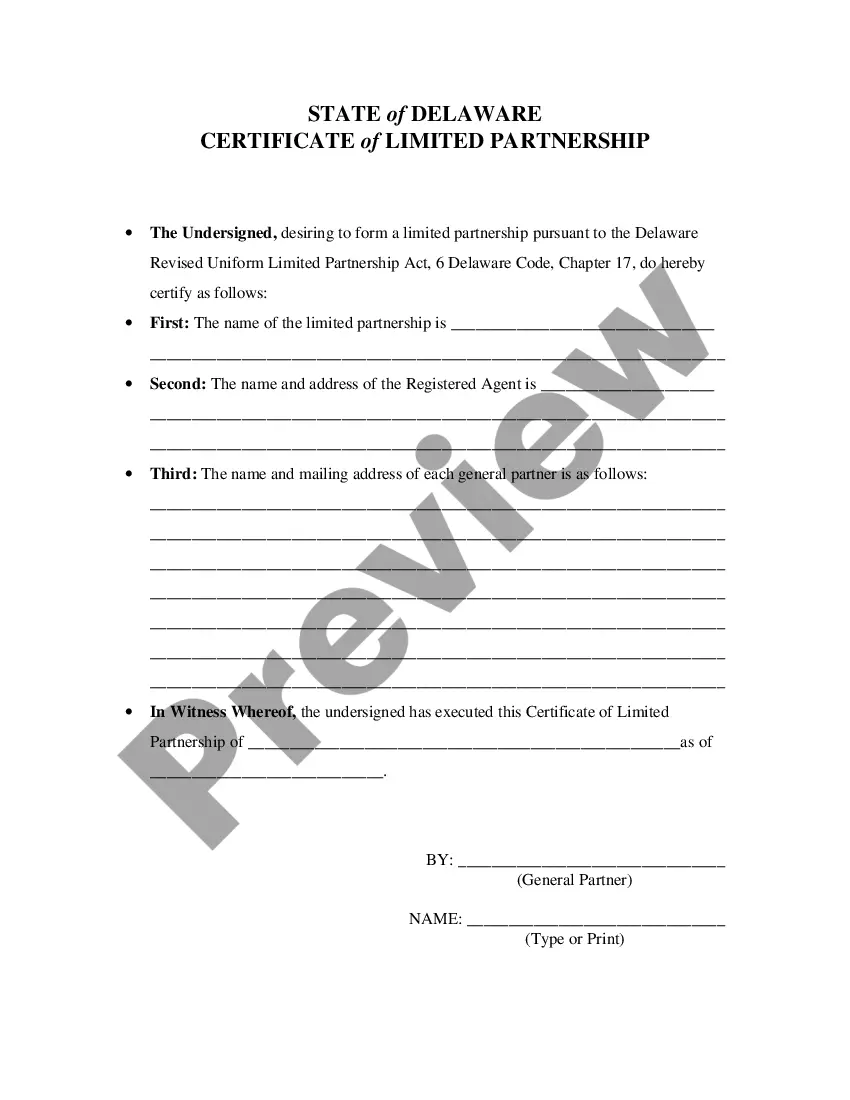

The Delaware Statement of Partnership Existence, also referred to as a Certificate of Limited Partnership, is a legal document that is filed with the Delaware Secretary of State. It is used to register a limited partnership and declares that a partnership exists in Delaware and its purpose. It must include the name and address of the partnership, the names and addresses of all general partners, the name of the registered agent, the purpose of the partnership, and the term of existence. The Delaware Statement of Partnership Existence must be signed by all the general partners and must be accompanied by the filing fee. There are two types of Delaware Statement of Partnership Existence — a Short Form and a Long Form. The Short Form is used for a simple registration while the Long Form is used for more complex partnerships.

Delaware Statement of Partnership Existence

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Delaware Statement Of Partnership Existence?

Engaging with official documents necessitates carefulness, accuracy, and utilizing well-prepared forms. US Legal Forms has been assisting individuals nationwide for 25 years, so when you select your Delaware Statement of Partnership Existence template from our collection, you can rest assured it adheres to federal and state statutes.

Utilizing our service is simple and speedy. To acquire the essential document, all you’ll require is an account with an active subscription. Here’s a quick guide for you to obtain your Delaware Statement of Partnership Existence in just a few minutes.

All documents are designed for multiple uses, like the Delaware Statement of Partnership Existence you see on this page. If you require them in the future, you can fill them out again without additional payment - simply visit the My documents tab in your profile and complete your document whenever necessary. Try US Legal Forms and manage your business and personal paperwork swiftly and with full legal adherence!

- Be sure to carefully review the form's content and its alignment with general and legal standards by previewing it or reading its description.

- Search for another official template if the one previously accessed does not suit your needs or state regulations (the tab for that is located in the top page corner).

- Log in to your account and download the Delaware Statement of Partnership Existence in your preferred format. If this is your first time using our service, click Buy now to continue.

- Create an account, choose your subscription plan, and make your payment using a credit card or PayPal account.

- Select the format in which you wish to save your form and click Download. You can print the blank or upload it to a professional PDF editor to submit it electronically.

Form popularity

FAQ

The so-called Delaware LLC tax loophole refers to the state's business-friendly tax policies, which can benefit certain companies. Delaware does not impose a corporate income tax on LLCs that operate outside the state, making it an attractive choice for many businesses. To take advantage of this tax structure, ensure that your partnership is properly established by filing the Delaware Statement of Partnership Existence. This can lead to significant savings and operational efficiencies.

Yes, a Delaware limited partnership can have one general partner. However, it must have at least one general partner and one limited partner to meet Delaware requirements. This allows for unique structures, such as a single-member LLC acting as the general partner. Remember to file the Delaware Statement of Partnership Existence to officially establish your partnership.

Filling out a partnership form involves several key steps. Start by gathering your partnership details, such as partner names, addresses, and the partnership's purpose. Then, make sure you comply with Delaware regulations by completing and submitting the Delaware Statement of Partnership Existence. Using a platform like uslegalforms can simplify this process, providing you with essential templates and guidance.

Absolutely, you can simultaneously hold an LLC and form a partnership. Many business owners choose this route to achieve specific legal and tax strategies. If you opt for this combination, ensure that you properly file your Delaware Statement of Partnership Existence, which outlines the structure of your partnership. This strategy allows for effective management while providing liability protection.

Yes, a Delaware LLC can function as a partnership. By forming a Delaware LLC, you can enjoy the benefits of limited liability while still operating in a partnership structure. To establish this, you will need to file the Delaware Statement of Partnership Existence, which confirms your partnership’s registration. This flexibility makes Delaware an attractive option for many business owners.

A Delaware Statement of Good Standing verifies that your business is compliant with state regulations and has met all filing requirements. This document is often needed when applying for loans or conducting business outside of Delaware. It's a key aspect of maintaining your Delaware Statement of Partnership Existence and solidifying your business's credibility.

Yes, Delaware recognizes domestic partnerships, allowing couples to register their partnership for legal purposes. This status provides certain legal rights and benefits, reinforcing the importance of maintaining a valid Delaware Statement of Partnership Existence. To explore options, consult legal resources or platforms like uslegalforms.

A Delaware LLC is not a partnership, but it can have similar characteristics, such as pass-through taxation. While both structures provide liability protection, an LLC is a distinct legal entity with flexible management options. Understanding these differences helps clarify your Delaware Statement of Partnership Existence.

Yes, Delaware requires that limited partnerships have a written limited partnership agreement to define the roles of general and limited partners. This agreement outlines ownership and operational details, which are essential for establishing a valid Delaware Statement of Partnership Existence.

To form a partnership in Delaware, start by drafting a partnership agreement that outlines the rights and responsibilities of each partner. After that, you need to register your partnership with the Delaware Division of Corporations, which formalizes your partnership status. This process is crucial for achieving a valid Delaware Statement of Partnership Existence.