District of Columbia Notification of Layoff and Termination Compensation Plan Agreement

Description

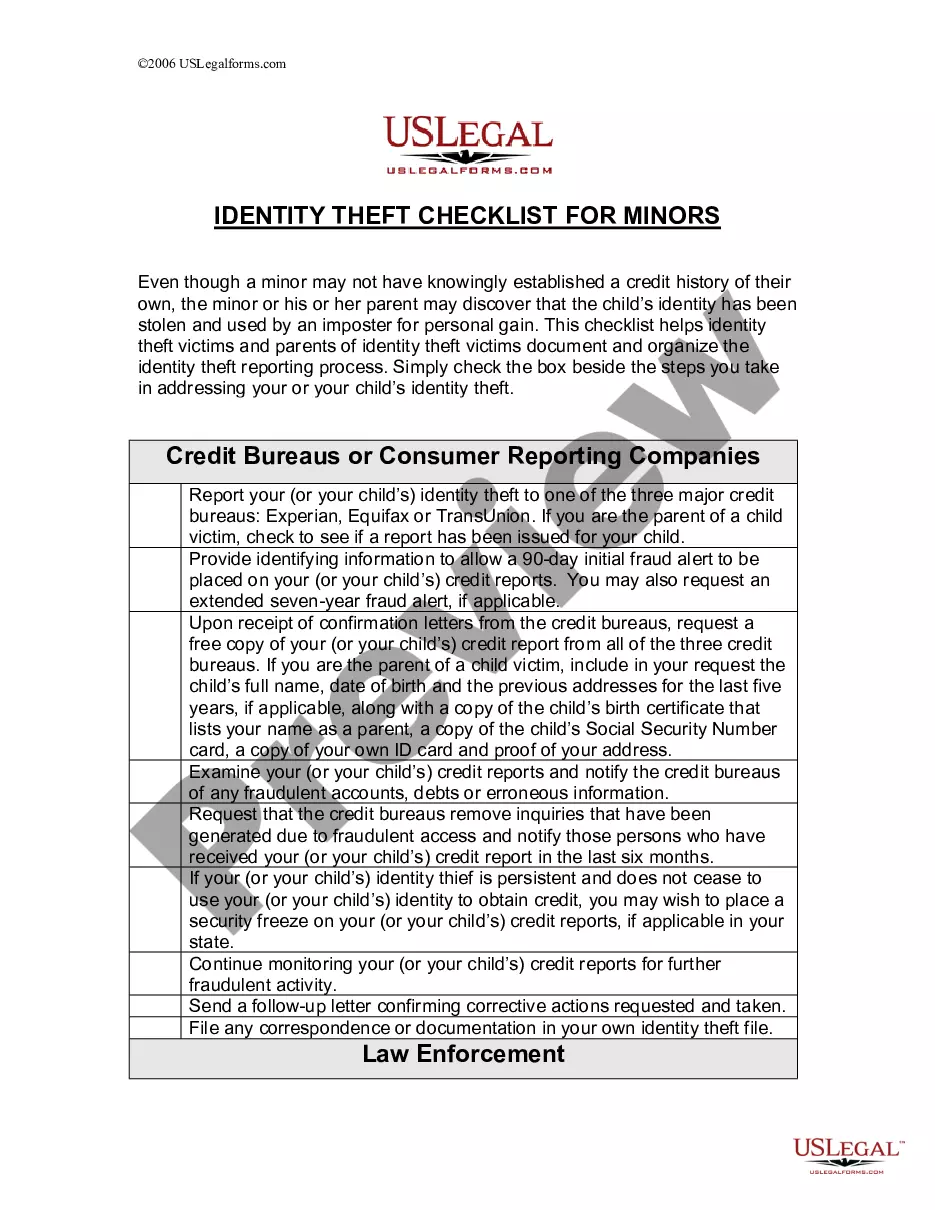

How to fill out Notification Of Layoff And Termination Compensation Plan Agreement?

It is feasible to spend hours online trying to locate the correct legal document format that meets the state and federal requirements you require.

US Legal Forms provides a vast array of legal templates that can be assessed by professionals.

It is easy to obtain or print the District of Columbia Notification of Layoff and Termination Compensation Plan Agreement from our service.

If available, utilize the Review option to review the document format as well.

- If you already possess a US Legal Forms account, you can sign in and select the Download option.

- Subsequently, you can complete, modify, print, or sign the District of Columbia Notification of Layoff and Termination Compensation Plan Agreement.

- Every legal document format you purchase belongs to you permanently.

- To obtain another copy of any acquired form, visit the My documents tab and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, verify that you have chosen the correct document format for the county/city of your choice.

- Review the form outline to ensure you have selected the appropriate form.

Form popularity

FAQ

You must be able and available to work, and you must be actively seeking employment. You must be unemployed through no fault of your own, as defined by D.C. law. You must have earned at least a minimum amount in wages before you were unemployed.

A mass layoff occurs under the WARN Act when: at least 50 employees are laid off during a 30-day period, if the laid-off employees made up at least one third of the workforce; 500 employees are laid off during a 30-day period, no matter how large the workforce; or.

Severance: Under the Retrenchment and Severance Benefits Act, a retrenched employee is entitled to a minimum severance payment of (i) two weeks' basic pay for each of their first four years of service and (ii) three weeks' basic pay for each additional year of service after that.

Severance pay a retrenched employee must at least be paid 1 week's pay for each completed year of ongoing service. However, the employer must pay the retrenched employee the amount specified in any policy or his/her employment contract, if that amount is larger.

You will be ineligible for benefits for the number of weeks of severance you received. If your employer pays you severance all at once in a "lump sum," you may or may not be entitled to unemployment benefits.

Severance pay is often granted to employees upon termination of employment. It is usually based on length of employment for which an employee is eligible upon termination. There is no requirement in the Fair Labor Standards Act (FLSA) for severance pay.

In D.C. and Maryland, the law requires employers to pay for unused PTO or vacation when the employee leaves. Failure to do so can result in enhanced damages. There is an exception to the law, however.

Severance Pay In accordance with the Payment of Gratuity Act 1972, a worker is entitled to a gratuity payment upon termination of his service after five years of continuous employment. Amount of severance pay is equal to 15 days' wages for each completed year of service.

District of Columbia labor laws do not have any laws requiring an employer to pay severance pay to an employee. If an employer chooses to provide severance benefits, it must comply with the terms of its established policy or employment contract.

If the severance pay at least equals the claimant's weekly benefit amount, the claimant is disqualified from receiving benefits until the severance pay is exhausted.