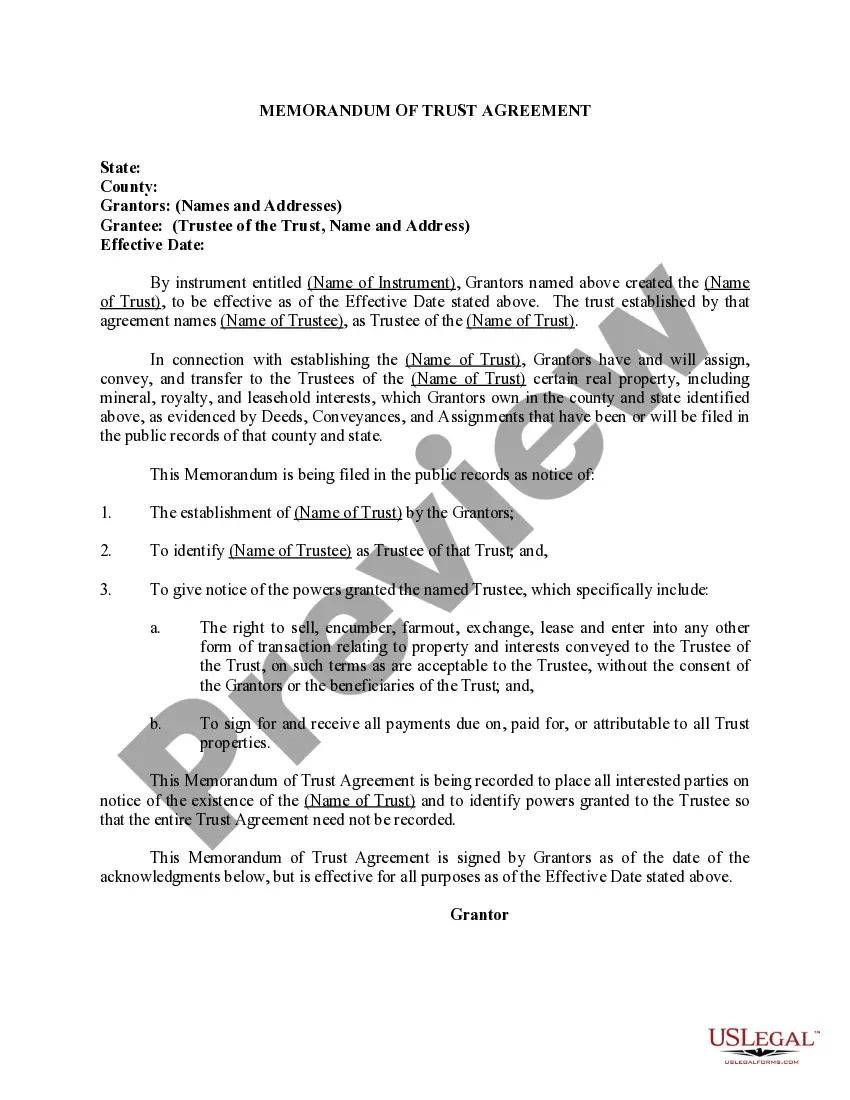

District of Columbia Memorandum of Trust Agreement

Description

How to fill out Memorandum Of Trust Agreement?

Discovering the right lawful document design can be a have a problem. Obviously, there are a variety of templates available on the Internet, but how would you get the lawful develop you need? Take advantage of the US Legal Forms site. The service gives thousands of templates, such as the District of Columbia Memorandum of Trust Agreement, which can be used for organization and private requires. All of the varieties are inspected by professionals and satisfy federal and state needs.

Should you be previously authorized, log in to the profile and then click the Acquire switch to obtain the District of Columbia Memorandum of Trust Agreement. Make use of profile to appear from the lawful varieties you have purchased formerly. Visit the My Forms tab of your profile and acquire yet another copy of your document you need.

Should you be a fresh user of US Legal Forms, listed below are basic directions so that you can stick to:

- Initially, ensure you have selected the proper develop to your metropolis/state. You can look through the form while using Review switch and read the form outline to make sure this is basically the right one for you.

- When the develop fails to satisfy your expectations, utilize the Seach discipline to get the appropriate develop.

- Once you are positive that the form would work, click the Buy now switch to obtain the develop.

- Choose the prices program you would like and enter in the needed info. Make your profile and pay money for an order with your PayPal profile or bank card.

- Select the data file file format and acquire the lawful document design to the system.

- Complete, edit and print out and indication the obtained District of Columbia Memorandum of Trust Agreement.

US Legal Forms is definitely the largest library of lawful varieties that you can find various document templates. Take advantage of the company to acquire professionally-produced papers that stick to express needs.

Form popularity

FAQ

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

District of Columbia Estate Tax With the adjustments, the 2023 exemption amount is expected to increase to $4,528,800 per person, up from $4,254,800 per person in 2022. Unlike the federal exemption, there is no provision for portability of the DC estate tax exemption between spouses.

Inheritances aren't considered income for federal tax purposes, but subsequent earnings on the inherited assets, including interest income and dividends, are taxable (unless it comes from a tax-free source).

A Security Affidavit is required on all Residential Deeds of Trust and Modifications. All Judgments, Orders, etc. must be certified by the DC Superior Court. All notarized documents must include the notary seal (if applicable), signature, name and expiration date.

The District of Columbia moved in the opposite direction, lowering its estate tax exemption from $5.8 million to $4 million in 2021, but simultaneously dropping its bottom rate from 12 to 11.2 percent. An inflation adjustment then brought the exemption to $4.53 million for 2023.

Inheritance tax is a tax on the right to receive assets at a person's death. DC repealed its inheritance tax so it is no longer an issue for DC residents. However, it can be an issue if DC residents own real estate in other jurisdictions that have inheritance tax such as Maryland.

If you're a resident of the District of Columbia and leave behind more than $4.2 million (for deaths occurring in 2022), your estate may have to pay D.C. estate tax. The D.C. tax is different from the federal estate tax, which is imposed on estates worth more than $12.92 million (for deaths in 2023).

DC's estate tax exemption was reduced to $4 million per person in 2021 and was set to be adjusted annually for cost of living adjustments starting in 2022. With the adjustments, the 2023 exemption amount is expected to increase to $4,528,800 per person, up from $4,254,800 per person in 2022.