District of Columbia Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status, take Investor statements regarding information, and waiver of claims."

How to fill out Accredited Investor Qualification And Verification Requirements For Reg D, Rule 506(c) Offerings?

You are able to devote time online trying to find the legal papers format that suits the state and federal requirements you want. US Legal Forms gives thousands of legal kinds which can be reviewed by specialists. You can actually download or produce the District of Columbia Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings from our service.

If you already have a US Legal Forms account, you are able to log in and click the Obtain button. Afterward, you are able to complete, modify, produce, or sign the District of Columbia Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings. Every legal papers format you purchase is your own forever. To have yet another version for any purchased form, visit the My Forms tab and click the corresponding button.

If you work with the US Legal Forms website the very first time, adhere to the easy directions below:

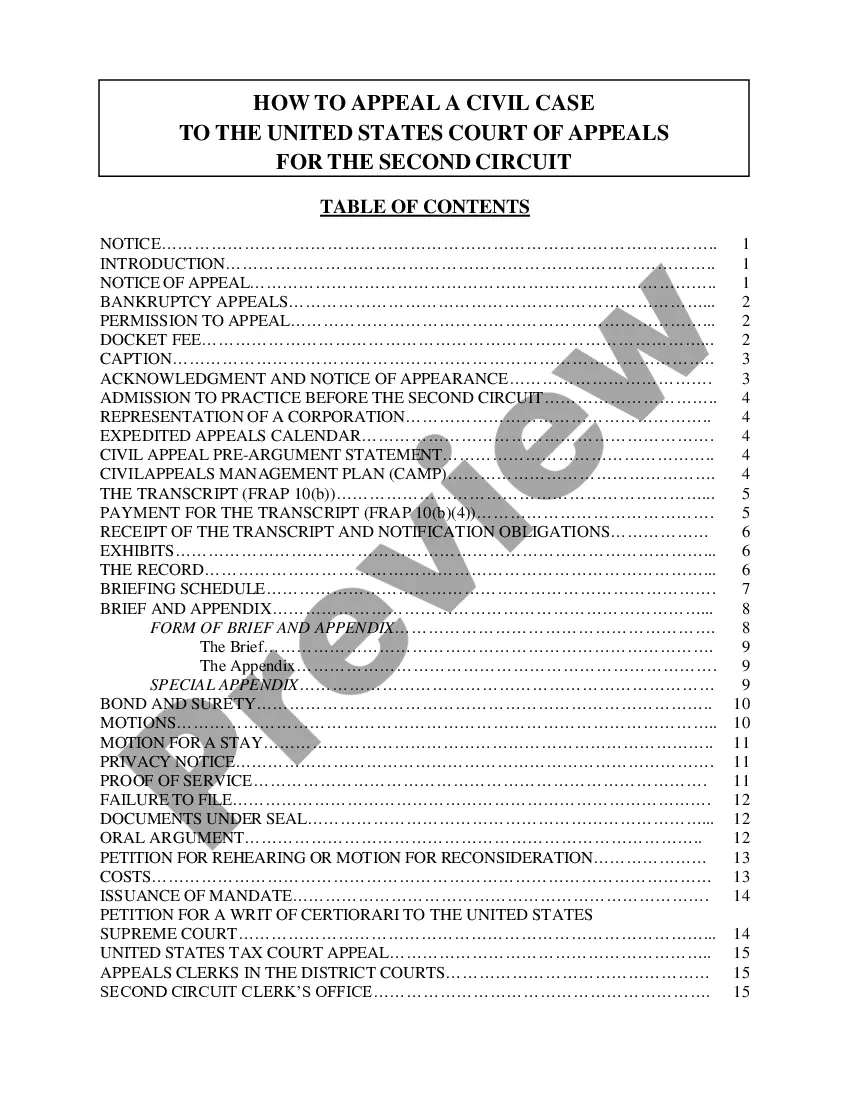

- Initially, ensure that you have selected the proper papers format for that area/town of your liking. Read the form outline to ensure you have chosen the correct form. If readily available, utilize the Preview button to search throughout the papers format as well.

- If you want to find yet another variation in the form, utilize the Research field to find the format that meets your requirements and requirements.

- When you have found the format you would like, simply click Purchase now to proceed.

- Select the costs program you would like, key in your references, and sign up for your account on US Legal Forms.

- Complete the deal. You should use your bank card or PayPal account to cover the legal form.

- Select the format in the papers and download it in your system.

- Make modifications in your papers if necessary. You are able to complete, modify and sign and produce District of Columbia Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings.

Obtain and produce thousands of papers templates utilizing the US Legal Forms Internet site, that provides the largest variety of legal kinds. Use expert and state-particular templates to deal with your company or personal requirements.

Form popularity

FAQ

A letter to be delivered by a registered broker-dealer, registered investment adviser, licensed attorney, or certified public accountant to assist the issuer in a Rule 506(c) offering in taking the necessary "reasonable steps" to verify the accredited investor status of a prospective purchaser.

Reviewing bank statements, brokerage statements, and other similar reports to determine net worth. Obtaining written confirmation of the investor's accredited investor status from one of the following persons: a registered broker-dealer, an investment adviser registered with the SEC, a licensed attorney, or a CPA.

Accredited Individual Investor ? By Income IR8A/income tax form declaring personal income not less than S$300,000 (or an equivalent document) A copy of employment letter/contract stating position and income, salary payslip, and bank statement recording such income. How do I verify my investor status? - Alta Knowledge Centre alta.exchange ? articles ? 4556508-how-do-i-... alta.exchange ? articles ? 4556508-how-do-i-...

In the case of a successful verification, you'll get an attorney's letter certifying that you have been verified as an accredited investor pursuant to standards required by federal laws. How to Verify Yourself (Accredited Investor) Verify Investor ? how-to-order-self-in... Verify Investor ? how-to-order-self-in...

Rule 506(c) permits issuers to broadly solicit and generally advertise an offering, provided that: all purchasers in the offering are accredited investors. the issuer takes reasonable steps to verify purchasers' accredited investor status and. certain other conditions in Regulation D are satisfied.

Other types of accredited investors The following can also qualify as accredited investors: Financial institutions. A corporation or LLC, not formed for the specific purpose of acquiring the securities offered, with total assets in excess of $5M. Knowledgeable employees of private funds. The Essential Guide to Becoming an Accredited Investor - Yieldstreet yieldstreet.com ? resources ? article ? how-t... yieldstreet.com ? resources ? article ? how-t...

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

VerifyInvestor.com is the leading resource for verification of accredited investors as required by federal laws. Verify Investor: Verify Accredited Investors | Investor Accreditation ... verifyinvestor.com verifyinvestor.com