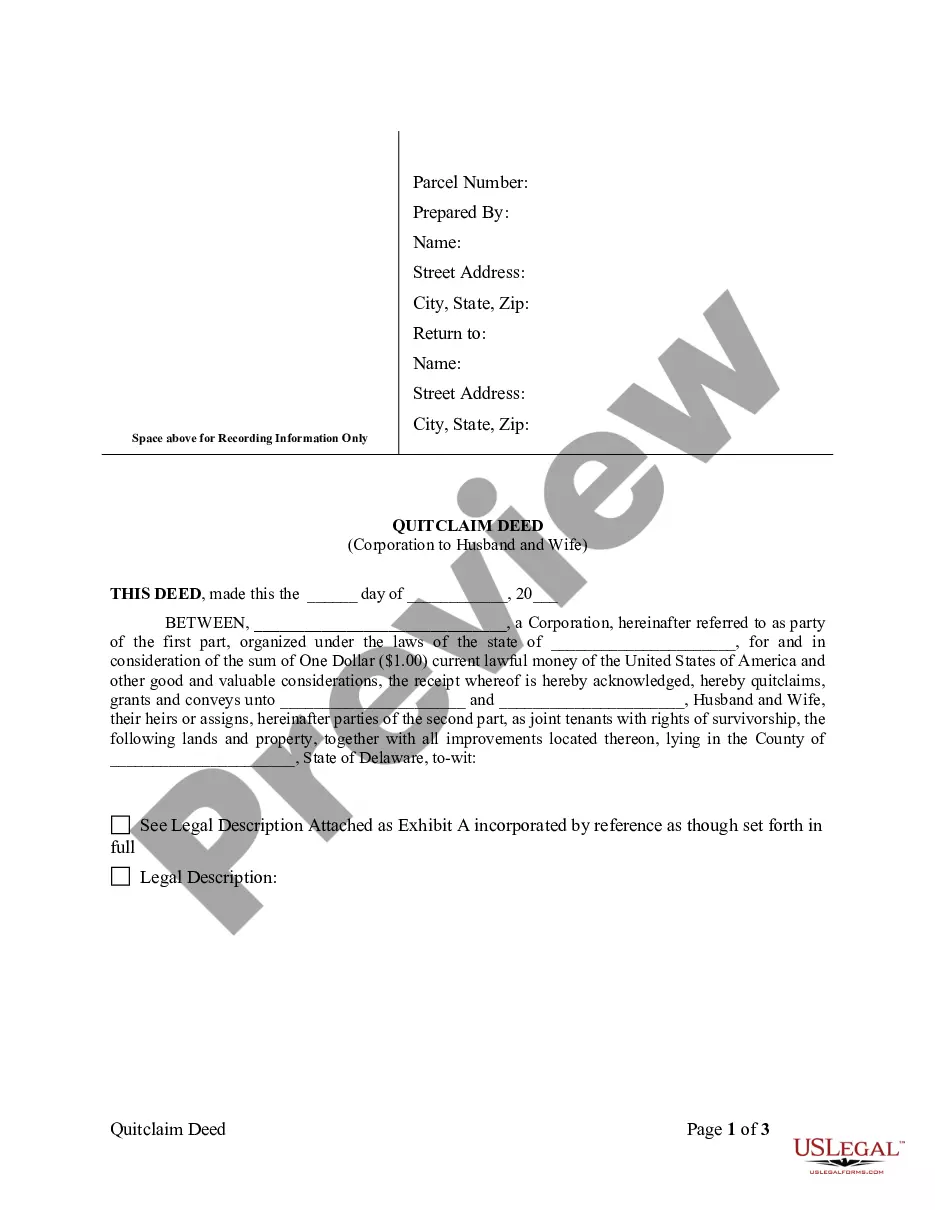

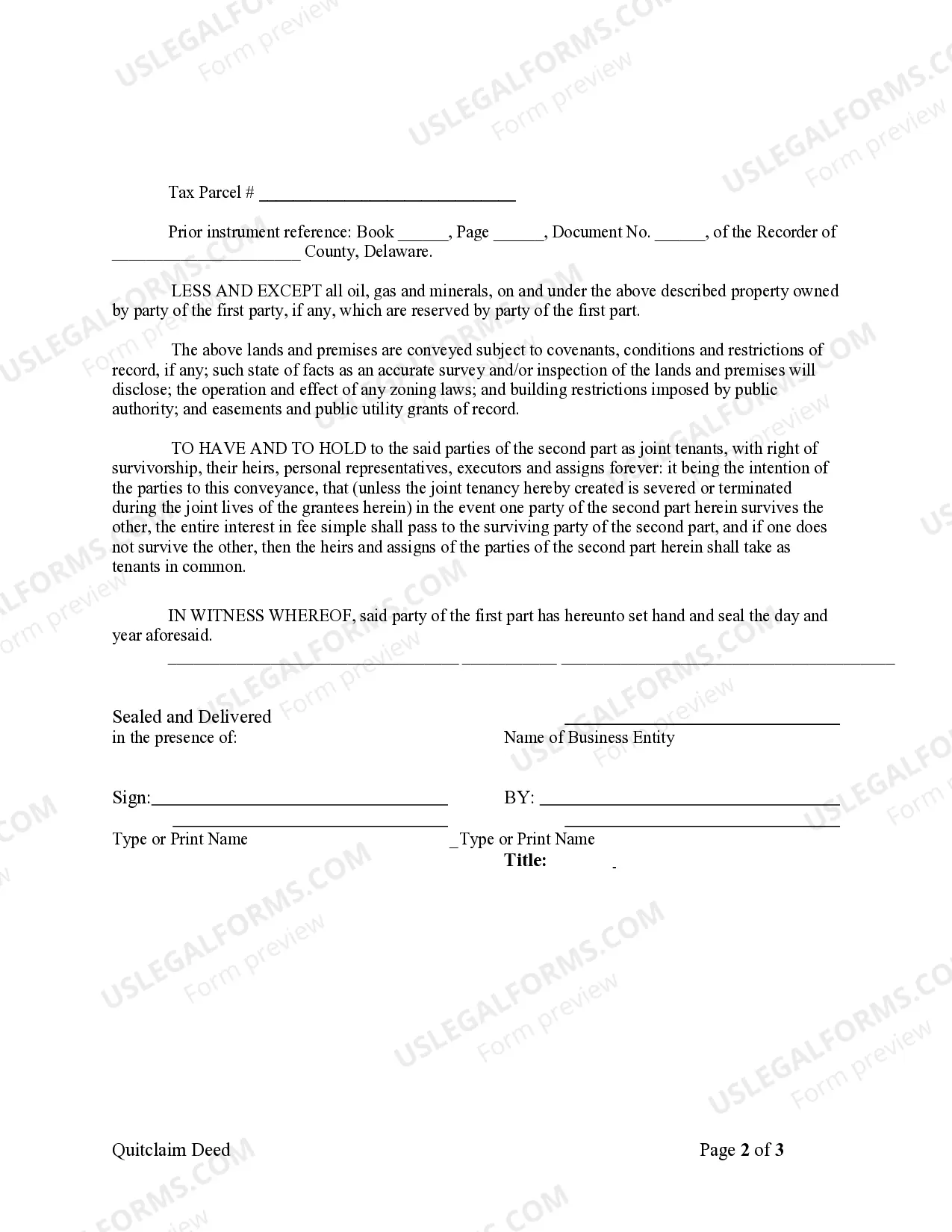

This Quitclaim Deed from Corporation to Husband and Wife form is a Quitclaim Deed where the Grantor is a corporation and the Grantees are husband and wife. Grantor conveys and quitclaims the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

Delaware Quitclaim Deed from Corporation to Husband and Wife

Description

How to fill out Delaware Quitclaim Deed From Corporation To Husband And Wife?

The higher the amount of documents you must prepare - the more anxious you feel.

You can discover countless Delaware Quitclaim Deed from Corporation to Husband and Wife models online, but you are unsure which ones to trust.

Remove the inconvenience and simplify acquiring samples using US Legal Forms. Obtain professionally created documents designed to comply with state requirements.

Provide the requested information to create your profile and complete your order payment using PayPal or credit card. Choose a suitable file format and acquire your copy. Access each template you obtain in the My documents section. Simply navigate there to generate a new version of your Delaware Quitclaim Deed from Corporation to Husband and Wife. Even with well-prepared templates, it is still essential to consider consulting your local attorney to double-check the filled-out sample to ensure your document is accurately completed. Achieve more while spending less with US Legal Forms!

- If you already have a US Legal Forms membership, sign in to your account, and you will find the Download option on the Delaware Quitclaim Deed from Corporation to Husband and Wife’s page.

- If you have not utilized our service before, follow these instructions to register.

- Verify that the Delaware Quitclaim Deed from Corporation to Husband and Wife is valid in your residing state.

- Double-check your selection by reviewing the description or using the Preview feature if it’s available for the selected document.

- Press Buy Now to initiate the registration process and select a payment plan that fits your needs.

Form popularity

FAQ

The best way to add your wife to your deed is to execute a Delaware Quitclaim Deed from Corporation to Husband and Wife. This process is straightforward and typically requires filling out the appropriate forms and recording them with your local county office. Make sure to provide all necessary information accurately, as this reduces errors and helps in maintaining clear property ownership.

Yes, you can add your spouse to the deed without refinancing by using a Delaware Quitclaim Deed from Corporation to Husband and Wife. This process allows you to transfer property ownership without altering your current mortgage terms. However, consider consulting a legal professional to understand how this may affect your mortgage agreements and ensure a smooth transition.

Adding a name to a deed can create complications such as potential tax implications or affecting your liability for existing debts. If the property is sold or mortgaged, both names may need to cooperate in the transaction, which can complicate matters if relationships change. Furthermore, in the case of divorce or separation, disputes over property rights may arise, especially with a Delaware Quitclaim Deed from Corporation to Husband and Wife, where intentions may not always remain clear.

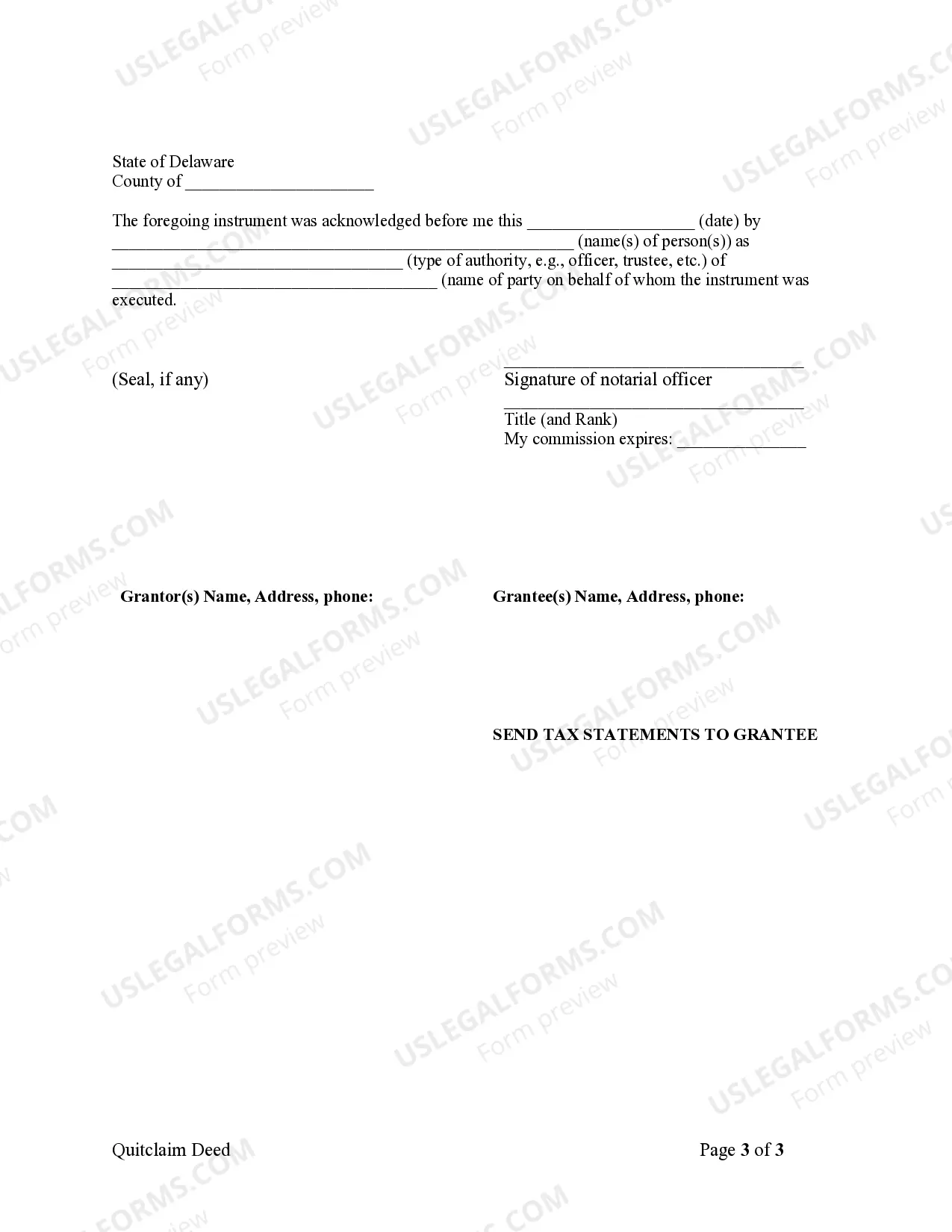

To add someone to a deed in Delaware, you can use a Delaware Quitclaim Deed from Corporation to Husband and Wife. This deed allows you to transfer property ownership without needing to re-fund or alter any existing mortgage. You will need to fill out the deed form, have it notarized, and file it with the county recorder’s office. This process ensures a legal transfer of property rights and establishes joint ownership.

Adding a spouse to a deed is typically a straightforward process, often achieved by executing a quitclaim deed. This involves creating a new deed that lists both spouses as owners. Utilizing a Delaware Quitclaim Deed from Corporation to Husband and Wife simplifies this process, as our platform can provide the necessary forms and instructions to ensure a smooth addition to the deed.

The primary disadvantage of using a quitclaim deed is the lack of warranty or guarantees regarding the property title. This means the recipient may inherit title issues or debts attached to the property. While a Delaware Quitclaim Deed from Corporation to Husband and Wife can facilitate easy transfers, it's essential to weigh these disadvantages against your specific needs and situation.

The strongest form of deed is a warranty deed, which provides the highest level of protection for the buyer. A warranty deed guarantees the grantor holds clear title to the property and offers a warranty against any defects. In contrast, a Delaware Quitclaim Deed from Corporation to Husband and Wife provides no such guarantees, making it crucial to understand the differences before transferring property.

One problem with a quitclaim deed is that it does not guarantee that the grantor has clear ownership of the property, which can lead to disputes. Additionally, a quitclaim deed does not protect against any liens or debts associated with the property. Therefore, when using a Delaware Quitclaim Deed from Corporation to Husband and Wife, it's wise to conduct due diligence to ensure clear title before proceeding.

To file a quitclaim deed in Delaware, you must complete the deed form and ensure it is signed by the grantor. Then, record the completed form with the appropriate county recorder’s office. Using a Delaware Quitclaim Deed from Corporation to Husband and Wife can simplify this process, as our platform provides templates and guidance to assist you in filing accurately and efficiently.

Quitclaim deeds are most often used for transferring ownership of property between family members, especially in situations like divorce, marriage, or when adding a spouse to the title. They are also suitable for transferring property into a trust or from a business entity, like a corporation, to personal ownership. This is especially useful when filing a Delaware Quitclaim Deed from Corporation to Husband and Wife.