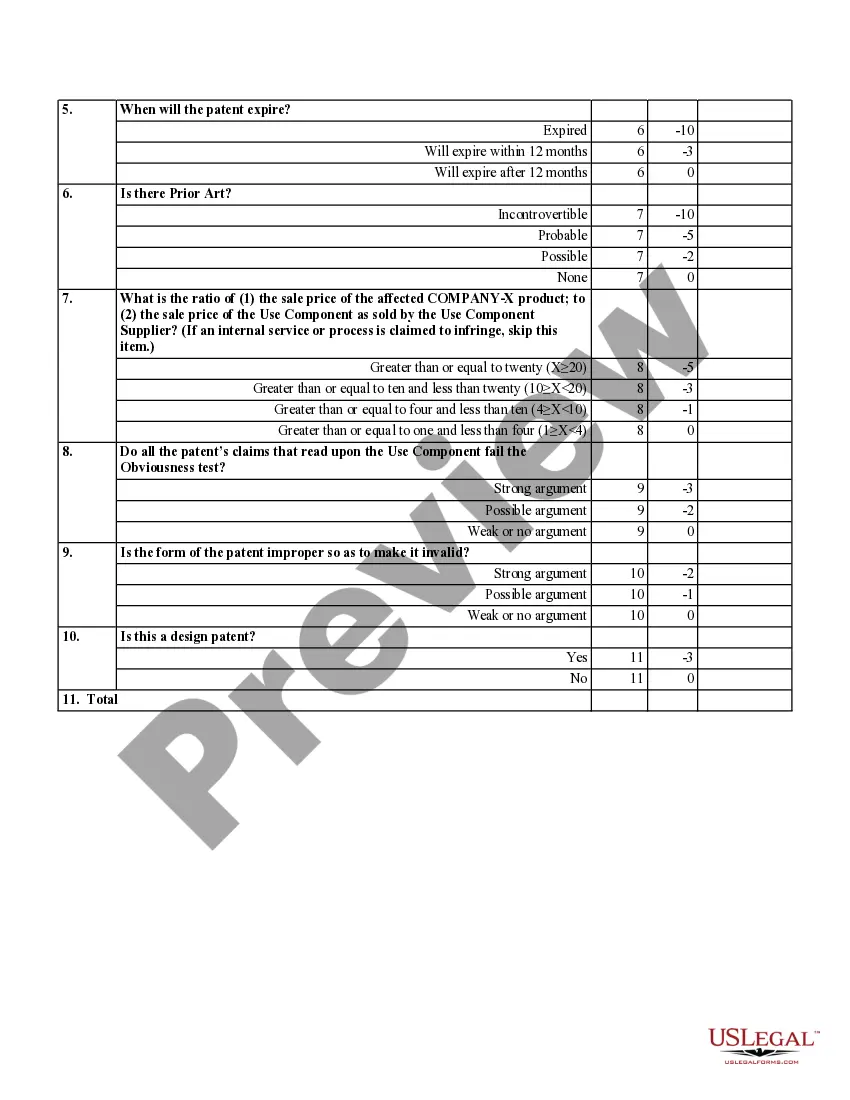

This is a patent use analysis worksheet for determining the overall likelihood of a royalty owing on a patent.

District of Columbia Patent Use Analysis Worksheet

Description

How to fill out Patent Use Analysis Worksheet?

If you wish to full, acquire, or printing authorized papers templates, use US Legal Forms, the biggest variety of authorized forms, that can be found on the web. Utilize the site`s simple and practical research to find the files you will need. A variety of templates for company and person purposes are sorted by classes and claims, or keywords. Use US Legal Forms to find the District of Columbia Patent Use Analysis Worksheet in a handful of click throughs.

Should you be already a US Legal Forms client, log in in your bank account and then click the Acquire button to find the District of Columbia Patent Use Analysis Worksheet. You may also gain access to forms you in the past downloaded in the My Forms tab of your bank account.

Should you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Ensure you have selected the shape for that proper metropolis/land.

- Step 2. Make use of the Review choice to look over the form`s articles. Do not forget to read the description.

- Step 3. Should you be not happy using the kind, take advantage of the Research discipline towards the top of the display to find other types from the authorized kind template.

- Step 4. Once you have located the shape you will need, click the Get now button. Opt for the costs plan you prefer and add your qualifications to sign up on an bank account.

- Step 5. Method the financial transaction. You can utilize your Мisa or Ьastercard or PayPal bank account to finish the financial transaction.

- Step 6. Select the format from the authorized kind and acquire it on your system.

- Step 7. Total, revise and printing or indicator the District of Columbia Patent Use Analysis Worksheet.

Every single authorized papers template you buy is yours forever. You may have acces to each and every kind you downloaded within your acccount. Go through the My Forms area and select a kind to printing or acquire once more.

Compete and acquire, and printing the District of Columbia Patent Use Analysis Worksheet with US Legal Forms. There are millions of specialist and status-specific forms you can utilize for the company or person requires.

Form popularity

FAQ

Direct any ruling questions to OTR, General Counsel at (202) 442-6500. Special rules on depreciation and business expenses For federal tax purposes, businesses may deduct bonus depre- ciation and additional IRC §179 expenses. DC does not allow the bonus depreciation deduction nor any additional IRC §179 expenses.

Generally, every corporation or financial institution must file a Form D-20 (including small businesses, professional corporations, and S corporations) if it is carrying on or engaging in any trade, business, or commercial activity in the District of Columbia (DC) or receiving income from DC sources.

DC participates in the Modernized e-File program for Corporation (D-20 family), Unincorporated Business Franchise (D-30 family with an EIN only) tax returns and Partnership Return of Income (D-65).

Maryland has legislatively decoupled from federal bonus depreciation, except when it is taken by a manufacturer, by decoupling from IRC § 167(a) and (k) 13.

Generally, an unincorporated business, with gross income (Line 11) more than $12,000 from District sources, must file a D-30 (whether or not it has net income). This includes any business carrying on and/or engaging in any trade, business, or commercial activity in DC with income from DC sources.

The filing of the D 30 is a requirement for operating or continuing to operate a motor vehicle for hire in the District by a non resident. The minimum tax is $250 if DC gross receipts are $1M or less. Minimum tax is $1,000 if DC gross receipts are greater than $1M.

The District of Columbia does not conform to the Tax Cuts and Jobs Act provision that provides a 100% first-year deduction for the adjusted basis for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023. The District does not allow a deduction for bonus depreciation.

State conformity with federal bonus depreciation rules lookup tool Alabama. Alaska. Arizona. Arkansas. California. Colorado. Connecticut. Delaware. ... Kentucky. Louisiana. Maine. Maryland. Massachusetts. Michigan. Minnesota. Mississippi. ... North Dakota. Ohio. Oklahoma. Oregon. Pennsylvania. Rhode Island. South Carolina. South Dakota.