District of Columbia Agreement Replacing Joint Interest with Annuity

Description

How to fill out Agreement Replacing Joint Interest With Annuity?

If you need to thorough, procure, or generate authentic document templates, utilize US Legal Forms, the largest repository of authentic forms, available online.

Leverage the site’s convenient and user-friendly search to locate the documents you require. Various templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Use US Legal Forms to find the District of Columbia Agreement Replacing Joint Interest with Annuity in just a few clicks.

Every legal document template you purchase is yours permanently. You gain access to every form you downloaded in your account. Click the My documents section and select a form to print or download again.

Complete and download, and print the District of Columbia Agreement Replacing Joint Interest with Annuity using US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the District of Columbia Agreement Replacing Joint Interest with Annuity.

- You can also access forms you previously downloaded from the My documents section of your account.

- If this is your first time using US Legal Forms, follow these steps.

- Step 1. Ensure you have chosen the form for the correct city/state.

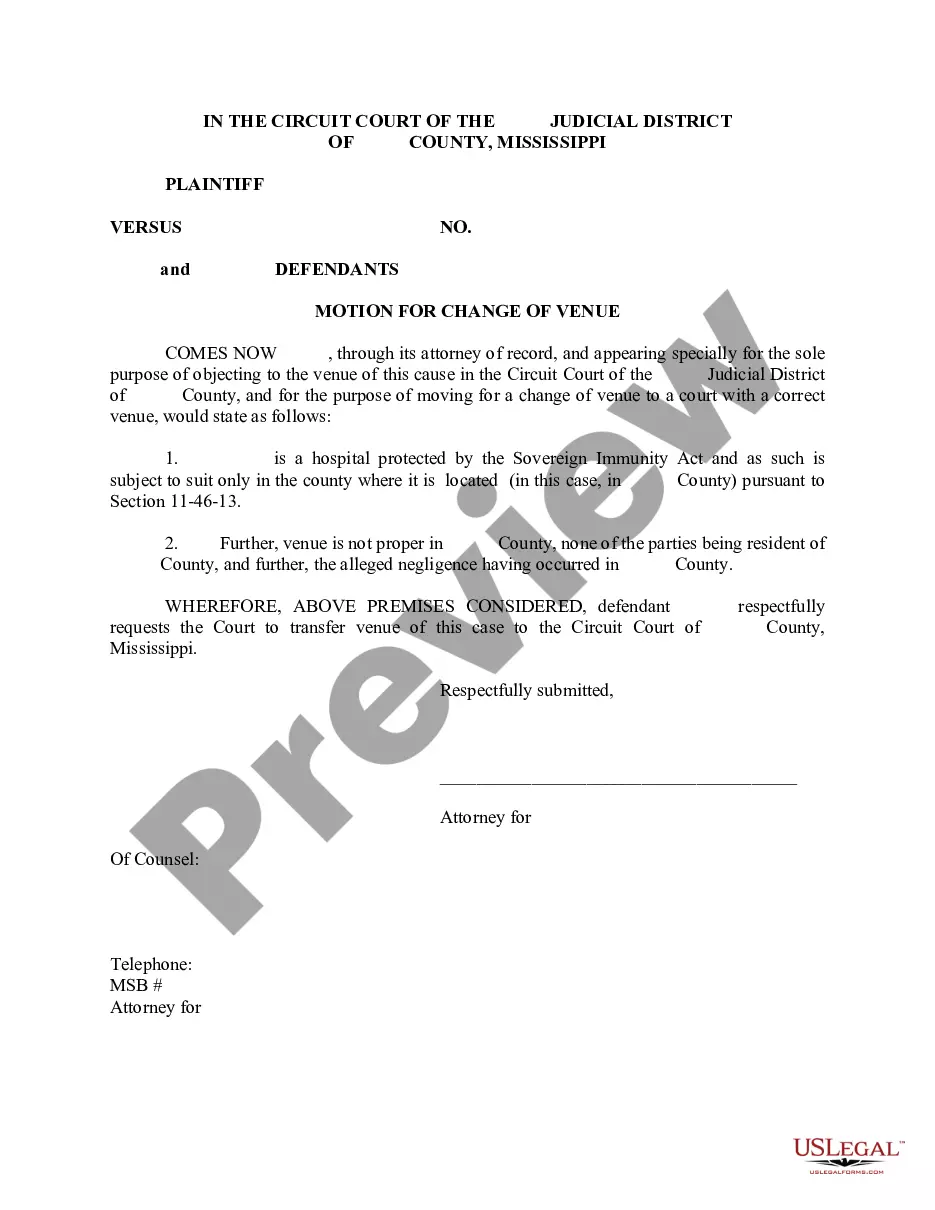

- Step 2. Use the Preview option to review the form's content. Make sure to check the description.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find alternative types of your desired document design.

- Step 4. Once you have located the form you want, click the Get now button. Select your preferred pricing plan and enter your details to create an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the District of Columbia Agreement Replacing Joint Interest with Annuity.

Form popularity

FAQ

Yes, if the owner and the annuitant are the same person, typically a spouse can be designated as a beneficiary. This designation can help ensure financial security for your partner. Exploring the District of Columbia Agreement Replacing Joint Interest with Annuity will provide you with more insights into beneficiary options.

A replacement occurs when a new policy or contract is purchased and, in connection with the sale, you discontinue making premium payments on the existing policy or contract, or an existing policy or contract is surrendered, forfeited, assigned to the replacing insurer, or otherwise terminated or used in a financed

The purpose of this regulation is: (1) To regulate the activities of insurers and producers with respect to the replacement of existing life insurance and annuities. (b) Reduce the opportunity for misrepresentation and incomplete disclosure.

(b) Where a replacement is involved, the agent shall do all of the following: (1) Present to the applicant, not later than at the time of taking the application, a Notice Regarding Replacement of Life Insurance in the form as described in subdivision (d).

A replacement occurs when a new policy or contract is purchased and, in connection with the sale, you discontinue making premium payments on the existing policy or contract, or an existing policy or contract is surrendered, forfeited, assigned to the replacing insurer, or otherwise terminated or used in a financed

If a replacement is involved in a transaction, the replacing insurer shall: (1) Verify that the required forms are received and are in compliance with this chapter; (2) Notify any other existing insurer that may be affected by the proposed replacement within 5 business days after: (a) Receipt of a completed application

(2) If replacement is involved: (i) Require from the agent or broker with the application for life insurance or annuity a list of all the applicant's existing life insurance or annuity to be replaced, and a copy of the replacement notice provided the applicant under § 81.4(b)(1) (relating to duties of agents and

A life insurance policy can be exchanged for an annuity under the rules of a 1035 exchange, but you cannot exchange an annuity contract for a life insurance policy.

A. The purpose of this regulation is: (1) To regulate the activities of insurers and producers with respect to the replacement of existing life insurance and annuities. (b) Reduce the opportunity for misrepresentation and incomplete disclosure.

Replacing a life insurance policy means you're buying a new life insurance policy and plan on terminating your current policy or letting it expire. Replacing life insurance policies isn't unheard of.