Trustor and trustee enter into an agreement to create a revocable living trust. The purpose of the creation of the trust is to provide for the convenient administration of the assets of the trust without the necessity of court supervision in the event of the trustor's incapacity or death. Other provisions of the trust document include: trust assets, disposition of income and principal, and administration of the trust assets after the death of the trustor.

District of Columbia Living Trust - Revocable

Description

How to fill out Living Trust - Revocable?

You can spend hours online looking for the proper legal template that adheres to the federal and state requirements you require.

US Legal Forms provides thousands of legal documents that can be reviewed by professionals.

It is easy to download or print the District of Columbia Living Trust - Revocable from the platform.

- If you currently possess a US Legal Forms account, you can sign in and click the Download button.

- Then, you can complete, edit, print, or sign the District of Columbia Living Trust - Revocable.

- Each legal document template you acquire is yours indefinitely.

- To obtain an additional copy of any purchased document, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for your chosen county/region.

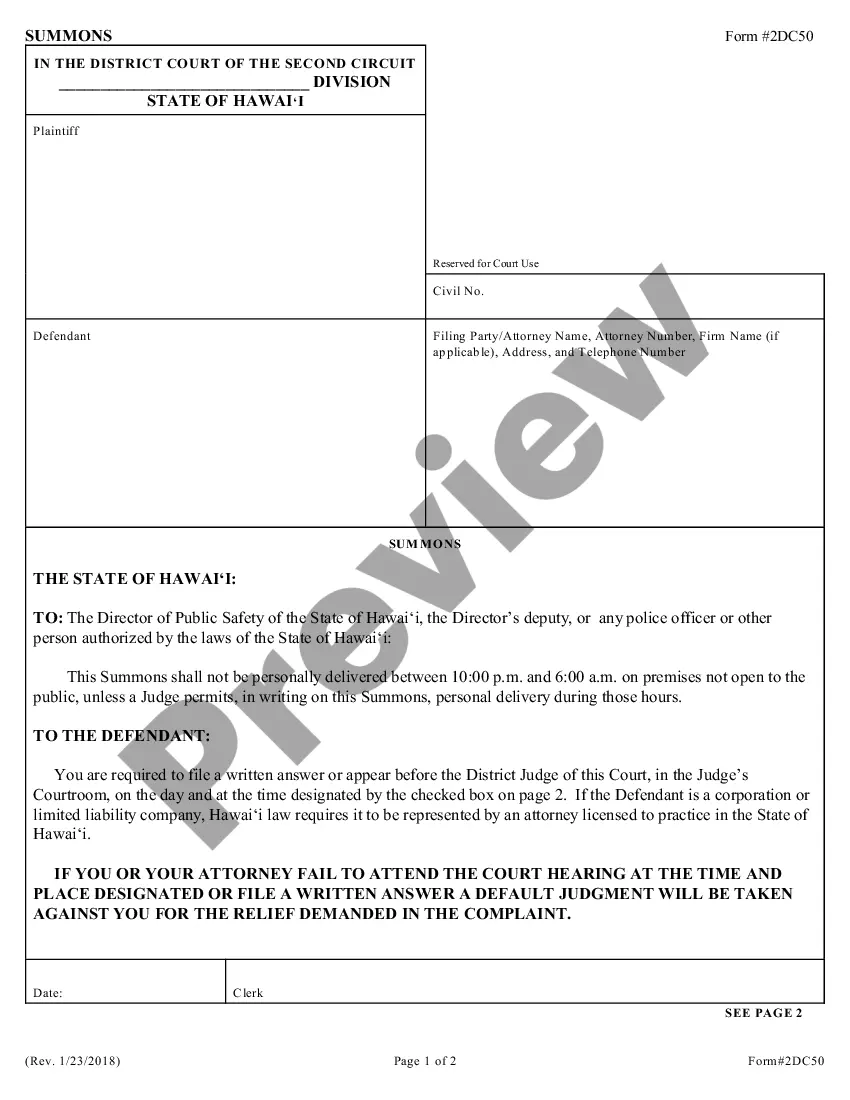

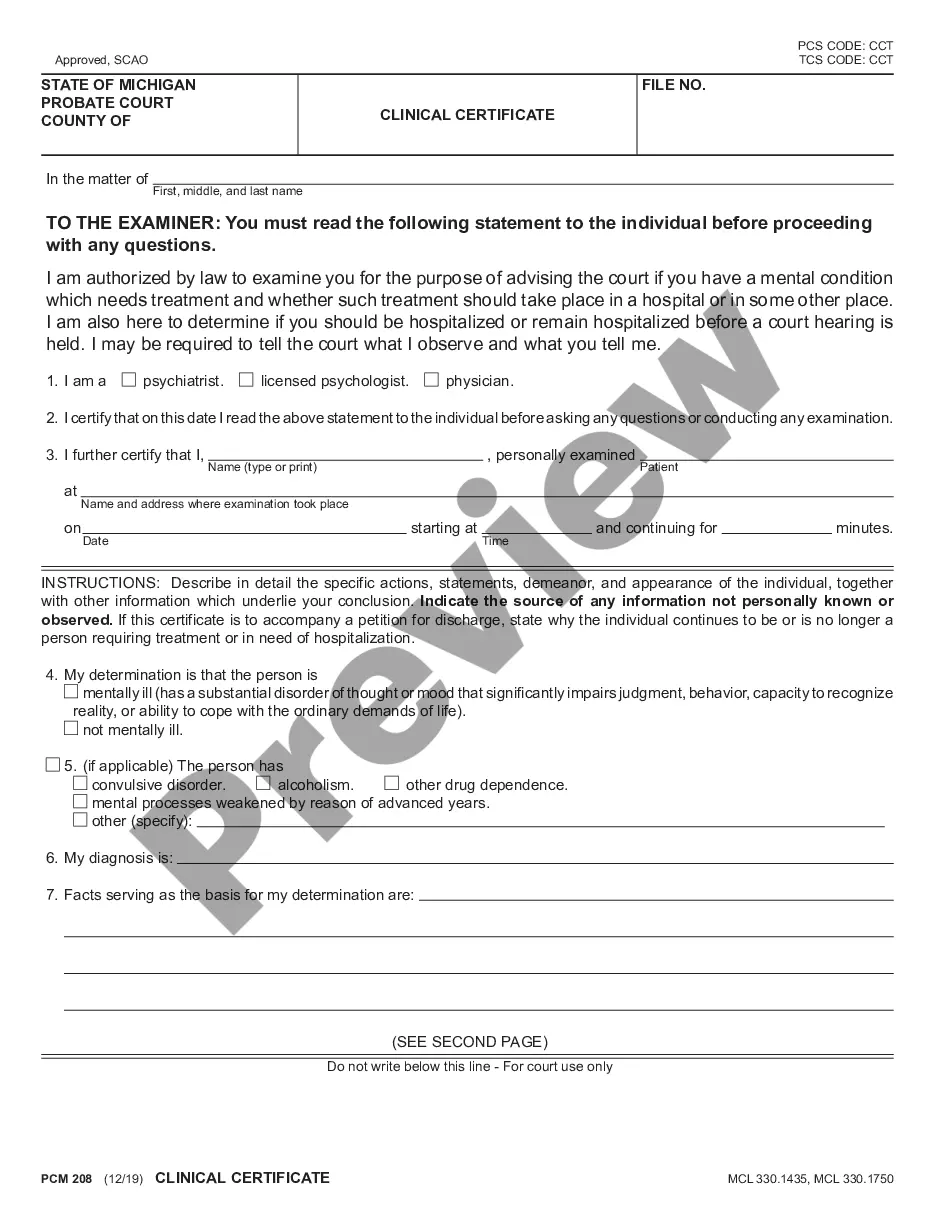

- Check the document description to confirm you have selected the right template. If available, use the Review button to browse through the document template as well.

- If you want to find another version of the document, use the Lookup box to find the template that meets your needs and criteria.

- Once you have located the template you require, click Get now to proceed.

- Select the pricing plan you desire, enter your details, and register for an account on US Legal Forms.

- Complete the payment process. You may use your credit card or PayPal account to purchase the legal document.

- Choose the file format for your document and download it to your device.

- Make any necessary changes to your document. You can complete, edit, sign, and print the District of Columbia Living Trust - Revocable.

- Download and print thousands of document templates using the US Legal Forms website, which features the largest selection of legal documents.

- Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

Filling out a District of Columbia Living Trust - Revocable involves a few key steps. First, provide your personal information as the grantor, then list the beneficiaries who will receive your assets. It’s also crucial to detail the assets you wish to include in the trust. Using a user-friendly platform like uslegalforms can make this process easier by guiding you through each section and ensuring you don’t miss important details.

Creating a District of Columbia Living Trust - Revocable on your own is definitely possible. Start by gathering essential documents like property titles, bank statements, and lists of assets. Next, review templates available online or consider using a reliable platform such as uslegalforms to help streamline the process. Be sure to sign and notarize the trust document to ensure its validity.

The best form of trust largely depends on your individual needs and estate goals. For many, a revocable trust, such as the District of Columbia Living Trust - Revocable, offers the perfect balance of flexibility and control. It allows you to manage your assets during your lifetime while simplifying the transfer process after death. Choosing the right option often requires careful consideration of various factors, and resources like USLegalForms can help guide you.

In an irrevocable trust, the trust itself is the legal owner of the assets, not the individuals who created it. This means once the assets are transferred to the trust, you relinquish control. However, you may still benefit from the income generated by the trust assets, depending on the terms set. Understanding this dynamic is crucial when considering a District of Columbia Living Trust - Revocable or irrevocable trust.

The three main types of trusts include revocable trusts, irrevocable trusts, and testamentary trusts. Revocable trusts, like the District of Columbia Living Trust - Revocable, allow changes during your lifetime. Irrevocable trusts cannot be altered once created, providing security and potential tax benefits. Testamentary trusts become effective after your death and are often outlined in your will.

The primary difference between a revocable and irrevocable trust lies in the control you maintain over the assets. A revocable trust allows you to alter or dissolve the trust during your lifetime, giving you flexibility. In contrast, an irrevocable trust cannot be changed once established, which provides benefits like asset protection. This makes the District of Columbia Living Trust - Revocable a popular choice for those wanting control over their assets.

Having your parents consider a District of Columbia Living Trust - Revocable might be beneficial for asset protection and efficient estate management. This approach allows them to control their assets during their lifetime and define how they want their assets distributed after passing. However, it's essential for them to assess their unique financial situation and consult with a legal expert to ensure this decision aligns with their overall estate planning goals.

Suze Orman highlights that individuals should have four essential documents for comprehensive estate planning: a District of Columbia Living Trust - Revocable, a durable power of attorney, a health care proxy, and a will. These documents work together to ensure your wishes are carried out regarding your assets and health care. By incorporating these elements, you can create a robust plan for your future. Utilizing platforms like uslegalforms can help you draft these documents efficiently.

A notable downside of a District of Columbia Living Trust - Revocable lies in its lack of creditor protection. This means that your assets could be vulnerable to claims or lawsuits during your lifetime. Additionally, you still need to keep up with administrative tasks, such as maintaining and updating the trust. It's crucial to weigh these factors against the benefits of establishing a trust.

Suze Orman emphasizes the importance of having a District of Columbia Living Trust - Revocable as part of an estate plan. She believes it provides flexibility and control over assets during one’s lifetime. Moreover, it simplifies the distribution process for beneficiaries, helping them avoid lengthy probate. Orman advocates that everyone should consider this estate planning option.