District of Columbia Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife

Description

How to fill out Testamentary Trust Of The Residue Of An Estate For The Benefit Of A Wife With The Trust To Continue For Benefit Of Children After The Death Of The Wife?

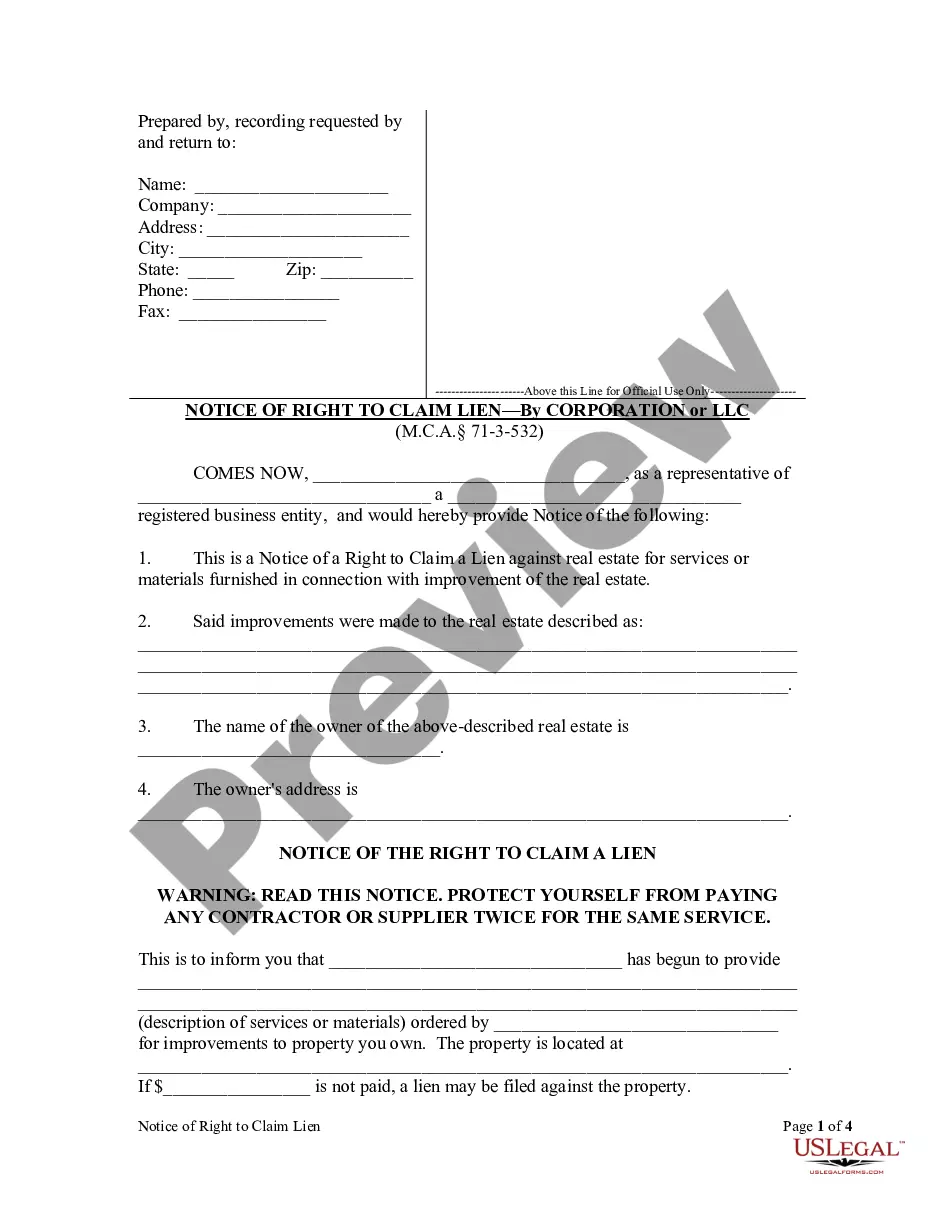

You can spend hours online trying to locate the proper legal document format that satisfies the federal and state requirements you need.

US Legal Forms offers thousands of legal templates that have been reviewed by experts.

You can download or print the District of Columbia Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Welfare of Children after the Wife's Passing from my service.

If you desire to obtain another version of the form, utilize the Lookup field to find the format that suits your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and then click the Obtain button.

- Afterwards, you can fill out, modify, print, or sign the District of Columbia Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Welfare of Children after the Wife's Passing.

- Each legal document format you obtain is yours indefinitely.

- To retrieve an additional copy of any downloaded form, navigate to the My documents tab and click the corresponding button.

- If you are visiting the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the appropriate document format for the region/town of your preference. Review the form information to confirm you have selected the correct form.

- If available, use the Preview button to review the document format as well.

Form popularity

FAQ

To become an executor of an estate, you must be named in the deceased's will. If there is no will, you can petition the probate court to be appointed as executor. Your responsibilities may include administering the District of Columbia Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife, managing assets, and ensuring proper distribution according to the will.

You can name your own testamentary trust as your beneficiary by including it on the beneficiary form in the following format. You cannot name someone else's testamentary trust.

Well, because a testamentary trust allows the grantor some control over the assets during his or her lifetime. After the grantor passes away, the testamentary trust, which is considered an irrevocable trust, is created. Irrevocable trusts can sometimes protect assets against judgments and creditors.

The trust can also be used to reduce estate tax liabilities and ensure professional management of the assets. A disadvantage of a testamentary trust is that it does not avoid probatethe legal process of distributing assets through the court.

How does it save tax? A testamentary trust allows the person who controls it to split the income generated by the trust between family members. Importantly, children who receive income from a testamentary trust are taxed at adult tax rates, instead of penalty rates (up to 66%) which apply to other types of trusts.

A testamentary trust allows the person who controls it to split the income generated by the trust between family members. Importantly, children who receive income from a testamentary trust are taxed at adult tax rates, instead of penalty rates (up to 66%) which apply to other types of trusts.

The adult pays the top marginal tax rate on their non-inheritance income. the beneficiaries of the testamentary trust include three. the low income rebate applies to the distributions to minors and. the inheritance earns income of $60,000 per annum.

Currently, taxable income earned in a testamentary trust is subject to the same graduated tax rates as an individual taxpayer (this is subject to change after December 31, 2015).

The major benefit of a trust is that it gives the settlor control over when and how his or her assets are disbursed. This is especially important for settlors who have young children or grandchildren. With a testamentary trust, assets can remain protected until the child is old enough to be financially responsible.

A testamentary trust is created to manage the assets of the deceased on behalf of the beneficiaries. It is also used to reduce estate tax liabilities and ensure professional management of the assets of the deceased.