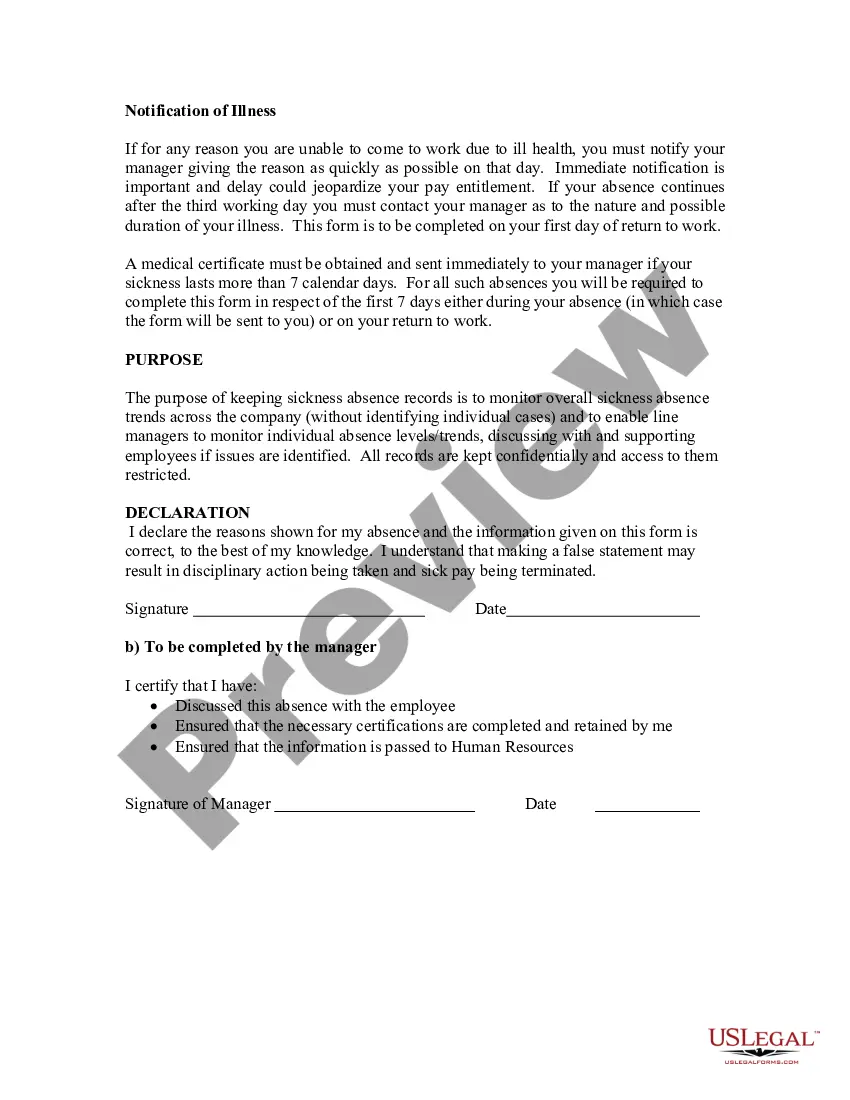

District of Columbia Record of Absence - Self-Certification Form

Description

How to fill out Record Of Absence - Self-Certification Form?

Selecting the appropriate legal document template can be quite a challenge.

Naturally, there are numerous templates accessible online, but how do you find the legal form you require.

Utilize the US Legal Forms website. The service offers a vast array of templates, such as the District of Columbia Absence Record - Self-Certification Form, which can be utilized for both business and personal purposes.

You can preview the form using the Preview button and read the form description to ensure it is the correct one for you.

- All of the forms are reviewed by professionals and comply with state and federal requirements.

- If you are already registered, Log Into your account and click the Download button to obtain the District of Columbia Absence Record - Self-Certification Form.

- Use your account to view the legal forms you have previously ordered.

- Navigate to the My documents tab of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your city/county.

Form popularity

FAQ

To be eligible for PFL benefits, you must: Be unable to do your regular or customary work. Have lost wages due to the need to provide care for a seriously ill family member, bond with a new child, or participate in a qualifying event resulting from a family member's military deployment to a foreign country.

Covered employers include all DC employers subject to DC Unemployment Insurance (UI) tax and self-employed individuals who choose to opt in to the program. In general, covered workers include all workers who (predominately) work in DC and no more than 50% in another jurisdiction.

How Much Can I Receive in Parental Leave Benefits? DC Paid Family Leave provides wage replacement of 90% of wages up to 1.5 times DC's minimum wage and 50% of wages above 1.5 times DC's minimum wage. The maximum weekly benefit amount is $1,000.

On July 1, 2020, the District of Columbia began administering paid leave benefits. DC workers can now apply for paid family leave. The Paid Leave Act provides up to: 2 weeks to care for your pregnancy.

If you are eligible for Paid Family Leave in the District of Columbia, you may receive a weekly benefit amount which is based on your weekly wages. The current maximum weekly benefit amount is $1,009.

We encourage you to use our benefits application portal to file a claim. If you are unable to apply online, please call our contact center at (202) 899-3700. Click to download our PFL Employee Handbook for additional information about qualifying events and the program.

You are eligible for Paid Family Leave benefits if you: Spend more than 50% of your time working in DC. Eligible workers must spend a majority of their time working the Districtincluding teleworking or telecommutingfor a covered employer, and must have completed that work during the year prior to needing leave.

The District of Columbia Family and Medical Leave Act (DCFMLA) requires employers with 20 or more employees to provide eligible employees with 16 weeks of unpaid family leave and 16 weeks of unpaid medical leave during a 24 month period. Employee Eligibility.

What you need to know about paid family leave and taxes: Benefits you receive under this program are taxable and included in your federal and District gross income. You will receive a Form 1099-G from the District reporting the payments you received during the year.