District of Columbia Revocable Trust for Real Estate

Description

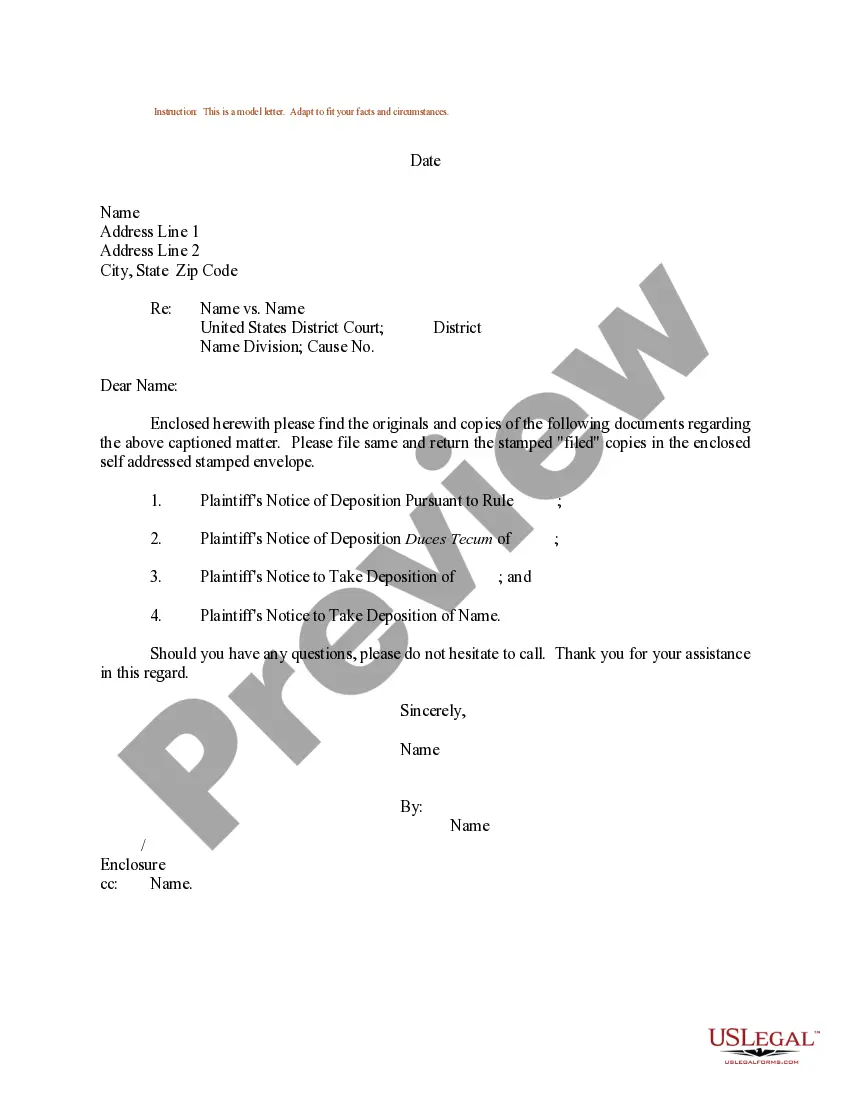

How to fill out Revocable Trust For Real Estate?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a broad selection of legal template forms that you can download or print. By utilizing the website, you can discover thousands of forms for business and personal uses, sorted by categories, states, or keywords.

You can locate the latest versions of forms such as the District of Columbia Revocable Trust for Real Estate within moments. If you already possess a subscription, Log In and download the District of Columbia Revocable Trust for Real Estate from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously obtained forms from the My documents tab in your account.

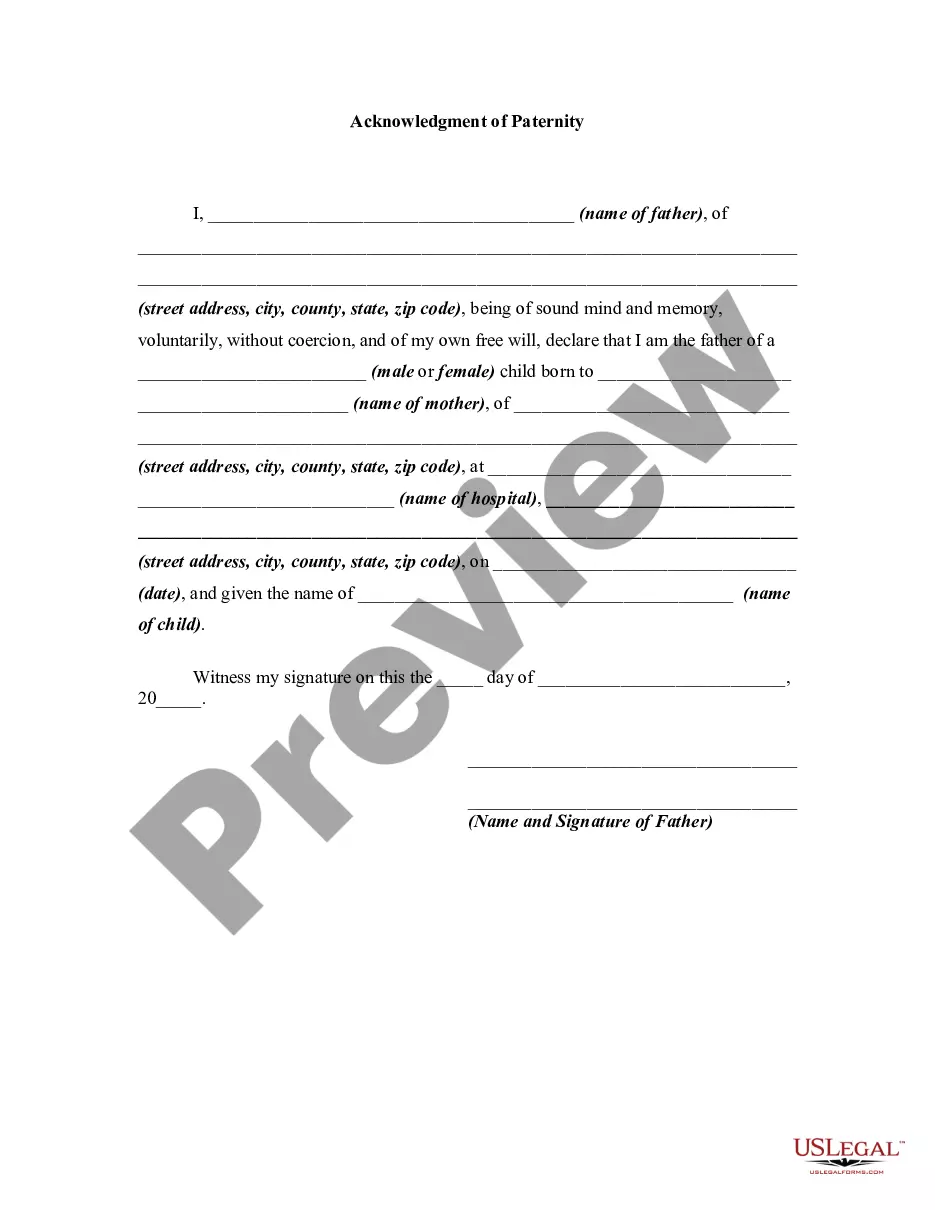

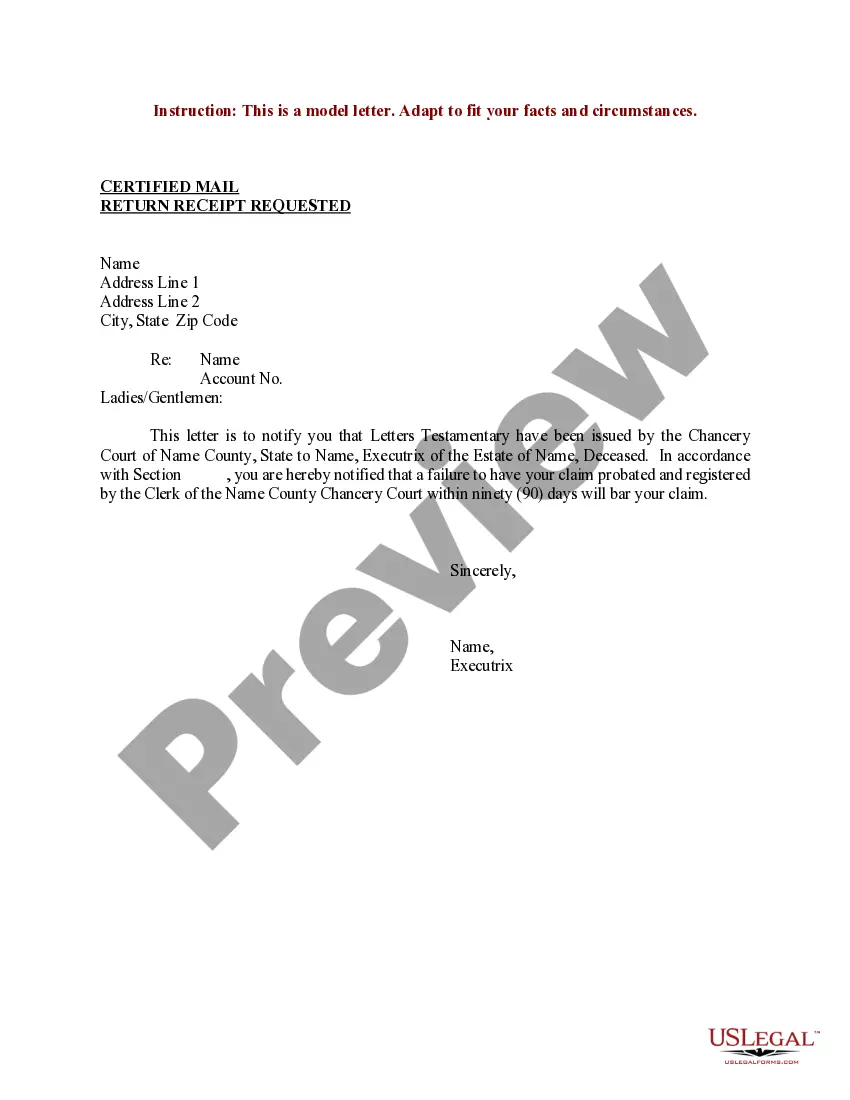

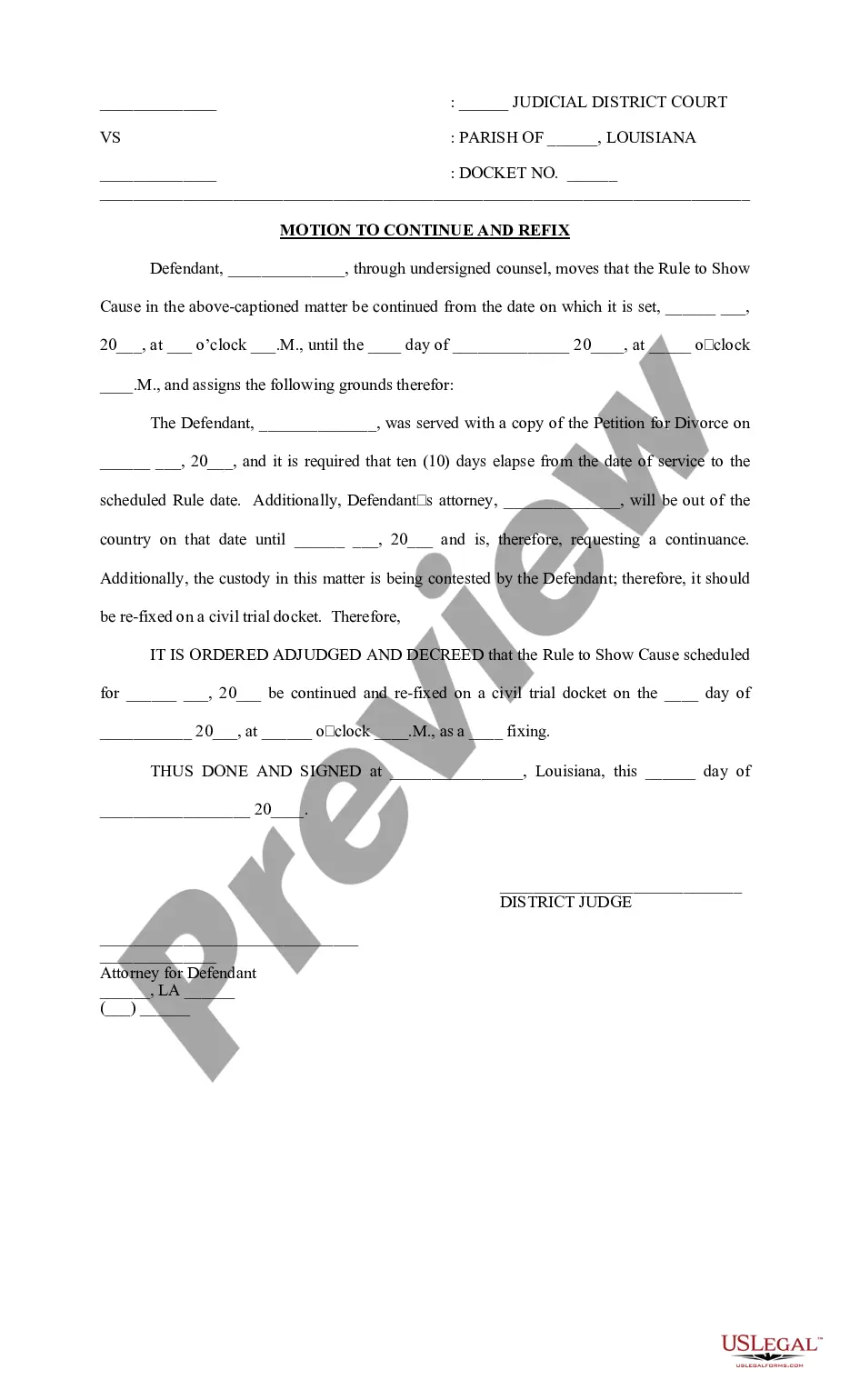

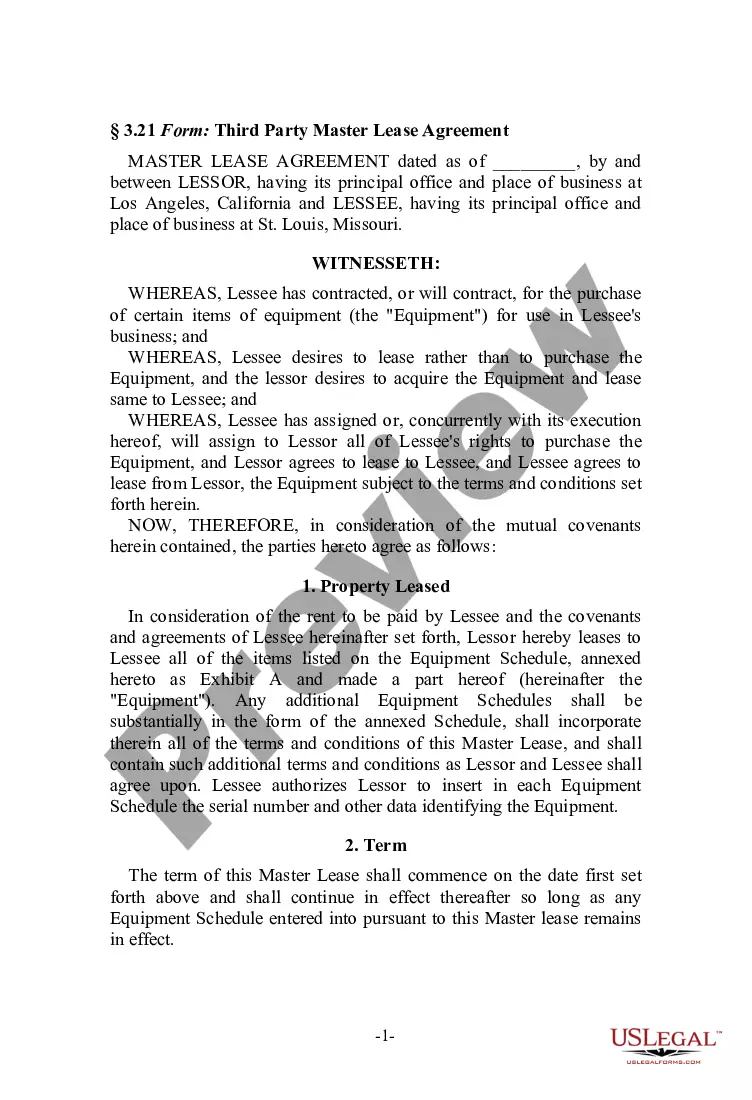

If you wish to use US Legal Forms for the first time, here are simple steps to assist you in getting started: Ensure you have selected the correct form for your city/county. Click on the Preview button to inspect the form's content. Review the form details to confirm that you have chosen the appropriate form.

Every template you add to your account does not have an expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

Access the District of Columbia Revocable Trust for Real Estate with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, select your preferred pricing plan and provide your credentials to register for an account.

- Process the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction.

- Choose the format and download the form onto your device.

- Make modifications. Complete, edit, print, and sign the acquired District of Columbia Revocable Trust for Real Estate.

Form popularity

FAQ

To report income from a District of Columbia Revocable Trust for Real Estate, you add the income to your Form 1040 along with any other personal income. It’s crucial to include all trust-related earnings, such as rental income or capital gains. Ensure you document all deductions and credits related to the trust's income. If you have questions about the specific reporting process, the uslegalforms platform can help you discover resources and forms you may need.

You do not need to file a separate tax return for a District of Columbia Revocable Trust for Real Estate because it is considered a disregarded entity. However, any income the trust generates must be reported on your individual tax return. It is essential to maintain proper documentation of the trust's income and expenses. If you're unsure, seeking guidance from a tax advisor can provide clarity.

Yes, a District of Columbia Revocable Trust for Real Estate is generally treated as a disregarded entity for tax purposes. This means the IRS does not view the trust as a separate taxable entity. Instead, all income generated by the trust passes through to you, allowing you complete control over tax responsibilities. This characteristic simplifies many aspects of tax reporting.

While a District of Columbia Revocable Trust for Real Estate can hold many assets, certain items are better kept outside the trust. These include retirement accounts, life insurance policies, and any assets that benefit from direct beneficiary designations. Additionally, you should avoid putting assets with significant tax implications, as this can complicate your tax situation. For a tailored approach, consult with a professional who can guide you on asset management.

Typically, a nursing home cannot directly take your home if it is held in a District of Columbia Revocable Trust for Real Estate. However, the assets in the trust are still considered part of your estate for Medicaid eligibility purposes. This means that if you need long-term care and apply for Medicaid, your home may be subject to estate recovery after your death. It's advisable to discuss asset protection strategies with a financial advisor to safeguard your property.

Placing your house in a District of Columbia Revocable Trust for Real Estate can be a wise decision for many homeowners. This approach allows for easy transfer of property upon death, avoiding the costly and lengthy probate process. Furthermore, it can provide peace of mind knowing your assets are managed according to your wishes. However, it is essential to assess your personal situation and consult with a legal professional before proceeding.

To establish a District of Columbia Revocable Trust for Real Estate, begin by determining your assets and beneficiaries. You should draft the trust document, which outlines how your assets will be managed and distributed. Consulting with a legal expert, such as those available at uslegalforms, can ensure that the trust complies with local laws. After creating the trust, remember to fund it by transferring your assets into it as needed.

Certain assets are typically better left outside a District of Columbia Revocable Trust for Real Estate. These include retirement accounts, like IRAs and 401(k)s, because they have their own beneficiary designations that should be kept intact. Additionally, life insurance policies might not need to be in the trust since they also allow for direct beneficiary designations. Understanding what to include or exclude from your trust is key to optimizing its benefits.

A significant mistake parents often make when establishing a trust fund is failing to fund the trust properly. In the case of a District of Columbia Revocable Trust for Real Estate, this means not transferring real estate or other assets into the trust. Without proper funding, the trust cannot fulfill its intended purpose of managing and protecting assets for beneficiaries. Always ensure that you include all relevant assets to prevent complications down the road.

Suze Orman advocates the use of a District of Columbia Revocable Trust for Real Estate, emphasizing its role in avoiding probate. She points out that this type of trust can provide control over your assets and ensure a smoother transition for your beneficiaries. However, she also advises that creating a revocable trust requires careful planning and understanding of your personal situation. Consider consulting a professional to navigate the details effectively.