Puerto Rico Material Return Record

Description

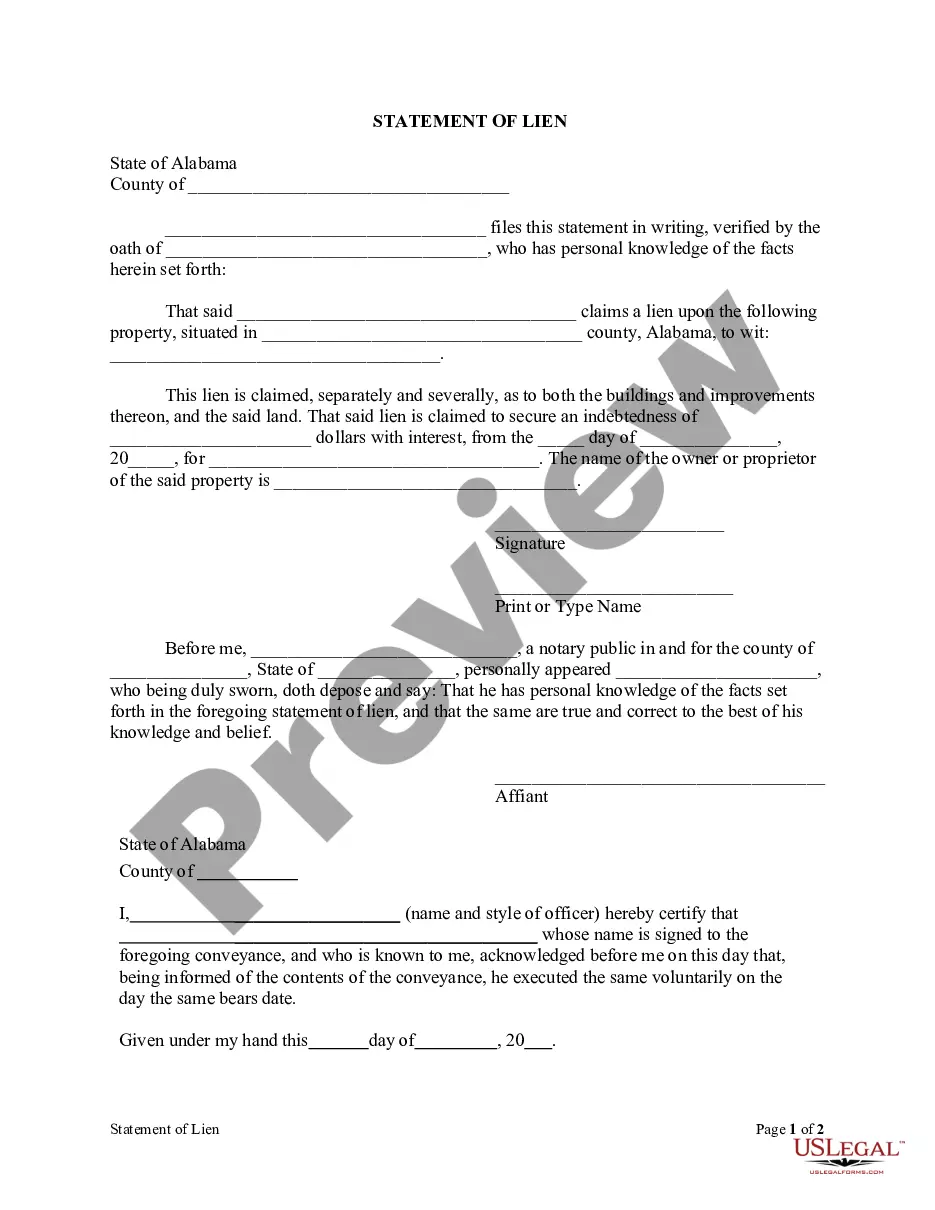

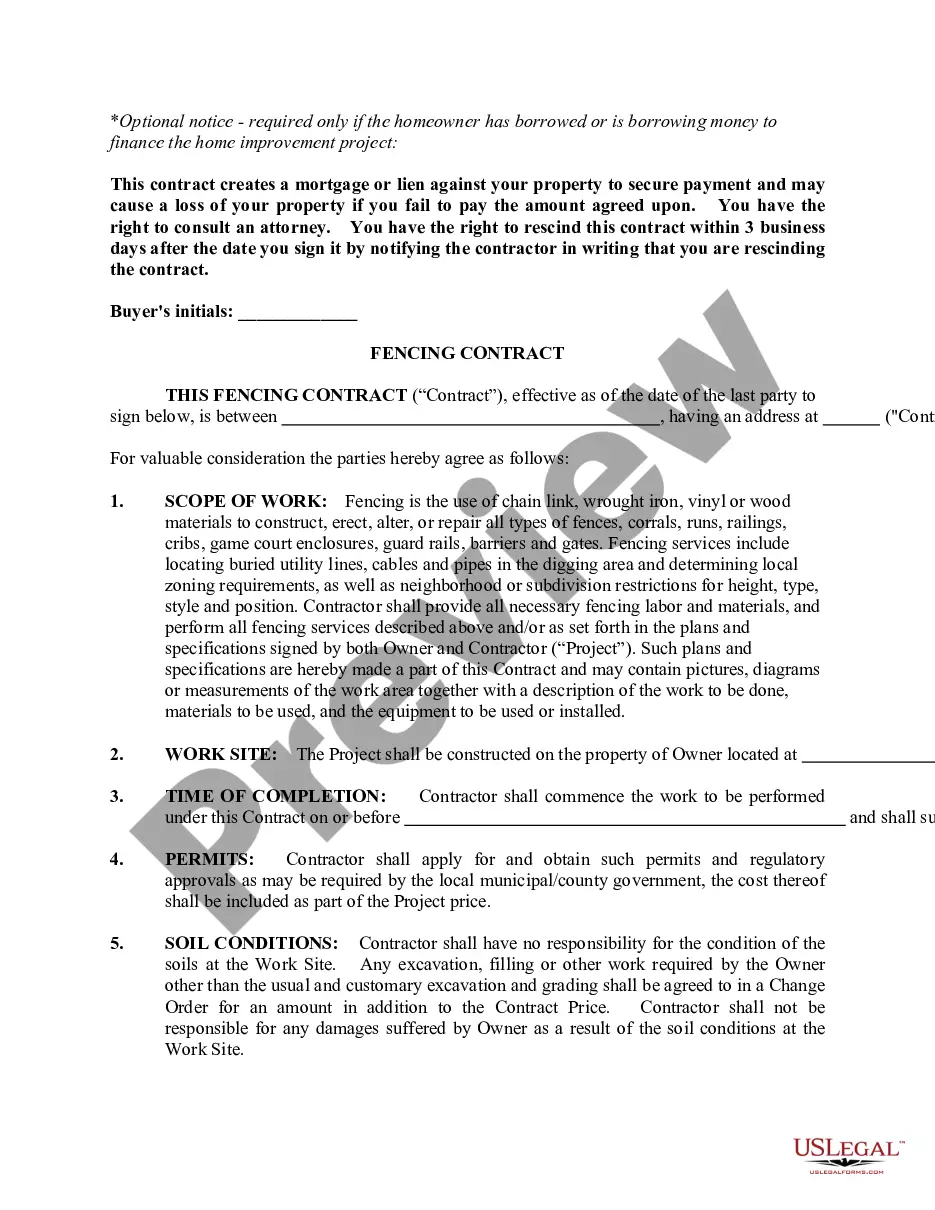

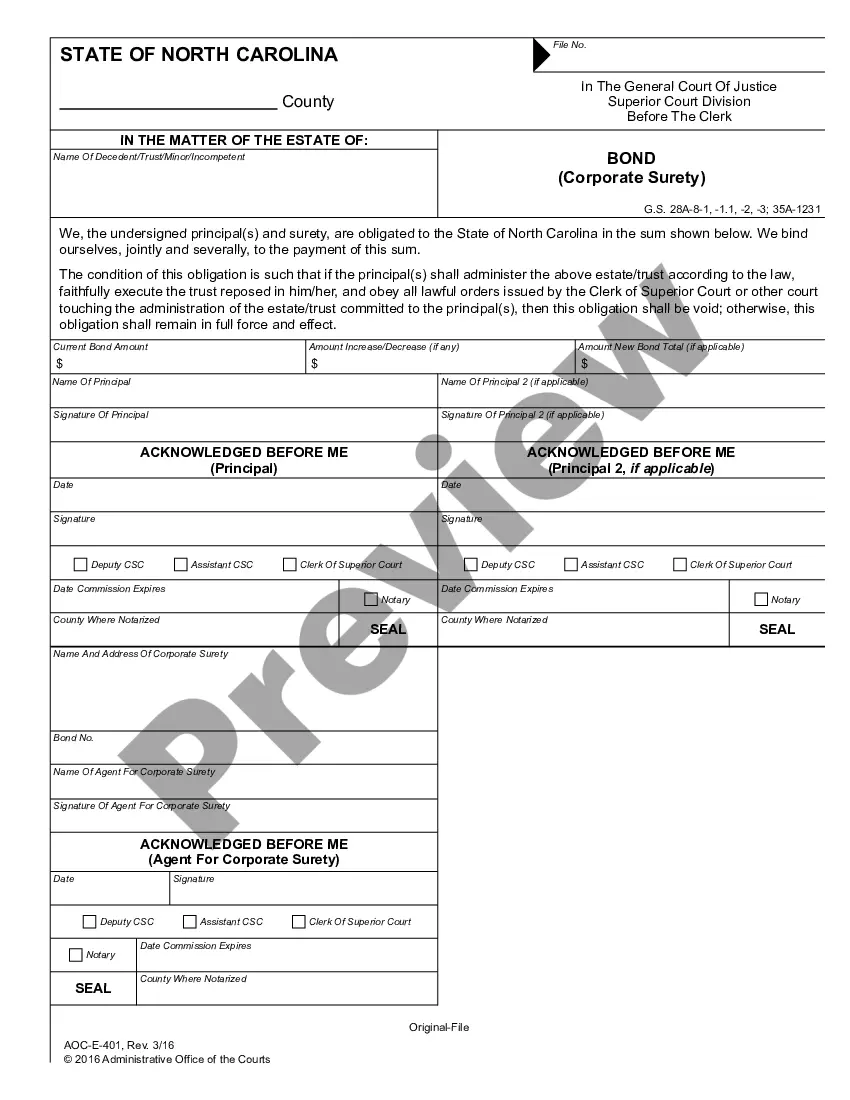

How to fill out Material Return Record?

If you need to aggregate, download, or create authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the website's straightforward and user-friendly search function to locate the documents you require.

Numerous templates for business and personal needs are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Download Now button. Choose your preferred pricing plan and enter your details to create an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to acquire the Puerto Rico Material Return Record in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click on the Download option to access the Puerto Rico Material Return Record.

- You can also retrieve forms you previously downloaded from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview feature to review the form's details. Be sure to read the information.

- Step 3. If you are dissatisfied with the form, employ the Search bar at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Among other things, Puerto Ricans don't pay federal income taxand that apparently makes the difference, even in this case, involving the rights of a citizen who lived on the mainland, paying taxes like every other resident, for nearly three decades.

Yes, since you are a Puerto Rico resident, you must file the Puerto Rico income tax return reporting all your earnings, and you may claim a credit in such return for any income taxes paid to the United States.

Amount. Payments for services rendered by corporations and partnerships amount withheld. See Form Common Fields. Form fields common to all form types. 480.6SP Form.

Residents of Puerto Rico who aren't required to file a U.S. income tax return must file Form 1040-SS or Form 1040-PR with the United States to report self-employment income and if necessary, pay self-employment tax.

Form 480.6C is intended for non-residents of Puerto Rico. It covers investment income that has been subject to Puerto Rico source withholding. This form is for information only. You should only enter form 1099-DIV in your tax return.

Use the PACER system to search for Federal civil & criminal court records in Puerto Rico by case number, party name, filing date, or last update. Provides dockets and documents. Registration with PACER and a small fee required.

The Puerto Rico Sales and Use Tax (SUT, Spanish: Impuesto a las Ventas y Uso, IVU) is the combined sales and use tax applied to most sales in Puerto Rico.

480.6D - Form 480.6D is intended for residents of Puerto Rico. It covers exempt income and income subject to the Puerto Rico Alternate Basic Tax (ABT).

The Puerto Rico Sales and Use Tax, or the "Impuesto a las Ventas y Uso (IVU)" in Spanish, consists of a 10.5% commonwealth-wide sales and use tax and a 1% local-option sales tax that is distributed to the city in which it is collected.

What is IRS Form 480.6A? Form 480.6A is issued by the government of Puerto Rico for the filing of informative returns on income not subject to withholding.