District of Columbia Series Seed Preferred Stock Purchase Agreement

Description

Preferred stock pays fixed dividends and has also the potential to appreciate in price. That is to say, it combines features of debt and equity.

Preferred stock usually yields more than common stock, and it can be paid every month or every quarter. The dividends are fixed or set according to a benchmark interest rate. The dividend yield is influenced by adjustable-rate shares, and participating shares are able to pay more dividends that calculated by common stock dividends or business profits.

This is a template for agreeing on preferred stock purchases for your company to use when working with investors."

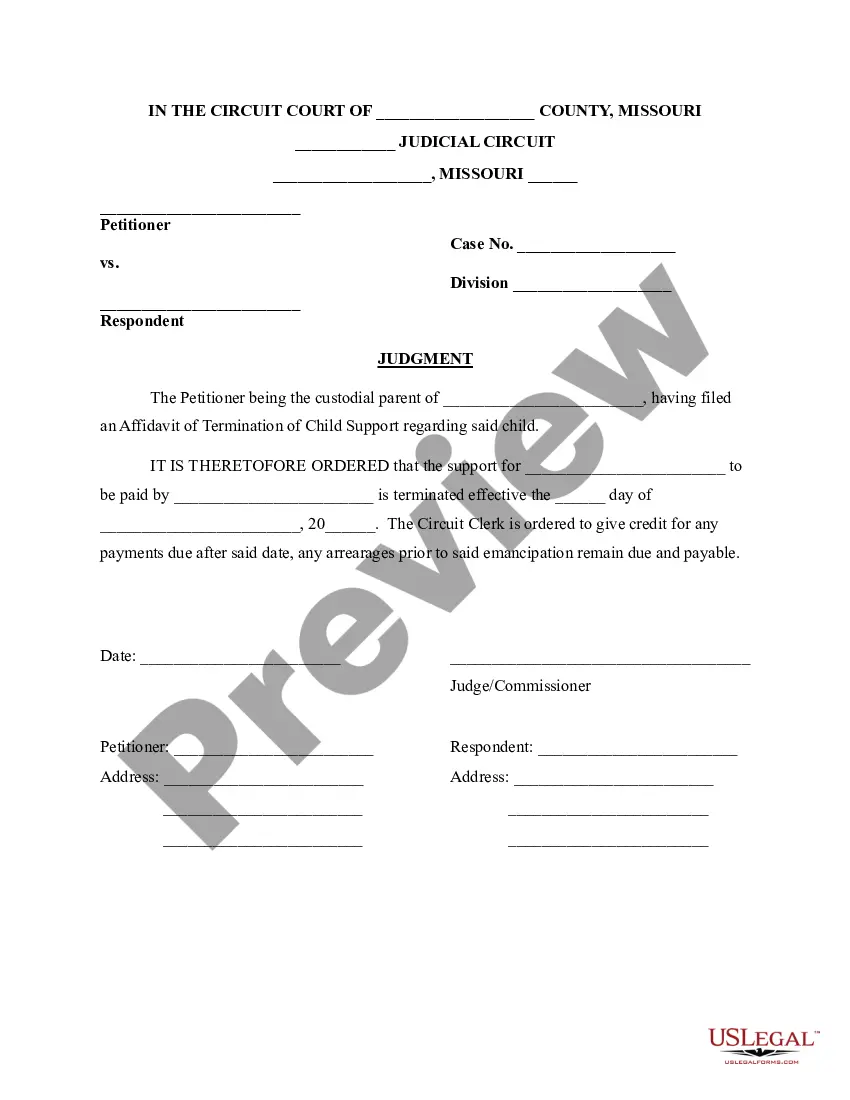

How to fill out Series Seed Preferred Stock Purchase Agreement?

If you have to total, download, or produce lawful document layouts, use US Legal Forms, the largest assortment of lawful varieties, that can be found on-line. Use the site`s simple and practical research to find the files you require. Different layouts for company and person functions are categorized by categories and suggests, or keywords. Use US Legal Forms to find the District of Columbia Series Seed Preferred Stock Purchase Agreement within a number of mouse clicks.

When you are presently a US Legal Forms consumer, log in to your bank account and then click the Down load switch to get the District of Columbia Series Seed Preferred Stock Purchase Agreement. Also you can access varieties you earlier delivered electronically from the My Forms tab of your bank account.

If you work with US Legal Forms initially, refer to the instructions under:

- Step 1. Be sure you have selected the form for your correct area/region.

- Step 2. Use the Review method to look over the form`s content material. Never overlook to read through the description.

- Step 3. When you are not satisfied with all the type, use the Research industry near the top of the monitor to find other variations in the lawful type web template.

- Step 4. After you have identified the form you require, click on the Purchase now switch. Choose the costs strategy you prefer and add your accreditations to register on an bank account.

- Step 5. Procedure the financial transaction. You should use your credit card or PayPal bank account to accomplish the financial transaction.

- Step 6. Pick the file format in the lawful type and download it on the system.

- Step 7. Comprehensive, revise and produce or indication the District of Columbia Series Seed Preferred Stock Purchase Agreement.

Each and every lawful document web template you purchase is the one you have permanently. You have acces to each type you delivered electronically inside your acccount. Go through the My Forms portion and pick a type to produce or download once again.

Remain competitive and download, and produce the District of Columbia Series Seed Preferred Stock Purchase Agreement with US Legal Forms. There are millions of specialist and condition-certain varieties you can utilize for your company or person requires.

Form popularity

FAQ

Series A funding comes after there is already a product and obvious traction. Seed funding is usually the first round of funding and raises a small amount of capital. In series A, the startup receives more capital to support future growth.

The first round of stock offered during the seed or early stage round by a portfolio company to the venture investor or fund. This stock is convertible into common stock in certain cases such as an IPO or the sale of the company.

The first round of stock made available to the public by a startup is referred to as Series A preferred stock. This type of stock is generally offered for purchase during the seed stage of a new startup and can be converted into common stock in the event of an initial public offering or sale of the company.

Series Seed Preferred Stock is a type of preferred stock issued by startups during their early stage of development. Preferred stock is a hybrid security that combines elements of both debt and equity.

These fundraising rounds allow investors to invest money into a growing company in exchange for equity/ownership. The initial investment?also known as seed funding?is followed by various rounds, known as Series A, B, and C. A new valuation is done at the time of each funding round.