Delaware Writ Levar Facias Real Estate Lien

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Delaware Writ Levar Facias Real Estate Lien?

If you're looking for a method to properly execute the Delaware Writ Levar Facias Real Estate Lien without the need for a lawyer, then you've found the ideal location.

US Legal Forms has established itself as the most comprehensive and esteemed collection of official templates for every personal and business circumstance. Every document you discover on our online platform is designed in alignment with federal and state laws, ensuring that your paperwork is accurate.

Another excellent feature of US Legal Forms is that you will never misplace the documents you bought - you can access any of your downloaded templates in the My documents section of your profile whenever you require it.

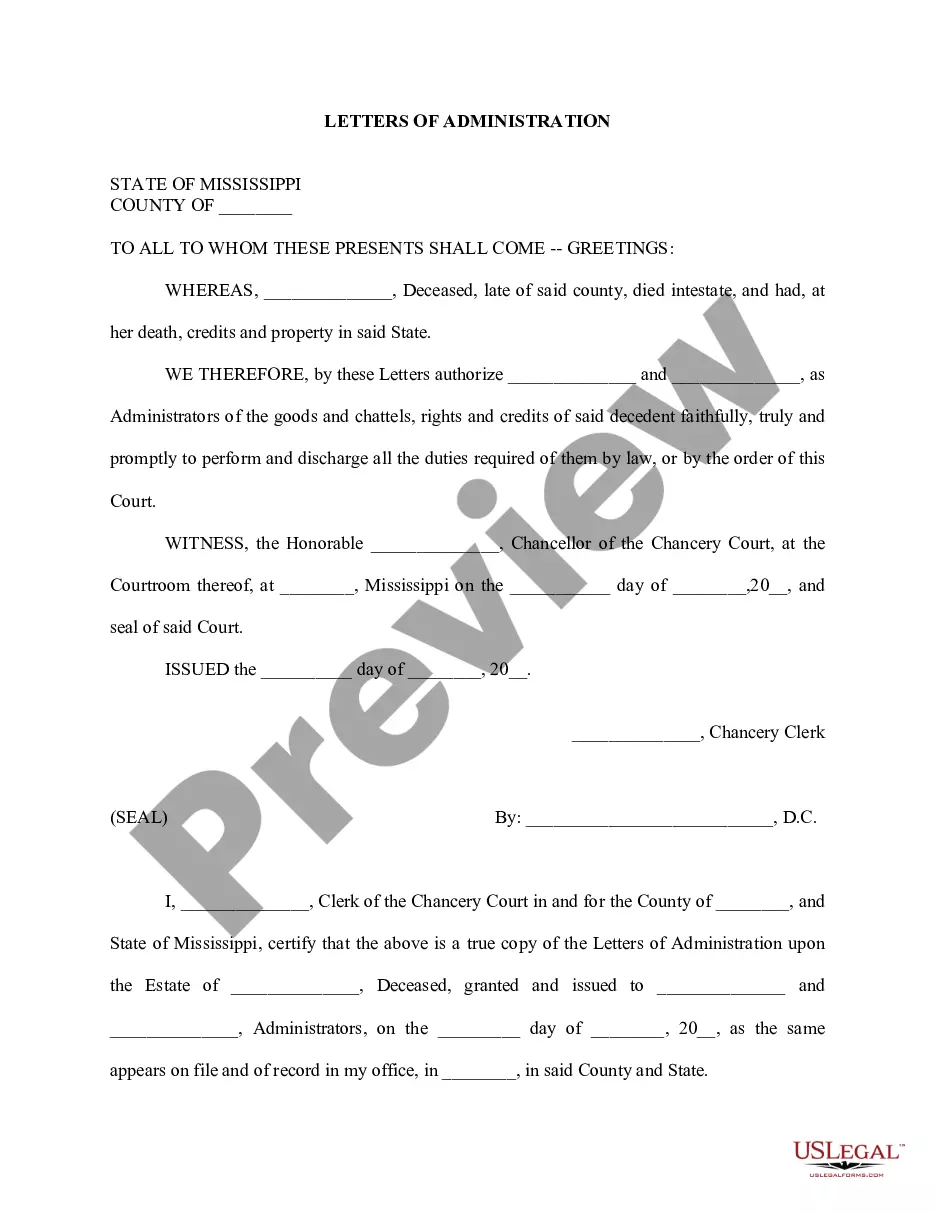

- Ensure the document visible on the page matches your legal needs and state laws by reviewing its text description or browsing the Preview mode.

- Input the document title in the Search tab at the top of the page and select your state from the dropdown to find an alternative template if there are discrepancies.

- Validate the content again and click Buy now once you are certain of the paperwork's adherence to all requirements.

- Log in to your account and click Download. If you don't have an account, create one with the service and choose a subscription plan.

- Utilize your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will become available for download immediately after.

- Choose the format you wish to receive your Delaware Writ Levar Facias Real Estate Lien in and download it by clicking the relevant button.

- Upload your template to an online editor to fill out and sign it quickly or print it to prepare a hard copy manually.

Form popularity

FAQ

Filling out a lien affidavit requires careful attention to detail. Start by gathering all relevant information about the debt and the property involved, ensuring you understand the formal requirements of a Delaware Writ Levar Facias Real Estate Lien. You will need to provide accurate descriptions and submit the affidavit to the correct legal authority. Following these steps helps establish the credibility of your lien and supports your legal rights.

The term scire facias essentially means 'to cause to know' and refers to the legal obligation to notify someone of a pending legal issue. In the context of liens, it plays a crucial role in enforcing or reinstating a lien that may have lapsed. Understanding scire facias can assist you in navigating the complexities related to your Delaware Writ Levar Facias Real Estate Lien. This knowledge empowers you to take control of your legal circumstances.

Putting a lien on a property in Delaware involves a series of clear steps. Begin by determining the type of lien you wish to file, such as a Delaware Writ Levar Facias Real Estate Lien. Then, prepare the necessary documents and file them with the appropriate court, ensuring all information is complete. Following these steps diligently can help you secure your interests in the property.

The conditions for a lien generally include a valid debt, proper documentation, and adherence to state laws. In Delaware, the Delaware Writ Levar Facias Real Estate Lien must be properly executed for it to be enforceable. Additionally, the property in question must be correctly identified and linked to the obligation. Being aware of these conditions helps you avoid complications during the lien process.

To file a lien on property in Delaware, you typically start by gathering relevant documents and information related to the debt. Next, you complete the necessary forms, ensuring you apply the Delaware Writ Levar Facias Real Estate Lien appropriately. Once you have filled out the forms, you submit them to the appropriate court along with any required filing fees. This structured approach ensures your lien is recognized and enforceable.

A writ of scire facias is a court order that requires an individual to appear and explain why a particular order should not be enforced. In the context of liens, this writ often serves as a legal tool to reinstate or enforce a lien that may have become dormant. Utilizing a Delaware Writ Levar Facias Real Estate Lien can help you manage your property rights effectively. It’s essential to grasp this concept to navigate any potential legal challenges.

Yes, you can place a lien on property you own. A lien signifies that a creditor has a legal claim to your asset until a specified obligation is fulfilled. This process is often initiated through a Delaware Writ Levar Facias Real Estate Lien, which helps secure the debt. By understanding this process, you can take appropriate steps to protect your financial interests.

To collect a judgement in Delaware, you can utilize a Delaware Writ Levar Facias Real Estate Lien. This legal document allows you to place a lien on the debtor's real estate property, ensuring that your judgement is secured. Begin by filing the writ with the appropriate court and serving it to the debtor. Additionally, consider using the US Legal Forms platform to access accurate templates and guidance that simplify the process of collecting your judgement.

The order of priority for liens starts with tax liens, followed by first mortgages, then junior liens, and finally the Delaware Writ Levar Facias Real Estate Lien. It is essential for property owners to understand this ranking to ensure their financial arrangements are secure. Knowing the order can influence investment strategies and real estate decisions. For assistance with these matters, consider leveraging the comprehensive tools from US Legal Forms.

Tax liens generally hold the highest priority among all types of liens, including the Delaware Writ Levar Facias Real Estate Lien. These liens take precedence over other claims against the property and must be satisfied first. Understanding this concept is vital for property owners and investors alike. Resources from US Legal Forms can help clarify these priorities and guide you in maintaining your real estate investments.