District of Columbia Stock Option and Dividend Equivalent Plan with exhibits of UGI Corp.

Description

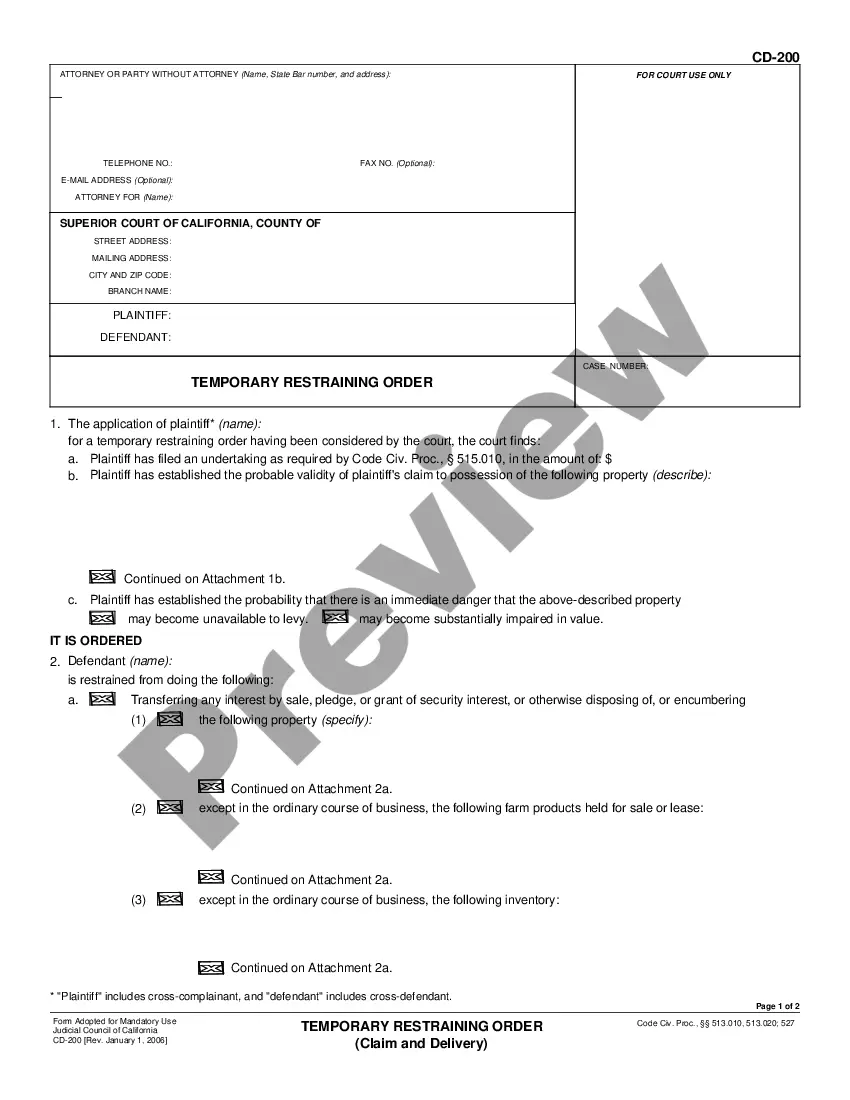

How to fill out Stock Option And Dividend Equivalent Plan With Exhibits Of UGI Corp.?

Have you been inside a placement that you need papers for either enterprise or specific reasons virtually every day? There are plenty of legal document templates accessible on the Internet, but getting types you can rely is not straightforward. US Legal Forms gives a huge number of form templates, such as the District of Columbia Stock Option and Dividend Equivalent Plan with exhibits of UGI Corp., which are published to meet state and federal needs.

When you are already acquainted with US Legal Forms internet site and also have an account, basically log in. Afterward, it is possible to obtain the District of Columbia Stock Option and Dividend Equivalent Plan with exhibits of UGI Corp. template.

Unless you come with an bank account and want to begin to use US Legal Forms, adopt these measures:

- Get the form you require and ensure it is for the right metropolis/county.

- Utilize the Preview key to review the shape.

- Look at the outline to ensure that you have selected the proper form.

- In case the form is not what you`re looking for, utilize the Search industry to obtain the form that meets your needs and needs.

- If you get the right form, click on Acquire now.

- Select the rates plan you want, submit the desired information to generate your bank account, and pay for an order using your PayPal or bank card.

- Choose a handy file formatting and obtain your version.

Locate every one of the document templates you possess bought in the My Forms menu. You may get a more version of District of Columbia Stock Option and Dividend Equivalent Plan with exhibits of UGI Corp. any time, if possible. Just go through the essential form to obtain or printing the document template.

Use US Legal Forms, the most extensive assortment of legal varieties, to save lots of time and stay away from mistakes. The support gives expertly manufactured legal document templates that can be used for a variety of reasons. Produce an account on US Legal Forms and begin creating your daily life a little easier.

Form popularity

FAQ

Does UGI Corp have sufficient earnings to cover their dividend? Yes, UGI's past year earnings per share was -$6.66, and their annual dividend per share is $1.47. UGI's dividend payout ratio is 52.13% ($1.47/-$6.66) which is sustainable.

Dividend payment history: UGI has a long history of paying dividends and has consistently increased its dividend payout for 36 consecutive years.

Credit ratings range from the highest credit quality on one end to default or "junk" on the other. A triple-A (AAA or AAa) is the highest credit quality, and C or D (depending on the agency issuing the rating) is the lowest or junk quality.

UGI was incorporated in 1882 as United Gas Improvement Co. In 1903, the company owned the majority of the stock of the Equitable Illuminating Gas Light Company, which operated the Philadelphia Gas Works. The company formed the United Electric Company of New Jersey in 1899.

01Ratings RatingActionTypeA-AffirmedLong Term Issuer Default Rating

Minimum Credit Rating means, with respect to a party, such party's senior unsecured debt is rated ?BBB+? or better by S&P, ?BBB+? or better by Fitch, or ?Baa1? or better by Moody's.

UGI has received a consensus rating of Reduce. The company's average rating score is 1.75, and is based on 1 buy rating, 1 hold rating, and 2 sell ratings.

B1/B+ are one of several non-investment grade credit ratings (also known as "junk") that may be assigned to a company, fixed-income security, or floating-rate loan (FRN). These ratings signify that the issuer is relatively risky, with a higher-than-average chance of default.