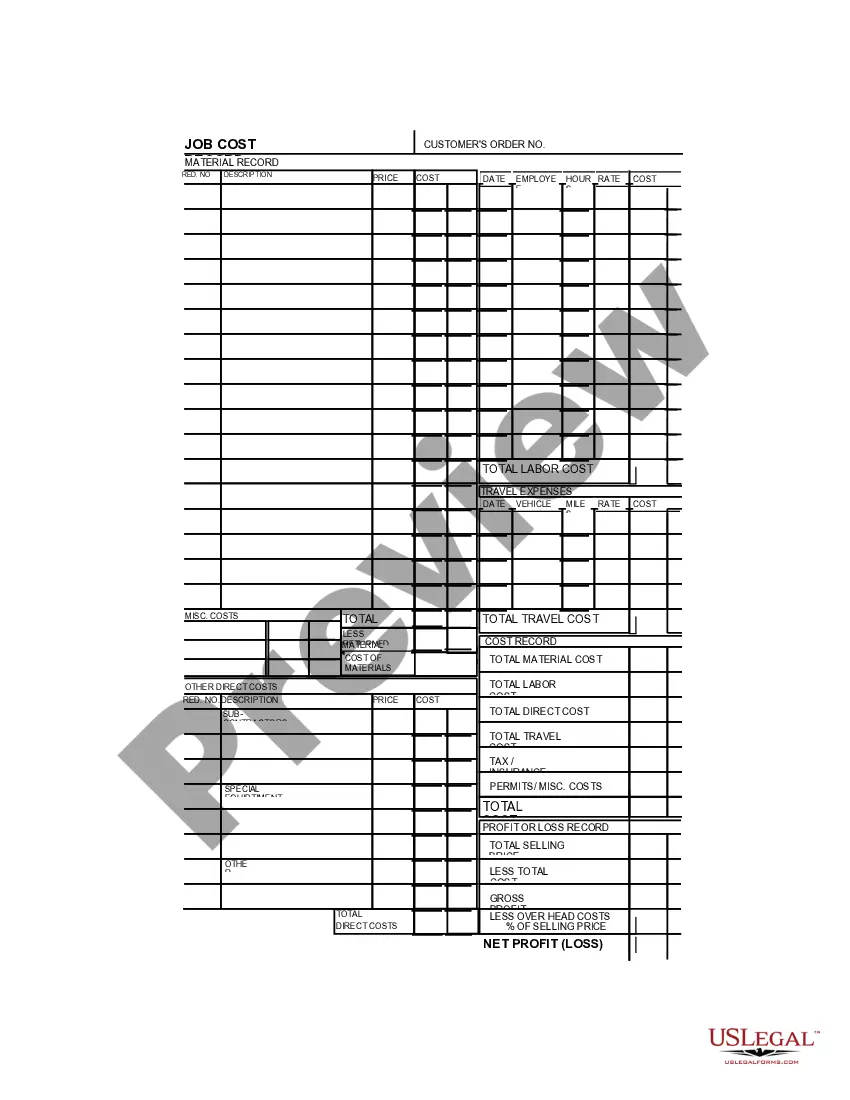

District of Columbia Job Invoice - Long

Description

How to fill out Job Invoice - Long?

You can allocate time on the web attempting to locate the legal document format that meets the state and federal requirements you require.

US Legal Forms offers a vast array of legal documents that are assessed by professionals.

You can download or print the District of Columbia Job Invoice - Long from the service.

If available, utilize the Review option to browse the document format as well.

- If you possess a US Legal Forms account, you may Log In and click on the Acquire option.

- Subsequently, you may complete, modify, print, or sign the District of Columbia Job Invoice - Long.

- Each legal document format you purchase is yours indefinitely.

- To obtain another copy of the purchased form, visit the My documents tab and click the relevant option.

- If it's your first time using the US Legal Forms website, follow the simple instructions below.

- First, make sure you have selected the correct document format for your county/city of choice.

- Review the form description to ensure you have chosen the right document.

Form popularity

FAQ

Yes, the District of Columbia offers a first-time penalty abatement for individuals and businesses who maintain a clean tax record. If you have no previous penalties, you may qualify to have your penalties waived. Filing your District of Columbia Job Invoice - Long accurately and on time can help you build this positive history. Always confirm your eligibility directly with the DC Office of Tax and Revenue.

The 183-day rule in Washington, DC, is crucial for determining residency for tax purposes. If you spend 183 days or more in the District during the tax year, you are typically considered a resident and may need to file a DC tax return. Understanding this rule can clarify your tax obligations and help you apply for the appropriate District of Columbia Job Invoice - Long effectively. Always consult with a tax professional to ensure compliance.