District of Columbia Private Trust Company

Description

How to fill out Private Trust Company?

It is feasible to spend multiple hours online trying to locate the valid document template that satisfies the state and federal requirements you need.

US Legal Forms offers thousands of valid forms that are reviewed by experts.

You can easily download or print the District of Columbia Private Trust Company from my services.

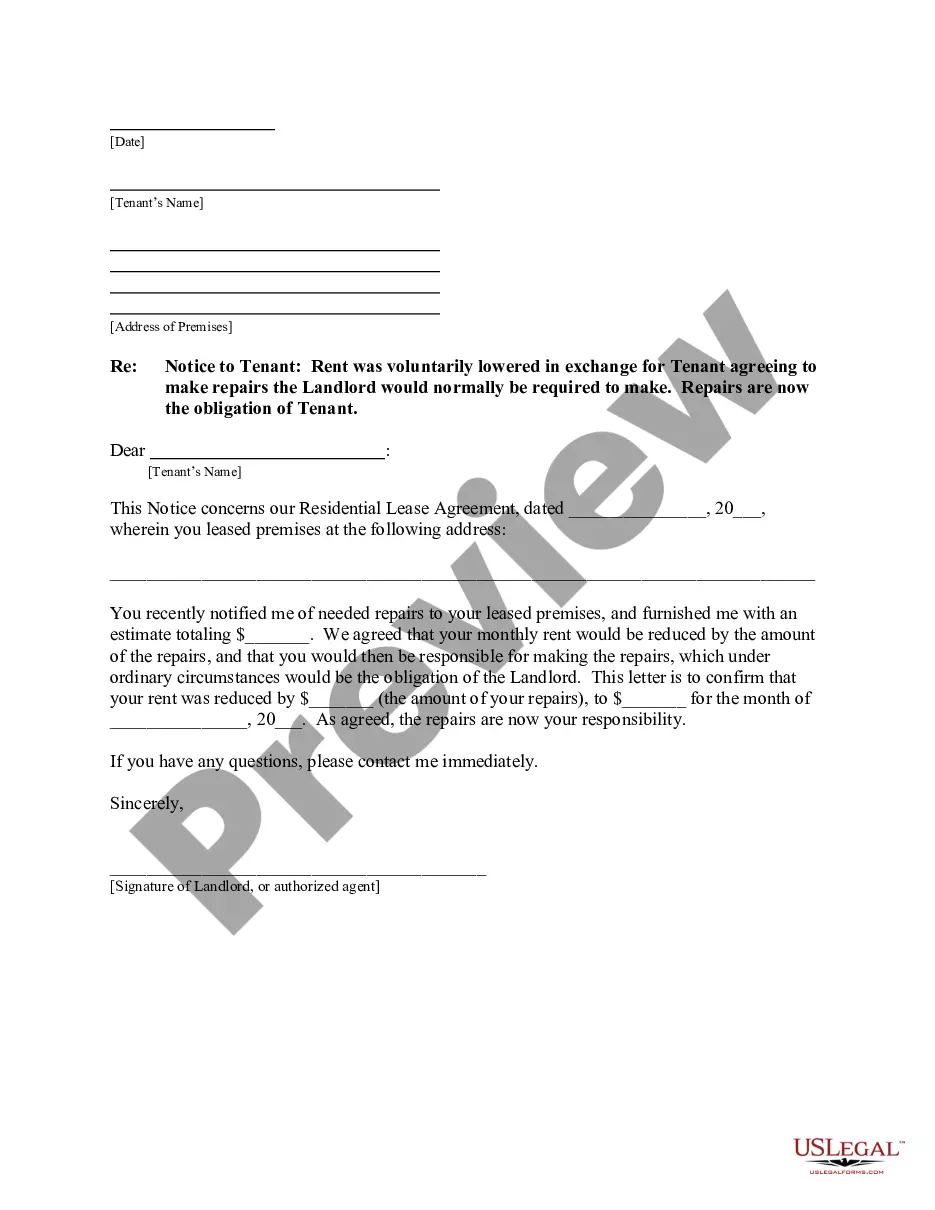

If available, utilize the Review button to examine the document template as well.

- If you have a US Legal Forms account, you may Log In and hit the Download button.

- Then, you can complete, modify, print, or sign the District of Columbia Private Trust Company.

- Every legal document template you acquire is yours permanently.

- To get another copy of a purchased form, navigate to the My documents section and click the associated button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for your preferred county/town.

- Review the form description to affirm you have selected the right form.

Form popularity

FAQ

Generally speaking, a directed trust appoints an individual or firm as an advisor who directs the trustee on a discrete aspect of the administration of the trust such as investment management or distributions to beneficiaries.

The four main types are living, testamentary, revocable and irrevocable trusts. However, there are further subcategories with a range of terms and potential benefits.

If you create a trust that takes effect while you are alive - known as a living trust or inter vivos trust - it will cost at least $1,000 to set up and establish. For a large trust, you will need to appoint a trustee to oversee it and manage investments held within the trust.

Private trust companies are designed to preserve ownership of family wealth, which may include business assets, real estate, alternative assets such as hedge funds or private equity. These assets are managed by the trustee in accordance with the wishes of the family.

A trust is a legal agreement that can be used as part of the estate planning process. It is best to consult a DC Trusts attorney to understand the nature of the document and its compliance with DC law.

Living trusts do not shield assets from Medicaid or creditors. If you would like to create a living trust in Washington, D.C., sign your written trust document before a notary public. To put the trust into effect, you must transfer ownership of your asset into it.

Section 5 of the Act states that with respect to: Immovable property: A private trust must be created by a non-testamentary instrument in writing. Further, the non-testamentary instrument needs to be signed by the author of the trust or the trustee and has to be registered.

To make a living trust in the District of Columbia, you:Choose whether to make an individual or shared trust.Decide what property to include in the trust.Choose a successor trustee.Decide who will be the trust's beneficiariesthat is, who will get the trust property.Create the trust document.More items...

You must file a 2020 DC Fiduciary Income tax return if you are the fiduciary of a DC estate or trust and: The gross income for the estate is $1 or more for the taxable year. The gross income for the trust is $100 or more for the taxable year.