.