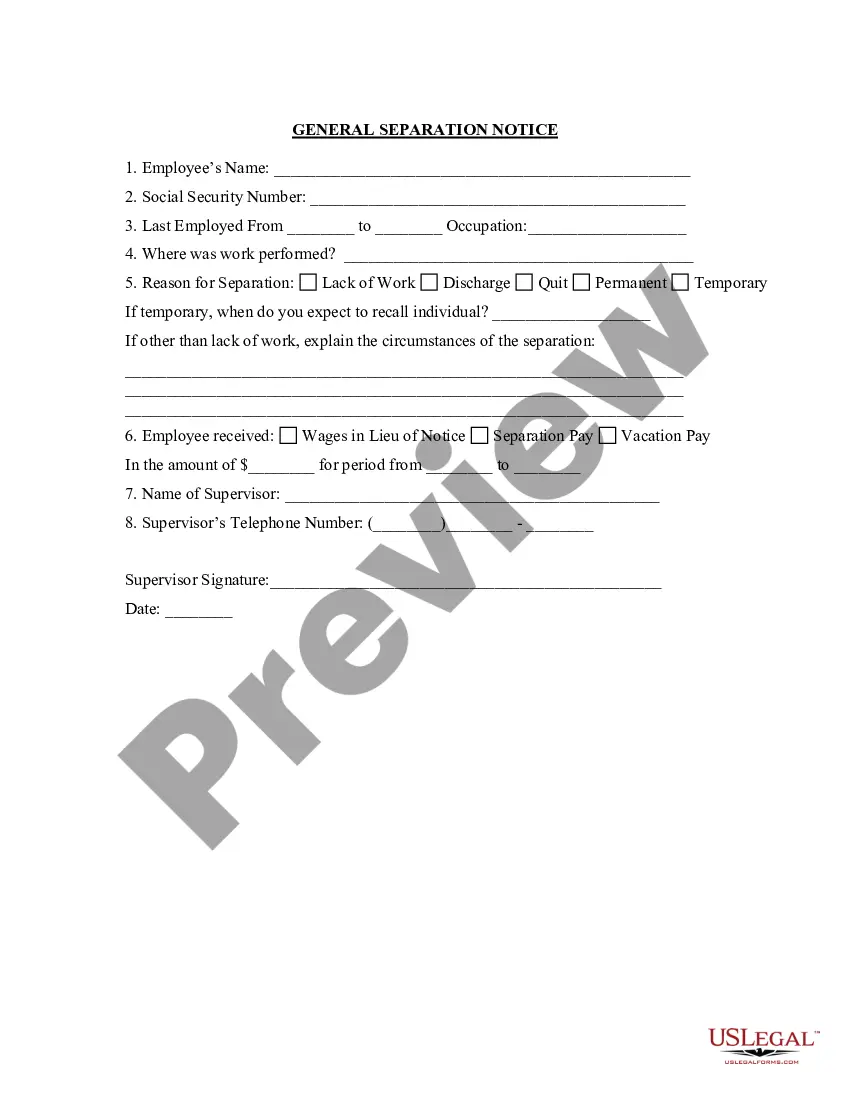

District of Columbia Separation Notice for Independent Contractor

Description

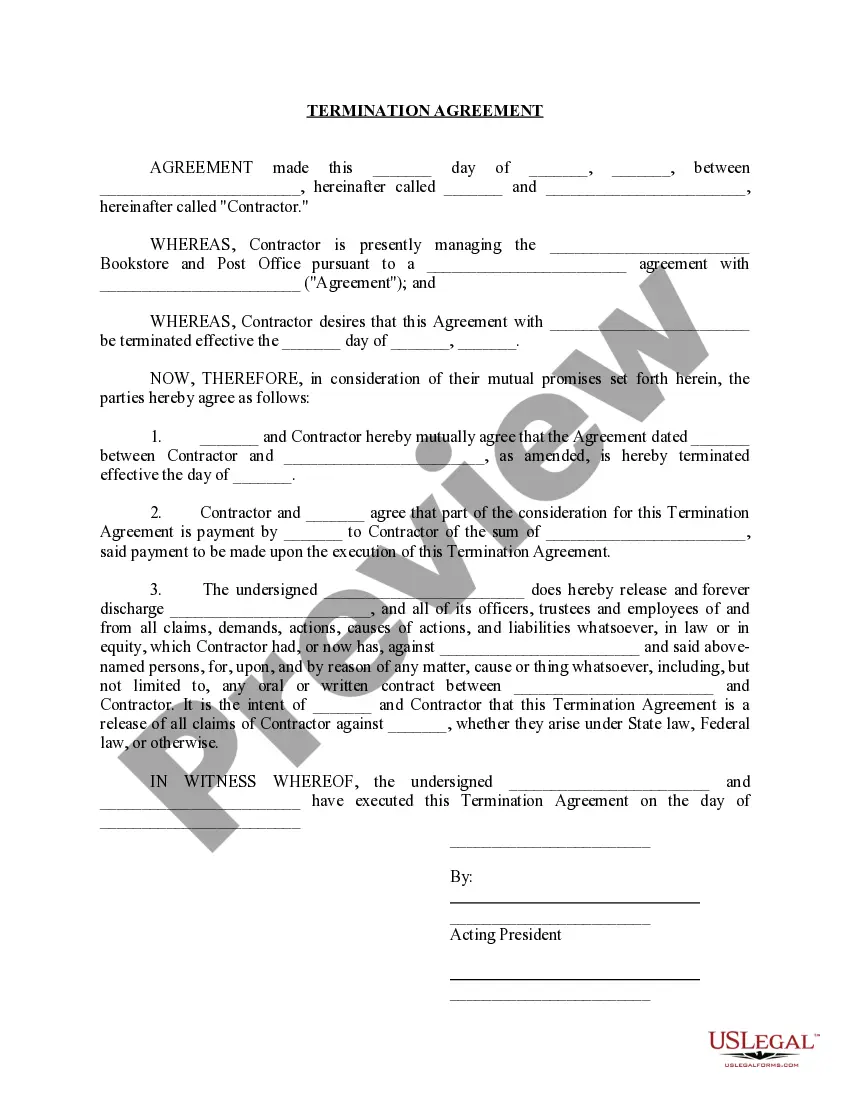

How to fill out Separation Notice For Independent Contractor?

Locating the correct valid document template can be a challenge. Naturally, there are numerous templates accessible online, but how do you find the authentic form you need.

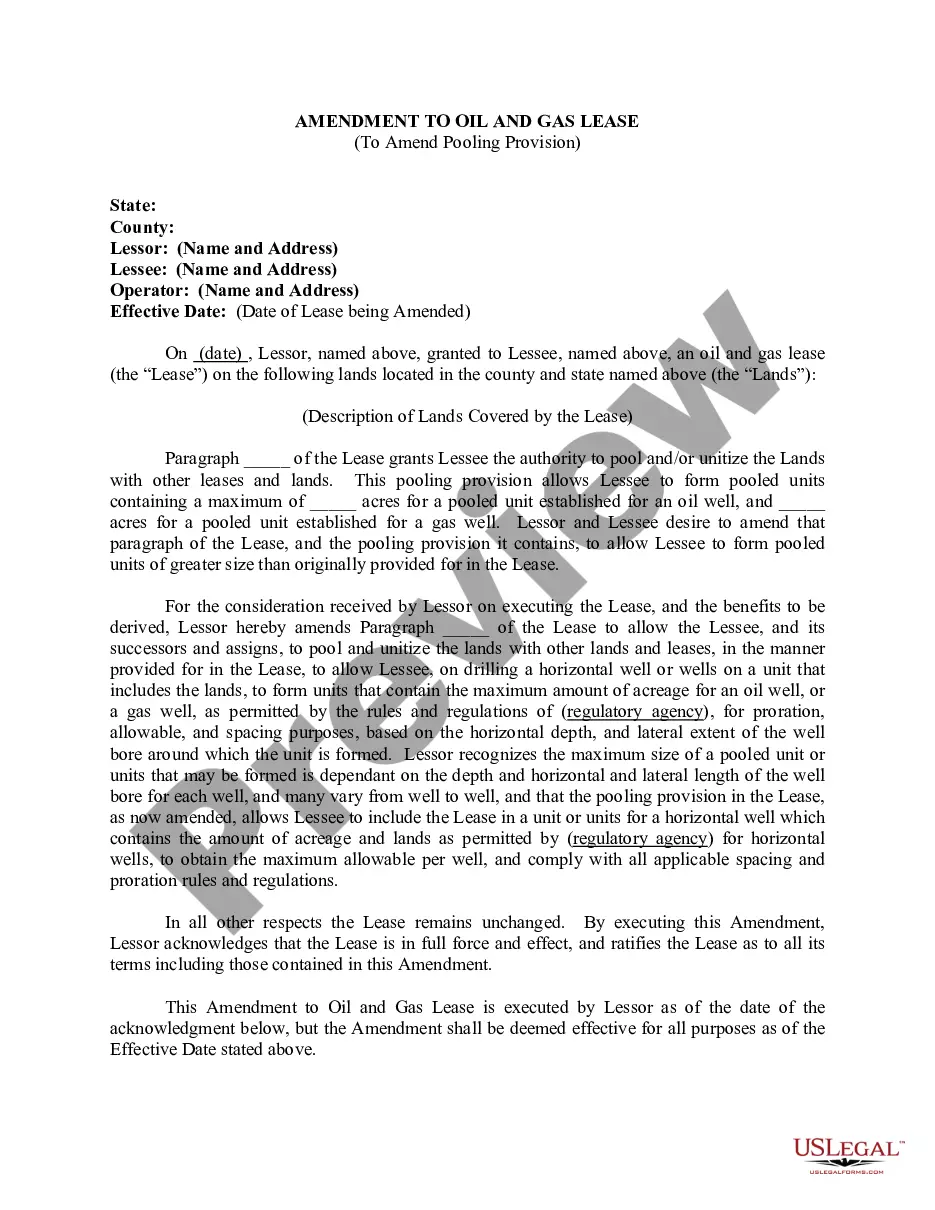

Utilize the US Legal Forms website. The service offers thousands of templates, such as the District of Columbia Separation Notice for Independent Contractor, which you can utilize for business and personal purposes. All of the documents are vetted by experts and meet federal and state regulations.

If you are already registered, sign in to your account and click the Download button to acquire the District of Columbia Separation Notice for Independent Contractor. Use your account to search through the legal documents you have purchased previously. Visit the My documents section of your account and obtain an additional copy of the document you need.

Complete, edit, print, and sign the acquired District of Columbia Separation Notice for Independent Contractor. US Legal Forms is the largest collection of legal templates where you can find numerous document formats. Utilize the service to download properly crafted papers that comply with state regulations.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your city/county. You can review the form using the Preview option and examine the form details to confirm it is the right one for you.

- If the form does not fulfill your requirements, utilize the Search field to find the appropriate document.

- Once you are confident that the form is acceptable, click on the Buy Now button to purchase the document.

- Select the pricing plan you prefer and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

District of Columbia labor laws do not have any laws requiring an employer to pay severance pay to an employee. If an employer chooses to provide severance benefits, it must comply with the terms of its established policy or employment contract.

PUA covers individuals who are not eligible for traditional UI benefits, including the self-employed, those seeking part-time employment, individuals lacking sufficient work history, independent contractors, gig economy workers; and those who have exhausted their benefit eligibility under both traditional UI and

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

A: To be eligible for Unemployment Insurance benefits, an individual must meet the following wage requirements: 2022 Wages must be reported in at least two quarters of the base period; 2022 At least $1,300 in wages must be reported in one quarter of the base period; 2022 At least $1,950 in wages must be reported for the entire

You must also have been unemployed, partially unemployed, or unable or unavailable to work due to at least one of the following reasons to be eligible for PUA: My place of employment was closed as a direct result of the COVID-19 public health emergency.

An independent contractor working as an individual is not subject to coverage under the DC unemployment insurance law.

Self-employed workers and contractors are typically not eligible for unemployment benefits. However, in this unprecedented crisis the State of Minnesota is offering unemployment compensation for the self employed and 1099 workers. This includes those with only part-time employment.

To qualify for benefits in the District, you must all of the following four requirements: You must have earned at least $1,300 in your highest paid quarter of the base period. You must have earned at least $1,950 during the entire base period. You must have earned wages in at least two quarters of the base period.

Contractors aren't covered by most employment-related laws. This means they don't get things like annual leave or sick leave, they can't bring personal grievances, they have to pay their own tax, and general civil law determines most of their rights and responsibilities.

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.