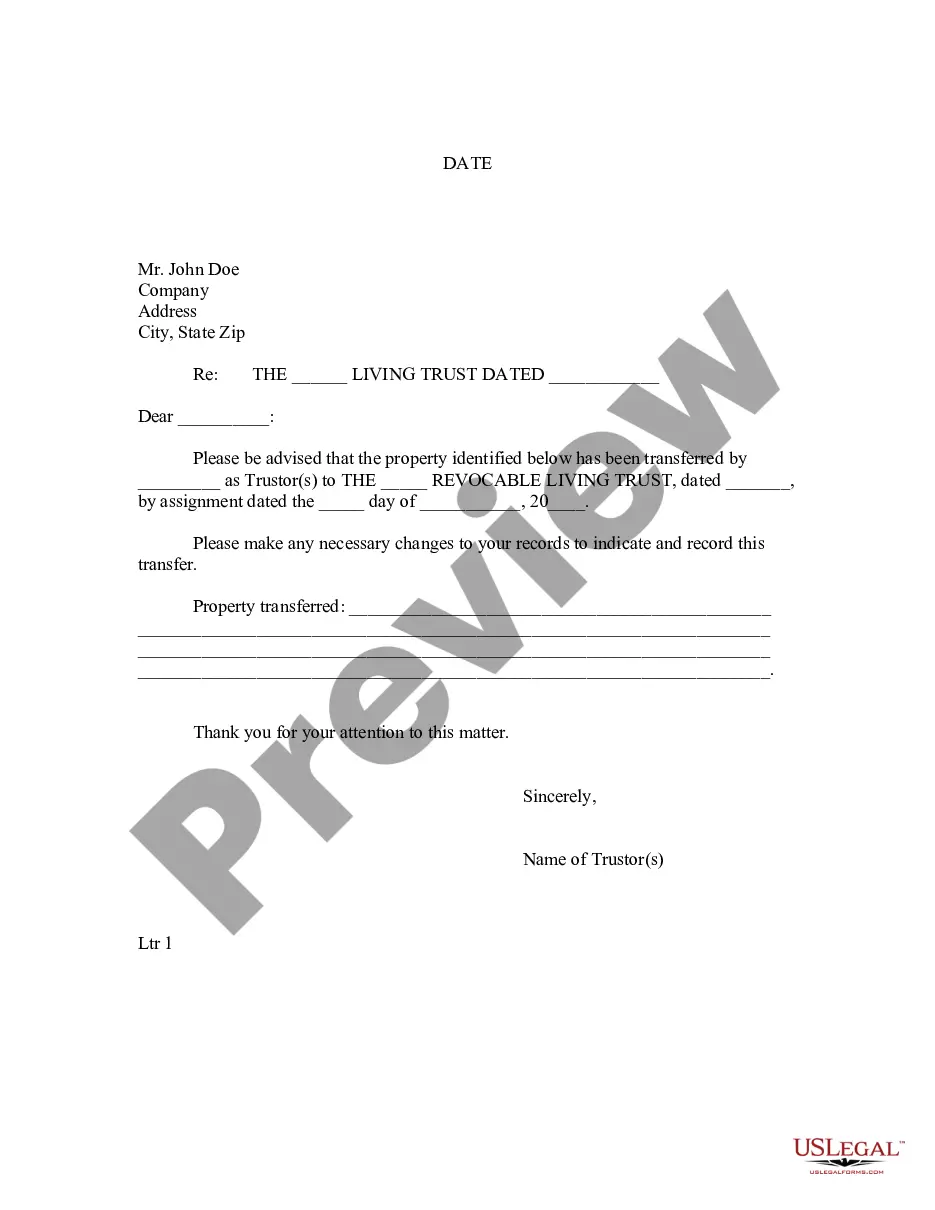

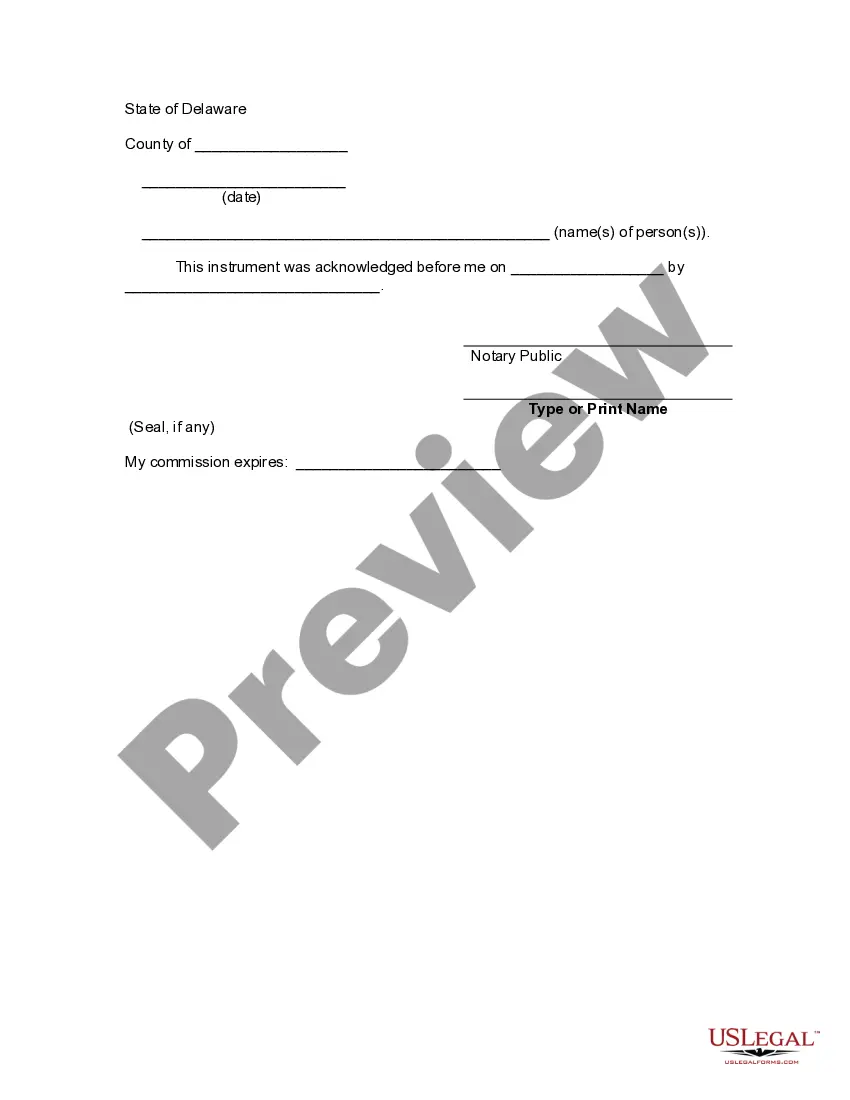

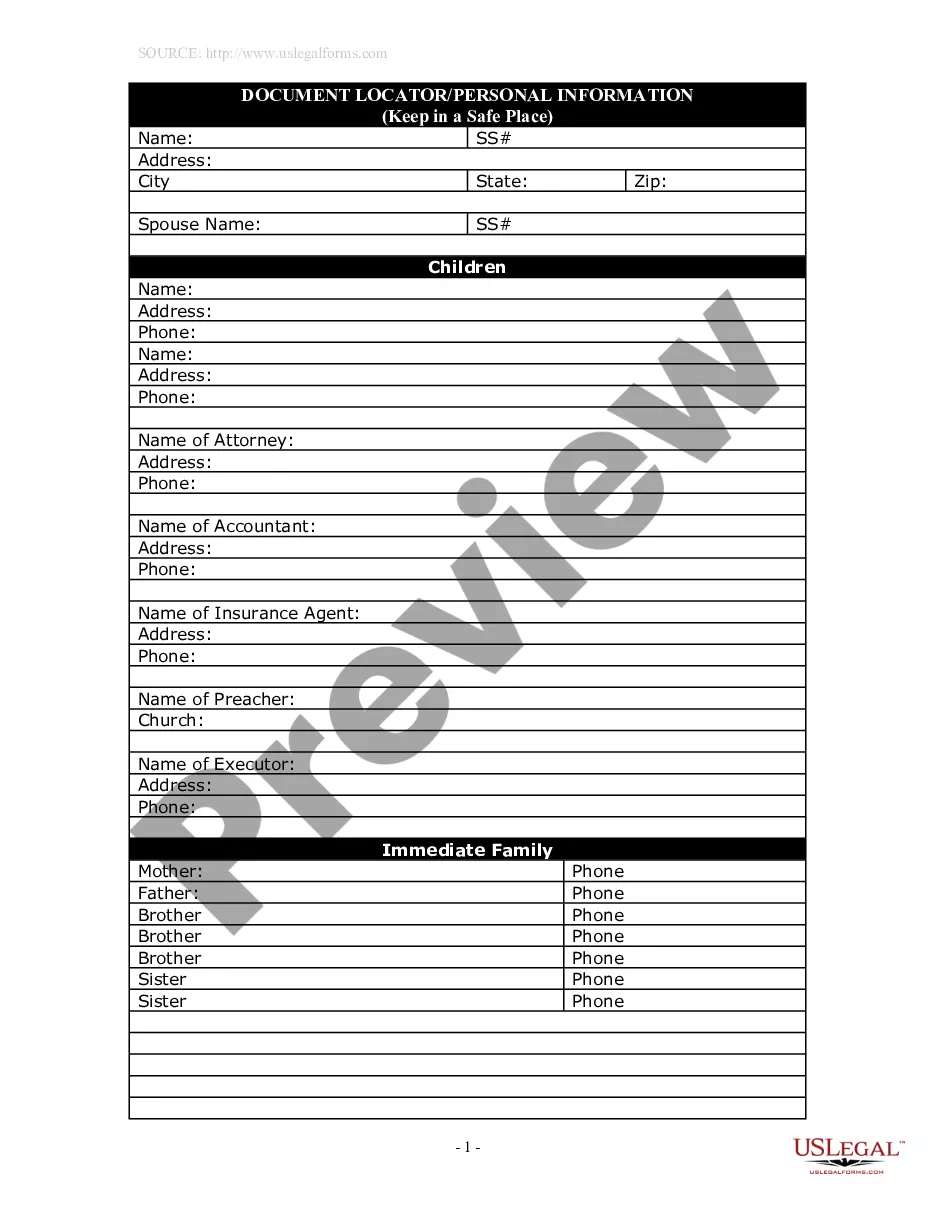

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trustor would use this form to specify what specific property was being held by the trust.

Delaware Letter to Lienholder to Notify of Trust

Description

How to fill out Delaware Letter To Lienholder To Notify Of Trust?

The larger amount of documents you need to prepare - the more anxious you become.

You can discover countless Delaware Letter to Lienholder to Notify of Trust templates online, but you are uncertain which ones to rely on.

Remove the frustration to simplify finding samples with US Legal Forms. Obtain properly drafted forms that comply with state requirements.

Provide the necessary details to create your account and pay for the order using your PayPal or credit card. Choose a suitable file format and take your sample. Access every template you download in the My documents section. Just go there to create a new version of the Delaware Letter to Lienholder to Notify of Trust. Even when utilizing professionally prepared templates, it's still crucial to consult a local legal expert to verify that your document is accurately completed. Achieve more while spending less with US Legal Forms!

- If you have a US Legal Forms subscription, Log In to your account, and you will see the Download option on the Delaware Letter to Lienholder to Notify of Trust’s page.

- If you haven’t used our site before, complete the registration process by following these instructions.

- Verify if the Delaware Letter to Lienholder to Notify of Trust is applicable in your state.

- Reassess your choice by reviewing the description or using the Preview function if available for the selected file.

- Simply click Buy Now to initiate the registration process and choose a pricing plan that suits your needs.

Form popularity

FAQ

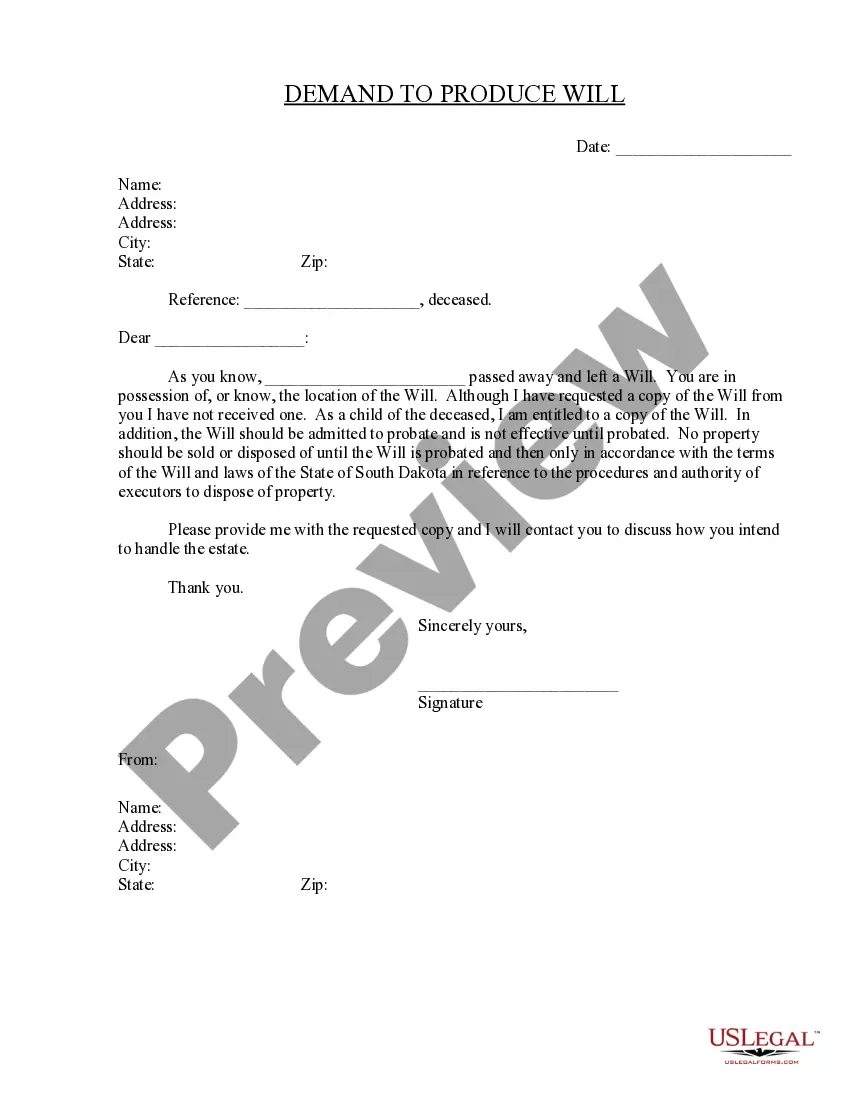

Yes, typically both parties must be present to sign the title during the transfer process in Delaware. If one party cannot be present, a Power of Attorney may be necessary. To facilitate the process further, especially in cases involving trusts or liens, consider using a Delaware Letter to Lienholder to Notify of Trust.

To transfer a car title to a family member in Delaware, begin by completing the title transfer and signing it over to the new owner. You should also include an odometer reading and provide a Delaware Letter to Lienholder to Notify of Trust if the vehicle is under a lien. Finally, visit the DMV to finalize the transfer.

A Delaware trust does not have to have a Delaware trustee, but appointing one can simplify legal and tax matters. Many choose local trustees for their familiarity with Delaware trust laws and regulations. Moreover, if you're handling a vehicle within that trust, using a Delaware Letter to Lienholder to Notify of Trust can help manage related liens.

Forming a Delaware trust involves drafting a trust agreement that specifies the terms and beneficiaries of the trust. You will also need to select a trustee who will manage the trust assets. Additionally, utilizing a Delaware Letter to Lienholder to Notify of Trust can clarify the trust's standing with any pertinent lienholders.

A Delaware trust does not always require a Delaware-based trustee, but using one can provide local advantages, including easy access to state laws. People often choose Delaware trustees for their knowledge of local regulations. If the trust has lienholder considerations, a Delaware Letter to Lienholder to Notify of Trust may further clarify responsibilities.

To transfer ownership of a car in Delaware, both the buyer and seller must fill out the title transfer sections on the title. If there is a lien on the vehicle, consider drafting a Delaware Letter to Lienholder to Notify of Trust. This document helps maintain clear communication with the lienholder during the transfer process.

To set up a trust in Delaware, you start by identifying your assets and selecting a trustee. Then, create a trust document outlining how you want your assets managed and distributed. It may also be beneficial to incorporate a Delaware Letter to Lienholder to Notify of Trust if your trust holds properties with existing liens.

The best way to transfer a car title to a family member is to ensure that the title is signed over correctly by the seller. Include the necessary odometer disclosure and, if applicable, a Delaware Letter to Lienholder to Notify of Trust to inform any lienholders. Lastly, don’t forget to visit the Department of Motor Vehicles to complete the process officially.

A Delaware trust offers several benefits, including asset protection, tax advantages, and privacy. It allows for greater control over the distribution of assets to beneficiaries. Additionally, using a Delaware Letter to Lienholder to Notify of Trust can simplify the process of keeping lienholders informed and secure during your estate planning.

Yes, a trust must have a trustee to manage the assets and ensure they are distributed according to the trust's terms. The trustee can be an individual or an institution, depending on your preferences and needs. When setting up a trust in Delaware, consider drafting a Delaware Letter to Lienholder to Notify of Trust to keep all relevant parties informed.