District of Columbia Pot Testamentary Trust

Description

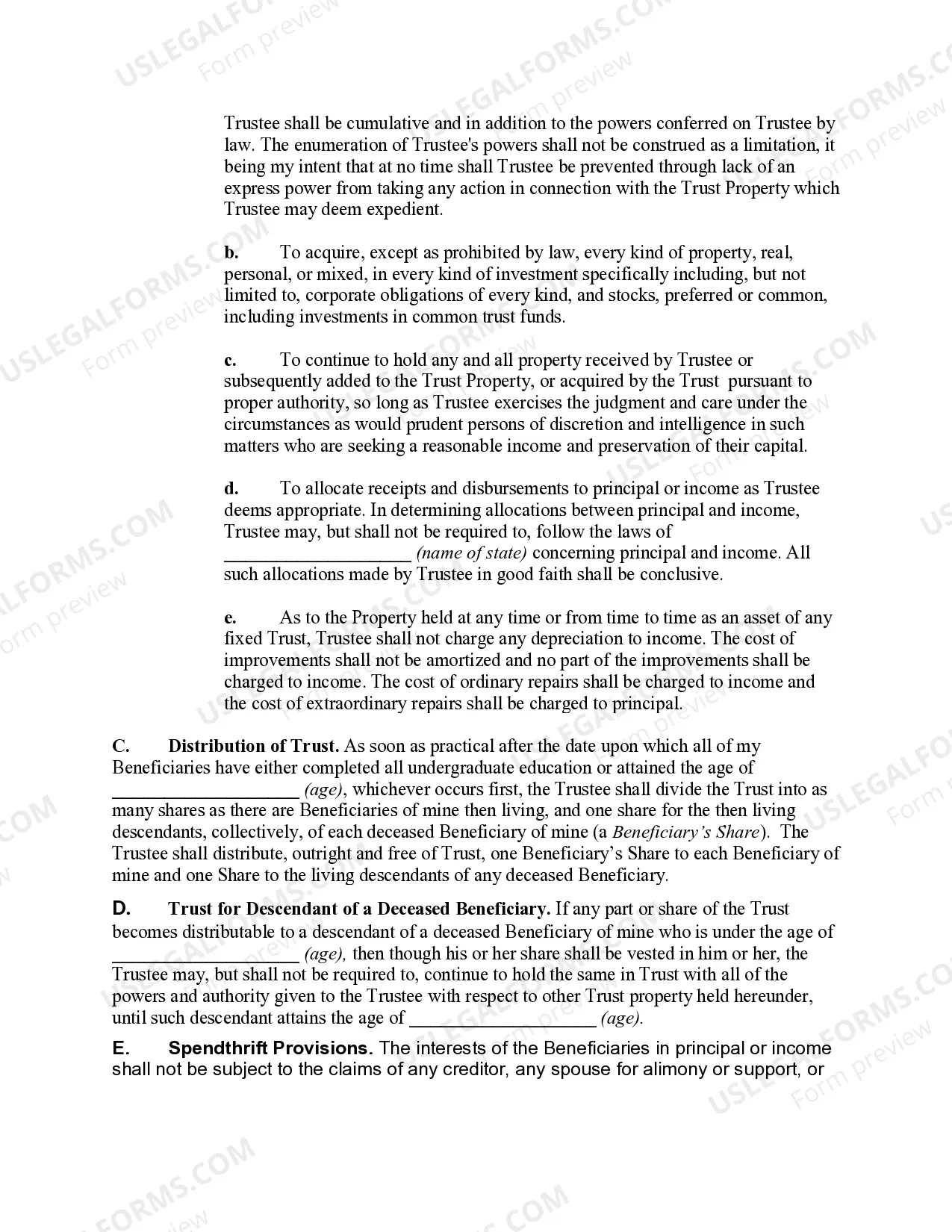

How to fill out Pot Testamentary Trust?

It is feasible to spend several hours online trying to locate the sanctioned document template that satisfies the state and federal requirements you need.

US Legal Forms provides countless legal forms that are reviewed by professionals.

You can easily download or print the District of Columbia Pot Testamentary Trust from this service.

If available, utilize the Review option to preview the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click on the Acquire option.

- Following that, you can complete, modify, print, or sign the District of Columbia Pot Testamentary Trust.

- Every legal document template you obtain is yours indefinitely.

- To obtain another copy of the purchased form, visit the My documents tab and select the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have chosen the appropriate document template for the state/city of your choice.

- Review the form description to confirm that you have selected the correct type.

Form popularity

FAQ

Washington, D.C. Inheritance Tax and Gift TaxThere is no inheritance tax in Washington, DC.

When a legal resident of the District of Columbia dies without a Will, that person's property must be probated through the same Probate Court process as the property of a person who died with a Will.

Is Probate Required by Washington Law? Probate: Washington law does NOT require a probate proceeding to be filed following death, regardless of whether the Decedent died with or without a Will (ie, testate or intestate, respectively).

A trust might further, be used to avoid probate, simply by providing a destination for lifetime gifts (which may so be removed from the estate). It's worth reflecting on whether such gifts, might, more usefully, be made to the intended beneficiary, in life.

Living trusts do not shield assets from Medicaid or creditors. If you would like to create a living trust in Washington, D.C., sign your written trust document before a notary public. To put the trust into effect, you must transfer ownership of your asset into it.

Probate is always needed to deal with a property after the owner dies. However, other organisations such as the deceased's bank, insurer, or pension provider may also request to see a Grant of Probate before releasing any money held in the deceased's name.

In D.C., you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will) naming someone to take over as trustee after your death (called a successor trustee).

Other Questions - Does a will need to be notarized? No. Under the law in the District of Columbia, the will must be in writing, signed by the testator, and attested and signed by at least 2 credible witnesses in the presence of the testator.

To make a living trust in the District of Columbia, you:Choose whether to make an individual or shared trust.Decide what property to include in the trust.Choose a successor trustee.Decide who will be the trust's beneficiariesthat is, who will get the trust property.Create the trust document.More items...