District of Columbia Grantor Retained Annuity Trust

Description

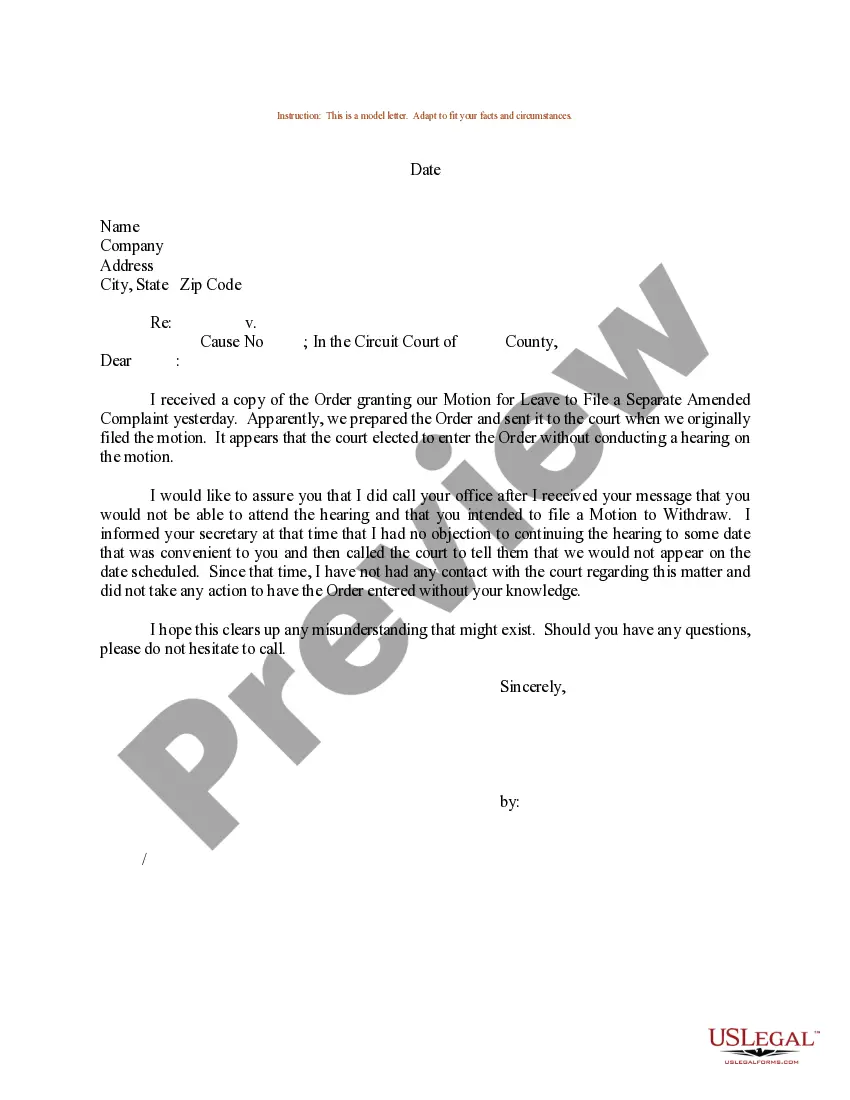

How to fill out Grantor Retained Annuity Trust?

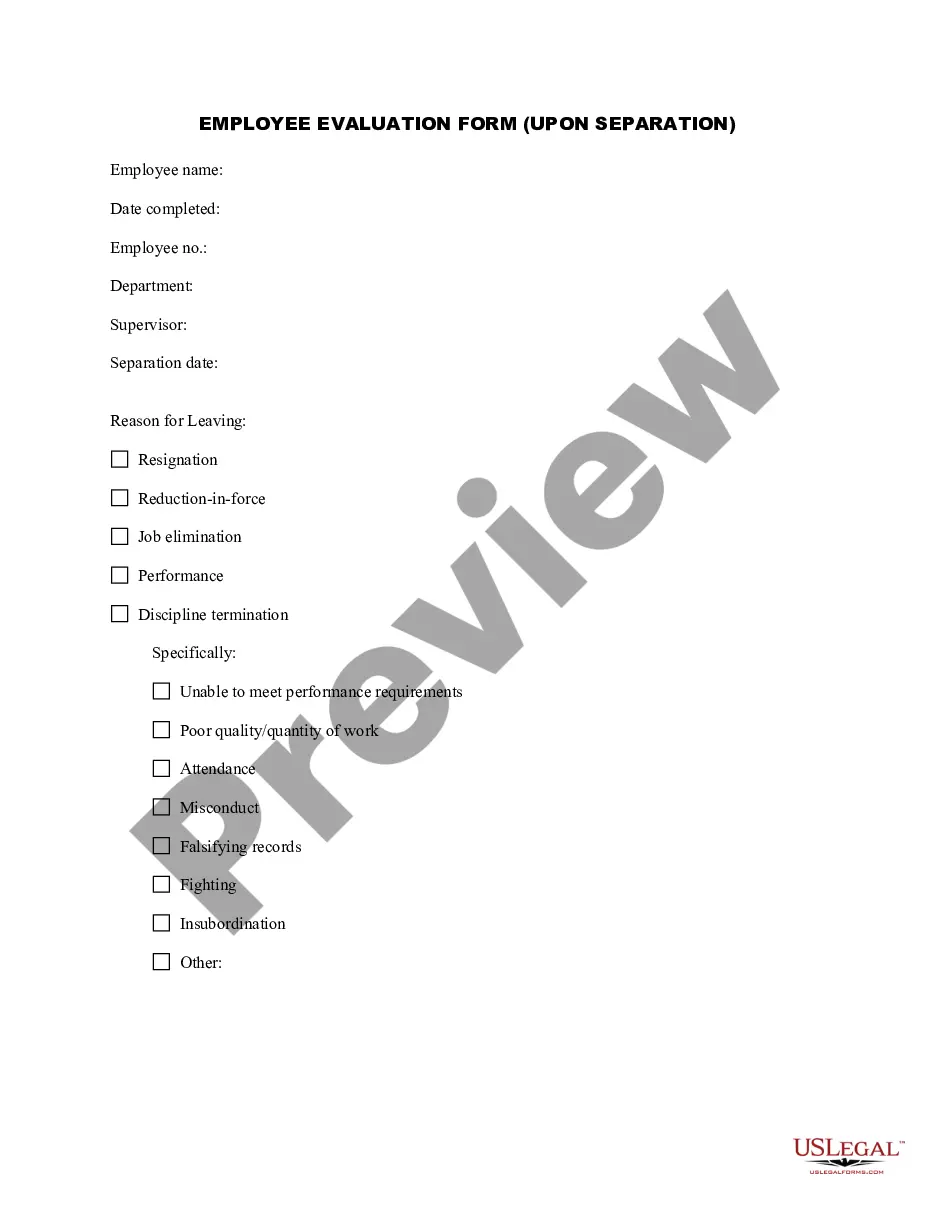

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for both business and personal use, organized by categories, states, or keywords.

You can obtain the latest editions of forms like the District of Columbia Grantor Retained Annuity Trust in just seconds.

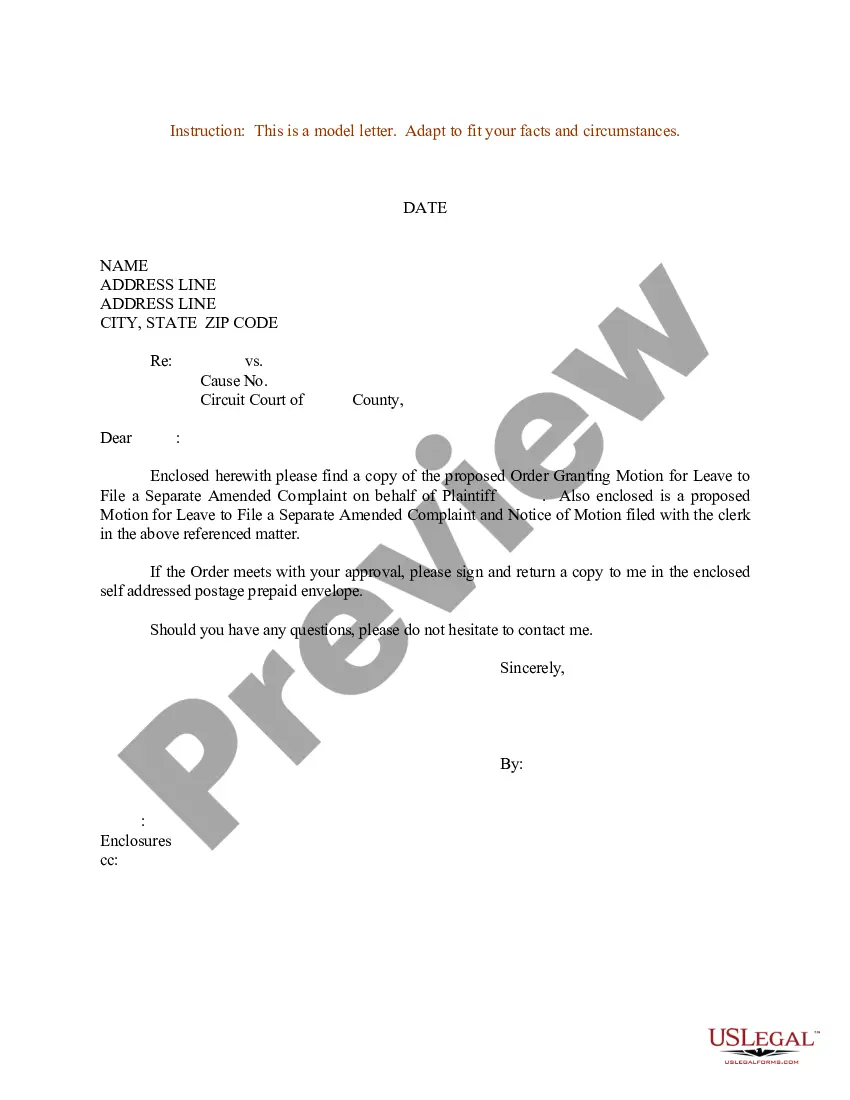

If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your selection by clicking the Download now button. Then, select your preferred payment plan and provide your details to register for an account.

- If you have a subscription, Log In and download the District of Columbia Grantor Retained Annuity Trust from the US Legal Forms library.

- The Download option will appear on each form you view.

- You can access all previously saved forms in the My documents tab of your account.

- If this is your first time using US Legal Forms, here are simple steps to get started.

- Ensure you have chosen the correct form for your city/state.

- Review the form’s details to verify that it meets your needs.

Form popularity

FAQ

If the grantor dies during the term of the GRAT and has the right to receive further annuity payments, a portion of the GRAT will be included in the grantor's gross estate for federal estate tax purposes.

Do gnats go away on their own? No, it's unlikely that gnats will go away on their own once they start reproducing. You will need to take proper measures to get rid of them, such as putting away your fruits, flushing out your drains, or changing the soil in your indoor plants' pots.

Grantor retained annuity trusts (GRAT) are estate planning instruments in which a grantor locks assets in a trust from which they earn annual income. Upon expiry, the beneficiary receives the assets with minimal or no gift tax liability. GRATS are used by wealthy individuals to minimize tax liabilities.

A grantor retained annuity trust, better known as a GRAT, is an irrevocable trust that pays an annuity amount to the grantor for a set period of years, after which the remainder passes to or for the benefit of children or others.

A GRAT is an irrevocable trust that allows the trust's creator known as the grantor to direct certain assets into a temporary trust and freeze its value, removing additional appreciation from the grantor's estate and giving it to heirs with minimal estate or gift tax liability.

GRATs are irrevocable trusts that last for a specific period of time of at least two years. The term you choose depends on your goals and expectations for asset growth potential, but we typically recommend a term between two and five years.

A grantor trust can, in a given case, be either revocable or irrevocable, although most types of grantor trusts involve an irrevocable trust. Certain types of trusts (such, as for example, a revocable trust) are disregarded not only for income tax purposes but also for federal estate and gift tax purposes.

Tax Implications of the GRAT During the term of the GRAT, the Donor will be taxed on all of the income and capital gains earned by the trust, without regard to the amount of the annuity paid to the Donor.

What Is an IDGT? An IDGT is an irrevocable trust most often established for the benefit of the grantor's spouse or descendants. The trust is irrevocable by design in order to remove the underlying trust assets from the grantor's estate.

How Are GRATs Taxed? GRATs are taxed in two ways: Any income you earn from the appreciation of your assets in the trust is subject to regular income tax, and any remaining funds/assets that transfer to a beneficiary are subject to gift taxes.