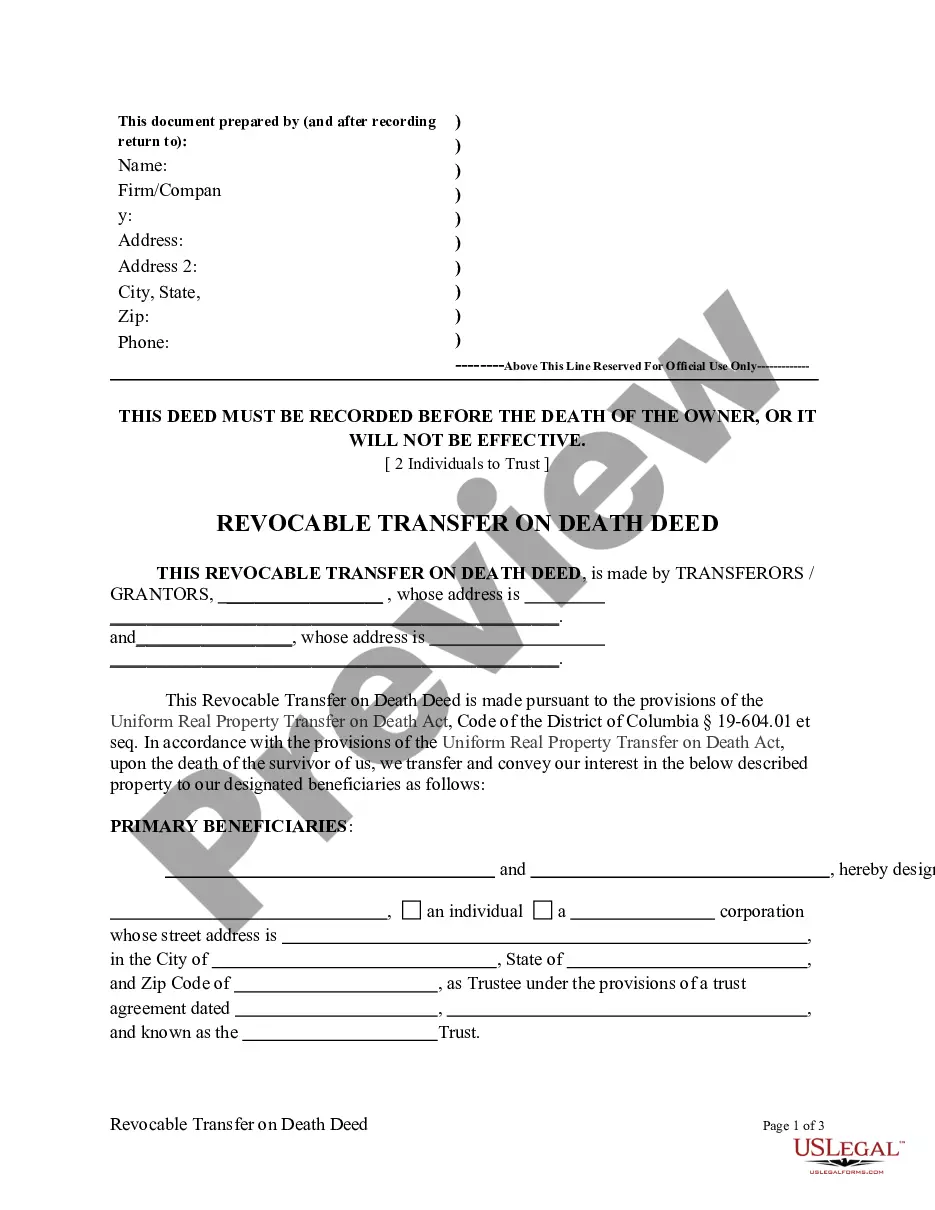

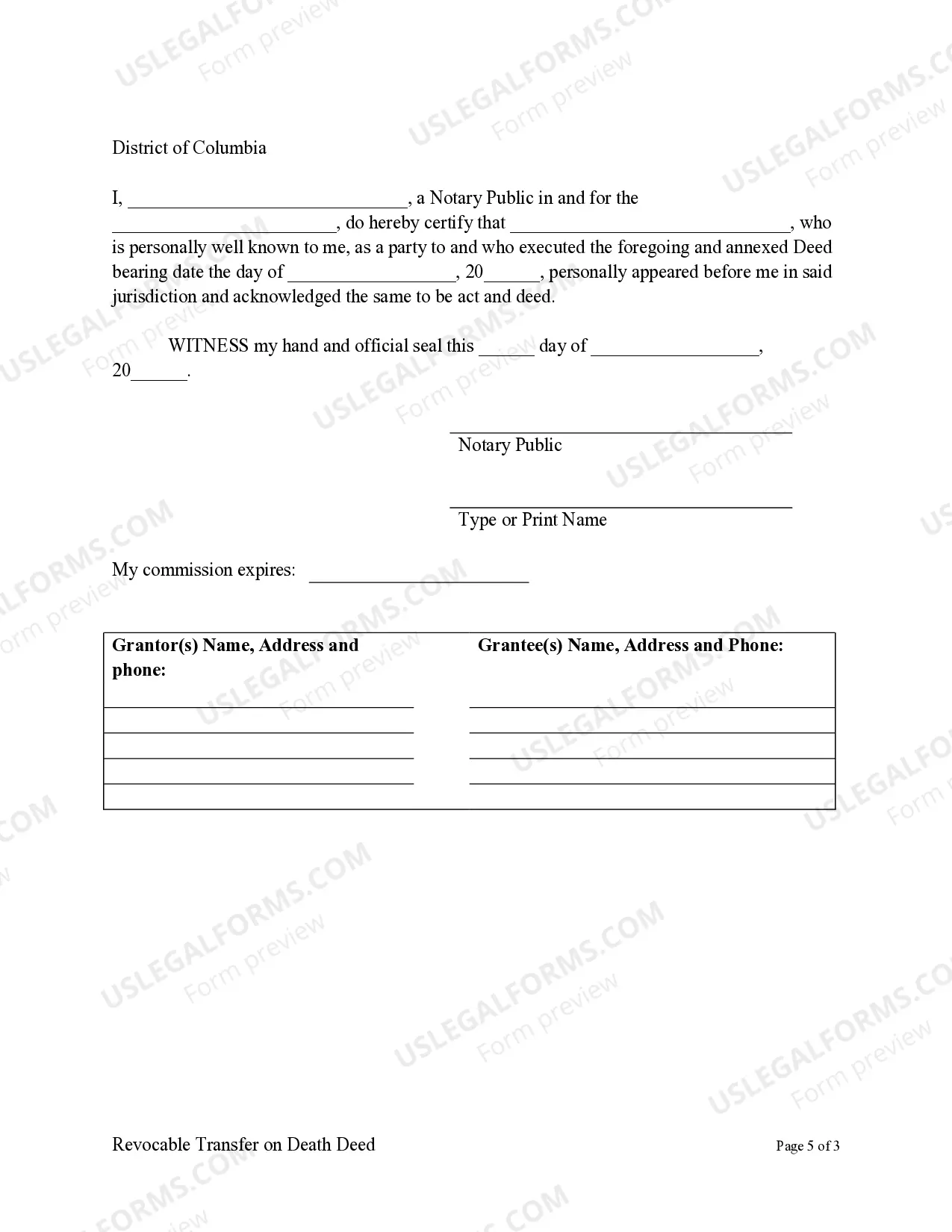

District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individual to a Trust

Description

How to fill out District Of Columbia Transfer On Death Deed Or TOD - Beneficiary Deed For Two Individual To A Trust?

Utilize US Legal Forms to secure a printable District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust.

Our court-accepted forms are crafted and frequently refreshed by experienced attorneys.

Ours is the most comprehensive library of forms online, offering reasonably priced and precise templates for clients, legal professionals, and small-to-medium businesses.

Click Buy Now if it is the document you need. Set up your account and pay through PayPal or credit card. Retrieve the template to your device and feel free to reuse it multiple times. Use the Search feature if you're looking for an alternative document template. US Legal Forms provides thousands of legal and tax templates and packages for business and personal requirements, including the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust. Over three million users have successfully employed our service. Choose your subscription plan and acquire high-quality forms in just a few clicks.

- The documents are categorized based on state, and many can be previewed before download.

- To access templates, users must possess a subscription and Log In to their account.

- Click Download beside any template you wish to obtain and locate it in My documents.

- For users without a subscription, adhere to these steps to promptly find and download the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust.

- Ensure you have the correct form related to the state required.

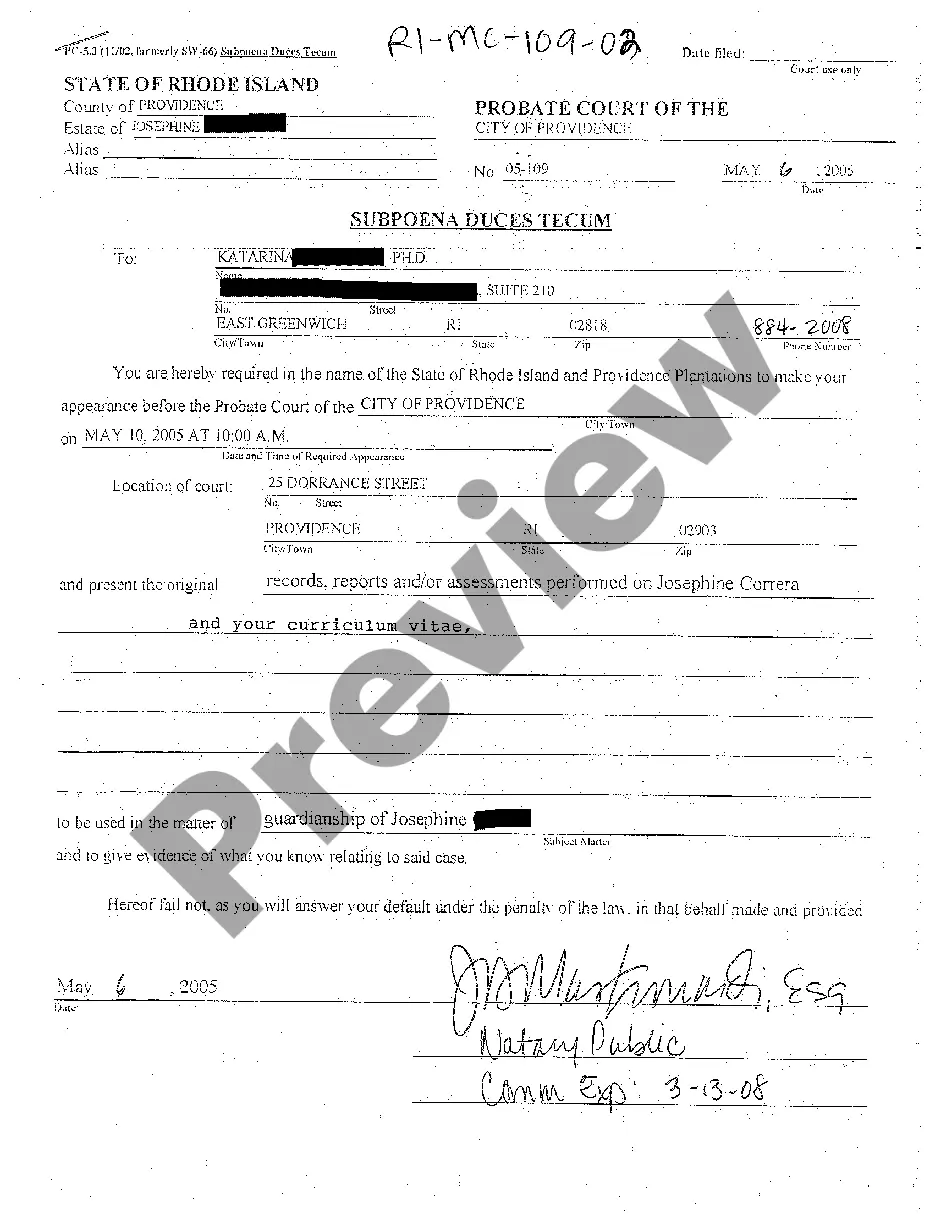

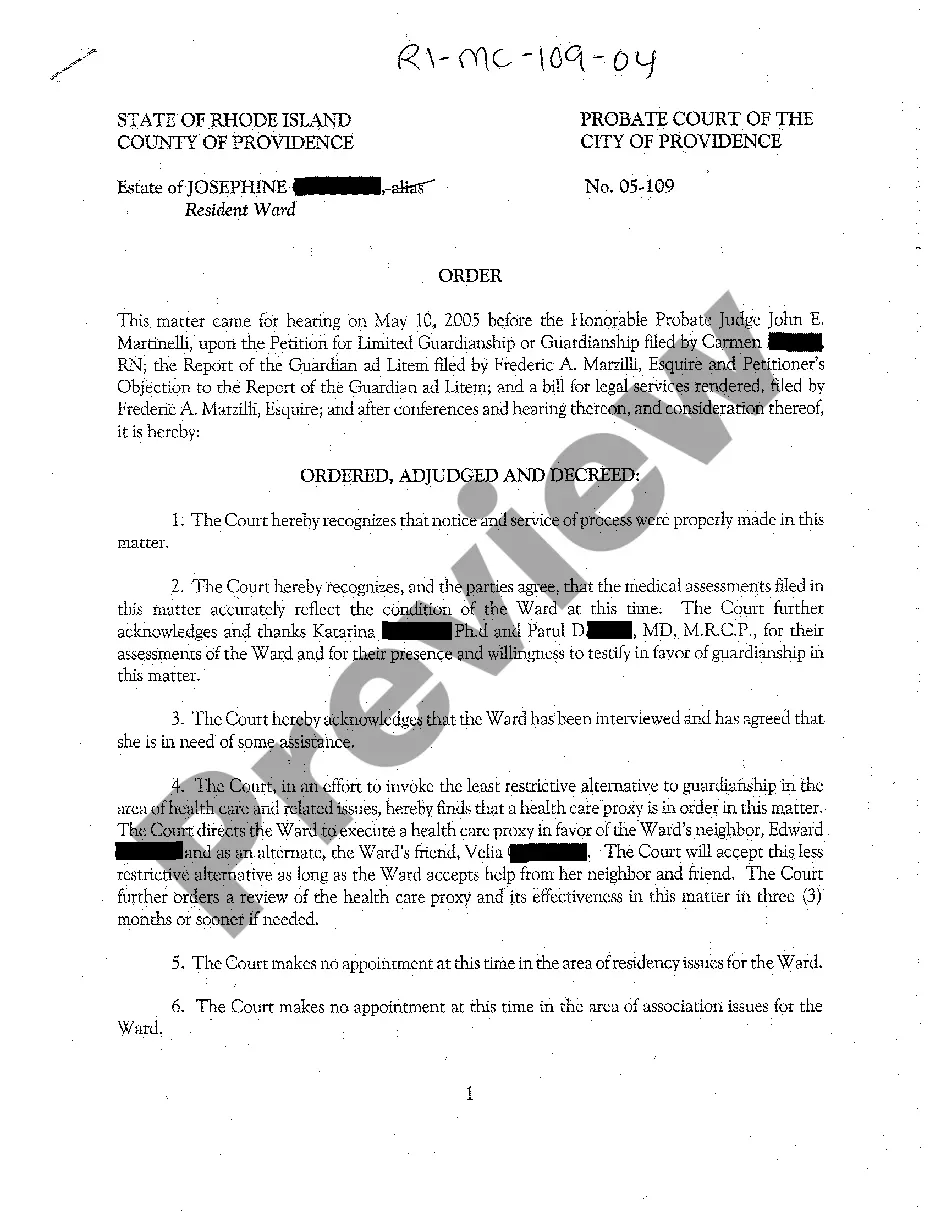

- Examine the form by reviewing the description and utilizing the Preview function.

Form popularity

FAQ

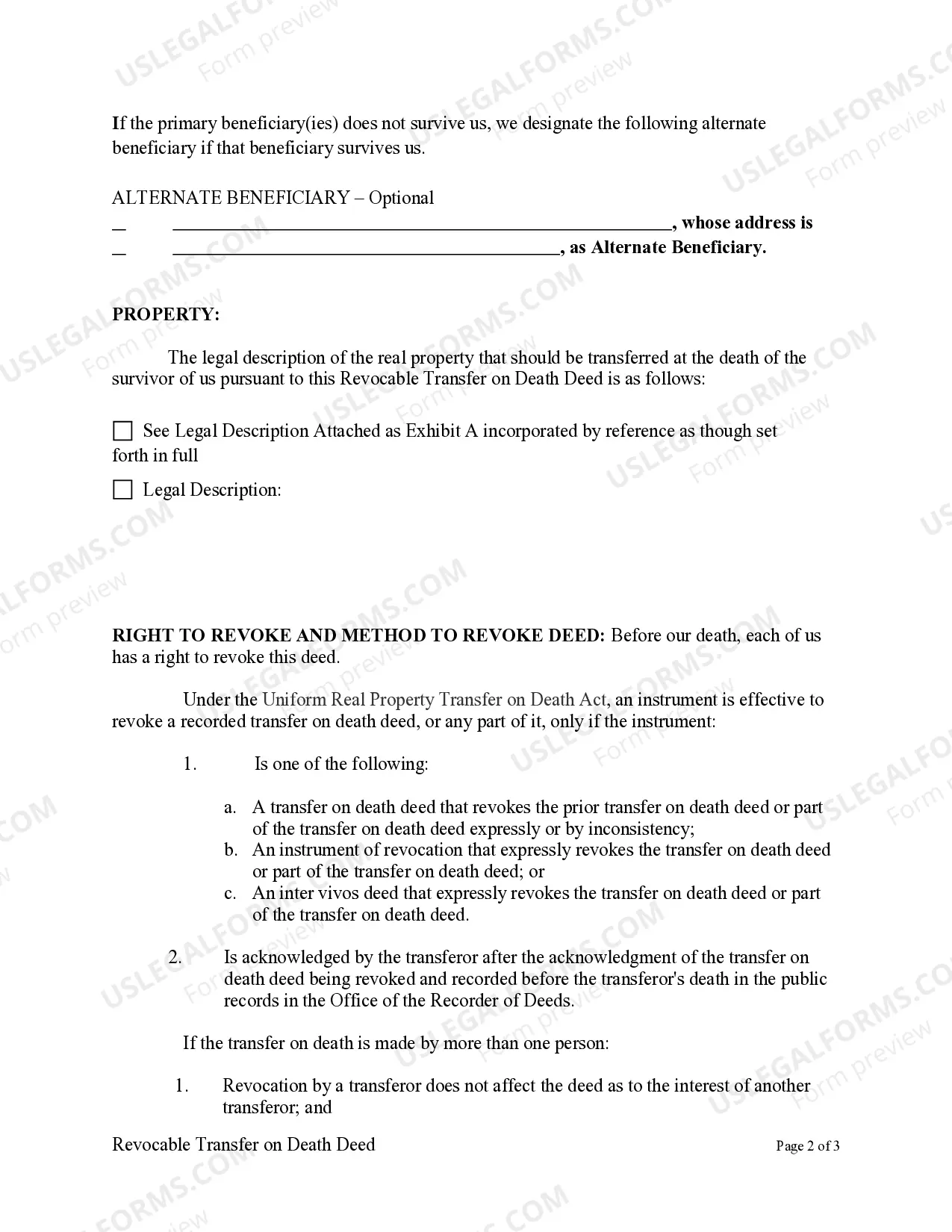

To transfer a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust to two beneficiaries, you need to clearly list both names on the deed. Ensure that both beneficiaries understand their rights and responsibilities regarding the property. It’s also beneficial to consult a legal platform like uslegalforms to ensure the deed is correctly drafted and compliant with state laws.

Yes, you can name two beneficiaries on a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust. This allows both beneficiaries to inherit the property upon your passing, providing a straightforward transfer without going through probate. Naming multiple beneficiaries can help ensure that your assets are distributed according to your wishes, offering peace of mind.

While you can complete a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust without an attorney, it is wise to consult one. An attorney can help ensure that the deed meets all legal requirements and effectively addresses your wishes. Even though it's possible to handle it yourself, expert guidance can save you time and prevent potential legal issues in the future.

The main disadvantage of the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust is that it can complicate matters if you have multiple beneficiaries. In some cases, the deed may not override existing legal obligations such as debt or other claims against the property. Additionally, if ownership needs to be changed because of unforeseen circumstances, a TOD may not provide the flexibility you need.

Choosing between a TOD and a beneficiary designation depends on your specific circumstances. The District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individual to a Trust is often preferred for real estate, as it allows for direct transfer and avoids probate. In contrast, for financial accounts, a beneficiary designation may be more appropriate since it directly applies to those types of assets and can offer additional benefits for your heirs.

TOD accounts can be a good idea for many individuals, as they streamline the transfer process of assets upon death. They eliminate the need for probate, enabling beneficiaries to access assets more quickly. However, it is important to consider your overall estate plan and whether a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individual to a Trust fits within your specific needs and goals.

The main difference lies in their function within estate planning. A District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individual to a Trust allows for direct transfer of property upon death, while a beneficiary designation typically applies to accounts or policies like life insurance. Essentially, TODs are specific to real estate, providing a seamless way to transfer ownership to named beneficiaries.

One disadvantage of the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individual to a Trust is that it may not address all estate planning needs. For example, it does not provide protections against creditors or taxes that might arise after death. Additionally, a TOD may create complications if there are disputes among beneficiaries, which can lead to legal challenges.

Filling out a Transfer on Death designation affidavit involves several critical steps. First, you need to accurately identify the property and the beneficiaries in the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust. USLegalForms offers easy-to-understand templates and instructions that simplify this process, ensuring you complete the affidavit correctly and efficiently.

While it is not mandatory to have an attorney for a Transfer on Death deed, consulting a legal expert ensures that you comply with all regulations. This is particularly important for the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust, as every jurisdiction may have unique requirements. USLegalForms provides guidance and templates that can aid you if you choose to manage the process independently.