District of Columbia Dividend Equivalent Shares

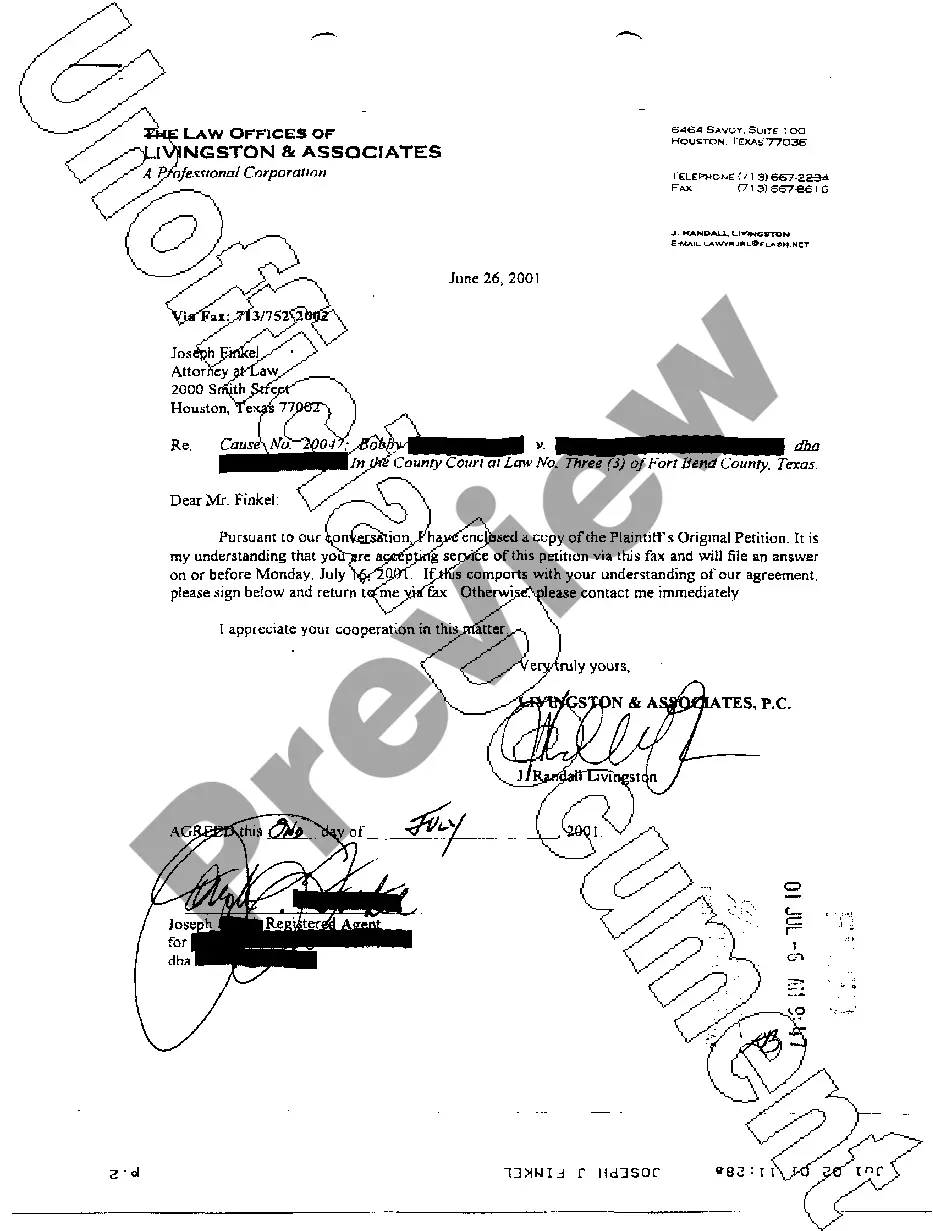

Description

How to fill out Dividend Equivalent Shares?

Have you been inside a position in which you need to have paperwork for either business or personal reasons just about every day? There are a variety of legitimate file themes available on the net, but getting types you can rely is not easy. US Legal Forms gives 1000s of type themes, much like the District of Columbia Dividend Equivalent Shares, that happen to be created to satisfy state and federal requirements.

In case you are currently knowledgeable about US Legal Forms web site and get an account, basically log in. After that, it is possible to acquire the District of Columbia Dividend Equivalent Shares web template.

If you do not have an account and want to begin using US Legal Forms, abide by these steps:

- Obtain the type you want and make sure it is for your right area/region.

- Use the Preview button to check the shape.

- See the description to actually have chosen the right type.

- In case the type is not what you are seeking, make use of the Look for area to obtain the type that fits your needs and requirements.

- Whenever you find the right type, just click Acquire now.

- Choose the costs strategy you need, complete the specified details to create your money, and purchase your order with your PayPal or charge card.

- Choose a handy paper structure and acquire your copy.

Locate all of the file themes you have bought in the My Forms menus. You can get a additional copy of District of Columbia Dividend Equivalent Shares at any time, if needed. Just select the required type to acquire or produce the file web template.

Use US Legal Forms, probably the most extensive assortment of legitimate types, to conserve time and avoid blunders. The service gives professionally made legitimate file themes that can be used for a selection of reasons. Make an account on US Legal Forms and begin making your lifestyle a little easier.

Form popularity

FAQ

Generally, taxpayers should file with the jurisdiction in which they live. If you live in Maryland, file with Maryland. If you live in Washington, D.C., Pennsylvania, Virginia or West Virginia, you should file with your home state.

States that have reciprocity with Virginia are: District of Columbia. Kentucky. Maryland. Pennsylvania.

(1) All business income shall be apportioned to the District by multiplying the income by a fraction, the numerator of which is the property factor plus the payroll factor plus the sales factor twice, and the denominator of which is 4.

Washington, D.C. has state tax reciprocity agreements with Maryland and Virginia.

Dividends from federal government obligations may be excluded from gross income for purposes of computing District of Columbia taxable income. (See ¶10-510 Starting Point for Computation.) The District also allows a subtraction from gross income for certain other dividend income.

The highest rate applies to incomes over $250,000. Virginia: 2 to 5.75 percent. The highest rate applies to incomes over $17,001. DC: 4 to 10.75 percent.

Washington, D.C. has state tax reciprocity agreements with Maryland and Virginia.

Maryland has reciprocal agreements with Pennsylvania, Virginia, West Virginia and the District of Columbia. If your employer withheld tax for one of the reciprocal states, you can claim a refund from the reciprocal state.