Delaware Assignment of Partnership Interest

Description

How to fill out Assignment Of Partnership Interest?

US Legal Forms - one of the largest repositories of legal documents in the USA - offers a broad selection of legal template files that you can download or create.

By using the website, you can access a myriad of forms for business and personal purposes, categorized by groups, states, or keywords. You will find the latest versions of forms such as the Delaware Assignment of Partnership Interest in moments.

If you have an account, Log In and download the Delaware Assignment of Partnership Interest from the US Legal Forms directory. The Download option will appear on every form you view. You can also access all previously saved forms in the My documents section of your account.

Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit. Complete, adjust, and print and sign the saved Delaware Assignment of Partnership Interest. Every template you added to your account does not have an expiration date and is yours indefinitely. Therefore, if you want to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Delaware Assignment of Partnership Interest with US Legal Forms, the most comprehensive collection of legal document templates. Utilize a vast number of professional and state-specific templates that fulfill your business or personal requirements and needs.

- Make sure you have selected the correct form for your city/region.

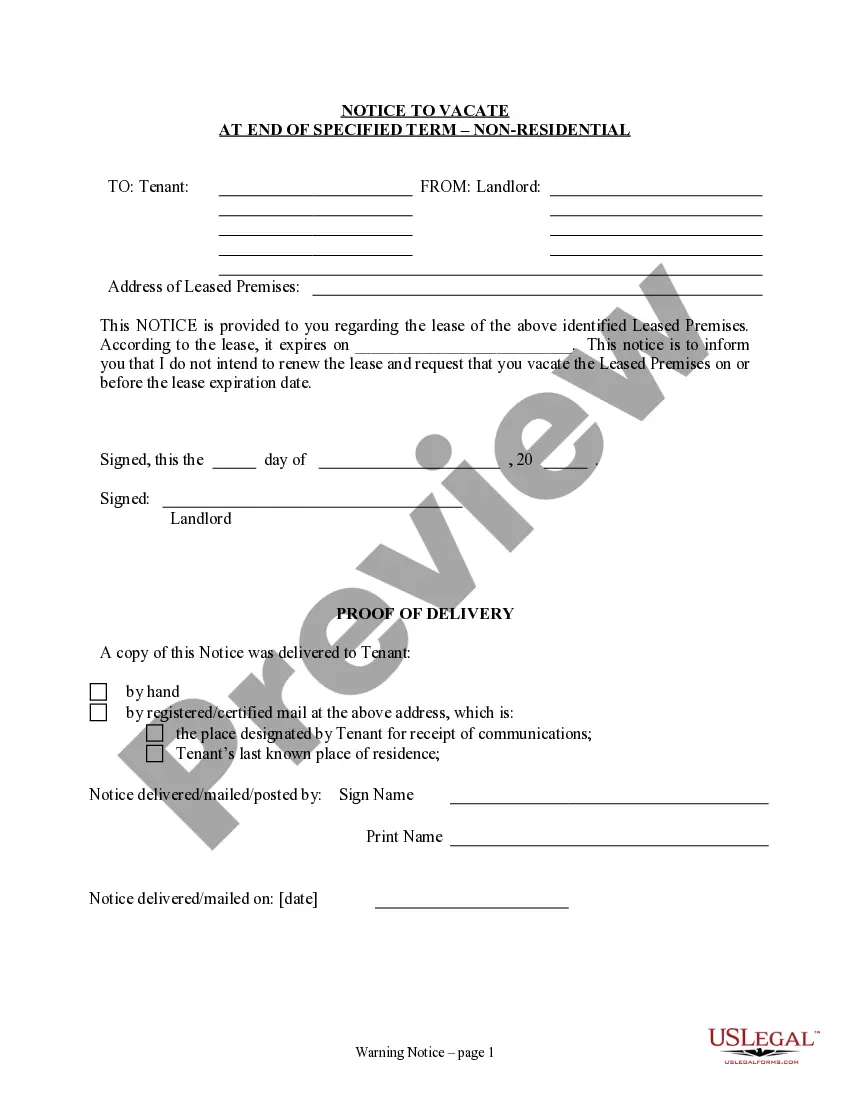

- Click the Preview option to examine the form's content.

- Review the form description to confirm that you have chosen the correct form.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- Once satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, select your preferred pricing plan and provide your information to register for the account.

Form popularity

FAQ

Forming a partnership in Delaware involves choosing a partnership type, drafting a partnership agreement, and registering with the state. You can utilize the Delaware Assignment of Partnership Interest to outline how ownership interests can be transferred in the future. Always consider consulting legal resources to ensure your partnership is established smoothly and efficiently.

The assignee of a partner's interest is the individual or entity that receives the transferred ownership rights from a partner. Under the Delaware Assignment of Partnership Interest, this person gains the right to receive profits but does not automatically gain a say in management unless specified. Clear communication about the rights and responsibilities of the assignee is crucial.

To report a transfer of partnership interest, you typically need to update your partnership agreement and notify the relevant authorities, such as the IRS. The Delaware Assignment of Partnership Interest is a practical tool for documenting this transfer properly, ensuring all parties are informed. Additionally, consult with a tax professional to understand the implications of the transfer.

Yes, you can assign a partnership interest as long as it aligns with the terms of your partnership agreement. The Delaware Assignment of Partnership Interest simplifies this action, providing a clear framework for completing the assignment legally. Always involve your partners in discussions about the assignment to maintain transparency.

An assignment of interest in a general partnership refers to the transfer of a partner's ownership rights to another party. This process is covered under the Delaware Assignment of Partnership Interest, which ensures that the transfer adheres to legal standards. The assignee typically does not gain management rights unless the partnership agreement specifies otherwise.

Changing partners in a partnership is possible, but it often requires following specific procedures set out in your partnership agreement. Utilizing the Delaware Assignment of Partnership Interest helps in documenting the change, ensuring that all legal requirements are met. Discuss these changes openly with your partners, as their consent may be necessary.

You can transfer partnership interest through an assignment or other means as outlined in your partnership agreement. The Delaware Assignment of Partnership Interest facilitates this process, helping you document the transfer clearly and legally. Each partner must agree to the transfer unless the agreement states otherwise, so communication is vital.

Yes, you can gift an interest in a partnership, but it’s essential to follow the partnership agreement and execute proper documentation. The Delaware Assignment of Partnership Interest allows you to easily transfer a portion of your ownership while maintaining compliance with state laws. Always consult with an attorney to ensure that the gifting process is handled correctly and does not violate any agreements.

To form a partnership in Delaware, you will need at least two partners and a clear partnership agreement. While general partnerships do not require formal registration, it is advisable to document your agreement to minimize potential conflicts. This documentation will support your Delaware Assignment of Partnership Interest by ensuring everyone is on the same page. You can turn to US Legal Forms for easy access to templates and legal advice tailored to your needs.

A Delaware LLC is not a traditional partnership, but it can have a partnership-like structure. An LLC offers limited liability protection to its members while allowing flexible management and tax options. Forming a Delaware LLC can be a strategic choice if you seek to enhance your Delaware Assignment of Partnership Interest while also protecting personal assets. US Legal Forms provides useful resources to help you choose the right structure for your business.