District of Columbia Resolution of Meeting of LLC Members to Acquire Assets of a Business

Description

How to fill out Resolution Of Meeting Of LLC Members To Acquire Assets Of A Business?

Finding the appropriate legal documents template can be challenging. There are numerous templates accessible online, but how do you identify the legal form you need.

Utilize the US Legal Forms website. This platform provides thousands of templates, such as the District of Columbia Resolution of Meeting of LLC Members to Acquire Assets of a Business, suitable for both business and personal purposes. All templates are reviewed by experts and meet federal and state regulations.

If you are already a registered user, Log In to your account and click on the Acquire option to access the District of Columbia Resolution of Meeting of LLC Members to Acquire Assets of a Business. Use your account to search through the legal documents you have previously purchased. Visit the My documents tab in your account to retrieve another copy of the document you need.

Choose the document format and download the legal documents template to your device. Complete, modify, print, and sign the received District of Columbia Resolution of Meeting of LLC Members to Acquire Assets of a Business. US Legal Forms is the largest collection of legal templates where you can find numerous document templates. Utilize the service to obtain professionally crafted paperwork that adheres to state requirements.

- Firstly, ensure you have selected the correct form for your jurisdiction/county.

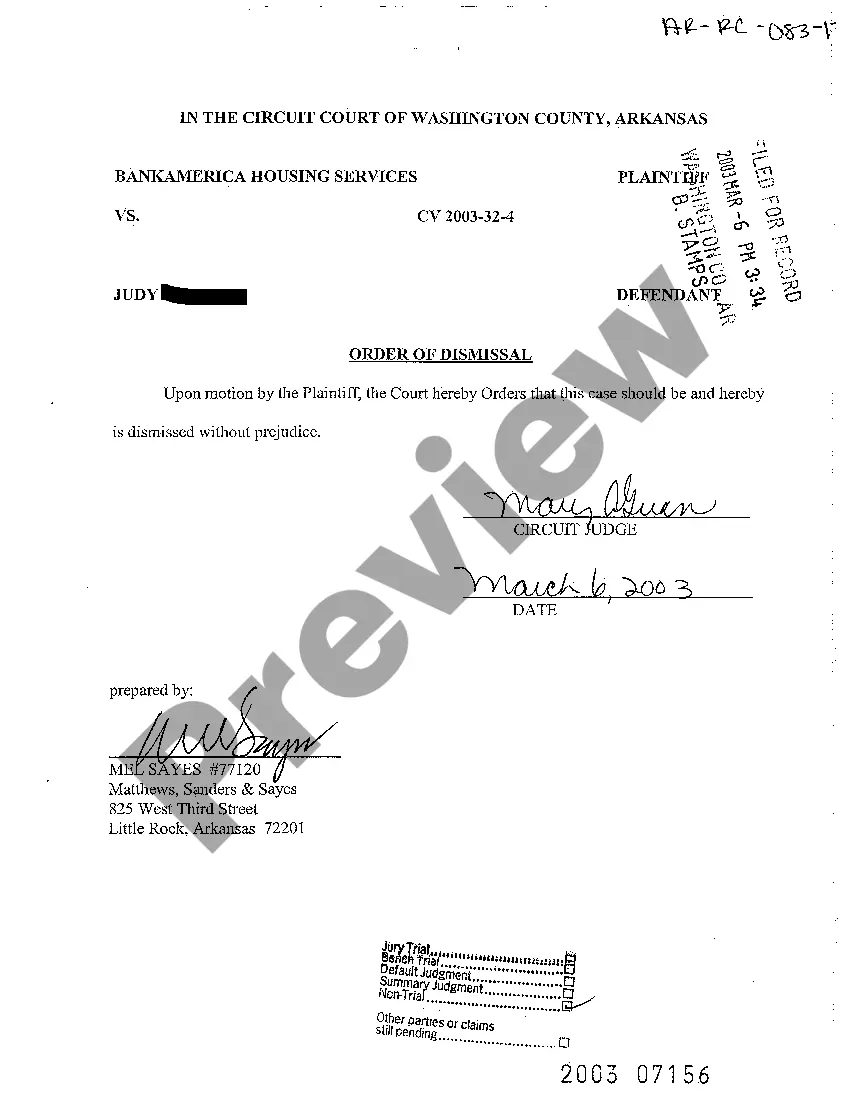

- You can review the form using the Preview option and read the form description to confirm it is suitable for your needs.

- If the form does not meet your requirements, utilize the Search field to find the correct form.

- Once you are confident that the form is appropriate, click on the Acquire now button to obtain the form.

- Select the pricing plan you prefer and provide the necessary information.

- Create your account and complete the transaction using your PayPal account or credit card.

Form popularity

FAQ

Steps of the Company Incorporation ProcessStep 1: Reservation of Business Name with the Securities and Exchange Commission (SEC)Step 2: Submission of Documents to SEC.Step 3: Registration with Local Government Units (LGUs) of the location where you want to establish your business.More items...

What must be included in articles of incorporation?the corporation's name and business address.the number of authorized shares and the par value (if any) of the shares.the name and address of the in-state registered agent.the names and addresses of its incorporators.

The IRS generally requires a minimum of three board members for every nonprofit, but does not dictate board term length.

The main components of the Articles of Incorporation include the name of the corporation, type of corporate structure. Depending on a company's goals and the industry, registered agent, number of authorized shares, and names and signatures of the owners of the corporation.

To reinstate a Washington DC LLC, you'll need to file the Reinstatement of Domestic Filing Entity (Form GN-5) with the Washington DC Department of Consumer and Regulatory Affairs (DCRA) Corporations Division. You'll also have to fix the issues that led to your Washington DC LLC's dissolution.

Explanation: Articles of incorporation must contain (1) the name of the corporation, (2) the number of authorized shares, (3) the address of the initial registered office of the corporation, (4) the name of its first registered agent at that address, and (5) the names and addresses of the incorporators.

Broadly, articles of incorporation should include the company's name, type of corporate structure, and number and type of authorized shares. Bylaws work in conjunction with the articles of incorporation to form the legal backbone of the business.

O The names of the initial members of the board of directors (D.C. law provides that a nonprofit corporation must have a minimum of three directors);

The Articles of Incorporation are a legal document submitted to the Government (provincial or federal) that establishes a business within Canada. This formation of a business structure (incorporation) is a 200bseparate entity 200b from the individuals who own the business.

The simple answer is that most authors agree that a typical nonprofit board of directors should comprise not less than 8-9 members and not more than 11-14 members. Some authors focusing on healthcare organizations indicate a board size up to 19 members is acceptable, though not optimal.